Yesterday market sentiment and buying interest lead by Pharma stocks such as - DPHARMA, PHARMA, KOTRA

Today market is lead by 2nd liner Pharma Stocks such as - BIOHLDG and SUNZEN.

Maybe many ppls no notice that CNI is another Pharma stock in Bursa Malaysia. Now CNI only traded at 8sen.

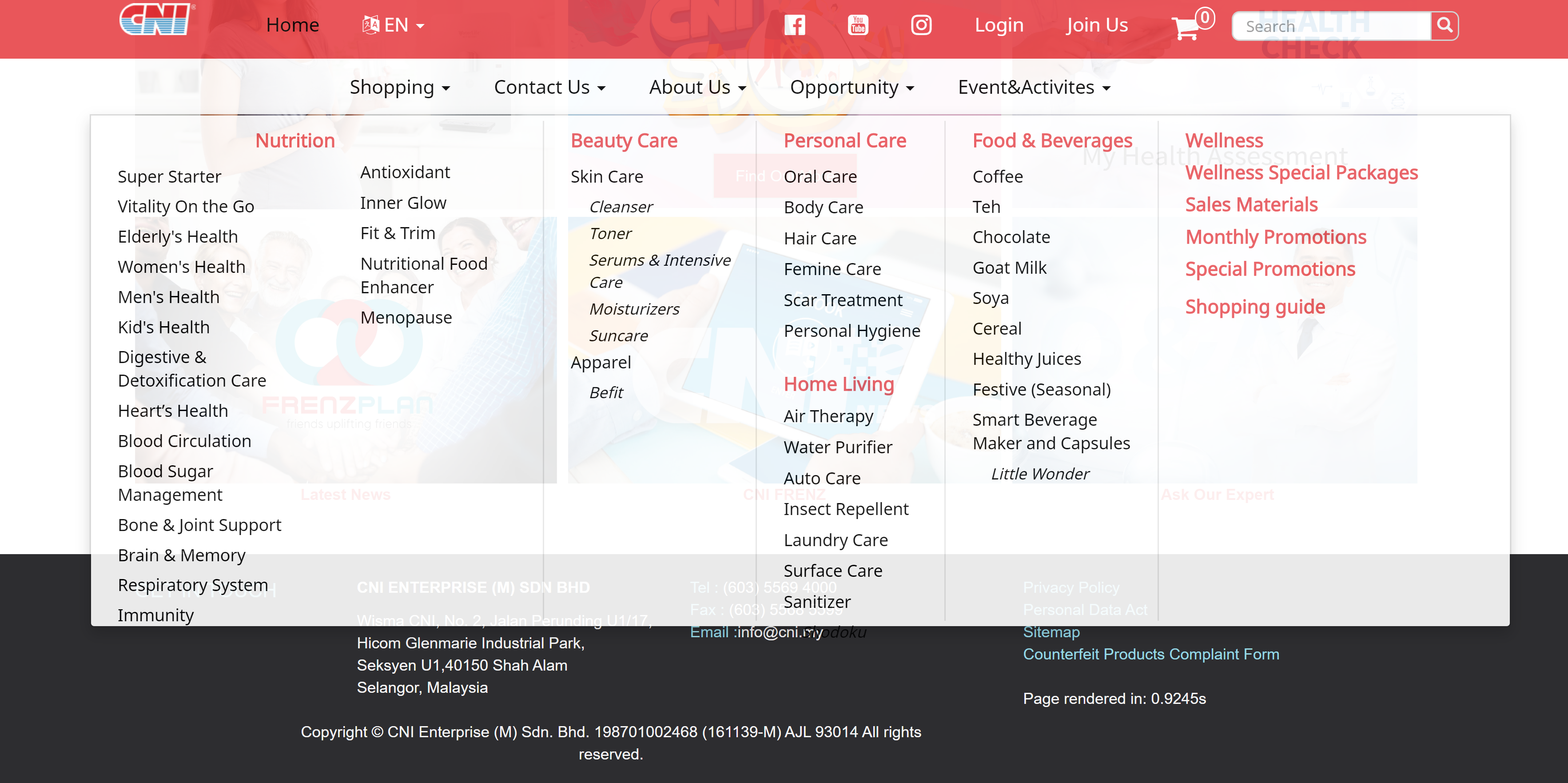

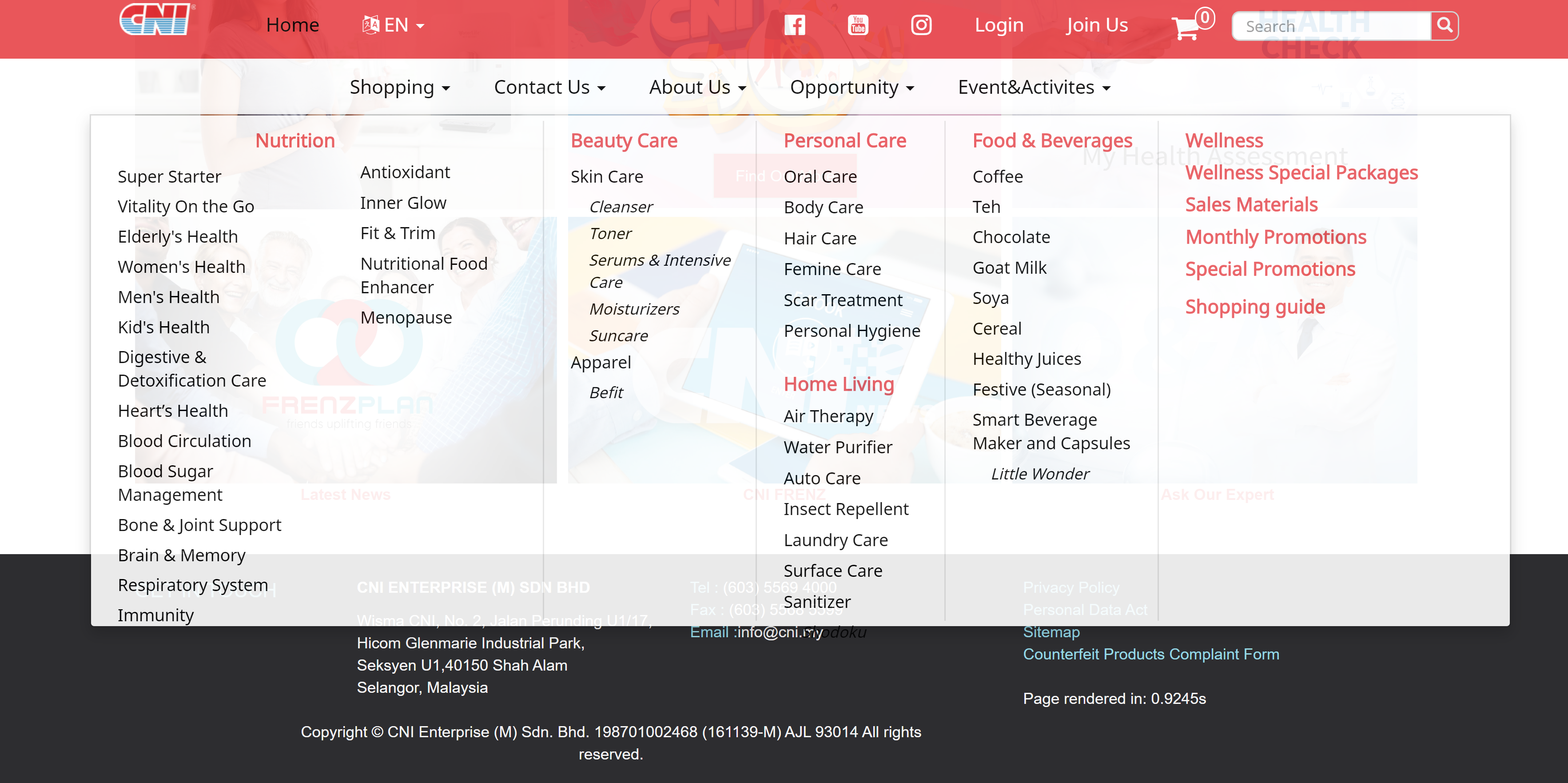

OVERVIEW OF BUSINESS AND OPERATIONS

During FY2019, there were no major changes to the Group’s fundamental business and focus. The growth of the Group continues to be driven by the existing businesses that can be segregated into 2 major reportable segments, comprising Marketing & Trading and Manufacturing. Our headquarter is located at Shah Alam, Selangor which is our corporate office. The Group has a nationwide presence with branches and distribution channels across Malaysia, Singapore, Brunei, and Myanmar. The Marketing & Trading segment now has 55 physical stores to support the business of its CNI Business Owners (“CBOs”). The Group also owns 3 international accredited manufacturing facilities with certification from ISO, HACCP and GMP and Halal certification from JAKIM. The manufacturing plants are located at Shah Alam, Selangor and Tainan, Taiwan which primarily carry out Original Equipment Manufacturer (OEM) contract manufacturing, manufacturing of foodstuffs and beverages, household and personal care products as required by the Marketing & Trading segment. While most of our products are distributed locally, we also export to countries such as Indonesia, China, Hong Kong, Thailand, Taiwan, Canada, USA, Philippines and Africa.

Manufacturing Segment

