This post first appeared at The Pelham Blue Fund, the premier day trading blog for Malaysia stocks and warrants.

Join our FREE Telegram Channel for real time trade highlights, winning trades, and market insights. Join our community for daily updates and the best market insights on Bursa Malaysia stocks.

Outcome

Gross Profits : RM8,097

Duration : One week

With an average purchase price close to 5 sen, we ultimately disposed a sizeable position at 7 sen within the day. The gains were too good.

SECOND ROUND

To really get to grips with short term trading, you have to consider the external situation before even considering whatever targeted stock you have in mind. In order to prevent dumb mistakes (which we make often), the state of the market is a good barometer of whether to trade at all.

Sounds logical right? A good market means can trade stocks lah. But you wouldn't believe how many brave souls dare try their luck with momentum counters on a day of red ink. These are the people who bought into DSONIC at 80 sen before a nasty drop in the KLCI brings it down to 60 sen in a couple of days. Meaning : if the seas are stormy, don't go swimming.

We had sensed that the 80-point gain in the KLCI was just the beginning. For context, the index had dropped 246 points (!) from the beginning of March until its lowest ebb on the 20th. We took account of the probabilities and permutations, such as an immediate drop in the KLCI in the subsequent days, followed by renewed strength.

Things were volatile, and the downside risks substantial. But all we had to do was wait and see if the right opportunity and environment presented themselves. It took a few days.

These are good indicators to keep in mind:

1) Post earnings strength in the stock is a bullish indicator

2) A broad based market rally will benefit the sector leaders first

However, while we had initially intended to wait for GAMUDA's earnings to be released before getting into GAMUDA-WE again, the technicals and price activity prompted us to re-enter.

On 25 March 2020, the warrant had another run-up and hit a peak of 9 sen before retreating. The mother share was as volatile as ever, and recorded consecutive red candles over the next few days (closing price lower than opening price), even though the prices are heading up on aggregate.

After a retreat to 7 sen - our previous exit price - we started looking again. At this point, our focus returned to GAMUDA's technicals, as explained below.

That box pattern was the trigger we needed, because it was highly suggestive that a breakout was imminent. So on 26 March, we re-established a smaller but still sizeable position in the warrants. GAMUDA's earnings also came out on the same day, as it turned out.

If the FBM KLCI were to gap up again the very next day (as it had been doing all week), we'd take our chances with GAMUDA possibly doing the same.

As it turned out, the stars were aligned.

A good market - the FBM KLCI was up by 25 points at its peak

A breakout in technicals - GAMUDA gapped up and went all the way to RM3.

And the stock gained post-earnings - a good sign.

On 27 March, GAMUDA hit RM3, completely obliterating our expectations here.

Right market. Right stock. Right idea. Eight grand.

Last week we had talked about the fundamental aspects of GAMUDA.

We simply made a point that it was better off keeping its highway

concession business for long term cash flow generation. Just do this and

it wouldn't have to worry about potential political ding dongs and the

unavoidable exposures, simply because it's one of the few truly reliable

first class construction contractors in this country.

This time, for the proper trade that we did in regards to this angle,

we'll talk about the technicals. We had the fundamentals in mind,

justifying our assertion that the stock was massively underpriced (since

the blog post was published on 24 March 2020, GAMUDA's stock has gained

15%).

But to truly make money from a good trading angle, it's all about

position sizing, good timing, a bit of market intuition, and some luck.

This trade is not that complicated once we get to the gritty details, we

promise.

To keep this very simple, we managed to make RM8,000 in profits, with

40% and 15% yields in separate trades, mainly due to three factors:

1) Good proxy / tradeable instrument to express our bullish view

2) An extraordinarily strong broader market in the KLCI

3) A little bit of skill

Skills are obviously necessary lah, but we will focus on the first

two as they are key to enlarging profits and to increase chances of a

successful trade.

