DAYANG ENTERPRISE HOLDING BHD

Undervalue or Overvalue

Directly taken from the 2018 Annual Report with appropriate amendment:

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This write-up contains some forward-looking statements in respect to the Dayang Group’s financial condition, results of operations and business. These forward-looking statements represent Dayang Group’s expectations or beliefs concerning future events and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

Readers are hereby cautioned that a number of factors could cause actual results to differ, in some instances materially, from those anticipated or implied in any forward-looking statement. In this respect readers must therefore not rely solely on these statements in making investment decisions regarding the Dayang Group. The writer shall not be responsible for any investment decisions made by the readers in reliance on those forward-looking statements.

Forward-looking statements speak only as of the date they are made, and it should not be assumed that they have been reviewed or updated in the light of new information or future events that would arise in the interim of the publication of this write-up and the time of reading this write-up.

Well the above has to be in small print to save space (thus time) as most will not read it in full.

My family and I hold shares in Dayang Enterprise Holding Bhd (Dayang).

Right all the obligatory disclaimer out of the way, lets dive into the gist of the matter.

DEMAND (Work-load)

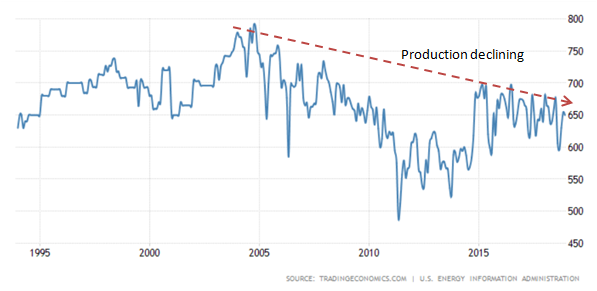

There are over 200 offshore platforms in the South China Sea providing the necessary facilities to produce oil that amount to about 650K barrel per day (bpd).

Production is declining since peaking in 2005 around 800k bpd.

Do note that this is OIL production ONLY and does not include gas production!

We all know that since oil price crashed in 2015, there were minimal CAPEX and maintenance to the 200 over platforms up till March 2018.

|

Another issue, ENTROPY. The Law of Entropy can be said like this – things will fall apart; rust never sleep; shit happens; what-ever can go wrong will go wrong; and so on.

Offshore platforms are no different.

FACT – there is demand (work-load) for not ONLY maintenance but to boost production.

Boosting production means modification work to platforms to take new equipment like compressors / injectors / high pressure pumps / new platform – hook up and commissioning, etc.

SUPPLY (Services)

All these activities fall under the various contracts awarded to Dayang in 2017, especially 2018 and recently from Hibiscus too.

Dayang indeed is the King of East Malaysia (after Hibiscus award – Sarawak to Sabah water).

So, coming quarters of 2019, revenue will be good after the drought from 2015 to early-2018, regardless it is lump sum or time rates (splitting hair here).

A bit of history

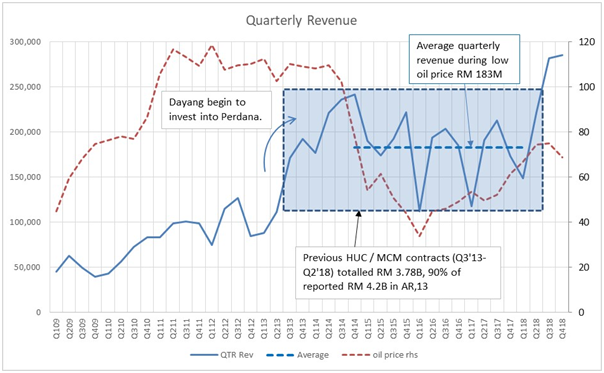

In 2013 Annual Report, it was reported that Dayang had an estimated RM 4.2B of the HUC / MCM contracts.

Looking at the quarterly reports, the total revenue from mid-2013 to mid-2018 is RM 3.78B. Not bad, 90% of the estimated RM 4.2B despite the low oil price from late 2014 until early 2018. Average revenue in this period (late-2013 to early-2018) is RM 756M per year.

Revenue for 2014 was RM 877M, 16% higher than the yearly average. This is called “front loading”.

A bit of future

Today, Dayang reported (4th quarter report & Annual Report) RM 3B work in hand, plus Hibiscus and Turkmenistan, that would be nearer to RM 3.7B. Yearly it would be RM 740M. With “front loading”, 2019 revenue could potentially be RM 858M.