The Manufacturing segment recorded revenue of RM30.4 million, a decrease of RM17.8 million or 37% compared to FY2018, mainly due to decreased local sales. The Manufacturing segment continues to focus on new product development and formulation enhancement with support from a well-maintained research laboratory and GMP plant facility to promote new scientific and innovative product development.

The Manufacturing segment’s continuous innovation, improvement and focus on efficiencies will remain to be at the heart of our business strategy with OEM customers. Total capital expenditure of RM1.9 million was incurred to upgrade the plant, machinery and equipment to further enhance the production efficiency. It is worth noting here that this segment is currently exploring new ultrafiltration technology to extract plant bioactive compounds. Its on-going project-bromelain enzyme extraction - has been published in a scientific journal (enzyme & inulin) to support Well3 L.E.A.F.

Today market is lead by 2nd liner Pharma Stocks such as - BIOHLDG and SUNZEN.

Maybe many ppls no notice that CNI is another Pharma stock in Bursa Malaysia. Now CNI only traded at 8sen.

OVERVIEW OF BUSINESS AND OPERATIONS

During FY2019, there were no major changes to the Group’s fundamental business and focus. The growth of the Group continues to be driven by the existing businesses that can be segregated into 2 major reportable segments, comprising Marketing & Trading and Manufacturing. Our headquarter is located at Shah Alam, Selangor which is our corporate office. The Group has a nationwide presence with branches and distribution channels across Malaysia, Singapore, Brunei, and Myanmar. The Marketing & Trading segment now has 55 physical stores to support the business of its CNI Business Owners (“CBOs”). The Group also owns 3 international accredited manufacturing facilities with certification from ISO, HACCP and GMP and Halal certification from JAKIM. The manufacturing plants