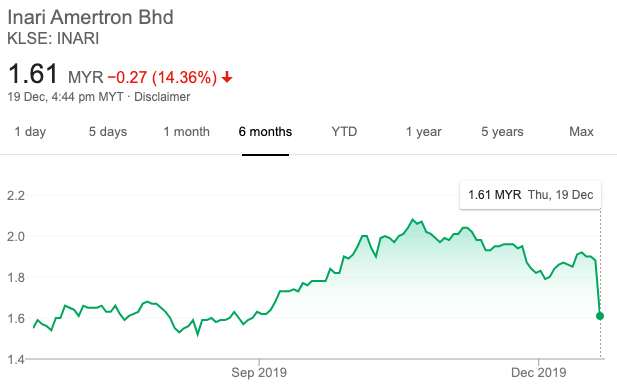

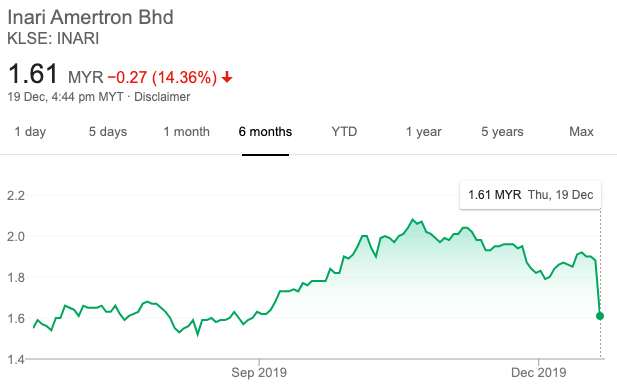

Today, Inari Ametron Berhad ("INARI")'s share price has fallen by 14.36% today,

one of the heaviest selldowns in its history. After reading comments

and opnions shared by the retail investors and bloggers, I realise most of them do not have in-depth knowledge and experience, in both: the Company, INARI itself and the industry. Information provided by them can be somehow misleading.

The objective for me to write this article is to share my personal views about the Company, INARI and the basis for the heavy selldown today. I, myself have bought INARI shares since 2013, during that time the company was known as Inari Berhad, before the completion of acquisition of Amertron INC Limited. Now, it is know as Inari Amertron Berhad.

I have been holding most of my shares from 2013 till now in 2019, despite the heavy selldown in 2018. It was and still is one of my substantial holdings. The objective of this article is NOT to recommend you to buy or to sell the shares, but to share my humble views about the Company wtih you. Since 2013, I have been keep in touch with some industry players and experts in the respective industry, that has broaden my knowledge about the Company and the industry landscape.

The Cause of Today Sell Down

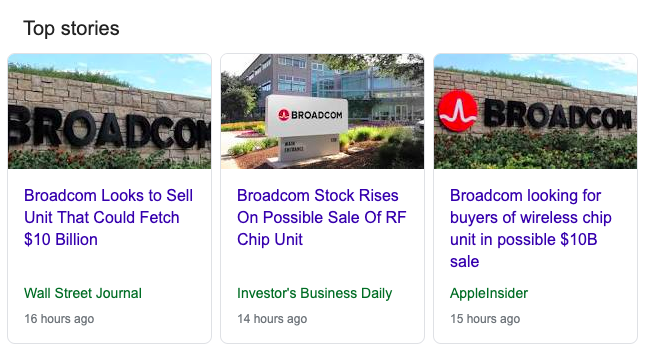

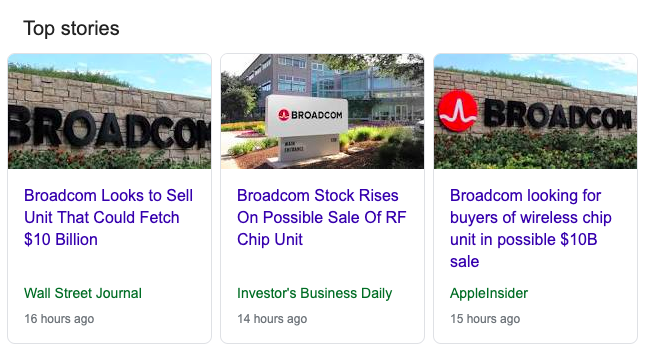

Several press releases have stated Broadcom on a possible sale of Radio Frequency ("RF") Chip Unit. Broadcom is one of the major customers of INARI. What would be the implications?

1. Broadcom Looks to Sell RF Chip Unit. It is a Possibility, Not a Confirmation.

Broadcom looks to sell the unit at $10 Billion. Broadcom is currently working with Credit Suisse Group AG to find a buyer for its RF unit. First, there is NO ready buyer. Second, a corporate exercise that involves M&A with value of more than $10B, it will take a long period of time, at least 6 months to 1 year for the legal and financial due diligence. And after all, the success rate of M&As is usually low.

