Dancomech Holdings

Company Background

Dancomech Holdings Bhd (DANCO) is engaged

in trading and distribution of PCE and Measurement Instruments. The

Company offer its products to palm oil and oleochemicals, oil & gas

and petrochemical, and water treatment & sewerage industries. For

now, it has a diverse customer base of 1,459 customers from various

industries.

The company hasn’t recorded any losses over the last 30 years, not even in 1997.

Dancomech Holdings is one of the Top 20 Jewels 2019 in RHB Picks

RHB Investment Bank Bhd's “Top Malaysia

Small Cap Companies 20 Jewels 2019” book. Given a TP of 0.84 - 0.95 for

Danco by RHB Investment Bank.

2019 Annual General Meeting

- The

Indonesian government encourages manufacturers to provide palm oil

production and exports, this actually increase the demand of Valve.

Danco is mainly selling locally through agent,

while Unimech has a large listed subsidiary in the local area and is

the most direct beneficiary; The increase in inventories as it is

expected that prices will be higher this year than last year; therefore,

sales and earnings have increased in recent quarters.

- Danco's main income is still from the

local market. They were asked whether the future of the Indonesian

market can be surpassed. There will be a possibility of it happening,

but it takes a very long time; the local business is saturated because

there are no more palm oil refineries on the market; They are all

focused on the Replacement market, which is called Recurring Income as

Valve has to be replaced after a certain period of use.

-

All local gloves companies are Danco's customers. However, only

Supermax insists not to give them orders. The reason behind it was left

unexplained.

- Some local customers purchase products

from Danco, but they may be used for foreign projects; that is, the

contribution of the local market is not necessarily used in local

projects.

- Arah Edar, which acquired a 55% stake

last year, won a contract at the end of 2018 and will continue to make

contributions. This can be evidenced by the current year Q1 and prior

year's Q4 revenues. Moreover, it can be seen that Danco will continue to

actively bid for the project.

- Whether it will be manufactured by

itself and not outsourced to OEMs? The management stated that it is not

easy to have relevant technology and employees.

- In summary, Danco's performance stability is quite high, mainly due to Valve being highly substitutable in

nature. The contribution from the Indonesian business is believe to

maintain a healthy financial position as per prior year. Furthermore,

with its superior performance in the past two quarters, it is highly

probable that the performance of Danco will continue to be stable.

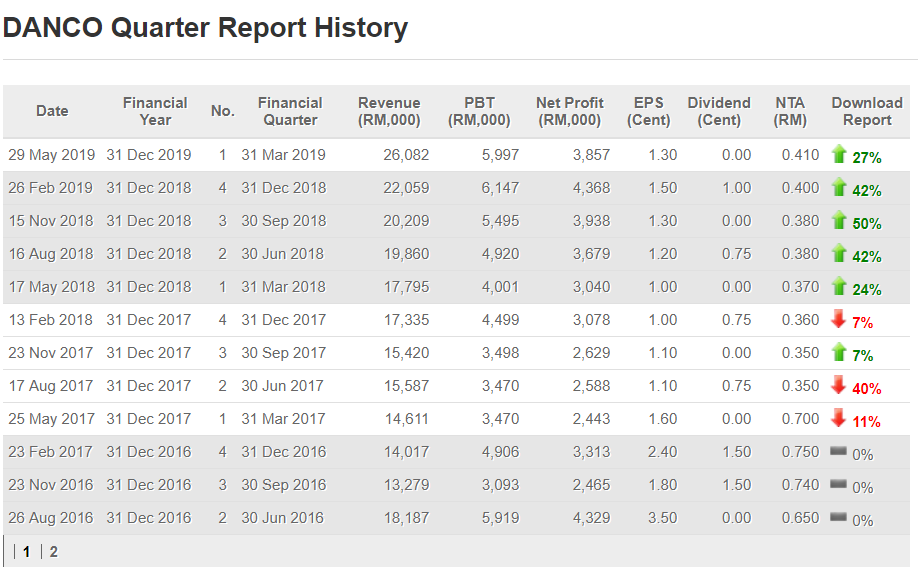

You

can see from the above table that its EPS for the last 4 quarters were

1.20, 1.30, 1.50 and 1.30 cents. Based on the following facts:

1. Strong contribution from Indonesia and latest acquisition (Arab Edar)

2. Accelerated rate of increase in profit.

It

is safe and conservative to assume that the company grow 20% to 30% of

their net profit each quarter. It will be 1.5 to 2.0. Averagely take by

1.8cents per quarter, in the next 4 quarters for financial year 2019.

That means its annual EPS will be 7.20 cents.

Based on P/E 12, the share price should be 7.2 X 12 = Rm 0.87

Based on P/E 15, the share price should be 7.2 X 15 = Rm 1.08

Based

on the Danco's past fundamental results, you can observe that the

company having steady growth since it's listed in Bursa Malaysia on year

2016. It is one of the best performing IPO stock in year 2016.

Only with strong earning and healthy cash flow of the company can distribute such good dividend to shareholders. The company's dividend yield 3.02% .which

is attractive enough because it is still a small cap company which

requires more cash on hand to grow and make more acquisition in future.

