With the promise seen in ES Ceramics Technology (KLSE: ESCERAM (0100) ) as highlighted in our initial analysis,

we found it necessary to dive deeper into the unknown to ensure that we

are not flushing funds into a dud stock. Therefore it is important to:

-

find out what we don’t know in order to derive logical assumptions.

- be objective in order to make sound investment decisions.

A half-hearted but necessary Technical Analysis

One of the first things that piqued our

interest in ESCERAM was the steady increase in trading volume from late

April, leading to the massive spike on June 1st, coincidentally just

right after the 4Q2020 book closure ending 31st May. During this time it

hit a 5-year high of 0.735, with 137 mil shares trading hands.

It may very well be speculative price

movement, but the trading pattern strongly indicates accumulation from

insiders throughout the 4Q accounting period, between the price range of

RM0.35 - RM0.50. The brief breakout on 1st June led to high trading

volatility, followed by the distribution phase as short-term traders

exited.

Since then it has been stuck in a

congestion box between RM0.45 - RM0.55. This is the period when the IBs

attempt to flush out weak / disinterested traders, by boring them to

death with the lack of activity and upward price movement.

Anyway, I will avoid diving further into

the TA, as the FA and human behavior aspects are of greater interest to

us. The above is just to point out very familiar devious strategies from

fund managers and IBs to influence share prices in the Malaysian

market.

We do not doubt that ESCERAM has garnered their attention. I mention again, 137 million shares trading hands in one day.

It wasn't always rosy…

A decade ago, ESCERAM had its fair share

of profitability and cash issues. In fact, 4Q2011 was one of the worst

quarters for them. During this time, they suffered a RM6.45 mil loss,

due to provision for diminishing value of subordinated bond investment

of approximately RM1.5mil, provision for slow moving inventory

(RM2.8mil), plus several other write-offs. (the provision for slow

moving inventory is likely due to excess production from H1N1 in 2010)

Nevertheless, we are talking about a

decade ago, and everybody now knows that ESCERAM's management has since

straightened out their business model and books. A cash-rich ACE market

share is quite rare, but we’re more interested in the profit growth

anyway.

Competitors

We conducted an investigation of other glove former producing companies in Malaysia:

CeramTec

Gateway Industrial Corporation

Gotaj Ceramics

Mediceram

Shinko Ceramics

FormTech

Diving in, we see that most of them are

negligible players, either lacking economies of scale, having a small

customer base, or an absence of quality certifications.

Below are ESCERAM’s credentials:

(if you have a German’s seal of approval, you know you’ve got something special)

It is evidently a small industry in terms

of competitors. CeramTec Malaysia and FormTech would be their closest

competitors with their production levels, but ESCERAM by far has the

largest production capacity in the country. In any case, all three

companies will get plenty in their respective piece of a very large

pie.

Note:

ESCERAM started in 1998, initially producing 240,000 formers annually.

In 2005, this number went up to 80,000 units per month.

Then in 2010, the Edge reported that

ESCERAM was the biggest manufacturer of hand formers in the country,

with a running capacity of 250,000 - 300,000 units per month, compared

to Ceramtec’s 150,000 units.

As of 2018, ESCERAM was producing at least 400,000 units per month.

We do not know what is Ceramtec’s running

capacity now. However, it is unlikely that they have surpassed ESCERAM -

an unknown to be verified with their management.

MCO

The question on most people's minds when

awaiting the quarterly results of companies during the previous

reporting period: were their businesses impacted by the MCO

restrictions? We also have to ask this question with respect to ESCERAM,

even if any potential impact is only short-term and does not affect

their once-in-a-lifetime windfall opportunity.

We cannot rule out that ESCERAM’s business was impacted by the movement control order which began in March.

At the same time, we also cannot rule out

that ESCERAM had applied for special permission to operate, seeing that

they fulfill the criteria set in point 47 of MITI’s specification:

We foresee that their glove former

production will struggle to play catch-up to the demand. This leads us

to our study of demand.

Unprecedented demand of glove formers due to Covid19

One of the few concerns is that ES

Ceramics may not be able to keep up with demand in present

circumstances, even at 100% production capacity.

This is what they have to keep up with:

-

At least an additional 26 billion gloves (+16% in capacity for the top 4 glove companies) to be added in 2020:

https://www.theedgemarkets.com/article/capacity-top-four-malaysian-rubber-glove-players-expected-rise-16-2020

-

Out of which 12 bil will come from SUPERMAX by 2022:

-

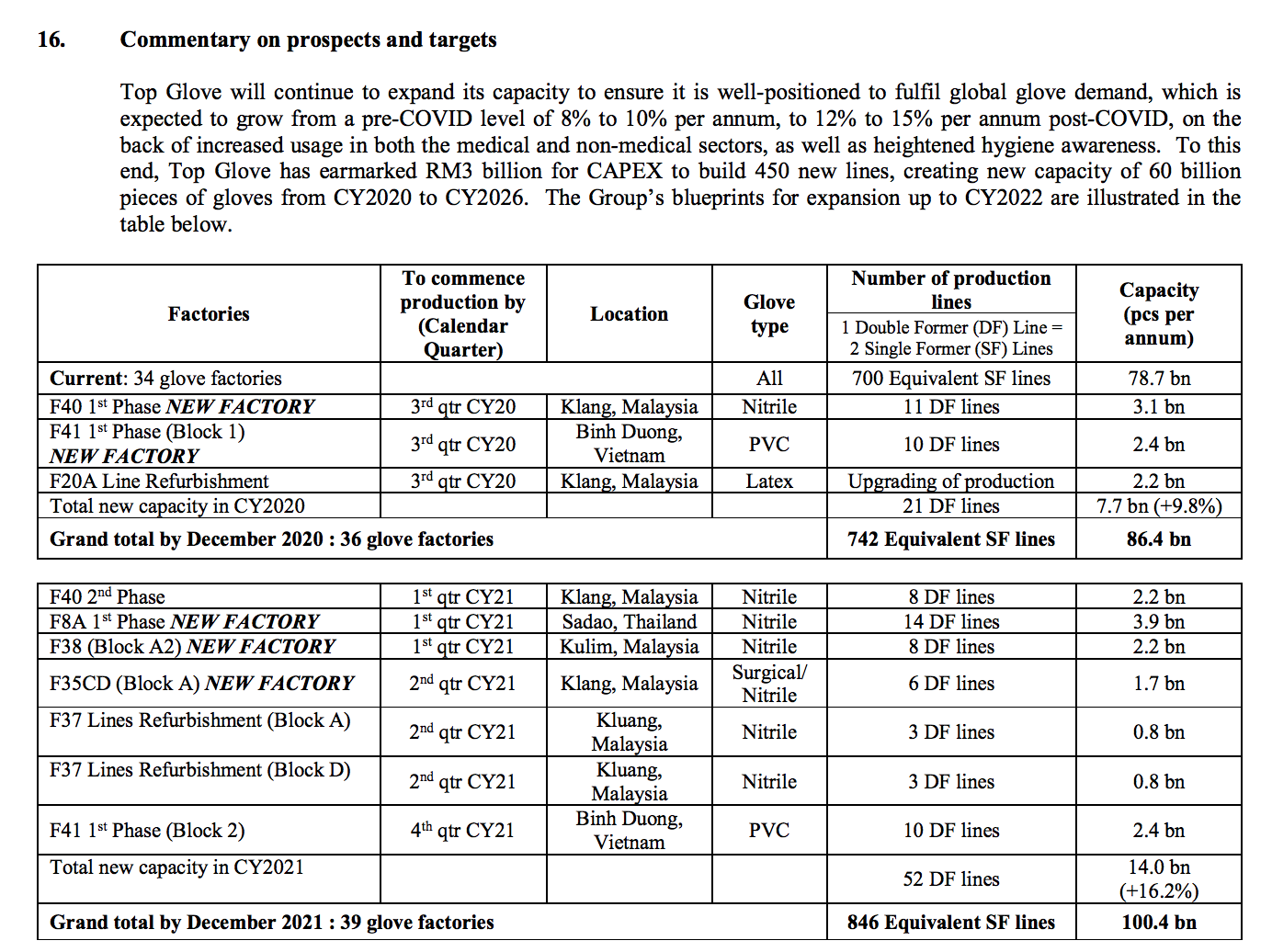

Out of which 7.7bil will come from TOP GLOVE in 2020, and another 14 bil in 2021

Not to be outdone, Sri Trang is ramping up capacity of an additional 3.4 bil gloves a year for the next 5 years:

As mentioned before, we are seeing a very large piece of the pie for the glove former industry, based on the ramp-up of the global glove production capacity.

Revisiting Thailand Operations

I neglected to mention the other big

glove player with a factory in Songkhla - Top Glove. Of course, this

would trigger some speculation - but we are just stating the obvious.

Top Glove's Thailand factory is located in Sadao, and the additional

capacity to be added there is 3.9 bil by 2021.

A side point to note: what we do know is

that ESCERAM’s major customer only constitute 10% of the group’s

revenue. Meaning that ESCERAM likely has more than one customer in their

Thailand operations.

What about Malaysia?

This statement alone by the CEO is enough to make me bullish about ESCERAM's Malaysian operations.

Target price

As the IPO price was 55 sen in 2005, we see anything below this as the perfect opportunity to accumulate. But

of course, all this is meaningless to you and me unless a forecast TP

can be reasoned out. It is always easy to make a buy call, the hardest

part is determining when to sell.

We will make a modest assumption that

the bottom line and EPS will gradually return to the same levels as

FY2017. With its bumper year looming for FY2021, we expect the 2017 EPS

to be easily achieved as a minimum.

Forecast FY2020 EPS: 1.82 sen

Forecast FY2021 EPS = 3.10 sen

Taking it's current PE of 30 which we find undemanding, we are looking at a target price per share of RM0.93.

This is of course a simplistic

valuation, which we will revise once we receive guidance from ESCERAM's

management in the upcoming 4Q result.

Risks to this forecast include:

- increase in raw material price

- increase in operating costs / delayed automation activities

- labour shortage

- absorption of market share from lesser competitors

https://klse.i3investor.com/blogs/HLresearchblog/2020-07-22-story-h1510639015-ESCERAM_Diving_deeper_and_revealing_salient_points.jsp

https://klse.i3investor.com/blogs/HLresearchblog/2020-07-22-story-h1510639015-ESCERAM_Diving_deeper_and_revealing_salient_points.jsp