Dear Valued Affluent Investors,

As all investors know, the market has recently rallied with most of the Mid caps rebounding from the lows. Many have said that the market has bottomed and a new bull has emerged- while some may still be bearish. Therefore, it is prudent for one to take a step-by-step analysis to navigate this market. As mentioned, the Midcaps have rallied the most. Largards remaining are Blue Chips, Small Caps and Microcaps. However, we believe that blue chip stocks will be the most negatively impacted due to the Coronavirus. Their large headcounts, fixed cost and large debt will make it hard for the heavyweights stocks to move.

Therefore, this leaves us with Fundamentally strong small-midcaps growth stocks with the largest potential upside. Value shines within a company in this category - KTC Berhad.

KTC BERHAD

About

Kim

Teck Cheong Consolidated Bhd is engaged in the distribution and

warehousing services of third party consumer packaged goods in East

Malaysia. “KTC

has more than 7,000 sales and distribution points covering 84 districts

in East Malaysia including Brunei. Some of the recent developments and

analysis of this company can be seen in this article below.

Expanding Clientele & Market Share

As

seen in the image below, KTC is seen partnering with strategic

businesses to enhance revenue and clientele base. This will only

increase over the years. Just in early 2020 alone, KTC has already made

very strategic business deals. KTC will not be affected by the COVID 19

as much as other large caps stocks as mentioned. In fact, some of the

products distributed such as Gardenia bread and groceries have been

selling like hot cakes during this period !

Source : News reports by TheStarOnline in 2020

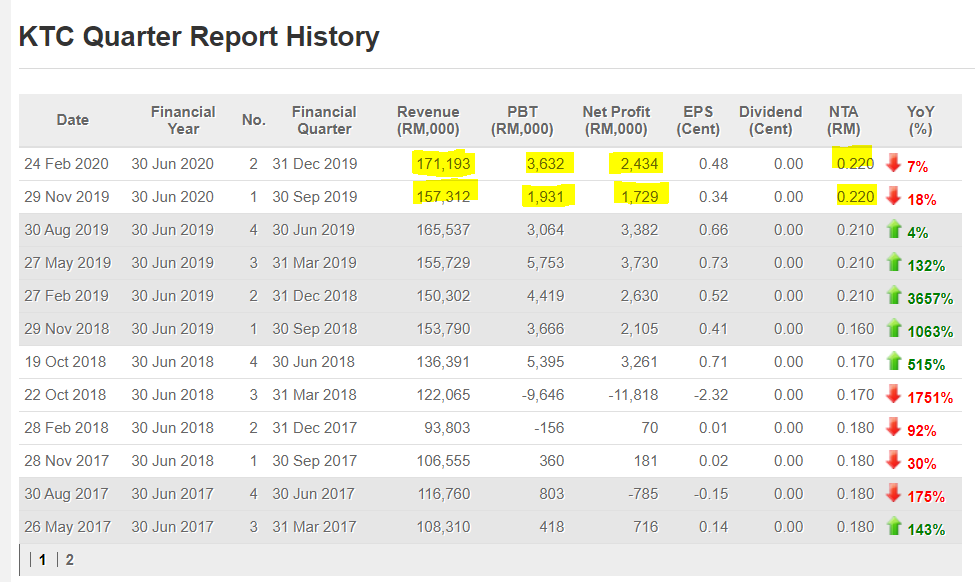

Aiming Growth & Profits

Revenue

is increasing at a healthy pace for this company. Although the margins

are relatively small, it is the nature of a Trading & Distribution

Business. What matters most for this company is increasing its Market

share, Clientelle and Economies of Scale. With this, margins will only

increase over time when they have a competitive edge over businesses in

the similar industry. NTA for this company is also increasing with

attractive PE of only 7.69x for a growth stock.

CHARTING BREAKOUTS - NEW UPTREND

KTC has recently broken out from its

downtrend pennant pattern. This is a bullish move, indicating a possible

new uptrend. First target for this stock can be seen at RM 0.215

followed by a bullish uptrend move all the way up to RM 0.50.

CONCLUSION

It

is crucial for stocks in this industry to have prudent management

skills to lead the company to great heights. Analyzing its key business

decisions and partnership in recent times, we view that KTC is currently

trading at attractive valuations and has large potential upside.

Management is wise as seen in the recent deals it just made, possible to

control a larger market share in the industry in future.

Thanks for reading.

Best Regards,

Greatwarrants

Best Regards,

Greatwarrants

Disclaimer:

Investing

in stocks is a great tool for capital gains. However, all investments

come with risk. Therefore, all investment decisions should be borne at

your own cost and I will not be held liable for any investment decisions

made. Do not buy Equities if you do not know the risk !! Thank you.

https://klse.i3investor.com/blogs/greatwarrants/2020-04-15-story-h1505960618-KTC_SHINING_VALUE_IN_PENNY_STOCK.jsp