- PANTECH is an One Stop Centre for Pipes, Valves & Fittings (PVF) to support fluid transmission requirement of customers at their demand levels. It is a major PVF solutions provider to both the upstream and downstream segments of the oil & gas industry.

- Pantech’s performance is correlated to the oil and gas industry as a whole. Pantech Group serves the oil and gas industry through two complementary core divisions.

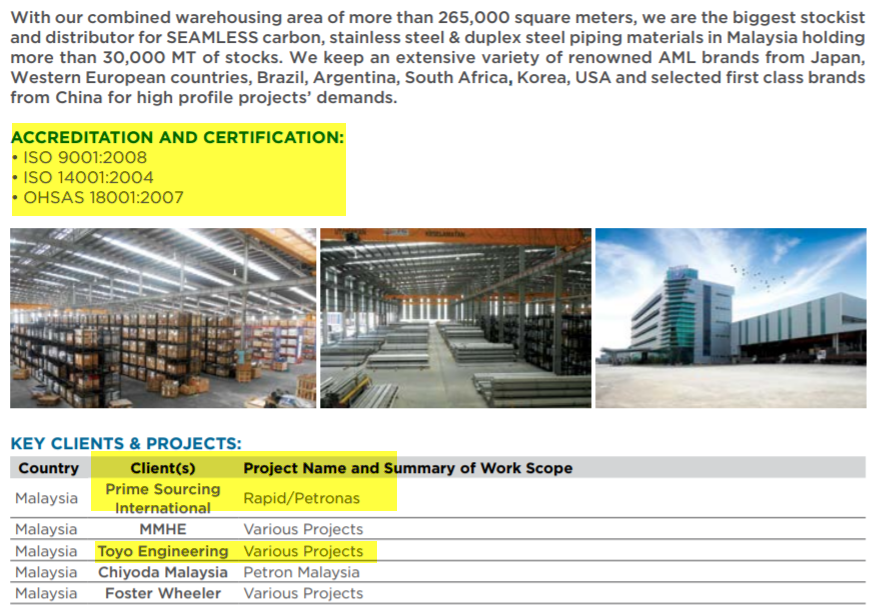

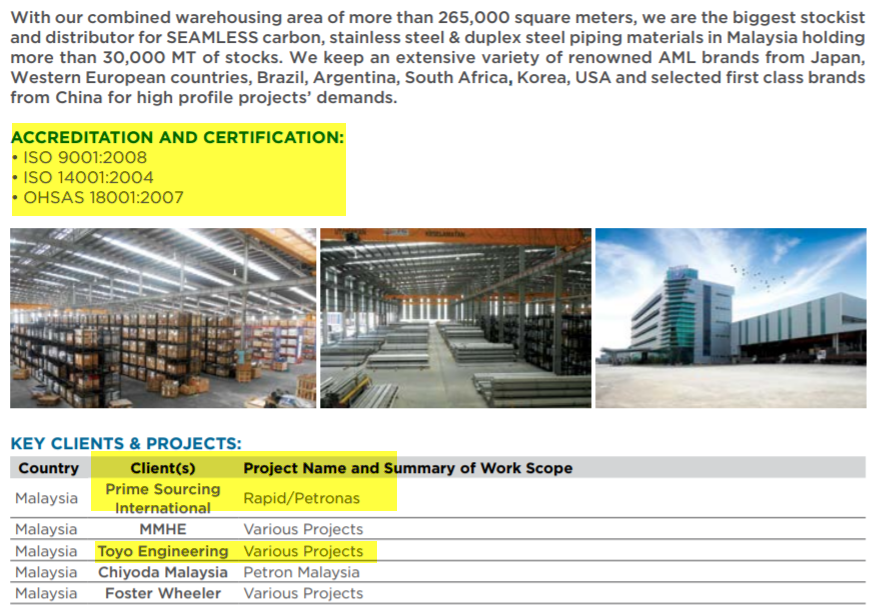

- Trading Divisions - The Trading division trades, supplies and stocks high pressure seamless and specialised steel pipes, valves, fittings and etc, mainly in Malaysia. The close locale to Pengerang in the Southeastern region of Johor facilitates an even more rapid turnaround for the RAPID project. The Trading arm contributed sales (57% of the group's total) as well as the operating profit (66%) in FY18 ended February. Pantech has SWEC code with Petronas which can serve as agent for foreign company to supply their products to Petronas or its subsidiaries (https://www.petronas.com/join-us/be-our-partner/our-licensing-registration)

- Manufacturing Division - The Manufacturing division has plants in Malaysia and UK, producing a standard and customised range of pipes and fittings of diverse materials such as carbon steel (21,000 mt p.a.), stainless steel pipe (16,500 mt p.a.), nickel alloys and etc. Some of the items produced include elbows, tees, reducers, stub ends and end-caps that comply with international standards. UK-based Nautic Steels which was acquired in 2013 for RM45m produces copper nickle and nickel alloy pipes and fittings (800 mt p.a.).