2018 revenue was RM 938M, is already higher than the “front loading” RM 858M. Could be first half of 2018 revenue is from previous contracts.

Remember ENTROPY? Well looking at the quarterly stats, the lean years of 2015 to 2017, the various E&P cut to the bone, maintenance, as oil price is lower longer! So, before “shit happen” (health, safety and environment, especially environment – oil spill and the like), they better do something when oil price recovered in 2018. That’s why 2018 revenue is so strong (pent-up demand).

Can 2019 be just as strong? Yes, not only because of ENTROPY but because there is added projects to boost production.

Do remember that Dayang, today with Perdana, has the CAPACITY, to do more!

There are 7 AWBoats in Dayang. Perdana has 2 AWBoats plus 7 AWBarges. The barges can accommodate 300 pax versus about 199 for boats. AWB is accommodation work boat or barge, boat has propulsion, barge, none. See Appendix 1 for vessels’ locations.

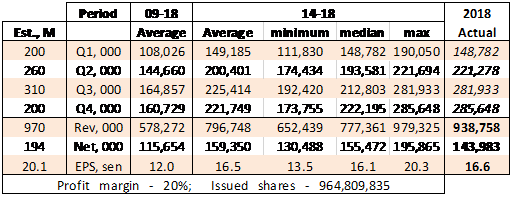

Two periods, 2009 to 2018 and 2014 to 2018 was analysed. From the above, Dayang before Perdana is a much different animal. The much lower revenue before Perdana pushes the average quarterly revenue too low and hence ignored thereafter. This is basically a Bayesian analysis.

The quarterly average, median, minimum and maximum for the period 2014 to 2018 was then found. And the resulting yearly total derived. Using 2018 info on shares issued, the respective EPS was found with a 20% margin (more later). Actual 2018 (bold) results included for completeness. Note that 2018 quarterly numbers do not add up to audited final number in BOLD.

Using past quarterly results, an estimate of coming 2019 revenue is made.

Surely to consider Dayang can only achieve minimum revenue for 2019 is highly not possible (too pessimistic).

Revenue nearer to average and median would be feasible.

2019 revenue between median to maximum is highly likely given the pent-up demand and the indication given by Management.

In 2018 4th Quarter report, Dayang said that work going forward is “sustainable”. This, “sustainable”, was mentioned in each of the previous quarterly reports that preceded with excellent quarterly results. The respective sentences are extracted to Appendix 2 for easy reference.

Weather

Last year, the monsoon was mild resulting in the best 4th Quarter revenue ever.

Normally, monsoon carries over into January / February the following year, that is, 2019. But as far as one can remember, there was not a prolong adverse weather at the beginning of this year.

So, quarter 1 2019 could be another good quarter compared with previous years’ 1st quarters.

Quarter 2 and 3 are always busy and this year is no different. Quarter 4, well unless one can travel to the future, odd is the weather could be bad. Your guess will be as good as my guess.

So, estimated quarterly revenue is 200M, 260M, 310M and 200M giving a total for the year of RM 970M. Using a profit margin of 20%, the net is RM 198M – EPS of 20.1 sen.

Profit margin

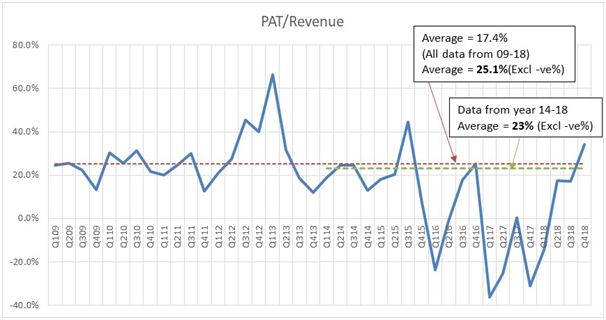

Below, average profit margin for the period 2009 to 2018 is determined that included negative quarterly profit margins. Ignoring these negative profit margins give an average margin of 25%.

Looking at the period 2014 to 2018 and ignoring negative margins, the average margin is 23%.

So, a 20% profit margin, about 13% discount from 23%, would be fair considering the risks involved.

