In a nutshell, my TP is RM1.45 conservatively. For a long-winded version, please continue reading :)

Tek

Seng Holdings Berhad finally announced its FY 2020 Q1 results on

Friday, 12 June 2020. I managed to buy a small position at approximately

RM0.48 on 1 June after accidentally stumbling upon i3 about their

involvement in PP Non-Woven sector. Having missed the glovemakers'

bandwagon, and a little FOMO in me, I decided to place some bets into

this small cap family-run business without delving deep, as I wanted to

have further confirmation and analysis from their Q1 report before

committing further. Thank god I did that!

Earnings were up 869% YoY and 136%

QoQ! So what next? A lot of you like myself will be wondering if this

is a one-trick pony, or a sustainable turnaround story? So I've spent

the last two nights reading through all their annual reports from 2010

to 2018, quarterly reports for 2019, obtaining and analysing financials

of their subsidiaries, namely Wangsaga Industries Sdn Bhd and Double

Grade Non-Woven Industries Sdn Bhd to get a better feel of the company,

and their financials.

Background

Tek

Seng Holdings Berhad is a company based in Penang pricipally involved

in the manufacturing of PVC related products. Current management mainly

comprises the 2nd-generation family members of founder late Mr Loh Phah

Seng @ Loh Boon Teik, of which his eldest son Loh Kok Beng took over the

helm in 1989. As such, All the siblings each have over 30 years

experience in the PVC industry and they collectively hold over 40% of

the company.

Failed Solar Venture

Tek

Seng's core business in PVC has always been a profitable business over

the 10-year horizon that I looked from 2009-2019. But perhaps it was

lacking in potential growth or the high competition with peers from

China, Thailand and Vietnam, they decided to venture into the solar

industry in 2012. It invested approximately RM300 million between 2012

and 2016 in capex for the solar segment, to manufacture and sell solar

panels etc. The venture began bearing fruits in 2015-2017 as it

contributed significantly to their top and bottom line, but that did not

last. The market dynamics for the solar industry faced massive

challenges thereafter, and in their 2018 annual report, they decided to

cease operations, citing that "the photovoltaic solar industry has been facing challenges from different aspects, eg. price pressure, government unfavourable policies as well as anti-dumping taxes implemented". I guess timing to venture into a business is really important and the management paid an expensive lesson having to incur losses for FY 2018 and FY 2019, due to total impairment losses for the solar segment of approx RM120m and inventory written down of approx RM23m. As of the latest Q1 report, no further impairment and inventory write down are recorded.

I believe the solar chapter is now of the past, and management is fully ready to restart from a clean slate and refocus their resources in their core business and expertise.

BUY call with 6-month TP of RM1.45 (142% gain from last closing price of RM0.60)

I try to be as prudent as I can in my analysis, and concluded with a BUY call based on the following:

1) Earnings visibility and resumption of dividend

2) Capital expenditure to propel growth and product portfolio

3) Healthy financial position

4) Sustained growth in PP Non-Woven medical and hygiene segment globally

5) Directors' shareholding and public awareness

| Financial Year 2020 | Revenue (RM'000) |

| Q1 | 52,005 |

| Q2 | 55,405 |

| Q3 | 55,069 |

| Q4 | 59,212 |

| TOTAL | 221,691 |

| FY 2020 | FY 2021 | |

| Revenue (RM'000) | 221,691 | 298,338 |

| PAT (RM'000) | 16,627 | 29,088 |

| EPS (Sen) | 4.61 | 8.07 |

| Expected Dividend (Sen) | 1.50 | 2.50 |

My analysis coincides with management guidance on Q1 report that results for the rest of year 2020 shall remain stable. While the global health crisis will lead to slowdown in their traditional core business in PVC Sheeting and fluctuations in raw material prices, the company is still net Covid positive beneficiary thanks to their explosive PP Non-Woven medical segment. With the recent run-up with glove counters trading at sky high PE, I would conservatively price this at 18x FY2021 forward EPS of 8.07, hence RM1.45.

Please refer to below for more details and assumptions.

1. Earnings Visibility and Resumption of Dividend

Out

of the RM52m revenue reported in Q1, I tried to make sense of how much

of that was contributed by the Covid-triggered sales for PP non-woven

medical products. Q12019 sales were approx RM40m from the total PVC

segment and I assume 0% YoY growth for this core business to get Q12020

sales of RM40m (FY2018 and FY2019 total sales both recorded less than 1%

growth for PVC segment). That should leave approximately RM12m additional sales in Q1, most likely coming from the PP Non-Woven medical segment.

I'd

be conservative and assume that Q1 factored in 50% of that impact, and

also assuming that it was already in their full capacity that they can

do for medical segment. Hence, Q2, Q3 and Q4 is expected to generate at

least RM23m additional to their core business

respectively. Nonetheless, their core PVC segment shall suffer a fall in

sales due to global economic slowdown. Having refer back to the impact

during the 2008/2009 financial crisis to their topline figures, I assume

their core segment to fall by 30%, 20% and 15% YoY respectively for Q2,

Q3 and Q4 2020. And for the full year of FY2021, it is assumed to

register a 10% growth to 2020 provided a gradual economic recovery then.