- Petronas group posted a stronger set of 1Q19 results with core PAT (profit after tax) of RM12b (+37% QoQ), driven by higher sales volumes, a weakened Ringgit and lowered costs. Petronas is expected to increase its capex commitment of >RM50b for 2019 (versus 2018 capex of RM46.8b). Key beneficiaries of an increased Petronas capex to include fabrication players (e.g. MHB, SAPNRG), drilling players (e.g. VELESTO, SAPNRG) which will directly or indirectly benefited Pantech (PVF and galvanized pipes supplier and manufacturer).

- The average capacity utilization of the two local Malaysia plants at around 90% in FY18, while UK’s Nautic Steels at 65%. PANTECH expects to raise the capacity of the two Malaysian plants by 15% over the next two years. In December 2016, the Manufacturing segment started operations on its first hot-dip galvanising plant which is also claimed to be the biggest in southern Peninsular Malaysia. The operations held via Pantech Galvanising have passed the loss making stage and the average capacity utilization rate of the plant was 50% in FY18.

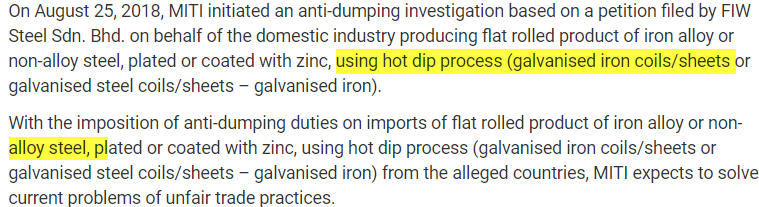

- Malaysia imposed 16% safeguard tax on galvanized steel from China and Vietnam from March 2019 to 2024 that will benefit Pantech in 2019 to 2024: Reference below:

Nanyang Report: http://www.enanyang.my/news/20190308/%E4%B8%AD%E8%B6%8A%E9%92%A2%E5%BE%81%E5%8F%8D%E5%80%BE%E9%94%80%E7%A8%8E16/)

NST report: https://www.nst.com.my/business/2019/03/467316/malaysia-slaps-anti-dumping-tax-steel-imports Excerpt from the MITI news as below:

- Earnings throughout the last five financial years have grew the shareholders equity every year which the NTA increases from RM0.55 as at the end of FY13 to RM0.79 at 2Q of FY19. The financial position has also improved considerably as their net gearing slowly reduced from 0.60x at the end of FY13 to 0.33x at the mid of FY19.

- Improving Export Markets - The export market has been strong for the Manufacturing division throughout the year, with export sales being the main contributor to overall sales increase. The Manufacturing units in Malaysia have seen exports increase by an aggregate of 60% compared to the previous financial year. While Malaysia remained the principal market at 60% of total revenue despite increased export sales in FY2018, Pantech's products are now present in 68 countries. (reference Annual report 2018)

10. Consistent and Sustainable Revenues and Profits in the last 5

years - Maintenance contracts of RAPID once completed will be a

good avenue of income. As it stands, maintenance contributes about 40%

to Pantech Group’s revenue from the oil and gas sector. Being in this

industry, maintenance works are essentially perpetual as they are critical in ensuring safety and optimal operations.

11. Beneficiary of Local Upstream CAPEX - Petronas had committed to an increased capex of >RM50b for 2019 (from RM47b in 2018),

of which ~RM30b will be for upstream, after it focused much of previous

years’ capex on downstream. I reckon the increased upstream capex will

be invested on the development of oil and gas new fields.

12. Pantech is the ONLY locally owned pipe supplying company under the “Petronas Framework Agreement”

- PANTECH provides pipes, valves and fittings not only used for the

transportation of oil and gas, but also for the engineering and

construction (E&C) phases of the fields (e.g. used as topside

structures and jackets, subsea platform pillars, etc). “Petronas

Framework Agreement” is to promote more local content, should there be

any such ruling.

