GENM (4715) Genting Malaysia Part 3: Why the market is dead wrong on the acquisition (boostmy)

Links to part 1 and 2 below:

https://klse.i3investor.com/blogs/boostmy/218521.jsp

https://klse.i3investor.com/blogs/boostmy/218784.jsp

Part 3: Why the market is dead wrong on GENM's acquisition

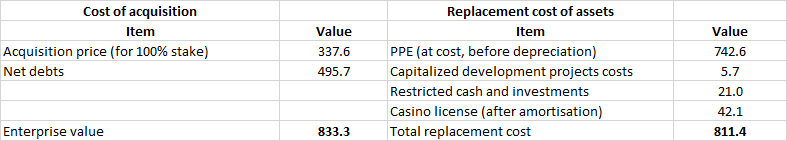

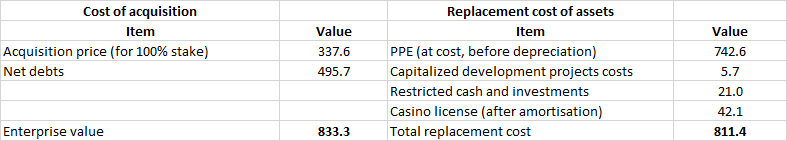

Calculating the replacement cost of constructing a greenfield casino

Why the deal was transacted at 1.6x book value and chapter 11 concerns.

https://klse.i3investor.com/blogs/boostmy/218521.jsp

https://klse.i3investor.com/blogs/boostmy/218784.jsp

Part 3: Why the market is dead wrong on GENM's acquisition

Calculating the replacement cost of constructing a greenfield casino

- The market is fixated on the Empire Resorts Inc deal (the deal) being a related party transaction (RPT) and a loss-making entity. It has failed to look at the deal objectively.

- I have read numerous reports on the deal, but none have attempted to justify the basis of deriving the acquisition price.

- For a loss-making entity, with its primary source of income (Resorts World Catskills) only in its 2nd year of operations, the appropriate valution method would be the Replacement Cost of Assets method (relative valuation methods and discounted cashflows are inappropriate).

- Looking at the deal objectively (disregarding the RPT and current loss-making state of the company), the acquisition is best viewed in comparison with constructing a greenfield casino.

- Except that with the acquisition of Resorts World Catskills, investors are able skip the riskiest period, ie the construction period of 3-4 years, the process of obtaining the casino license, and land lease rights (remember Mashpee?).

- Explained simply, the deal should be viewed as a method of inorganic growth, ie M&A - an alternative to building a brand new casino in New York as part of GENM's organic expansion.

- The enterprise value of 100% in Empire Resorts Inc of USD833.3m is only USD21.9m higher than the total replacement cost associated with constructing Resorts World Catskills up to its current state. In this sense, the deal is fair.

- Just imagine if GENM proposed to construct Resorts World Catskills from scratch, exposing itself to many risks, instead of through the acquisition route. Would the market react the same way?

Why the deal was transacted at 1.6x book value and chapter 11 concerns.

- Because Empire Resorts Inc is a listed company in Nasdaq with a market price (market capitalisation). The deal offered at market price of USD9.74 must take into account both the buyer as well as the seller.

- However, looking at its 52-week range of USD6.31-USD16.96, the acquisition price of USD9.74 is at a 16.3% discount to the median of the trading range, favoring the acquirer slightly.

- Don't forget that while the deal is mainly an acquisition of shares from Kien Huat, it will be extended to the minority shareholders of Empire Resorts Inc and a fair price is necessary for the deal to go through.

- The market's reaction to stating that entering Chapter 11 was a possibility was overblown. The company was stating the obvious when it said that if it continued incurring losses andif Kien Huat or funding from new shareholders was not obtained, Chapter 11 was a possibility.

- Because it does not create any synergies or make any business sense. Remember that Kien Huat had been the sole funder for the construction of Resorts World Catskills up to this point, oversubscribing to right issuances at higher prices.

