CAELY (7154) - UNDERVALUED GEM - POTENTIAL RTO TARGET !!!

Hi to all fellow investors and traders !

Today I would like to highlight a stock which I think might be an undervalued gem and could be a potential target for Reverse Take Over (RTO). That stock is CAELY HOLDINGS BHD or CAELY (Code 7154, Main Board, Consumer Products/Services).

CAELY (BSKL Code 7154)

Personal TP Short To Mid Term : 50c, Long Term : 60-70c

Here are my thoughts :

1. New Major Shareholder Entry Was Also Around 60 ++ cents

Refer below news article from 30th August 2018 where businessman Dato Seri Goh Choon Kim emerged as substantial shareholder in CAELY. He is the chairman of GTM Property, which has interests in property development as well as hospitality and leisure.

At the time, CAELY share price were ranging above 60 cents. Therefore, at the current price now, I do not believe that any of the major shareholders are going to dispose their shares.

https://www.theedgemarkets.com/article/goh-choon-kim-emerges-substantial-shareholder-caely

2. Undervalued - High Net Assets and Low Liabilities

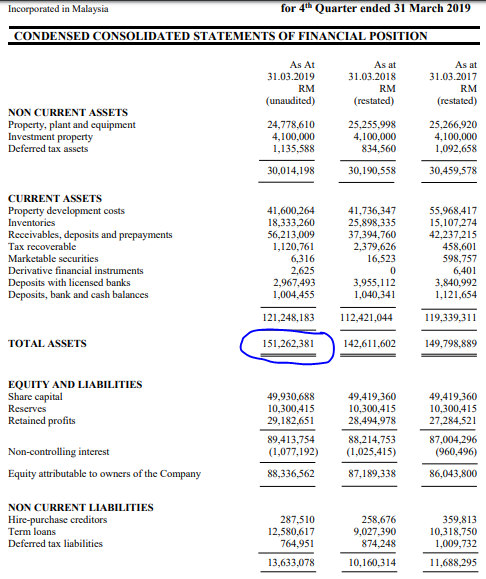

Refer below screenshot from latest 2019 quarter result. We can see the comparison between their total assets and liabilities as below:

TOTAL ASSETS : RM 151.26 million (RM 1.09 a share)

TOTAL LIABILITIES : RM 62.93 million

Difference in assets and liabilities : RM 88.33 million

Therefore, in my opinion, any company looking for entry into the main board, could be targeting CAELY as an RTO entry with the possible price range of between 60 - 80 cents, which is reasonable considering its high NTA and low liabilities. The offer could go as high as RM 1.09 which is its current NTA value.

An offer below 60 cents might be rejected by shareholders.

https://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=7154

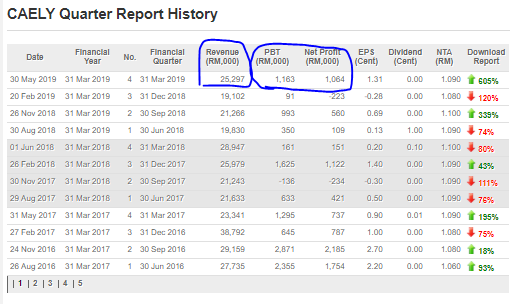

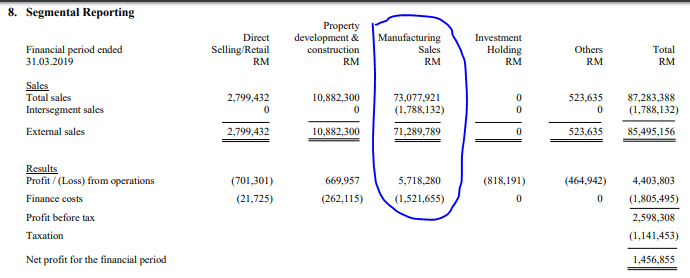

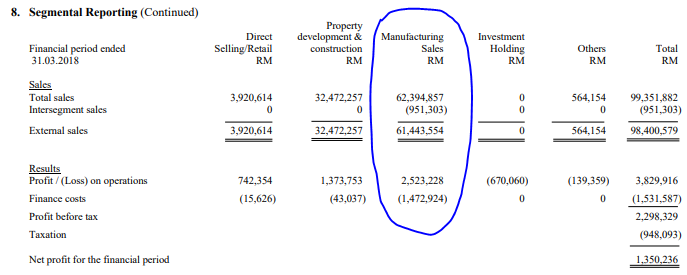

3. Financials - Turning a Profit from Improved Core Business

Refer below screenshot from latest 2019 quarter result. CAELY had recorded a net profit of RM 1.064 million in latest quarter. Also, for the full year performance, we could see that their core business which is manufacturing sales, are improving in 2019 compared to 2018.

Result of Manufacturing Sales Segment:

FY 2019 :

Sales : RM 73.1 million ( + RM 10.7 million or +17.1% compared to previous year)

Net Profit : RM 4.2 million ( + RM 3 million or + 250% compared to previous year )

FY 2018 :

Sales : RM 62.4 million

Net Profit : RM 1.2 million

4. Technicals - Rebould After Grossly Oversold - Breakout of Downtrend

Refer below screenshot of CAELY daily chart from July 2018 to latest July 2019. As mentioned before, entry of new major shareholder was in August 2018 where the price range was between 60 - 65 cents.

Price has since been on a downtrend, until recently last Friday 26th July 2019 where buyers had shown interest in this counter, registering volume of 1.38 million units.

The share price looks bullish due to following :

i. Breakout of downtrend channel since April 2019

ii. MACD crossing signal

iii. Significant volume jump

5. Alternative Entry - Via CAELY WARRANT A

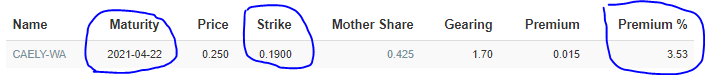

Refer below screenshot of CAELY WARRANT A profile.

A few factors making this warrant attractive:

i. Matury in April 2021 - another 21 months to expiry

ii. Strike price of 19 cents - currently mother is trading above the strike price, therefore the warrant will be sensitive to any movement in the mother share

iii. Premium of 3.53% which is considerably low for a warrant with long life

CONCLUSION

Based on my opinion, CAELY should be garnering interests in the coming weeks, based on below:

i. New Major Shareholder Entry was at 60 ++ cents

ii. High Net Assets compared to Liabilities

iii. Turned a good Quarter Profit on the back of improved core business

iv. Breakout of downtrend with increased volume interest and MACD crossing signal, which shows short term bullish bias in this counter

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUYCALL AND ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/217016.jsp