CiA.CONSORTIUM of INDEPENDANT ANALYST

@free@prob@wok@chief@dynasty@yfhew1@fightingdragons

topGLOVE SUPERmax BULL COMING !!!!

topGLOVE SUPERmax BULL COMING !!!!

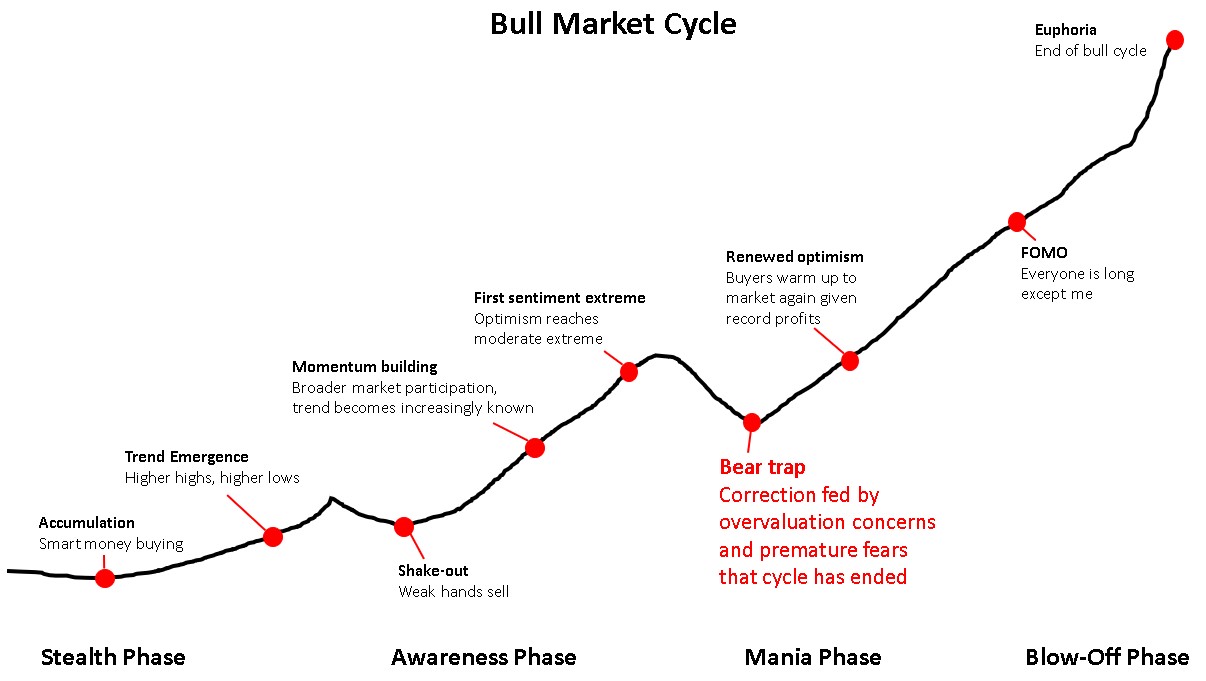

From the above BULL market cycle.

We are exactly at the BEAR TRAP stage = Correction fed by overvaluation concerns & premature fears that cycle has ended.

Here is our basis to believe so.

