- Some packaging products’ demand declined but it is cushioned by other products increasing sales during MCO. Overall sales is not affected much during MCO as 80% of its products are for export purposes. Management is still confident to achieve the 1 billion revenue target in 2020.

- Currently, 45% of the revenue comes from stretch film, and 18% from food packaging product. The revenue has achieved a growth rate of about 8-10% every year over the past 3 years. It is targeted to reach a revenue of 1.5 billion by 2023 (double digit revenue growth on continous expansion).

- At moment the Japan market demand is very stable. Tguan is the biggest garbage bag exporter to Japan. About 10-12% of total consumption of garbage bags in Japan came from Tguan.

- Tguan is also expanding their PVC food wrap production line whereby 10 more production lines are planned to be installed in the next 5 to 8 years’ time. Tguan is aiming to become the biggest producers in Asia Pacific in the next 5 years. Currently there are only 3 major manufacturers in South East Asia (TGuan of Malaysia, Nanya of Taiwan in Vietnam and MMP of Thailand).

- A new factory on 16 Acres located in Sungai Petani, Kedah has been completed and installation for its 5th Nano stretch film line is completed pending European Engineers to be onsite for final parts assembly and commissioning. One Nano line is equivalent to 80-90mil revenue a year.

- Management is also building another new factory adjoining to the existing PVC plant for the 10 new 10 PVC food wrap lines.

- Nano stretch film is a highly elastic-plastic material used to wrap items and secure them on pallets. One of the greatest benefits of nano stretch film is that it can reduce the thickness while retaining a strong holding force on the wrapped pallet (can be used in automated high speed wrapping machines which require highly stretchable film which is quite common in Europe).

- Let have a look why we need more premium stretch film due to a lot of Europe wrapping machines are now automatic and work in high speed (nano stretch film allow you to stretch more compared to normal stretch film in auto-machine). Let see the video of the auto-wrapping machine using stretch film at link below (high speed vs low speed)

-

https://www.youtube.com/watch?v=L0fKTtNi27o&feature=youtu.be (high speed, need nano stretch film) -

https://www.youtube.com/watch?v=1QUCRpe4vco (low speed)

- The demands of Europe stretch film plastic packaging market remain strong. Currently Tguan sales to EU is < 2% of the EU market. Management targeted to achieve a double digit growth (up to 50%) increase in sales in Europe in the near future.

- It is worth mentioning that every shipment of Tguan to the European market bear an import tax of 6.5%. Even with the tax, they are still able to compete with tax free European companies which due to its operation efficiency and its premium market product.

- The EU line constructed in Aug 2019 has reached its full order in Oct 2019. A 3rd blown film line is planned to be installed in June 2020 and is expected to have its full order by end of 2020. The new line will add RM 20M to 25M a year to the group's revenue.

- A new state-of-art blown film line designed for food packaging planned with BRC certification to be constructed in 2020 to house the 4th European Line. For detail of BRC certification please refer to https://www.certificationconsultancy.com/brc-food-documents-manual-procedures.htm?

- The local demands of Tguan’s blown film product is picking up since Q3 of 2019 due to consolidation of packaging industry players where fewer suppliers are available in the market (Scientex acquired some smaller players).

- The PE price (raw material of Tguan) have fallen by 15% to around USD750 to 800 per ton in May from Jan 2020. Low raw material price provide Tguan ample room to maintain its profitability.

- Strong USD/MYR rate also can help Tguan to improve their margin as 80% of their products are for export

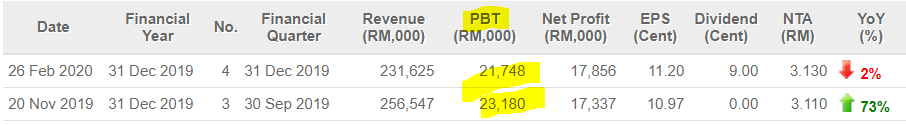

- Overall Tguan is expected to achieve consistent PBT of at least 20M per quarter as shown in the past 2 quarter in FY 2019.

-

Tguan has a healty balance sheet and cash flow over past 5 years, with net cash of MYR87.5mor net cash per share of 55 sen. The operating cash flow has been consistently positive in the last five years. It also pay decent dividend over past 9 years (DV is 2.3% currently based on price of 3.48).

- In short, Tguan has been growing in the past 3 years in term of revenue and profitability. It has growing its profitability from RM44.5m to RM61.8m over the past 3 years with a CAGR of 11.6%. Going forward for the next 3 years, management expect to grow continuously for its revenue and profitability which are supported by its nano stretch film and food wrap production line expansions.

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company and the contents of this report should not be considered as professional financial investment advises or buy/sell recommendations. I strongly encourage you to do your own research and take independent financial advice from a professional before you proceed to invest.

I make no representations as to the accuracy, completeness, correctness, suitability, or validity of any information on my report and will not be liable for any errors, omissions, or delay in this information or any losses and damages arising from its display or usage. All users should read the posts and analysis the information at their own risk and we shall not be held liable for any losses and damages.

https://klse.i3investor.com/blogs/lionind/2020-05-16-story-h1507063941-Tguan_part_2_Moving_Toward_to_1Billion_Revenue_Davidtslim.jsp