13. Positive outcome from DOC. (The US Department of

Commerce (DOC) has cleared Pantech Group Holdings Bhd's wholly-owned

subsidiary Pantech Steel Industries Sdn Bhd (PSI) of circumventing the

antidumping duty (AD) order on butt-weld fittings from China. As a

result, PSI will immediately commence shipments of its carbon steel

butt-weld fittings to the US once again. This is expected to have a positive impact on the group's revenue and profit going forward,. The carbon steel plant utilisation remains low at 30% as the suspension of exports to the US earlier.

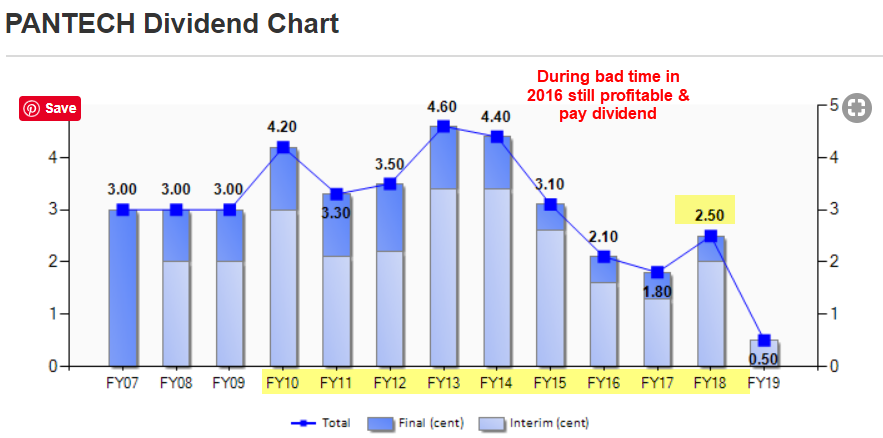

14. Management of Pantech has been generous in dividend payout over past 11 years with dividend yield of 4.5% in FY2018 . Total dividend paid over past 10 years is 35.5 sen (average 3.55 sen per year). The chart below shows the dividend payout records of Pantech.

15. Valuation - with higher orders from Oil and Gas

players (like Sapnrg and Velesto more contracts have been secured in

2018 and 2019), higher export contribution from manufacturing division

and possible US anti-damping uplift for its shipment and future US

export, it estimated that EPS for FY2020 (Mar 2019 to Mar 2020) could in the range of 6.8 sen to 7.5 sen. Based on PE9x to PE10x, fair value for Pantech could be in the range of 61 sen to 75 sen. (the price is supported by low price-to-book ratio: 0.61x and high dividend yield of 4.5%)

16. Risk:

- Rising labour cost (foreign workers levy and min wages increment in 2019)

- Crude oil plunge

- Petronas reduces capex.

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is

strictly for sharing purpose, not a buy or sell call of the company and

the contents of this report should not be considered as

professional financial investment advises or buy/sell recommendations. I

strongly encourage you to do your own research and take independent

financial advice from a professional before you proceed to invest.

I make no representations as to the accuracy, completeness,

correctness, suitability, or validity of any information on my report

and will not be liable for any errors, omissions, or

delay in this information or any losses and damages arising from its

display or usage. All users should read the posts and analysis the

information at their own risk and we shall not be held liable for any

losses and damages.

Appendix:

