Malaysia Stock Analysis – Tenaga (5347)

Tenaga Nasional Berhad (Tenaga) was founded in 1949 and is

headquartered in Kuala Lumpur, Malaysia. The company is mainly engaged

in power generation through thermal power plants and hydropower plants,

transmission and distribution of electricity in Malaysia

The company also manages and operates a transmission network

interconnected with Thailand and Singapore. In addition, Tenaga also

produces transformers, high voltage switchgear and cables.

In general, Tenaga is one of the top 30 blue chip stocks in Malaysia

with a market capitalization of around 74 billion, and currently has the

third largest market capitalization in Malaysia.

Tenaga has four main businesses, namely Generation, Grid, Distribution Network, and Retail.

Tenaga users are divided into home users, business users, industrial

users and others (eg street lights). And the majority is home users.

Tenaga is capable to produce approximately 10,918 MW of electrical

energy. Approximately 119,000 GWh of electricity can be sold in one

year.

The Equivalent Availability Factor (EAF) of the Tenaga Peninsula Power

Plant (the index used to measure plant efficiency) is 85%-90%; and the

Equivalent Unplanned Outage Factor (EUOF) (the index used to measure

plant failure time) is only 2.7% - 7.1%.

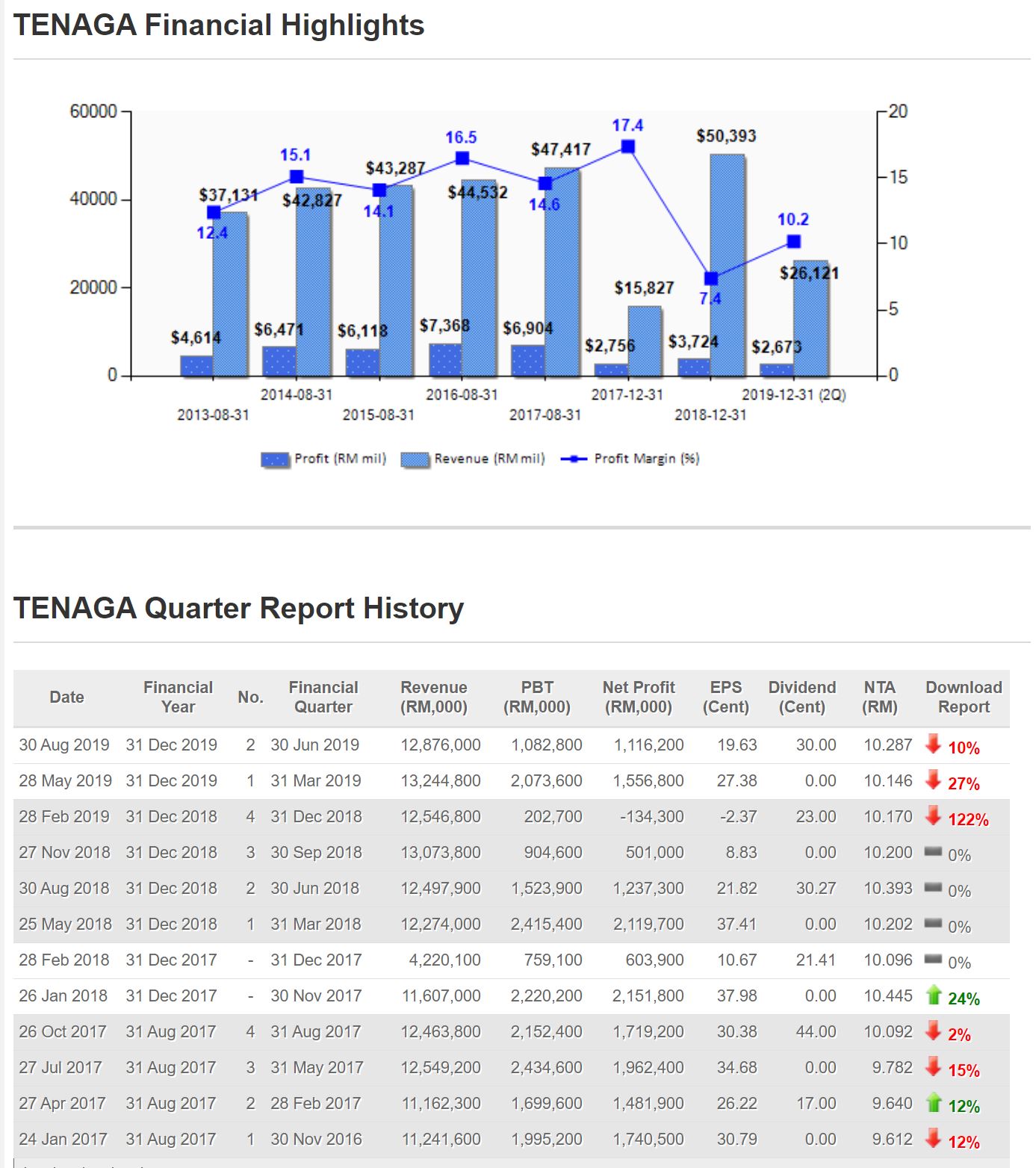

In the past five years, TENAGA's turnover has been growing steadily.

The growth rate over the past five years is an average of 4.2% per year.

Due to the change in the financial reporting date of TENAGA in 2017,

there are two more quarters in FY2017. In order to be fair, the data for

these two quarters will not be included in the calculation when

comparing.

From 2014 to 2017, TENAGA's net profit basically did not increase,

maintaining an average of about RM 6.7 bil. But in FY 2018, TENAGA's net

profit was only RM 3.7 bil, a drop of 46%.

However, is the net profit for the 2018 fiscal year really as bad as it seems?

Looking closely, TENAGA has an asset impairment of RM1.07 bil, a

one-time foreign exchange loss of RM 0.39 bil and regulatory adjustments

in fiscal year 2018. If these one-time gains and losses are removed,

the company's after-tax profit It is RM 5.44 bil.

Future Prospect:

In the coming year, the company will strive to expand the power generation business turnover plan to expand the company restructuring plan, and cultivate high-skilled, knowledgeable and effective teams to meet future challenges.

The company will increase thermoelectric production through a 70% owned Jimah East Power plant to meet growing demand.

As the company moves into a fully digital and automated grid and

distribution network in the near future, the company hopes to establish

its own grid college in the future, focusing on developing subject

matter experts with the necessary financial, technical and leadership

skills to become the grid department.

In terms of infrastructure, the company will continue to strengthen the

central 500kV grid highway to ensure continuous power supply, reduce

transmission losses, and equipped with 3,000 additional distribution

substations and DA technology. The company will also work to complete

the asset investment plan to submit grid and distribution network

proposals to governments and regulators prior to the upcoming third

regulatory period, RP3 (2021-2023).

Management believes that the implementation of their highly skilled

workforce, coupled with the reimagined TNB strategy, will help the

company seize the industry's new opportunities for a more sustainable

future.

https://klse.i3investor.com/blogs/LouisYapInvestment/232115.jsp