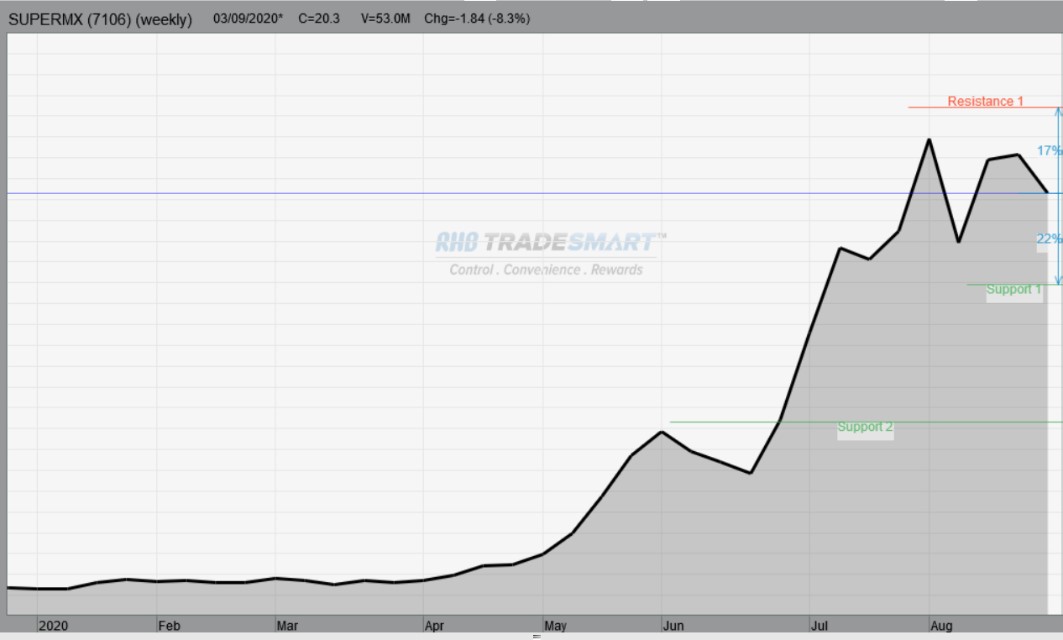

We extracted the chart of Supermax and tested a few models to against this cycle.

Below is the line chart in Weeks.

And this is what we have discovered;