The proxy here is GAMUDA-WE a company issued warrant that only

expires in 2021. It had a nice run last year due to positive movement in

the mother share, but by late February, it all went to hell. In the

span of just one month, the warrant dropped by 88%.

We assume that you don't live under a rock, or if you do, you

probably have decent Wi-Fi. GAMUDA and pretty much every single Bursa

Malaysia stock fell by oh so much due to the epic market meltdown in

March.

The GAMUDA mother share itself fell by about 40% in just three weeks. But with a huge conversion price of RM4.05 for GAMUDA-WE, and compared with the mother share's price of about RM2.50 at the lows, the warrant was technically... worthless.

The GAMUDA mother share itself fell by about 40% in just three weeks. But with a huge conversion price of RM4.05 for GAMUDA-WE, and compared with the mother share's price of about RM2.50 at the lows, the warrant was technically... worthless.

GAMUDA-WE : One month price performance from 21 February to 21 March 202

THE TRADE

Over a seven-day period, we committed to several trades in GAMUDA-WE.

We simply chose the warrant because... that's what we usually do.

The weight of our convictions means we are willing to get that extra leverage factor. Had we bought the mother shares instead and enjoyed that 15% price gain, our profits would likely have been about a third of what we eventually got from the warrant.

The weight of our convictions means we are willing to get that extra leverage factor. Had we bought the mother shares instead and enjoyed that 15% price gain, our profits would likely have been about a third of what we eventually got from the warrant.

At 4-4.5 sen, just from a pricing standpoint alone, the warrant was

absurdly cheap. It only had to move one sen for 20% in gains. It was

fairly liquid (allowing for easy exit) and fairly volatile (giving it a

chance to move swiftly based on trading activity), making it a great

candidate for proxy trading.

We already knew from the recent market rout that stocks like GAMUDA

are totally not liquid and very volatile. This sounds bad at first, but

the volatility offers a chance for us to catch the upswing. We could

possibly buy at lower prices and benefit from a sudden move up - and we

did.

Now, what could push the price up? As much as we'd like to say it was from our quality analysis and timely blog post, it likely was not.

This brings us to the second crucial factor : the major recovery of

the KLCI in the stock market. It was a wave that took everything with

it, including GAMUDA. More importantly, we had anticipated it.

We have lived through market shocks and profited from them before : the current one was unnerving, but more in the sense that we fear not getting into obvious profitable opportunities.

A 100-point move in mere days does not come often. Statistically speaking, we have not seen this happen at any point over the past seven years. The last real big move was on the first trading day after the 13th General Election in 2013, when market moods were at all time highs.

We had an idea what a big move in the KLCI would do. First it's the blue chips that will rally big, followed by the sector leaders, and then the momentum counters. In a final thrust, pretty much everything rockets up.

Amid this grouping, GAMUDA was the surest, clearest sector leader around in construction. The company is really, actually, good - we do believe in the fundamentals - and the stock is tradeable. Even better, we had found our valuable warrant proxy that we cherish so much.

The right company, the right stock, and the right trading instrument. That's what it takes.

FIRST ROUND

We got lucky. On 20 March 2020, we happened to accumulate the warrant on the very day the market bottomed out in the near term. Maybe it was intuition, maybe it was a pure fluke. But we did enough to buy a major position in GAMUDA-WE just before the mother share skyrocketed.

GAMUDA shares shot up from RM2.52 to a peak of RM2.81 on this day, primarily influenced by the FBM KLCI's historic move. The index gained 80 points that day, and as we've just said, when it's a market tsunami, everything is dragged along with it.

We have lived through market shocks and profited from them before : the current one was unnerving, but more in the sense that we fear not getting into obvious profitable opportunities.

A 100-point move in mere days does not come often. Statistically speaking, we have not seen this happen at any point over the past seven years. The last real big move was on the first trading day after the 13th General Election in 2013, when market moods were at all time highs.

We had an idea what a big move in the KLCI would do. First it's the blue chips that will rally big, followed by the sector leaders, and then the momentum counters. In a final thrust, pretty much everything rockets up.

