Are you good in picking up good stock? And beating KLCI like nothing?

If the answer is a big YES, then no need wasting your time to read further.

This article is for those people who will be happy to perform in line with KLCI.

How to perform in line with KLCI?

Invest in Unit Trusts that hold big blue chips? No, no, most Unit Trusts under perform KLCI because they charge high annual fees.

Invest in ETF that tracking KLCI? No, no, there is also annual fee.

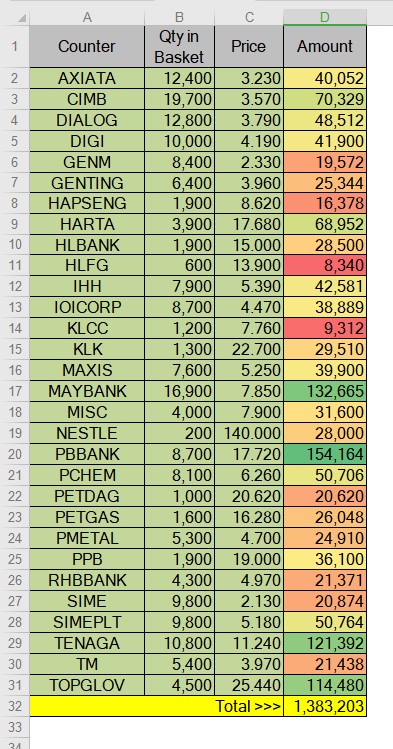

What about just copy the portfolio (basket of stocks) of KLCI ETF? Can, can, can, see the following screen shot. But aiya, you need RM1.38 million.

Now, I teach you a method that not only matching KLCI, but most of the time perform slightly better than KLCI.

Take Friday Closing Numbers:

KLCI = 1590

FKLI (Dec) = 1565

Let say you want to invest RM79500 into big blue chips (KLCI's counters),

Alternative 1:

1.1) Just buy blue chips for RM79500,

1.2) Let assume the KLCI will close at 1600 at end of this year.

1.3) Then your portfolio will be 79500*1600/1590 = RM80000,

1.4) You will receive dividend of about 26.22*50 = RM1311,

1.5) Refer my previous post on KLCI's Diveidend, on how to get that 26.22 dividend.

1.6) Your profit will be = 80000 + 1311 - 79500 = RM1811,

1.7) Or it is 1811 / 79500 = 2.28%.

Now, I suggest another alternative,

Alternative 2:

2.1) The same amount of RM79500,

2.2) Take RM10000 and open a future account, Long one contract of FKLI (Dec) at 1565,

2.3) The balance RM69500, put in bank FD earning 1.85% a year.

2.4) Time fly and at 31st Dec 2020,

2.5) Balance in future account = 10000 + (1600 - 1565)*50 = RM11750,

2.6) Balance in bank FD = 69500 + 69500*(1.85%*158 / 365) = RM70057,

2.7) Your profit will be = 11750 + 70057 - 79500 = RM2307.

2.8) Or it is 2307 / 79500 = 2.90%.

You see,

The Alternative 2 out perform Alternative 1 by = 2307 - 1811 = RM496,

or in percentage it out perform by = 2.90% - 2.28% = 0.62%.

The out performance is fixed regardless of at what level KLCI settle at year closing.

Very Important, so must say three times:

Trade at your own risk.

Trade at your own risk.

Trade at your own risk.

https://klse.i3investor.com/blogs/gambler/2020-07-26-story-h1510749494-How_to_perform_matching_KLCI_and_in_fact_most_of_the_time_perform_sligh.jsp