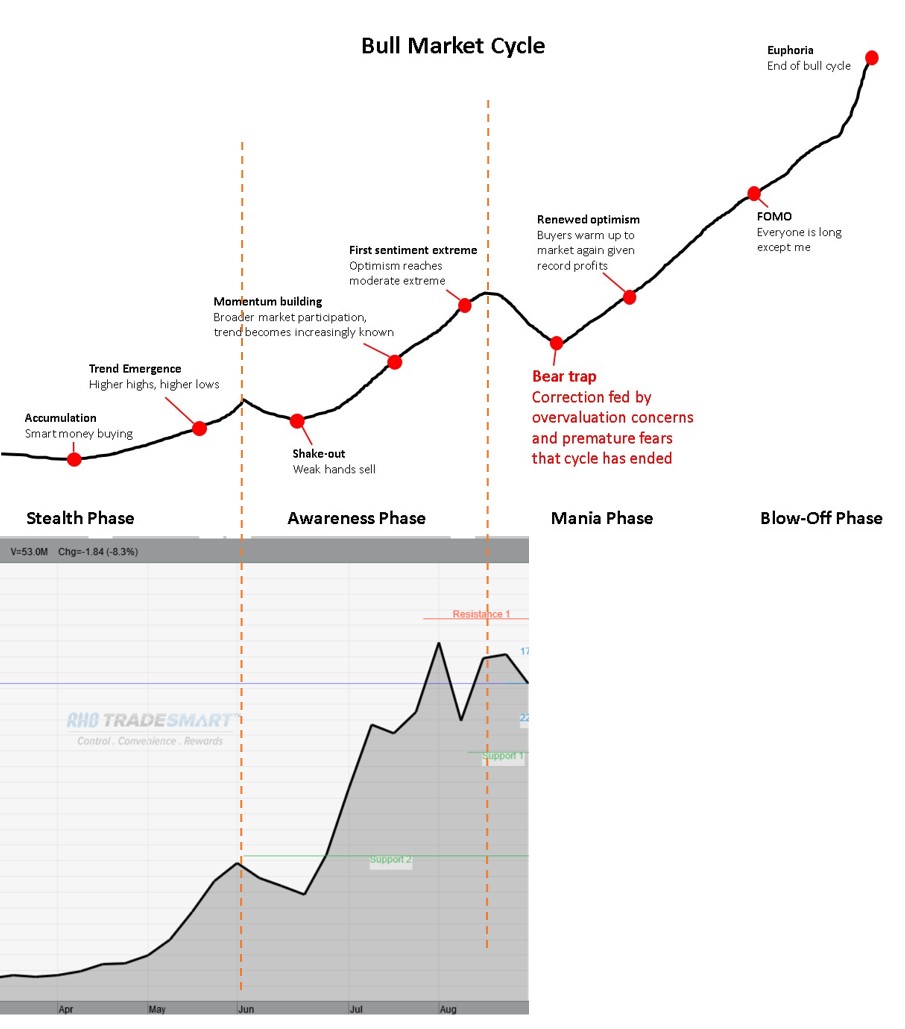

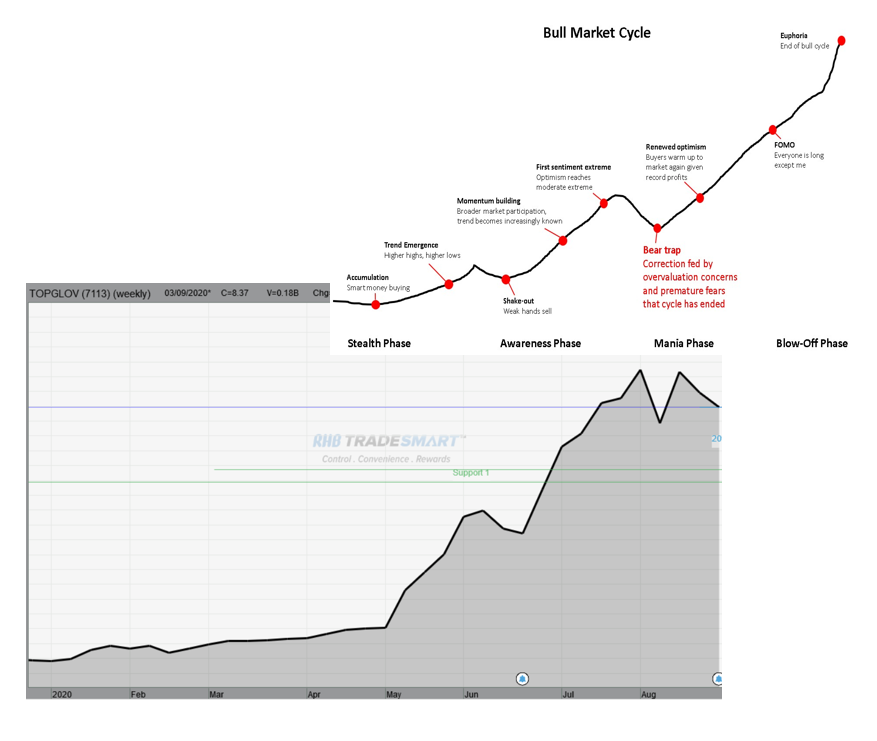

The same pattern is also observed with Topglove’s Weekly chart as you can see here;

That is when majority of retailers are escaping without knowledge that what the future is forthcoming. Under the scenario that ASP will peak in JUN 2021 and sustaining til the end of 2021. Gloves company will continue to enjoy super and unimaginable profit til 2022. During this time, please be aware that many companies in Bursa will continue to report lacklustre or even heavy losses due to covid rampage.

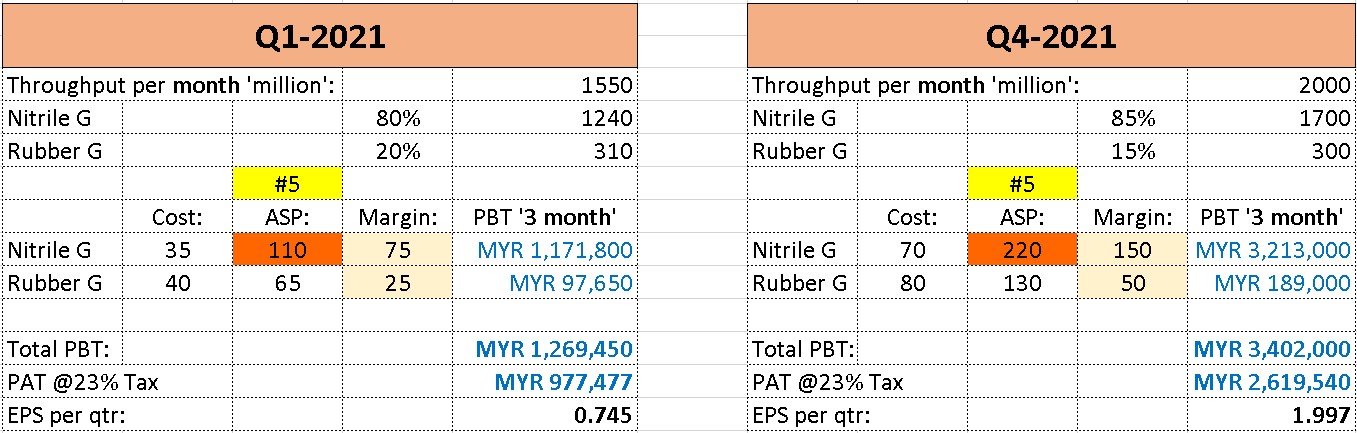

Why we believe a super bull market is coming for glove stock. Here is our viewpoint taking Supermax as an example:

SUPERMAX OBM-X ASP USD280 by JUN 2021.

