https://klse.i3investor.com/entity/5199/44282/2099339118.jsp

https://klse.i3investor.com/insider/substantialShareholder/5199/12-Mar-2020/481549_3246827909.jsp

https://klse.i3investor.com/insider/substantialShareholder/5199/20-Mar-2020/483005_2261277579.jsp

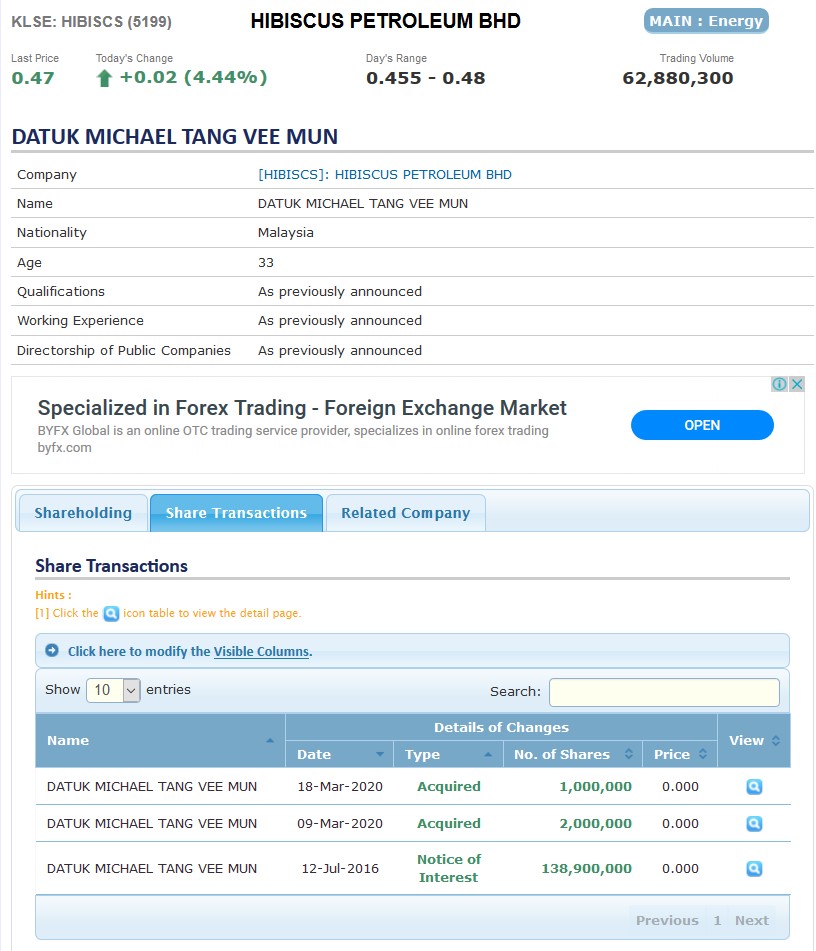

Polo is Hibiscus Petroleum’s new substantial shareholder

KUALA LUMPUR: Hibiscus Petroleum Bhd announced yesterday that it had secured London Stock Exchange’s AIM-listed Polo Resources Ltd as a new substantial shareholder, with an 8.4% stake.

In a statement to Bursa Malaysia, Hibiscus said it had entered into a share placement agreement with Polo. Under the deal, Hibiscus issued 90 million new shares at 23.5 sen each to Polo, which invests in mining assets.

“Although the oil and gas (O&G) industry is languishing in an environment of oversupply and low prices, Hibiscus is on track to generate positive cash flows and grow its high-quality asset base. We are very excited about the prospects of our investment in Hibiscus,” Polo executive chairman Datuk Michael Tang Vee Mun said.

Tang, 42, qualified as a barrister in London and holds a Bachelor of Laws degree from the London School of Economics and Political Science. He was formerly with legal firm Shearn Delamore & Co from 2001 to 2004, and was the youngest partner ever in the firm’s history.

In April 2006, he emerged as a substantial shareholder of QSR Brands Bhd — which owned KFC Holdings (M) Bhd — with 18 million shares or about a 7.5% stake, held via his vehicle, British Virgin Islands-registered Giganite Ltd.

Tang upped his stake to as high as 29.7 million shares or 12.2% in December 2006, and ceased to be a substantial shareholder of QSR in June 2009, after slowly disposing of his stake.

Market talk then was that a tussle was brewing between parties aligned to Datuk Soh Chee Wen and another faction close to Datuk Ishak Ismail for control of QSR’s cash cow, KFC Holdings.

Tang was also involved in quite a few large deals, namely the acquisition of Nanyang Press Holdings Bhd by Huaren Holdings Sdn Bhd back in 2001, and the injection of Mid Valley Megamall held under Mid Valley City Sdn Bhd into Kriss Components Bhd (since renamed Kriss Assets Bhd) in 2003.

Interestingly, he was also a shareholder of Single Malt Sdn Bhd, a company involved in the sale of single malt whisky. His partner in this business was Datuk Ling Hee Leong, son of former MCA chieftain Tun Dr Ling Liong Sik.

Tang is also an independent non-executive director of Tropicana Corp Bhd; he was appointed to the board on Nov 13, 2009.

More recently, he founded Mettiz Capital Ltd, an investment company with a 14.55% stake as at June 30, 2014 in Polo.

Tang took over the helm of Polo back in mid-2013. In the financial year ended June 30, 2014 — the first financial year under his purview — the company’s loss widened to US$19.01 million from US$16.2 million the year before.

According to Hibiscus’ statement, Polo invests in O&G, coal, gold, iron ore, copper and phosphate projects.

The 90 million Hibiscus shares placed out to Polo forms a portion of Hibiscus’ private placement exercise.

Hibiscus had earlier proposed to place out up to 326.94 million new shares or 25% of its enlarged issued and paid-up share capital.

On Aug 6 this year, Hibiscus announced that it is acquiring a 50% stake in Shell UK Ltd, Shell EP Offshore Ventures Ltd, and Esso Exploration and Production UK Ltd in the Anasuria Cluster of O&G fields for US$52.5 million.

Together with Ping Petroleum Ltd, which is acquiring the remaining 50% interest, it has jointly entered into conditional sale and purchase agreements for the said purchase.

According to the joint statement, the Anasuria Cluster is located 175km east of Aberdeen in the UK Central North Sea, and comprises a 100% interest in three producing fields, namely Teal, Teal South and Guillemot A, and a 38.65% stake in the Cook oilfield, together with the related field facilities. The assets have a proven and producing resource base which provides a platform for further development.

Hibiscus, which was originally an O&G special-purpose acquisition company, graduated from the category on May 16, 2012, after it completed its qualifying acquisition to buy a 35% stake in Lime Petroleum plc for RM165 million. Lime Petroleum is an early-exploration outfit and owns three oil exploration concessions in the Middle East.

Subsequently, Hibiscus (fundamental: 1.55; valuation: 0.9) also managed to close several deals, which expanded its presence to as far as Norway.

However, the independent O&G exploration and production company had been incurring losses for six consecutive quarters since the first quarter ended March 31, 2014, before it turned profitable in the first quarter ended Sept 30, 2015 on gains from foreign exchange due to the appreciation of the US dollar against the ringgit.

Year to date, Hibiscus’ share price has plunged 72.41% to close at 24 sen yesterday, with a market capitalisation of RM240.3 million.

https://klse.i3investor.com/blogs/HIBISCS/2020-04-06-story-h1485817342-MICHAEL_TANG_VEE_MUN_ACQUIRED_HIBISCUS_SHARE_ON_9MAR_18MAR.jsp