Should there be NO DEAL for the sale on the RF Chip Unit by Broadcom, there is NO financial impact to INARI's business.

2. IF Broadcom has sold out its RF Chip Unit successfully, INARI might lose its Radio Frequency business as a Supplier?

First, INARI has proven its capabilities in RF throughout the years based on merit where INARI was awarded as Best Supplier (Best Contract Manufacturers) for 2010, 2015 and 2017.

Second, the Radio Frequency components are in an extremely high demand market, due to faster 5G adoption and potential high volume of 5G phone sales.

Third, there are limited OSAT service providers specialising in Radio Frequency with huge production capabilities. INARI's new plant ("P34") in Batu Kawan with a total floor space of 680,000 square feet was completed in May 2019. P34 is the biggest plant for INARI, in Block B - to cater for spillover RF testers in preparation for future 5G business.

Fourth, switching of OSAT supplier, especailly a Supplier (INARI) who was awarded as Best Supplier for a number of years is not a cost-effective decision, where it would cause a huge disruption to the supply chain.

3. Potential of More Orders to INARI, either from Existing or New Strategic Owner?

In 2020, we are expecting a faster 5G adoption and huge volume of 5G phones will be rolled out. Qualcomm Inc expects global smartphone makers to ship 450 million 5G handsets in 2021 and another 750 million in 2020, the world's largest supplier of mobile phone chips said.

Hope my sharing (combined with industry experts' views) would allow you to understand more about INARI and the industry landscape. Last but not least, while technology and semiconductor players such as Apple, Broadcom, Qualcomm and etc., their share prices are at all-time highs, I'm very optimistic with INARI's business prospects.

https://klse.i3investor.com/blogs/Inari88/2019-12-19-story-h1481234242-Irrational_Selling_of_INARI_by_a_Long_Term_Shareholder_and_Industry_Pla.jsp

The objective for me to write this article is to share my personal views about the Company, INARI and the basis for the heavy selldown today. I, myself have bought INARI shares since 2013, during that time the company was known as Inari Berhad, before the completion of acquisition of Amertron INC Limited. Now, it is know as Inari Amertron Berhad.

I have been holding most of my shares from 2013 till now in 2019, despite the heavy selldown in 2018. It was and still is one of my substantial holdings. The objective of this article is NOT to recommend you to buy or to sell the shares, but to share my humble views about the Company wtih you. Since 2013, I have been keep in touch with some industry players and experts in the respective industry, that has broaden my knowledge about the Company and the industry landscape.

The Cause of Today Sell Down

Several press releases have stated Broadcom on a possible sale of Radio Frequency ("RF") Chip Unit. Broadcom is one of the major customers of INARI. What would be the implications?

1. Broadcom Looks to Sell RF Chip Unit. It is a Possibility, Not a Confirmation.

Broadcom looks to sell the unit at $10 Billion. Broadcom is currently working with Credit Suisse Group AG to find a buyer for its RF unit. First, there is NO ready buyer. Second, a corporate exercise that involves M&A with value of more than $10B, it will take a long period of time, at least 6 months to 1 year for the legal and financial due diligence. And after all, the success rate of M&As is usually low.

Should there be NO DEAL for the sale on the RF Chip Unit by Broadcom, there is NO financial impact to INARI's business.

2. IF Broadcom has sold out its RF Chip Unit successfully, INARI might lose its Radio Frequency business as a Supplier?

First, INARI has proven its capabilities in RF throughout the years based on merit where INARI was awarded as Best Supplier (Best Contract Manufacturers) for 2010, 2015 and 2017.

Second, the Radio Frequency components are in an extremely high demand market, due to faster 5G adoption and potential high volume of 5G phone sales.

Third, there are limited OSAT service providers specialising in Radio Frequency with huge production capabilities. INARI's new plant ("P34") in Batu Kawan with a total floor space of 680,000 square feet was completed in May 2019. P34 is the biggest plant for INARI, in Block B - to cater for spillover RF testers in preparation for future 5G business.

Fourth, switching of OSAT supplier, especailly a Supplier (INARI) who was awarded as Best Supplier for a number of years is not a cost-effective decision, where it would cause a huge disruption to the supply chain.

3. Potential of More Orders to INARI, either from Existing or New Strategic Owner?

In 2020, we are expecting a faster 5G adoption and huge volume of 5G phones will be rolled out. Qualcomm Inc expects global smartphone makers to ship 450 million 5G handsets in 2021 and another 750 million in 2020, the world's largest supplier of mobile phone chips said.

Hope my sharing (combined with industry experts' views) would allow you to understand more about INARI and the industry landscape. Last but not least, while technology and semiconductor players such as Apple, Broadcom, Qualcomm and etc., their share prices are at all-time highs, I'm very optimistic with INARI's business prospects.