Excerpts from JCBNext Annual Report

The search for new businesses and investments continued but we were not able to close any deals. The year was not a failure by any standard. We choose to be selective and only invest if all our check boxes are ticked. Good sustainable businesses with quality management are hard to come by at the right price. Our experience with 104 Corporation and 1010 Printing shows there are good companies out there, companies with good businesses and management that pays regular dividends, and these are the type of companies that we will be looking for going forward.

Warren Buffett says “Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time.” He goes on to compare Investing with making babies, but I think I shall not go into that. The Oracle of Omaha also says “Rule No. 1: never lose money; Rule no. 2: don’t forget rule no. 1.” While it is tempting to rush our first major investment after the sale of Jobstreet business just to get the monkey out of our backs, we would prefer to wait and get it right in order to be able to reap years and years of growth and profits from the investments we make today.

Mark Chang, The Real Warren Buffet of Malaysia

LETTER FROM THE FOUNDER & CHIEF EXECUTIVE OFFICER

Dear shareholders,

For 2016, we saw the exit of some of our larger shareholders. After holding on for a couple of years since the sale of the JobStreet.com operation, SEEK was keen to sell their shares and some other substantial shareholders through the years thought it was a good time to exit as well. Albert (Wong Siew Hui) and I decided to buy their block of shares which triggered a Mandatory Take-Over Offer to the rest of the shareholders. As the result of this exercise, management (including myself) now emerges as the majority shareholder of JcbNext. Hopefully, shareholders will now have extra comfort knowing that, being the majority shareholder, the management's interest will be more aligned with the rest of the shareholders. With this corporate exercise, it also allows management to focus on longer-term and not short-term results.

