Dear fellow readers,

Once

again, these writings are just my humble highlights (not

recommendation), feel free to have some intellectual discourse on this.

You can reach me at :

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/

or Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

__________________________________________________________

__________________________________________________________

Dear all, apart from Riverstone Holdings Ltd. which I was the earliest to discover and highlight the stock, I have yet to write an article on the glove sector due to a proliferation of articles / reports by research analysts , authors and promoters which made me feel writing another article is redundant. However, given the selldown in glove sector in recent days since Top Glove reported extraordinary results, I would like to share my humble view with all. (A detailed article would follow later on)

When

I first called Riverstone Holdings in 2019, I remembered it was only 90

sens SGD, today it closed $2.31 SGD (high of $2.49). I have not sold a

single share since then. Why did I choose this company? Some may ask, if

I was so good, why did I fail to notice other gloves stocks like the

big 4 and only focused on Riverstone? Bear with me and let me share a

true story.

Luck

was on my side when I was representing a client (US buyer of medical

gloves) during their visit to Malaysia scouting for suppliers. They

wanted Top Glove even before visiting other glove makers thinking

Topglove is number 1. However they later on realised in terms of

quality, Tier 1 nitrile medical gloves were Hartalega, (lesser known)

Riverstone, (non-listed) YTY Group. Through this business dealing, I had

the chance to visit Riverstone manufacturing facility, meet with the

management team. I knew I had to invest after my visit because I was

impressed with their facility and most importantly the management team /

founder philosophy. This was before Covid-19 pandemic.

Shortly after that, I started studying the sector and found :

1. Hartalega -

would always command a premium over the rest (founder Mr Kuan - is an

industry titan / pioneer) with strong balance sheet and state of the art

facility / technology.

2. Top Glove

is the ever expanding, aggressive, high profile number 2 chasing

Hartalega market leader (market cap) position. What made me hesitant was

the huge debts taken to expand - perpetual sukuk. I never liked overly

aggressive business philosophy. However, today Topglove is reaping the

full benefit due to their aggressive growth model.

3. Kossan was

the number 3, steady, expanding with good margin glove player who was

not as aggressive as Topglove but reliable and willing to work hard to

fulfil their OEM client needs whilst carving their own niche is

technical gloves.

4. Supermax was

the OBM player who had fluctuating performance, and margin that was

lower with a less healthy balance sheet. Today, Supermax OBM model is

paying off benefiting from full ASP increase.

When

Covid-19 was still known as Novel Coronavirus in end Jan and before a

full blown pandemic, during a round of golf, a seasoned investor whom I

was having a game with told me to buy Supermax. The price was RM1.70

then. I refused as my biggest reservation was the past political issues

of the founder. Clearly, I was wrong.

Subsequently,

when Riverstone results was out, I knew that this sector is due for

rerating. Then the glove stocks started the run and I was desperately

looking for the next glove stock still a laggard as Big 3 were shooting

through the roof. Luckily, I found Sri Trang Agro (Thailand and

Singapore dual listed) both were still significantly undervalued. I took

a huge position. My subscribers did too and today, all are sitting on

good profits from Riverstone and Sri Trang. We are still holding till

today.