Petronas outlook

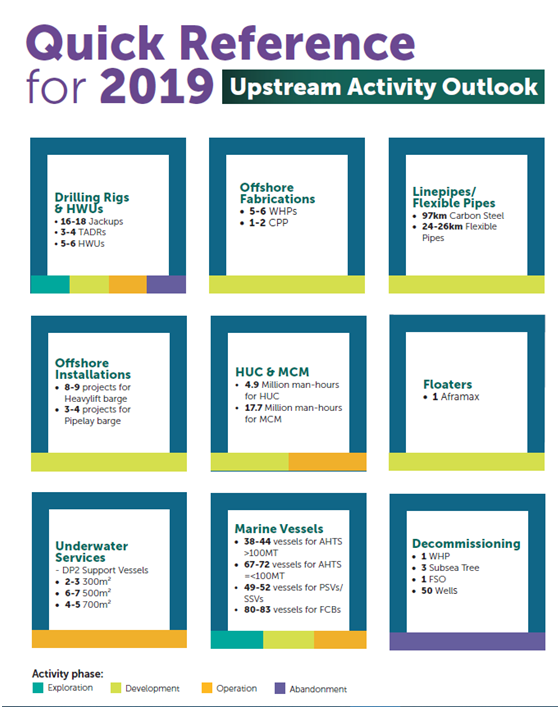

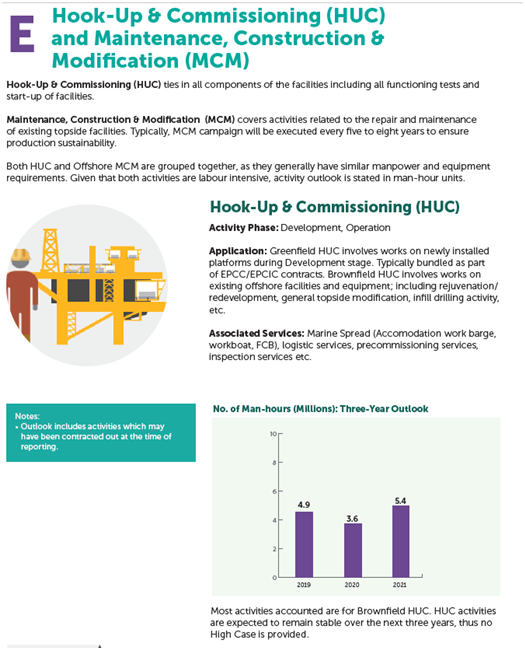

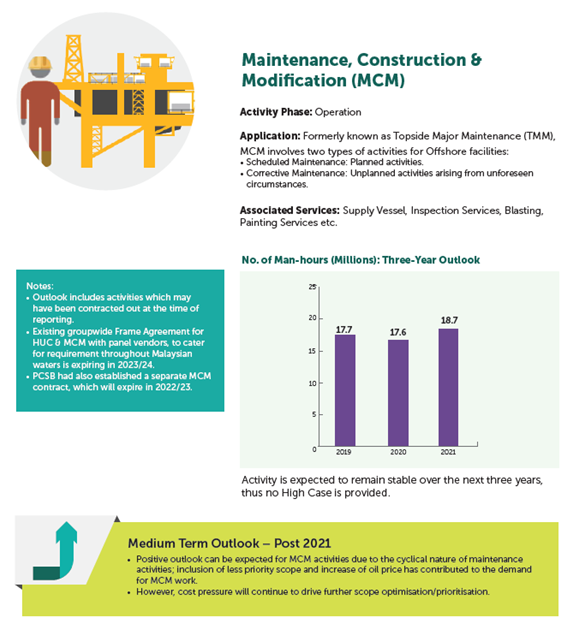

The 2019-2021 outlook indicated high activity level for maintenance of 17+ million manhours for each of next three years. For more details please refer to Appendix 3.

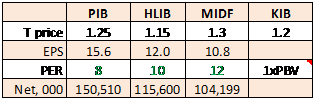

Investment Banks EPS

Here are the EPS from various investment banks (IB). A simple estimate could be to just distributed the RM 3B over 5 years, RM 600M per year. A 20% profit margin will give RM 120M – EPS 12.4 sen.

KIB uses Book Value of one time. However, checking with various books on security analysis as well as the World Wide Web, the book value should have intangibles back-off.

In 2018 annual report, Goodwill is RM 654M, thus adjusted book value would be just 49 sen. With target price of RM 1.2, the price to book is 2.5 times.