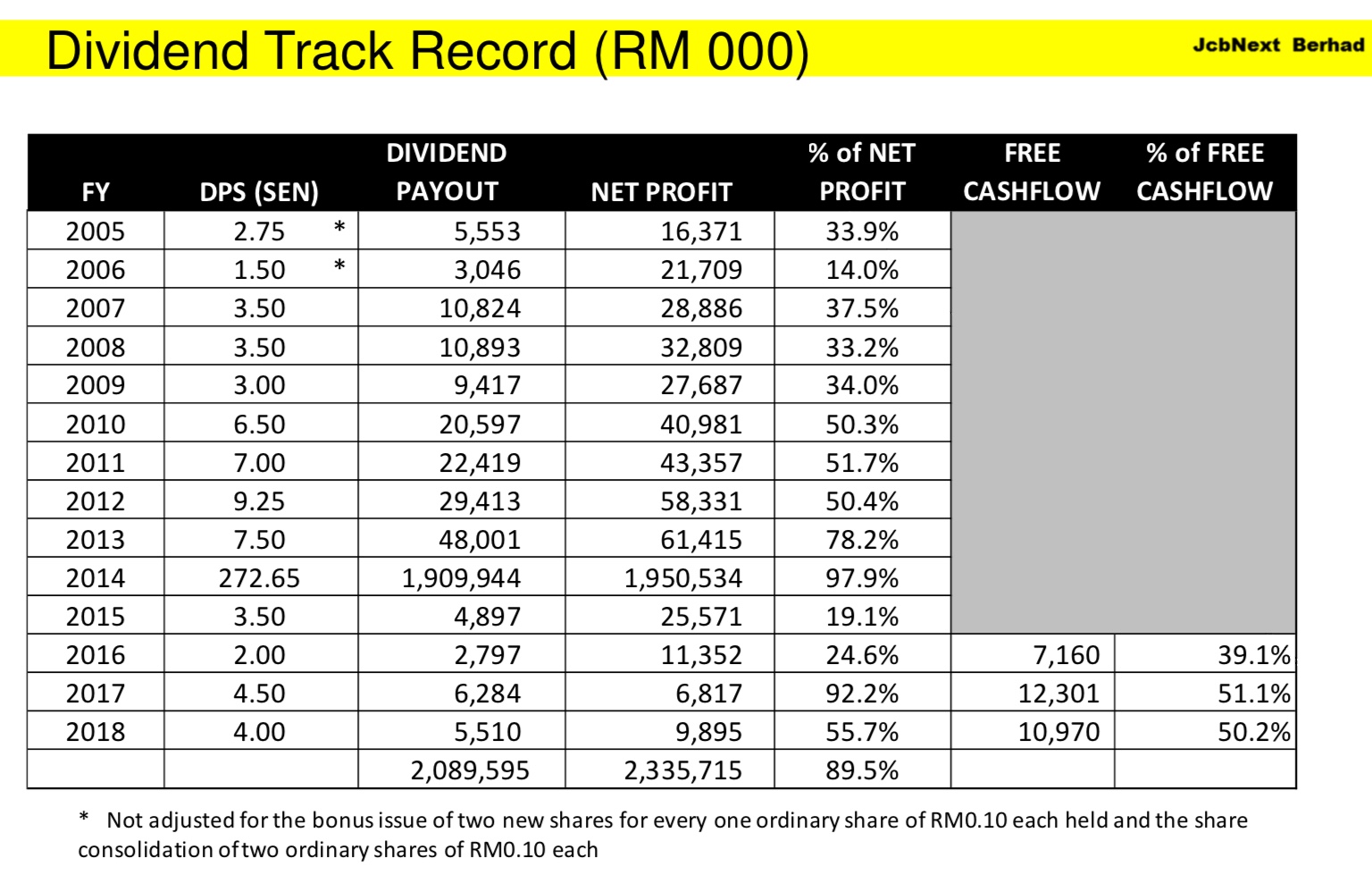

The aspiration of JcbNext moving forward is to be a listed company that can continuously distribute dividends to shareholders every year and for many years to come. For that, our investment focus is on companies that are able to generate good free cash flow and willing to distribute those free cash as dividends back to shareholders. We are also mindful and conservative with our finances - we don't have much debt and prefer not to have any debt at all. Debt always increases the risk to our Company and has a higher chance to interrupt our future dividend payout. As management of this Company, our ultimate performance goal is the dividend payout to our shareholders. Revenue, profit, book value, share prices and others are secondary objectives.