- Synergies will be created after integrating with GENM's Resorts World Casino NYC. It currently has a 41.8% market share in the Northeast US region which will increase with Resorts World Catskill. This will creating better operational scale on loyalty programs and marketing initiatives, not to mention lower administrative costs.

- There is also the consideration of cannibalisation. If Kien Huat fully acquired Resorts World Catskills and continued pouring its own money into the venture as it takes market share from Resorts World Casino NYC, how would investors view it?

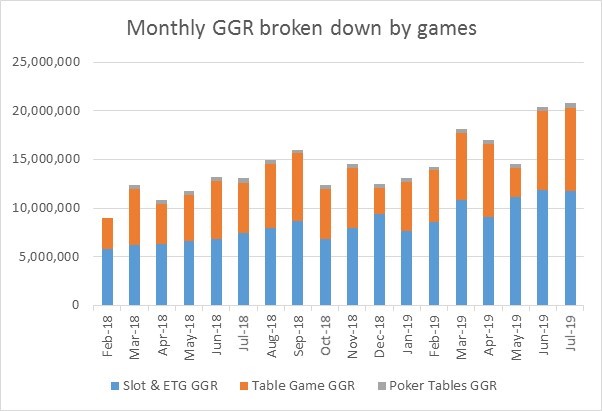

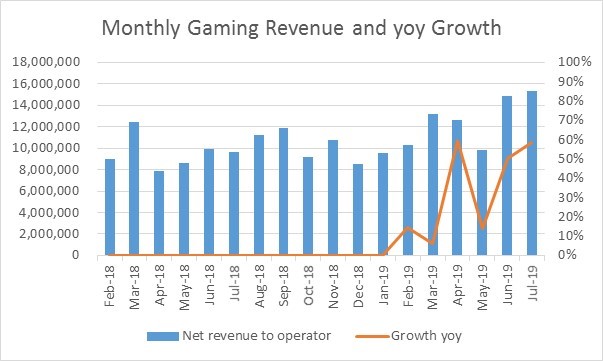

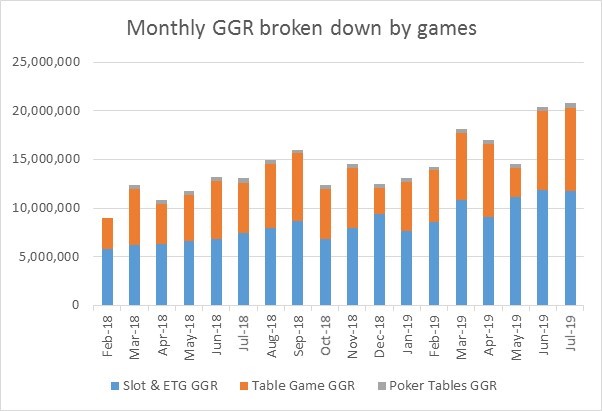

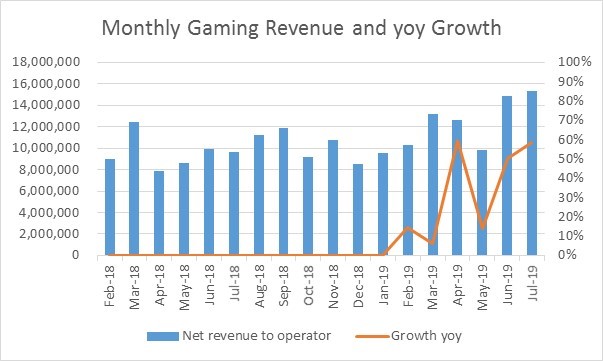

- Both GGR and net gaming revenue was up 59% yoy and 2% mom for the month of July 2019.

- This rate of growth, along with the VGM facility at Monticello recommencing in June 2019 and the commencement of sports betting in July 2019, I am fairly confident that Empire Resorts Inc will breakeven at EBITDA level in 3Q19.

https://klse.i3investor.com/blogs/boostmy/219481.jsp