1. Information about Pantech: Certifications and Accreditation.

https://pantech-group.com/about-us/certifications/

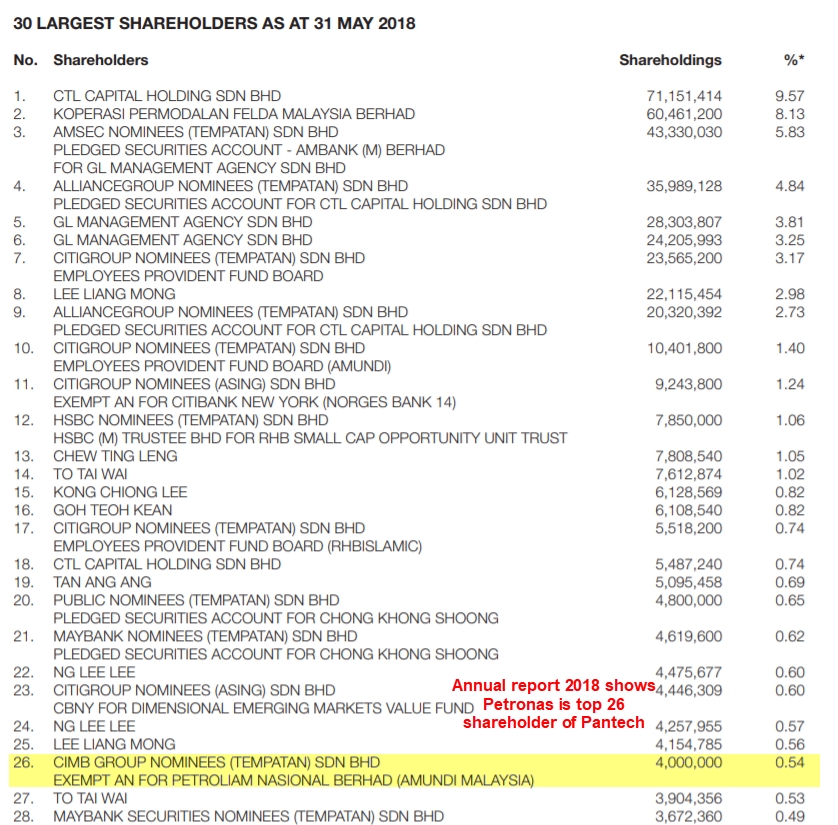

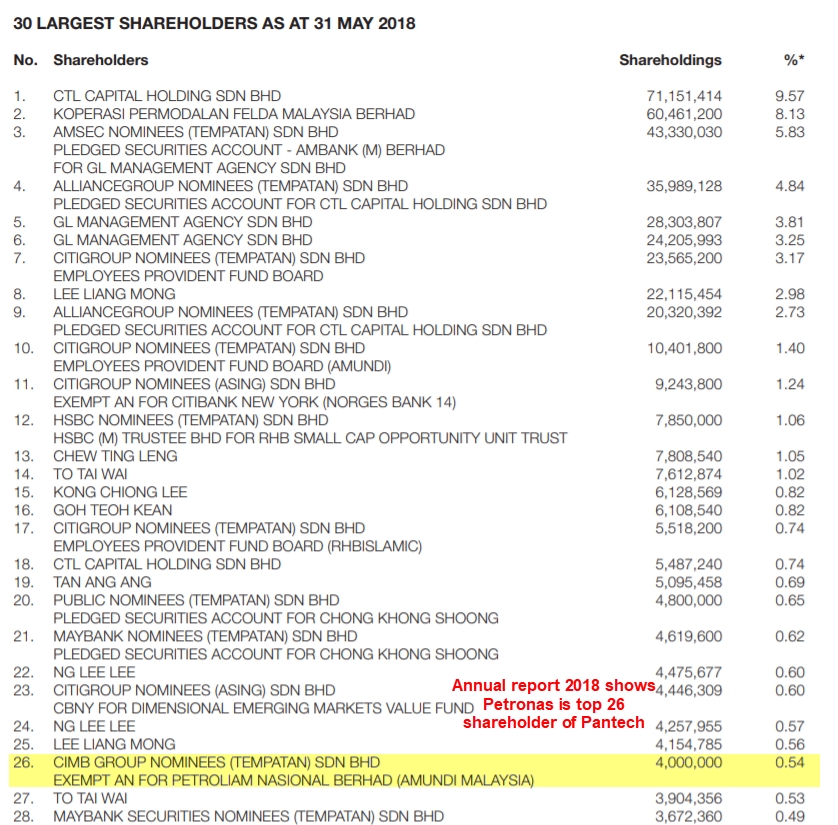

2. Actually Petronas is in the top 30 shareholders (no 26) of Pantech as show in their 2018 Annual report. Pantech may has some advantages in securing orders from Petronas capex or related order as it is their registered vendor.

Source: Pantech Annual report 2018

1. Information about Pantech: Certifications and Accreditation.

https://pantech-group.com/about-us/certifications/

2. Actually Petronas is in the top 30 shareholders (no 26) of Pantech as show in their 2018 Annual report. Pantech may has some advantages in securing orders from Petronas capex or related order as it is their registered vendor.

Source: Pantech Annual report 2018

https://klse.i3investor.com/blogs/lionind/211857.jsp