Hi to all fellow investors and traders !

Today I would like to highlight the following counter:

SOLID AUTOMOTIVE BERHAD or SOLID (Code 5242, Main Market, Consumer Products/Services)

SOLID - This Company's Earnings Improved 2 Quarters in a Row !!! Solid Future Ahead ~

Here are my thoughts :

1. Improved Earnings 2 Quarters in a Row - Possibly Will Invite Long Term Investors Back Into This Company

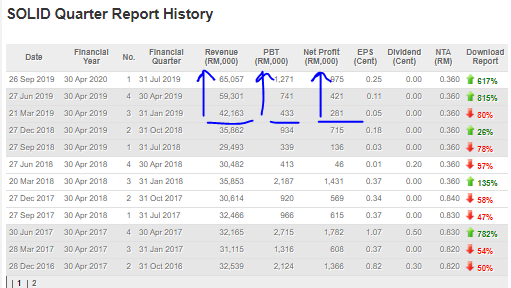

Refer below screenshot of SOLID summary QRs. With the recent QR posted on 26th Sept 2019, SOLID revenue and net profits have been improving for 2 quarters in a row now.

With this solid growth strength, investors which golden rule to look at

company with earnings improvement every quarter, might be considering

to buy and hold this counter in anticipation for long term capital

growth prospects.

Revenue hit all time high in the recent quarter, therefore with some

cost management in place, I am sure that SOLID could be posting net

profit of at least RM 1 million ++ for the coming quarter and even post

between RM 2 - 4 million net profit should the company manage its costs

well.

2. Substantial Shareholder Mr Ker Boon Kee - Added 1.0745 million units in September alone

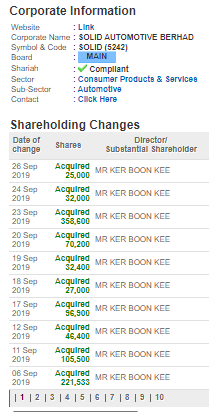

As per the shareholder report,

it seems that SOLID majority shareholders are the "KER" family. Refer

below screenshot of the latest shareholding changes in the company.

We could see that Mr Ker Boon Kee (substantial shareholder, but not a director) has been buying a total of 1.0745 million units in September alone.

From this, it reflects confidence in the company and that possibly the share prices are going to move higher from here onwards.

3. TA Analysis - Worst is Over - Volume Building into the Oversold Chart

Refer below weekly chart of SOLID. A few observations below:

i. SOLID was trading at RM 0.50- 0.60 range in 2017 before it announced deteriorating profits

ii. A Rounding Bottom pattern is forming, with the recent low of RM 0.20 hit in April 2019. Near Term Resistances seen at EMA200 and EMA360 which is RM 0.30 and 0.38.

iii.. Stochastics and RSI indicating gross oversold, indicating that downside potential might be very limited

iv. Volume is building significantly, together with the price increase

4. SOLID WARRANT A - Trading at Discount now Undervalued !!!

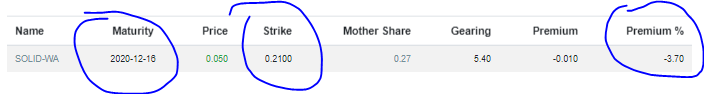

Refer below profile of SOLID WARRANT A (SOLID WA).

Maturity is December 2020 (15

months to expiry) and strike price at 21 cts. Now it is trading at -3.7%

premium, meaning trading at a discount price.

With the volume picking up in the mother shares, I anticipate that the

warrant will soon be trading at a fair value once the market notices

that this warrant still has a long expiry to go and the big upside

potential of the mother share.

Mother share price os 38 cts, implies the warrant to be trading at 17 cts in theoretical price.

CONCLUSION

Based on my opinion, I believe SOLID should be seeing interesting trend in the weeks ahead. based on below:

i. Improved earnings 2 quarters in a row, which might be inviting long term investors back into this company

ii. Recent substantial shareholder Mr Ker Boon Kee added 1 million shares shows confidence in company future

iii. Limited downside in the charts due to oversold, potential upmove in the Rounding Bottom formation

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUYCALL AND ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/227269.jsp