There seem a mis-understand of using price to book value valuation method. This method is used to value capital intensive businesses like automobile, E&P, transportation like airlines and banks.

Yes, Dayang is in the Oil and Gas business, but it is not an E&P – exploration and production.

Maybe PERDANA valuation is appropriate to be based on book value.

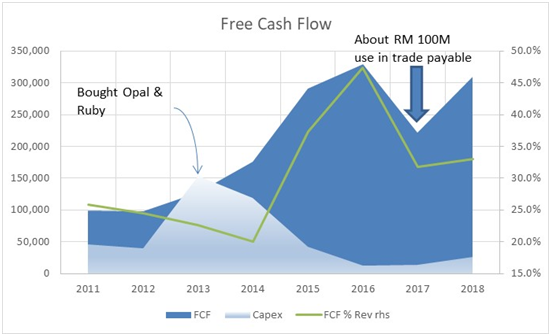

Cash Flow

The past few years of low oil price for longer, created a lot of impairment (non-cash movement). So, an analysis of cash flow would review a lot.

What is most showing, during the low oil price period, FCF exceeded 30% of revenue! So, if 2019 revenue is RM 1B, using just 30%, the FCF would approximate RM 300M. As CAPEX is now relatively low going forward, there will be ample fund to pay down borrowing or take up any capital requirement arising from Perdana’s debt restructuring without recourse to shareholders of Dayang.

At 31/12 18, there is RM 194.6M cash (or cash equivalent), 20 sen per share.

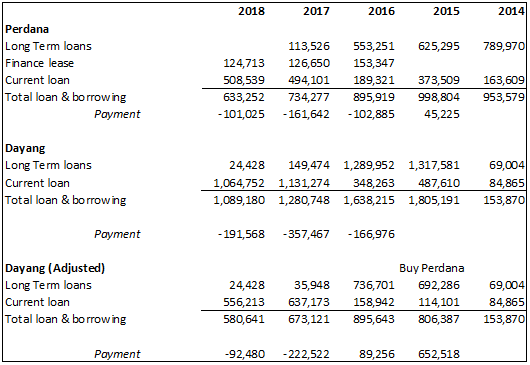

This write-up is not complete without touching on debt.

Dayang’s debt included Perdana’s, thus debt level of Dayang (only) is adjusted as shown. Dayang can comfortably pay down its’ own loan obligation as seen above, as well as Perdana’s.

Dayang had advance about RM 200M to Perdana to pay their debt obligation as cash flow at Perdana is insufficient.

SUMMARY

1) There is demand for Dayang service due to ENTROPY and declining oil production

2) Petronas Outlook indicated next three years, maintenance will need 17 million manhours per year

3) Dayang, with Perdana is capable to fulfil the demand for coming 5 years

4) Estimated 2019 revenue is RM 970M, with 20% margin, EPS is about 20 sen.

5) Cash flow of Dayang is good and able to meet its debt obligation as well as Perdana

6) Dayang 2019 EPS is underestimated by IB

Do note that there are risks a plenty: -

- Oil price dropping below USD 50 per barrel (Brent); this is the current oil price used for most development projects hurdle; if so, may cause oil majors to cut back again

- Weather risk

- Implementation / execution risk

Longer term risk like losing Petronas’ licenses, recall of outstanding loans and such like are beyond this write-up.

CONCLUSION

Dayang has the capability and capacity to carry out more than the RM 3.7B work awarded since 2017.

Because of ENTROPY and declining oil production, higher maintenance and modification work arising from projects to arrest declining production would result in high level of activities leading to 2019 EPS of 20 sens. This is higher than those given by investment banks (10.8 to 15.6 sens).

Petronas Outlook confirmed this level of high activities.

Free cash flow is excellent and more than enough to repay borrowing (instalment) of both Dayang and Perdana as going forward, there is low CAPEX requirement.

Any debt restructuring of Perdana leading to additional capital need from Dayang is easily covered by the very good free cash flow as well as the cash now in hand of 20 sens per share (RM 195M).

Undervalue or overvalue

In a rational world, PER of 10 would be fair given the risker marine work and oil / gas environment.

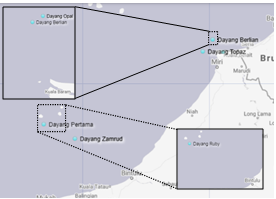

Appendix 1

Dayang is very busy. There are insufficient vessels that additional vessels need to be chartered from Perdana as per reports (source: Bursa) below.