Amid this grouping, GAMUDA was the surest, clearest sector leader around in construction. The company is really, actually, good - we do believe in the fundamentals - and the stock is tradeable. Even better, we had found our valuable warrant proxy that we cherish so much.

The right company, the right stock, and the right trading instrument. That's what it takes.

Sniffing for opportunities - 20 March 2020

FIRST ROUND

We got lucky. On 20 March 2020, we happened to accumulate the warrant on the very day the market bottomed out in the near term. Maybe it was intuition, maybe it was a pure fluke. But we did enough to buy a major position in GAMUDA-WE just before the mother share skyrocketed.

GAMUDA shares shot up from RM2.52 to a peak of RM2.81 on this day, primarily influenced by the FBM KLCI's historic move. The index gained 80 points that day, and as we've just said, when it's a market tsunami, everything is dragged along with it.

And of course, the warrant correspondingly reflected the mother share

gains. We recall vividly not wanting the price to go up, since we

haven't finished accumulating yet. But we are not complaining about the

outcome.

With an average purchase price close to 5 sen, we ultimately disposed a sizeable position at 7 sen within the day. The gains were too good.

SECOND ROUND

To really get to grips with short term trading, you have to consider the external situation before even considering whatever targeted stock you have in mind. In order to prevent dumb mistakes (which we make often), the state of the market is a good barometer of whether to trade at all.

Sounds logical right? A good market means can trade stocks lah. But you wouldn't believe how many brave souls dare try their luck with momentum counters on a day of red ink. These are the people who bought into DSONIC at 80 sen before a nasty drop in the KLCI brings it down to 60 sen in a couple of days. Meaning : if the seas are stormy, don't go swimming.

We had sensed that the 80-point gain in the KLCI was just the beginning. For context, the index had dropped 246 points (!) from the beginning of March until its lowest ebb on the 20th. We took account of the probabilities and permutations, such as an immediate drop in the KLCI in the subsequent days, followed by renewed strength.

Things were volatile, and the downside risks substantial. But all we had to do was wait and see if the right opportunity and environment presented themselves. It took a few days.

These are good indicators to keep in mind:

1) Post earnings strength in the stock is a bullish indicator

2) A broad based market rally will benefit the sector leaders first

However, while we had initially intended to wait for GAMUDA's earnings to be released before getting into GAMUDA-WE again, the technicals and price activity prompted us to re-enter.

On 25 March 2020, the warrant had another run-up and hit a peak of 9 sen before retreating. The mother share was as volatile as ever, and recorded consecutive red candles over the next few days (closing price lower than opening price), even though the prices are heading up on aggregate.