The segment has registered approx between 10% and 15% PBT margin over

the last 8 financial years. I assume an overall PBT margin of 10% in

FY2020 and 13% in 2021.

As

I have mentioned, their PVC business have always been profitable albeit

lacking of growth. And in all those profitable years, management have

been making it a point to declare dividend to reward shareholders, with

an approximately 30% payout ratio. With solar business now out of the

picture, their earnings turnaround shall continue with high certainty,

accompanied with growth fueled by the PP Non-Woven medical segment.

2. RM20million Capital Expenditure

With just a not very obvious one-liner in the Q1 report, management has indicated that they have allocated RM20m

for PP Non-Woven segment. To put things into perspective, their total

capex in the overall PVC segment (including PP Non-Woven) for the past 6

financial years 2014-2019 amounted to ONLY approx RM18m. This is

probably the most obvious hint that management see huge opportunities

from this segment and they are ready to commit big. Assuming that this

RM20m capex of new production line only come on-stream and contribute in

FY2021, I conservatively assume an additional annual contribution of

additional RM20m (20% increase in capacity) to top line growth in

FY2021.

3. Healthy Financial Position

As

at 31 March 2020, they have cash and bank balances of RM47m, and a low

gearing ratio of 0.1 times. If market dynamics continue the way they

are, they have the firepower to invest further in the future if deem

appropriate. NTA per share stood at RM0.54. The state of the financials

of Tek Seng is very healthy and the valuation of close to book value

gives further comfort on downside risk from the latest closing price of

RM0.60.

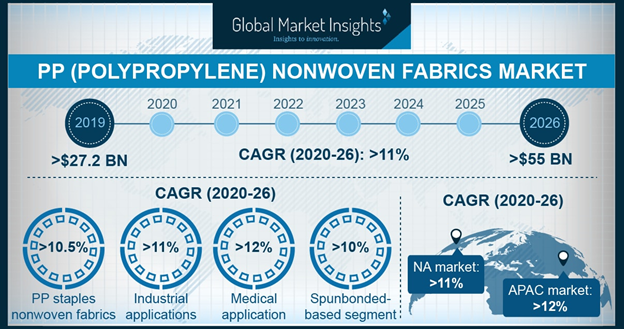

4. Sustained Growth in PP Non-Woven Medical and Hygiene Segment Globally

Self-explanatory

from the above global market research report, PP Non-Woven Market

expected to grow at a CAGR of 11%, of which APAC and medical application

is in the sweet spot of above average growth rate. This time round, Tek

Seng is the right company, in the right place, at the right time "天时,地利,人和" matches. And Q1 report is evidence that they are fully prepared to exploit this vast market opportunity.

5. Directors' Shareholding and Public / Media / Broker Awareness

The

main directors of the company (3 siblings) collectively own more than

40% of shareholdings, as like many of Bursa-listed family run

businesses. Compared to other more professionally run companies

especially in the Western world, the main benefit of this is that the

management interests are in-line with shareholders. They would want

better share price performance and dividend payout as you do too.

Another

aspect that I really like about Tek Seng is that it flew under the

radar of most of media and market participants, as such, it is a true

gem with massive untapped potential. There were almost no media article

on their Q1 excellent report, and even on i3 forum it is fairly a quiet

affair for now. Most retail and institutional investors probably still

busy goreng glove stocks and its small market cap currently meant that

it probably won't pique the interests of most fund managers yet. I also

have more confidence with the management's low key approach of further

investment into PP Non-Woven segment. Unlike some other listed companies

who just started to venture into the current hot businesses of face

mask, PPE equipment or anything Covid-related, and doing it high profile

just for the purpose of "goreng" its shares. Tek Seng is already in the

business of PP Non-Woven since at least 2005 and they do it nice and

quiet, while aggresively taking full advantage of the current situation.

CONCLUSION

Given

the above, I probably should have bought more before they announced Q1

results but that would be nothing more than gambling, since I have no

inside information prior to the announcement. What we can do now is act

with all the information we have, now that Q1 results are out. Based on

the latest closing price of RM0.60, it is a no-brainer BUY call with

high upside potential and low downside risk. I hope to be able to double

down on this investment tomorrow before it goes limit up at RM0.90.

Anything below RM0.80 still gives a massive upside of at least 80%.

Let's get our hands in this before it gets all the media attention with the LIMIT UP.

Disclaimer:

I do own some shares in Tek Seng Holdings Bhd.

**Please do your own due diligence and feel free to fact check or clarify my assumptions / numbers.

https://klse.i3investor.com/blogs/ahairytraderblog/2020-06-14-story-h1508786110-TEK_SENG_7200_Sell_on_News_or_Limit_Up.jsp

https://klse.i3investor.com/blogs/ahairytraderblog/2020-06-14-story-h1508786110-TEK_SENG_7200_Sell_on_News_or_Limit_Up.jsp