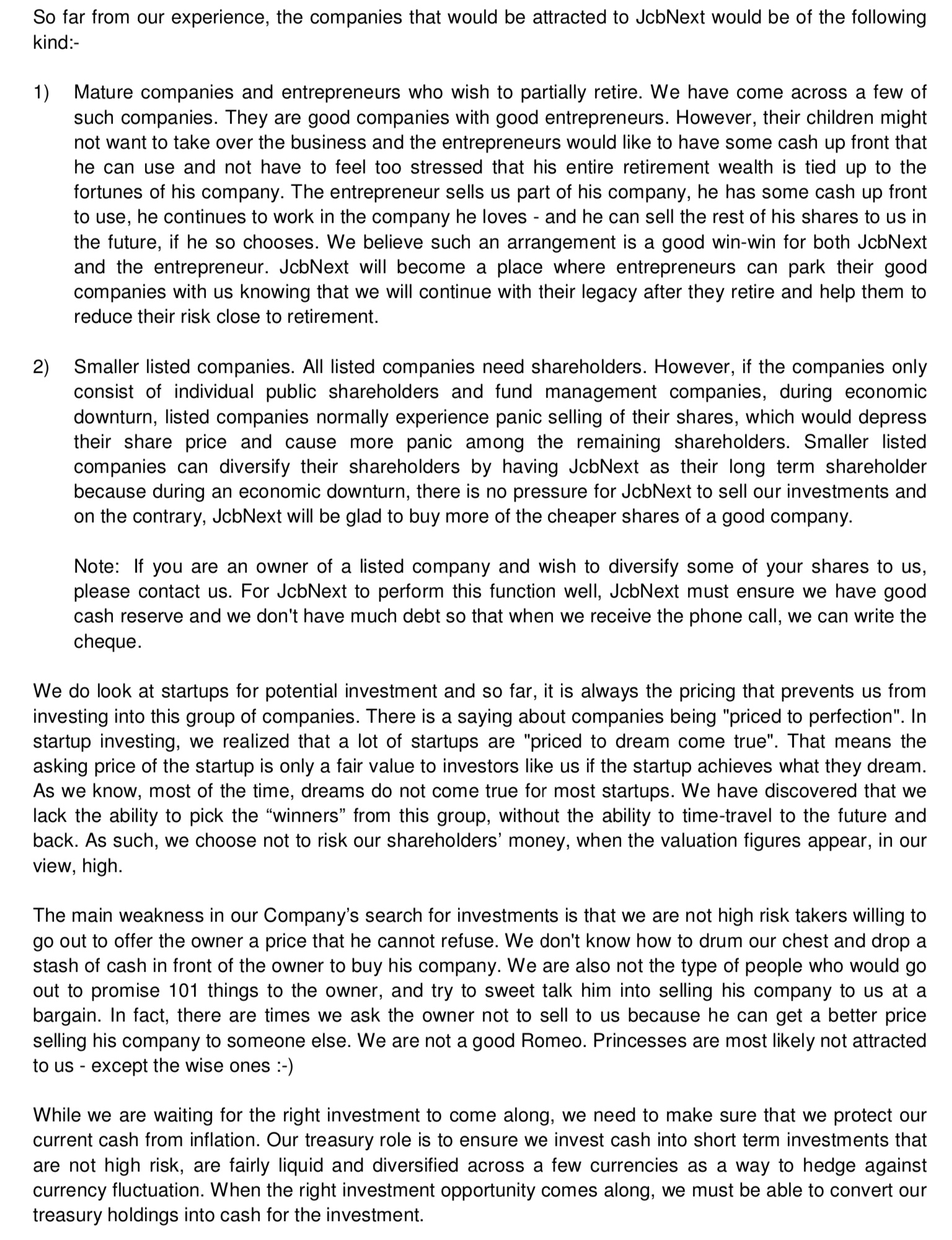

As for the type of companies we are looking at, we look for both listed and unlisted companies and we don't mind buying a minority interest or 100% of companies.

The criteria we look for will be:-

1) Good business. We define good businesses as businesses that have good loyal customers, do not require a lot of capital reinvestment, a healthy profit margin, relatively stable business in operations for a number of years, and not in an overly competitive industry. Good businesses will generate good free cash flow that can be returned to shareholders as dividends.

2) Shareholder-friendly management. Good management is a given criteria for any good company. Equally important is having a shareholder-friendly management so that when there is extra profit, those profit will be managed to the best interest of all the shareholders. Those extra profit can be reinvested in the company for future growth or returned to the shareholders as dividends. Non- shareholder-friendly management will use those extra cash for the benefit of their personal interest first. So the company could be a good business but as a shareholder, we receive only a small portion of our rightful share of the gain or potentially none at all.

3) Right price. Even for a good business with a shareholder-friendly management, our investment will still be bad if acquired at a high price. It is important that we are conservative in our valuation of businesses so that we have a good margin of safety in our investments. As our main goal is investment for future dividend, we can compare the potential dividend return from an investment opportunity presented to us, versus returns from alternatives like S&P 500 ETF, KLSE Index ETF or money market fund. We could be busy evaluating all the various business ventures everyday but if the price is not right, we will not do any investment and we don't mind waiting for years to find the right company at the right price. This is an advantage JcbNext has as compared to other companies such as fund management companies where they have pressure to invest all year round even when the market is near its peak.

Total market value of JCBNext's equity portfolio had doubled to RM 222 million in 2016 vs cost of RM 113 million.

Benjamin Graham Price

https://klse.i3investor.com/blogs/Felicity/2020-09-22-story-h1514242576-The_Real_Warren_Buffett_of_Malaysia_A_Price_Ben_Graham_Would_Love_to_Bu.jsp