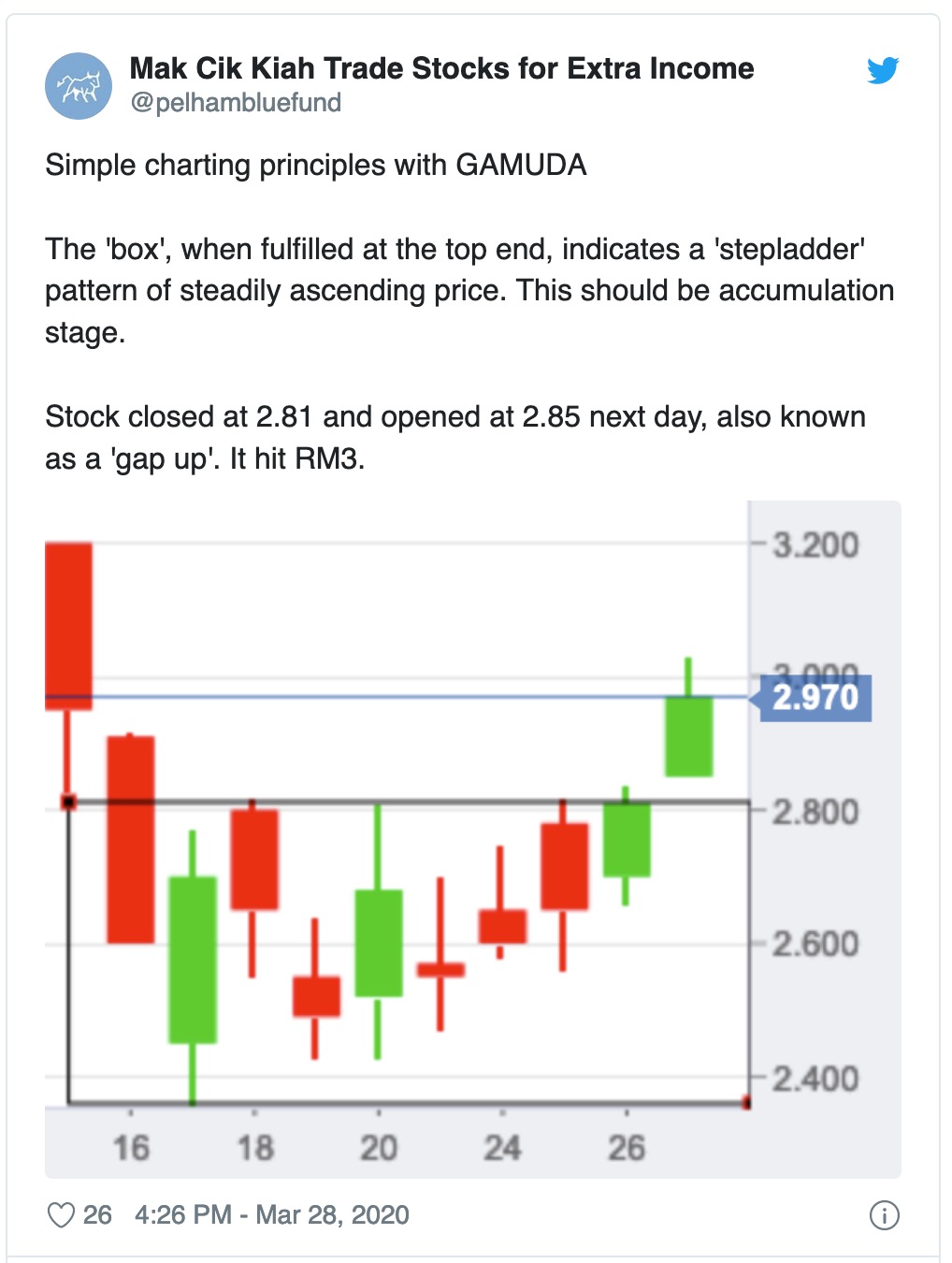

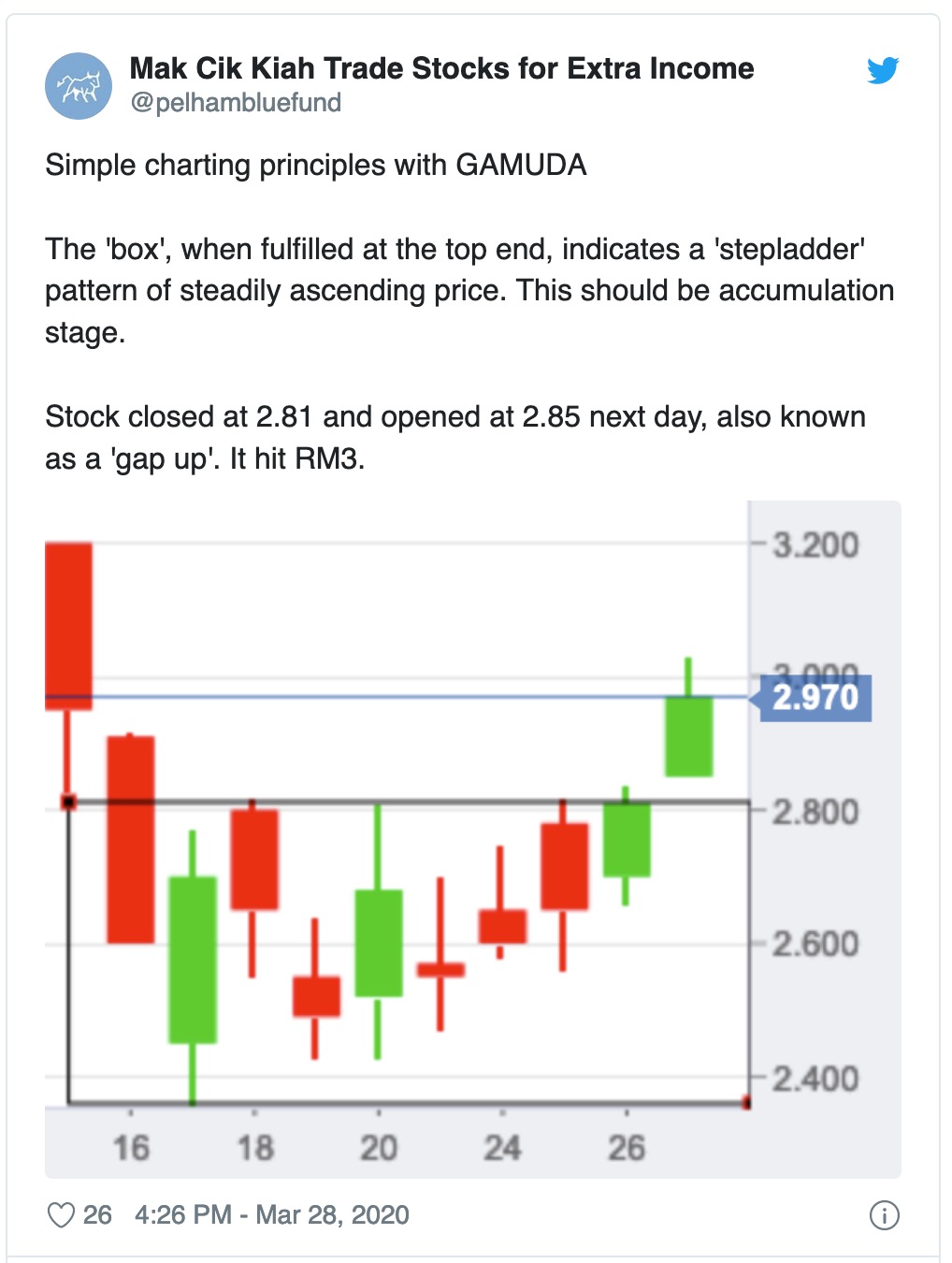

After a retreat to 7 sen - our previous exit price - we started looking again. At this point, our focus returned to GAMUDA's technicals, as explained below.

That box pattern was the trigger we needed, because it was highly suggestive that a breakout was imminent. So on 26 March, we re-established a smaller but still sizeable position in the warrants. GAMUDA's earnings also came out on the same day, as it turned out.

If the FBM KLCI were to gap up again the very next day (as it had been doing all week), we'd take our chances with GAMUDA possibly doing the same.

As it turned out, the stars were aligned.

A good market - the FBM KLCI was up by 25 points at its peak

A breakout in technicals - GAMUDA gapped up and went all the way to RM3.

And the stock gained post-earnings - a good sign.

On 27 March, GAMUDA hit RM3, completely obliterating our expectations here.

From our earlier blog post : not 12 months, but a few days as it turned out !!

We've had enough. It was a Friday, and our expectations in this stock

trading theme were nearly fully met. As GAMUDA hits RM3, we planned an

exit, and by doing this we made double digit gains in 24 hours.

Right market. Right stock. Right idea. Eight grand.

https://klse.i3investor.com/blogs/pelhambluefund/2020-04-01-story-h1485700007-Trading_GAMUDA_WE_in_a_bear_market_how_we_made_RM8k_profits_in_one_week.jsp