Net Cash around RM52million. The cash per share around RM0.18. Almost 30% of the companies is CASH.

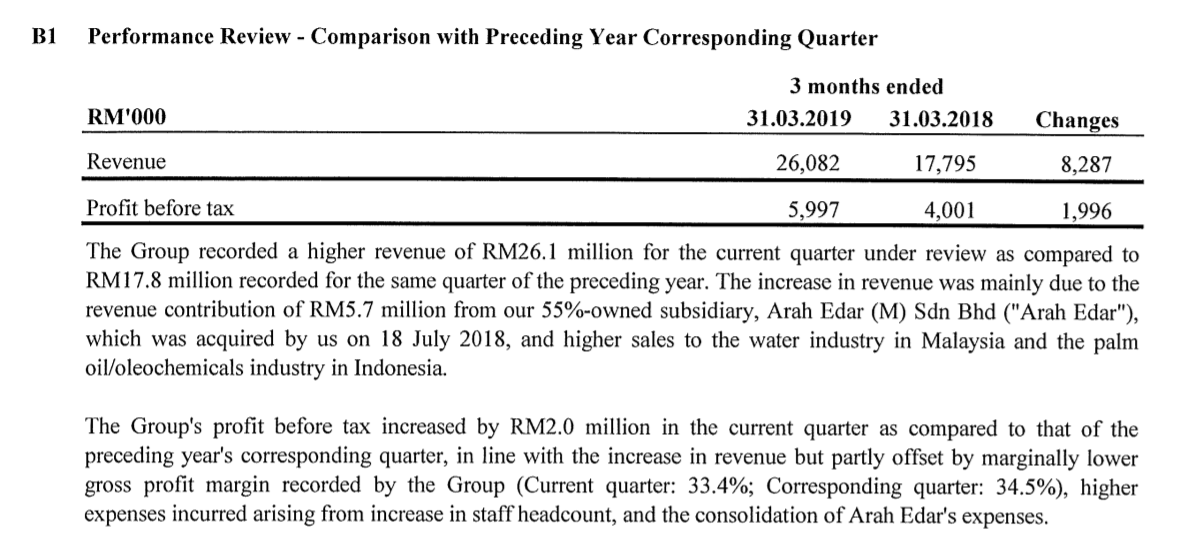

On the first quarter of FY19, the group recorded highest record revenue of RM26.1million and RM5.9mil of profit before tax. The group's gross profit margin is around 33.4%. However, higher sales contributed by the water industry in Malaysia and palm oil/oleochemicals industry in Indonesia.

If you notice the latest acquired subsidiary is making a great effort on putting the company in new record high level, which is proven by last 2 quarters with record high revenue & earning. It is believed that they can do even better in FY19 if they can get new projects for their group.

Technical Analysis

Based on TA, today Danco rebounded from support of 0.54 closed at 0.58 highest. Strong interest is generating with buyers supported. Selling pressured is gone after it is dropped from 0.68 peak level to 0.53 lowest. Around 20% + from peak is gone. With strong earning of Danco, it will start to regain the interest of investors at low pricing. Danco must stand above 0.60 will attracts more investors interest. First breakout 0.60, next will be 0.65. TA target price will be around 0.75 first TP. Do set your own cut losss price to prevent any big losses.

Conclusion

Danco below RM0.60 will have low liqudity of volume because most of the shares is hold by their family members and Yayasan Guru Tun Hussien Onn. Interesing that is Yayasan Guru Tun Hussien Onn converted 6mil of warrants to Danco. Which means they pump in more money for Danco. Moreover, Danco is rebounding with the gain of interest of Oil and Gas companies. Oil and Gas companies activity increase will indirectly benefit their company too. To be honest, how many companies in Bursa Malaysia have such sustainable earning with continously 5 quarters of growing. Few example that rise like hell and so much of hype from retailers is Master and Redtone. Both of them have similarities with Danco that is doesn't move much after growing few quarters. The latest quarter result only spark them up because the market lack of companies like them. Last but not least, Fundamental Analysis Target Price will be RM0.87 to RM1.07 which requires time to happen. My job is to point of companies that is good enough for investors to look at it during low price. Not pointing companies that have news that uncertain or create rumours like stock market operators in i3investors. The proof of a good companies is shown in this article. Please share it out if you feel it is useful enough.

Disclaimer

I am just an author who shares my

opinion, views and general information. The comments above do not

represent any recommendation of buy or sell call. Investments carry risk

that you will have to bear at your own cost. I will not be held liable

for any investment decisions made. Please seek for professional advice

before you made any decisions.

https://klse.i3investor.com/blogs/wilsonliew/213149.jsp