Happy Sunday Dear all,

As you all have known by now, I am Heavenly Punter. Today I would like to give you a stock pick and hope can be beneficial for everyone. I hope to be like KYY one day, just joking. My Golden Rule stock selection is 3 consecutive drop in Net Profit !

The stock in focus today is Econpile Berhad. (read on before judging)

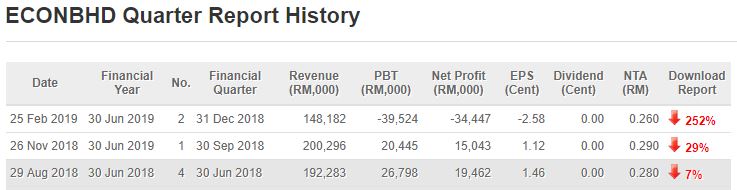

As shown clearly here, Econpile Berhad has achieved consecutive 3 declining Net Profit Quarters.

A bit more information on this Econpile Berhad company: they operate mainly as a piling and earthwork specialist. They do mainly piling solutions, earth retaining systems and earthworks for high end property development projects, and infrastructure projects.

(I know you don't know what the heck are these, just refer the pictures below)

Earthwork means digging, Earth Retaining Systems, Piling (Bored Piling the drill drill one not the hammer type)

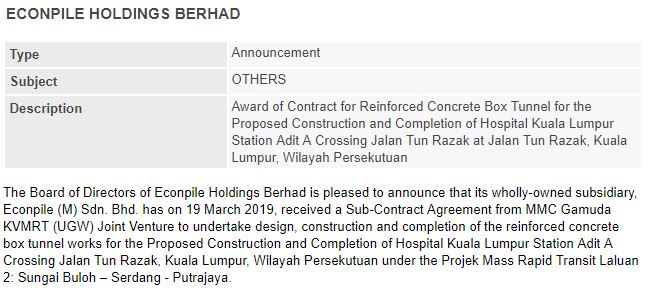

One of the leading piling specialist in Malaysia with the largest orderbook amounting to RM 1.0+ billion. The management team has been extremely good at securing contracts. Just this month March, they have secured two new contracts:

Contract 1: Worth RM 68.8 million

Contract 2 worth RM 44.7 million.

Even in such TOUGH TIMES in the construction sector, this company's management team is able to secure contracts after contracts, not to mention they have an outstanding orderbook of RM 1+ billion.

In the past 5 years since listing on Bursa in 2014, the company has consistently delivered good shareholder returns, net profit margin of 10% + and upwards. You might then ask why recent quarter make loss ah? As you all know by now, the construction sector in Malaysia is hit really hard, not many companies in the construction sector able to report profit. But in the case of Econpile Berhad, Management has provided explanation on the recent FIRST EVER REPORTED QUARTERLY LOSS. Management has cited in the QR report that

Like I said will this company be profitable again after making it's first quarterly loss?

I really don't know, but is the management trustworthy enough?

That's a definite YES from me.

For me, even without the ECRL projects, the company still have such a huge outstanding orderbook that it doesn't really need to worry, also don't forget how good the management team is at securing more and more contracts.

As for the cost overrun in property development project, the management should be able to mitigate such cases in future by increasing the tender prices and transfer the increased costs to the property developers.

Thank you everyone, have a good Sunday. Hope I gave you some insights on my punting skills today!

https://klse.i3investor.com/blogs/Day3/200300.jsp