are located at Shah Alam, Selangor and Tainan, Taiwan which primarily carry out Original Equipment Manufacturer (OEM) contract manufacturing, manufacturing of foodstuffs and beverages, household and personal care products as required by the Marketing & Trading segment. While most of our products are distributed locally, we also export to countries such as Indonesia, China, Hong Kong, Thailand, Taiwan, Canada, USA, Philippines and Africa.

Manufacturing Segment

The Manufacturing segment recorded revenue of RM30.4 million, a decrease of RM17.8 million or 37% compared to FY2018, mainly due to decreased local sales. The Manufacturing segment continues to focus on new product development and formulation enhancement with support from a well-maintained research laboratory and GMP plant facility to promote new scientific and innovative product development.

The Manufacturing segment’s continuous innovation, improvement and focus on efficiencies will remain to be at the heart of our business strategy with OEM customers. Total capital expenditure of RM1.9 million was incurred to upgrade the plant, machinery and equipment to further enhance the production efficiency. It is worth noting here that this segment is currently exploring new ultrafiltration technology to extract plant bioactive compounds. Its on-going project-bromelain enzyme extraction - has been published in a scientific journal (enzyme & inulin) to support Well3 L.E.A.F.

This is not an advice to buy or sell. It is my own personal opinion for sharing.

I do not take accountabiitly for any trading occuring from my information.

https://klse.i3investor.com/blogs/call/2020-07-23-story-h1510694531-Another_Pharma_Stock_CNI_5104.jsp

https://klse.i3investor.com/blogs/call/2020-07-23-story-h1510694531-Another_Pharma_Stock_CNI_5104.jsp