Following are the locations of the 7 AWB. Out of 7, only 1 is be back at Kuala Baram port.

- Pertama – D35R-A since 3/3/19

- Ruby – D35DP-A since 28/2/19

- Berlian – Betty since 16/3/19; Baram since 6/5/19

- Topaz – BKJT-A since 4/3/19

- Opal – Baram A since 18/3/19

- Zamrud – D18 since 18/4/19

- Nilam – anchor at Kuala Baram since 28/3/19

Perdana AWB locations are as follow: -

- Excelsior – to E11 soon

- Enterprise – unknown

- Endurance – Baronia since 2/3/19

- Odyssey – Bakau

- Resolute – Kemaman Supply Base

- Protector – Miri anchorage since 14/4/19

- Emerald – going to Baronia

- Liberty – at Labuan

- Sovereign – at Luconia

LETTERS OF AWARD FROM DAYANG ENTERPRISE SDN BHD TO CHARTER 2 UNITS OF ACCOMMODATION WORKBARGE (This announcement is dated 21 March 2019)

The Board of Directors of PPB wishes to announce that the wholly-owned subsidiary of the Company, Perdana Nautika Sdn Bhd (“PNSB”) has on 20 and 21 March 2019 accepted the letters of award to charter two units of accommodation workbarges (“AWB”) to Dayang Enterprise Sdn Bhd (“DESB”), a wholly-owned subsidiary of Dayang Enterprise Holdings Berhad (“Dayang”) which is a major shareholder of PPB. The first AWB will be chartered for a period of 120 days with an extension option and the contract will begin on 29 March 2019. The second AWB will be chartered for 200 days with an option period of 15 + 15 days and the contract is effective from 1 April 2019 (collectively, the “Vessels Charter”).

PERDANA PETROLEUM BERHAD ("PPB" OR THE "COMPANY")

LETTER OF AWARD FROM DESB MARINE SERVICES SDN BHD TO CHARTER A WORKBOAT (This announcement is dated 23 April 2019)

The Board of Directors of PPB wishes to announce that the wholly-owned subsidiary of the Company, Intra Oil Services Berhad (“IOSB”) has on 15 April 2019 accepted the letter of award to charter one unit of workboat (“WB”) to DESB Marine Services Sdn Bhd (“DMSSB”), a wholly-owned subsidiary of Dayang Enterprise Holdings Berhad (“Dayang”) which is a major shareholder of PPB. The WB will be chartered for 180 days with an option period of 150 days and the contract is effective from 15 April 2019 (the “Vessel Charter”).

Appendix 2

Below are the Prospect statements extracted from the quarterly reports of 2018. Note the dates that these reports were released. This meant that knowledge of quantities of work (revenue) of next quarter were already known.

Q1 2018 – prospect, page 20 (released on 24 May 2018)

Currently, more vessels are employed, and the Group is confident of a better 2Q and 3Q, barring unforeseen circumstances. ……. Presently, activities for all the Dayang contracts are ramping high and this should continue through to the end of 2018.

Q2 2018 – prospect, page 23 (released on 24 August 2018)

Taking cue from the work orders in hand, we are hopeful that business operations will remain busy over the coming months which bode well for our financial results. Barring any unforeseen circumstances, we are optimistic that the turnaround in our earnings will be sustainable, …….

Q3 2018 – prospect, page 23 (released on 23 November 2018)

Barring any unforeseen circumstance, we are optimistic that the turnaround in our earnings will be sustainable, premised on our fairly sizeable order book of RM3 billion to last us until 2023.

Q4 2018 – prospect, page 24 (released on 22 February 2019)

Barring any unforeseen circumstances, we are optimistic that the strong earnings trend will be sustainable, premised on our fairly sizable order book of RM3 billion to last us at least until 2023.

Also take note, the use of “sustainable” repeatedly, especially Q4, this would mean that Q1 2019 should be decent.

Appendix 3

Petronas Outlook – extract of page 42, 52 and 53 indicating the work-load for year 2019, 2020 and 2021.

So, it will be busy years for Dayang (and Perdana).

Page 42

Page 52

Page 53

https://klse.i3investor.com/blogs/teoct_blog/206761.jsp