FGV (5222) - WHY I THINK THE UPCOMING QR MIGHT IMPROVE !!!

Hi to all fellow investors and traders !

Hi to all fellow investors and traders !

Today I would like to post an update on following counter:

FGV HOLDINGS BERHAD or FGV (Code 5222, Main Board, Plantation)

You may also read my recent post on FGV & MSM in below link:

FGV - WHY I THINK THE UPCOMING QR MIGHT IMPROVE !!!

Here are my thoughts :

1. Lack of Analysts Coverage on the Impact of Pare Down in MSM Stake & Other FGV Corporate Restructuring Actions

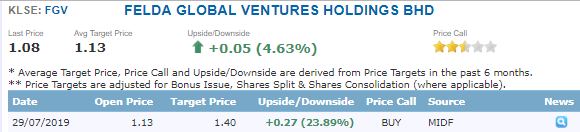

Refer below

list of research house reports released since discussions of paring down

their stake in MSM surfaced. This is in reference to KLSEI3INVESTOR

website.

Only MIDF had released a report with a target price of RM 1.40. I did not see any other IBs providing coverage on this matter.

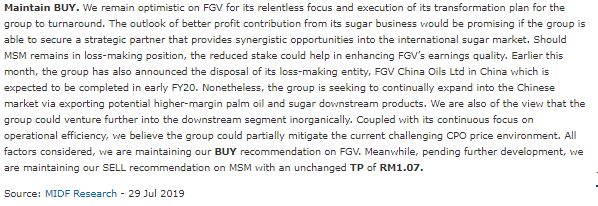

MIDF had

maintained BUY on FGV as it remains optimistic of the company focus and

execution of transformation plan to turnaround the group. The recent

disposal of loss making entity FGV China Oils Ltd in China was also a

good move for FGV.

I believe, more

IBs should be writing and providing their opinions on FGV as recently,

they had taken many actions in pursuit of their turnaround.

Let me list down a few of the many recent major happenings in FGV as a refresher:

i. Sale of stake in MSM

ii. Disposal of FGV CHINA OILS LTD for RM 100 million

iii. FGV Chairman commented on seeing greater operational improvement

iv. FGV in talks to sell Indonesian unit

2. One of the Best Research Coverage - Overlooked - Earlier Report by AllianceDBS Research with TP RM 1.75

One of the positive reports I could find was one by Alliance DBS Research, written on 10th April 2019 with a TP of RM 1.75.

Based on their report, FGV is one of the biggest plantation land owners

in the country, yet trades at an enterprice value per hectare (EV/ha)

of about USD 9,500 (RM 38,950) - a 57% discount to the average EV/ha of

USD 22,000 under Malaysia coverage, indicating signifcant upside

potential. FGV is t rading at 0.9 times book or -1 standard deviation

since 2015, and is the lowest in Malaysian plantation universe.

3. FGV - New FELDA Chairman Tan Sri Mohd Bakke Salleh (formerly from SIME DARBY PLANTATIONS) - Positive Impact for FGV

Refer below news article from 27th June where Tan Sri Mohd Bakke Salleh had been appointed as FELDA chairman.

Coming from

extensive experience in Palm Oil industry, I believe that he will have

the right vision and strategies for FGV to continue improving its

business and return it back to its glory old days.

4. Improvement in its Core Business - PLANTATION

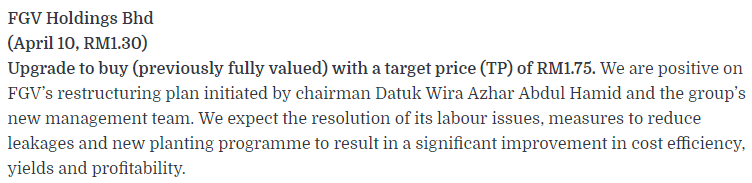

Refer below Quarter Result summary for FGV:

In most recent quarter result,

we see that even though FGV had recorded net loss of RM 3.4 million,

they recorded a Profit Before Tax (PBT) of RM 23.1 million, compared to

the previous 4 quarters where they had reported PBT losses.

Lets look a bit more detailed

on the segmental information to see the improvement. Below are the 3

latest quarter results of FGV from Nov 2018, to Feb 2019, to May 2019.

The revenue remains in the range of RM 3.1-3.3 billion. The interesting part to highlight is that we see the obvious improvement in the PLANTATION segment:

Nov 2018 : Loss of RM 849.8 million

Feb 2019 : Loss of RM 121.5 million

May 2019 : Gain of RM 39.8 million

Therefore, despite how the CPO

prices move, it seems to me that FGV has focused on the more important

things to ensure its profitability in the PLANTATION sector, which is

the management of its OPERATION COST and OPTIMIZATION.

Also, with the discussion of

selling down their stake in MSM (sugar business) which has been loss

making for the last 2 quarters, I believe FGV is in the right track to

improve its profitability for the coming quarters.

Nov 2018 report:

Feb 2019 report:

May 2019 report:

5. Technicals - Bull Flag Consolidation - Low Risk Entry at Mid BB

Refer below daily chart of FGV from March 2019 till now.

A few observations below:

1. FGV forming a bull flag consolidation with supports at RM 1.03 area. Prices have touched this level 2 times and rebounded, indicating support in this region

2. Stochastics and RSI indicating oversold levels, and momentum shifting upwards

3. Significant volume jump to 6.44 million units on Friday 9th August 2019 compared

to previous day of 2.5 million units, despite going into long weekend

holiday (12th August Monday is Hari Raya Haji holidays for BSKL)

4. Current closing price of RM 1.08 is slightly below mid Bollinger Band level, indicating relatively low risk entry as the buying momentum has started since 8th August 2019

5. Resistances seen at top BB, which is recent high price of RM 1.17.

Coincidently, this also overlaps with the bull flag breakout level.

Therefore a breakout above RM 1.17 would be indicating strong bullish

breakout towards RM 1.30 level.

CONCLUSION

Based on my opinion, I believe upcoming FGV QRs might be showing good improvements, based on below:

i. Hopefully better coverage from local or foreign IBs on FGV latest corporate actions

ii. New FELDA Chairman with extensive experience in palm oil industry - TAN SRI MOHD BAKKE SALLEH

iii. Improvement in its core business namely plantation

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUYCALL AND ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHORhttps://klse.i3investor.com/blogs/InvesthorsHammer/218963.jsp