AirAsia caught our attention when director announces a special dividend of 90 sen a share, the stock next day immediately gap up from RM2.60 to RM3.00, we do not have AirAsia shares and we start thinking whether it is still worth for us to chase

we state out two valuable reasons

1) AirAsia 3.0, digitizing to e-commerce which will not slow down its growth and greatly reduce the cost of business which allows AirAsia to distribute unuse cash as a dividend

2)We think Tony Fernandes need more cash(dividend) from AirAsia to buy more AirAsia shares because he foresaw the next 10years of business, the best method to top up is to get the dividend and reinvest back to Airasia

Having thought of chasing Airasia, we have found much more better choice ,sharing same agenda & same reasons to own the shares --- AirAsiaX

We decided to purchase AAX because it is extremely undervalue, with 5 reasons:

1)Airasia X will have the best ever year in 2019 :

WHAT IS best ever year means??

Mean aax will perform better than 2018 2017 2016...... 2013 since the company listed

Q1 shows come back to positive earning after 3 losing streak qr. We believe coming qr will perform better....

After Q1 2019 released , we started to believe Tony Fernandes words in twitters and we start to analyse the stocks.

2) AirAsia 3.0 to help save cost and enhance revenue

AirAsia has no boundary of data sharing with AirAsia X, after two years of working closely with Google and other data companies Airasia Group Bhd expects cost savings and revenue enhancement beginning next year.

An

analyst said in a report the AirAsia 3.0 plan would solidify the

airline’s business via predictive maintenance, which would result in

cost savings by FY20. It will enhance online user experience by

transforming AirAsia.com into an all-in-one travel and lifestyle

marketplace, facilitated by its mobile payment facility BIGPay.

https://www.thestar.com.my/business/business-news/2019/05/17/airasia-30-to-help-save-cost-and-enhance-revenue/

https://ir.airasia.com/misc/1Q19-presentation-airasia.pdf

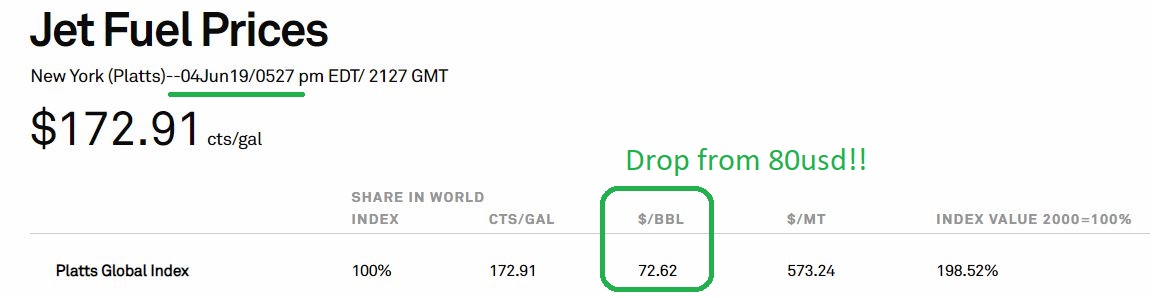

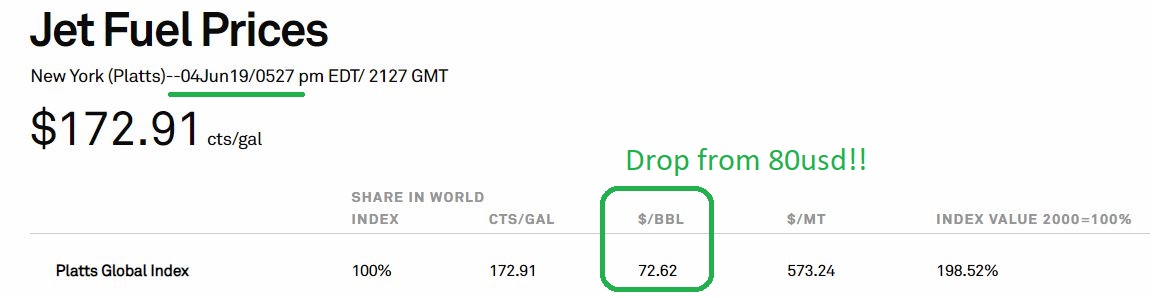

3) Jet oil and brent oil prices crashing

latest QR shows average fuel price was at 79USD/Barrel,

NOW, we checked the Jet Fuel Prices , the price now selling at 72.62USD/Barrel only!

Do know that Jet Fuel cost the most, oil prices simply drop by 10% will boost AirAsiaX's profit to next record level

https://www.thestar.com.my/business/business-news/2019/05/17/airasia-30-to-help-save-cost-and-enhance-revenue/

https://ir.airasia.com/misc/1Q19-presentation-airasia.pdf

3) Jet oil and brent oil prices crashing

latest QR shows average fuel price was at 79USD/Barrel,

NOW, we checked the Jet Fuel Prices , the price now selling at 72.62USD/Barrel only!

Do know that Jet Fuel cost the most, oil prices simply drop by 10% will boost AirAsiaX's profit to next record level

4) Commentary on prospects : Festive season + school holiday will boost AAX coming Q2

The Group views current forward booking trend are performing within expectation. Demand is expected to pick up in June from the festive season and in conjuction with midterm school holidays in the Region.

Improving overall cost performance remains one of the Company's main

priorities in 2019. A lot of initiatives are being put in place via

digitalisation to reduce costs. In order to better serve the growing

demand in the region, AirAsia X Thailand will be adding up to five

aircraft through operating leases in 2019. On the other hand, AirAsia X

Malaysia is expected to remain with 24 aircraft as it focuses on

maximising aircraft utilisation of its current fleet and leverage on the

Group’s strategy in new route launches as well as increasing

frequencies of core routes. For the remaining quarters of 2019, the

Company remains cautious on the challenging global backdrop and pressure

on Malaysia Ringgit but optimistic to observe healthier demand across

most sectors in addition to a favourable fuel hedging strategy

5) Datuk Kamarudin and Tony Fernandes acquiring shares

Both directors are increasing their stakes , and they never sell it since last purchase!!!

Our AAX 2019 strategy

We are buying AAX batch by batch

First entry level 22.5sens

second entry confirmation break up level 24sens

third entry confirmation breaup up 26sens & if brent oil break below 60usd

fourth entry confirmation break up 28sens & if brent oil break below 55usd

TP1 32sens

TP2 will be identified after next QR

HOLDING MID to Long Term

join our telegram on

DISCLAIMER : Investment involve risk,

including possible loss of principle and other losses. This article and

charts are provided for information only and should not be construed as a

solicitation to buy or sell any of the instruments mentioned herein.

The author may have positions in soe of these instruments. The author

shall not be responsible for any losses or lost profits resulting from

investment decisions based on the use of the information contained

herein. If investment and other professional advice are required, the

services of a licensed professional person should be sought.

https://klse.i3investor.com/blogs/share4u2019/209708.jsp