PBBANK (1295) Public Bank: The price is cheaper. Should I buy now?

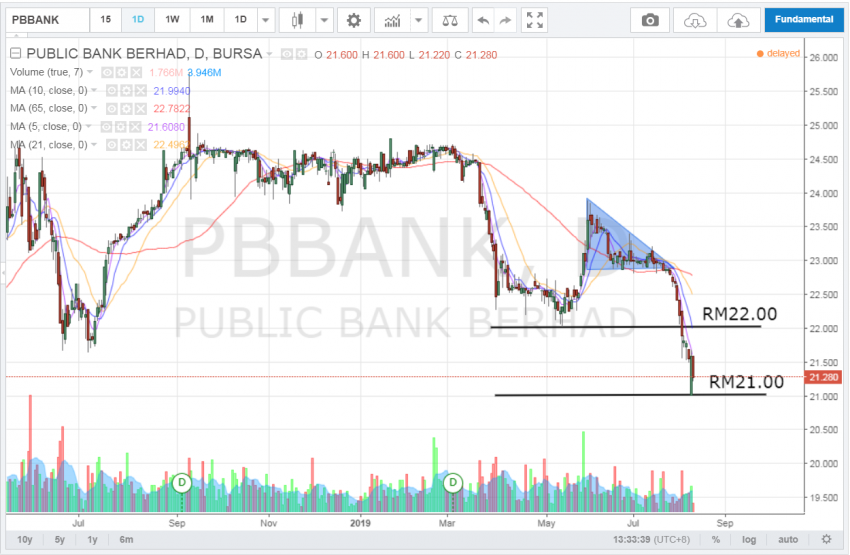

In July 18 after the secondary test, Public Bank began to rally and soaring as much as 19.02% over the next 2 months. On 12th September, the stock fell 4.88% in a single day and was unable to break the RM25.08 resistance. Here, the 6 months consolidation was traded between RM23.73 and RM24.80. Several heavy daily trades occurred during the consolidation, which implied a possible of distribution from the large operators.

On 21st Mar 19, the selling broke RM23.73 support and fell 8.85% in 7 days with high volume. The stock then traded above RM22.00 for 1.5 months approximately. In May 19, it showed a possible spring and gained 6.51% towards the end of the month. However, the rally stopped and did not demonstrate strength subsequently.

The stock formed a descending triangle in June 19, which produce ambiguous meanings. The high volume on 19th June and 11th July showed a possibility of distribution from the large operators. On 24th July, the stock penetrated the support line which confirmed the bearish signal. The breakout was alarming and the stock fell 5.98%.

The penetration of RM22.00 with high volume indicated the sellers were in control. The green candle on 6th August showed a likelihood of buyers, however, the low volume could not offer the validation of a bullish signal. I reckon retailers should keep this stock in the monitoring list and do not buy now. After all, the stock is heading downtrend. (Click here for the full picture)

http://www.geraldkohstockcharts.com/2019/08/07/public-bank-the-price-is-cheaper-can-i-buy-now/?utm_source=rss&utm_medium=rss&utm_campaign=public-bank-the-price-is-cheaper-can-i-buy-now