I

wanted to be patient to wait for results earnings before I make a call

which is my style.I couldn't believe how crazy the sector rerated as

retailers, research analysts and promoters were pushing Big 4 and other

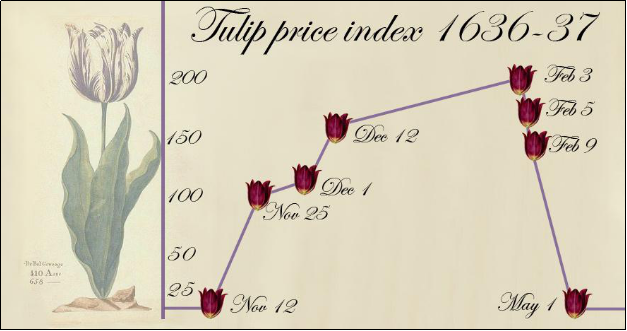

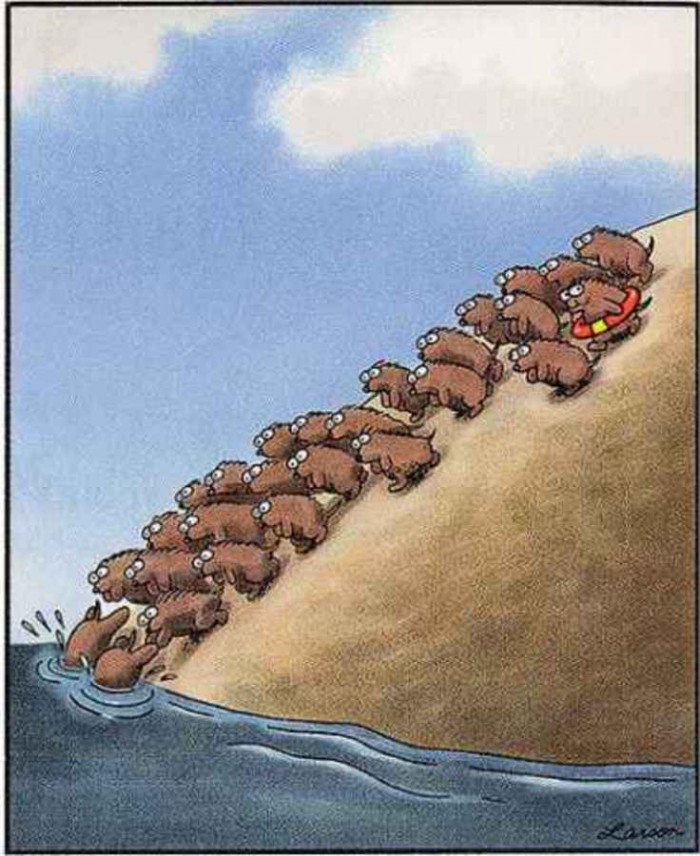

lesser known / loss making glove players. To me it has become like a

"Tuilp Mania". But I was wrong when Top Glove released the results last

week. It was off the charts. They were right.

Now fast forward to today, the entire sector appears to be facing sell off due to a variety of reasons. I

won't address it here one by one but will deal with it in a later

article. I will only say this - the gloves sector retracement / selloff

is a godsend opportunity to those who missed the ride. Whoever entered

earlier and is taking profit now, congratulations, you or the fund did

well hence taking profit off the table is good discipline.

BUT,

this is a good opportunity to collect Topglove, Supermax, Kossan and

Hartalega (in order of position) because fundamentally, this will be a

record run never seen in our history and it is a culmination of 30-40

years since the industry was built by the pioneers back when there were

over 300 players competing. What you see today are the reward being

reaped after years of innovation, persistence, competition by these

manufacturers who built their business on solid foundation that even

China manufacturers with their skilled copycat / technology innovation

cannot compete. Malaysia glove sector is an industry that controls 65%

of world market share not by sheer luck or opportunistic play. It is

years of organic growth backed by natural resources, technology

innovation, R&D which has won the trust, certification and global

reputation for the country.

This

is my view and I hope it will clear some of the confusion / anxiety /

worry faced by my fellow investors. Rather than throw your money into

syndicated promoted goreng stocks with poor fundamentals, have a little

faith in our Malaysian industrialist who have toiled and sweat more than

30 years to play a big role in fighting covid-19 global pandemic and

protecting frontliners with their products. Their valuation is more than

justified and I believe this is one of the best opportunities in the

market right now.

_______________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

https://klse.i3investor.com/blogs/tradeview/2020-06-19-story-h1508875515-_Tradeview_2020_Commentaries_on_The_Recent_Glove_Sector_Selldown_Since_.jsp