With current asp of USD180 in August, projecting a US$10 increase per month. ASP could reach USD250 to USD280 by April to Jun 2021.

we jus take a USD220 asp as mean.

Based on above (based on 1.3 billion share) if we estimate :

(0.745 + 2)/2 x4 qtr = RM 5.48 (RM 2.74 ex bonus)

PE now is only 21/ 5.48 =3.8

We believe most glove counter especially the big ones are going into single or 10+ PE going forward if price is not moving in tandem with profit growth.This will be grossly undervaluation sector wide and will attract more funds .

For more info on Topglove PAT and Glove company PAT relationship with share price. Here is another deeper analysis.

https://klse.i3investor.com/blogs/glovesvsvaccine/2020-09-04-story-h1513318067-Gloves_Top_Glove_Supermax_Harta_Kossan_it_s_all_about_PAT.jsp

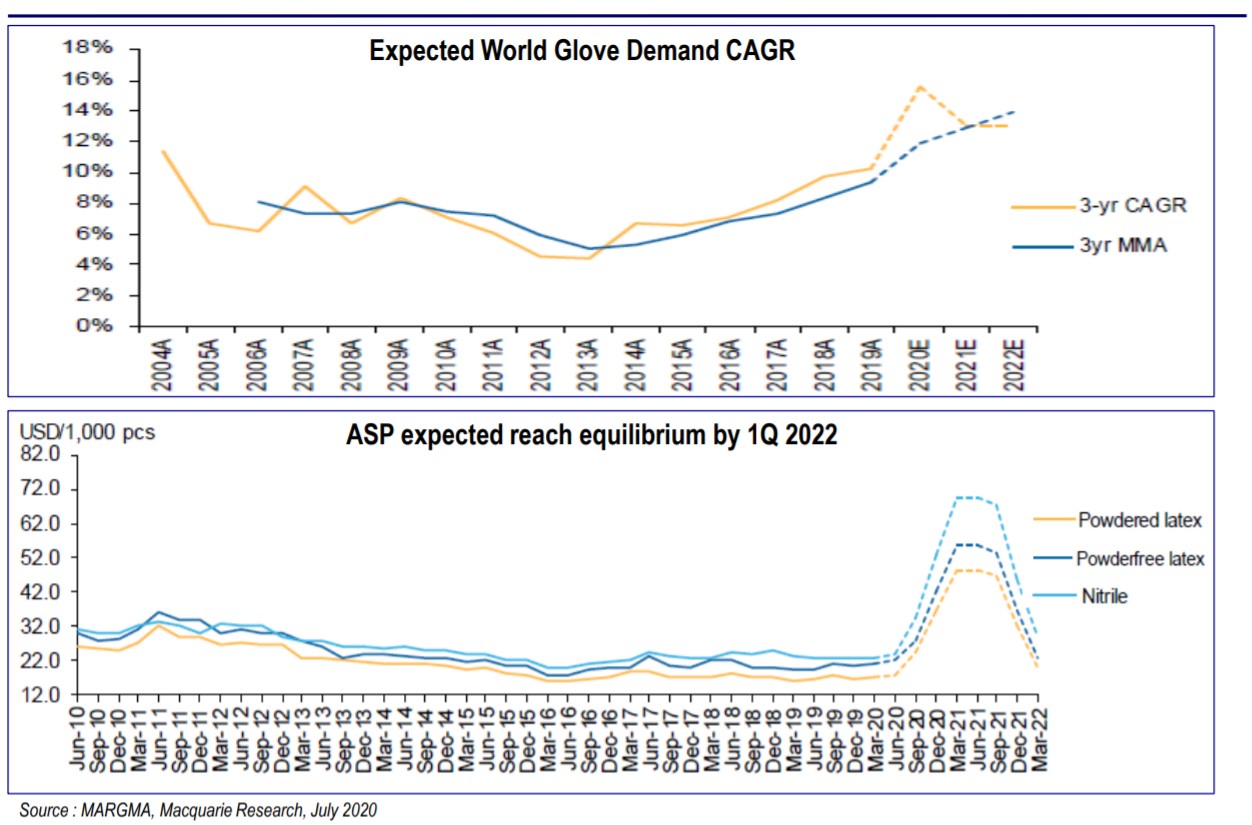

DEMAND SIDE FORCAST

From the below forcast , ASP will peak in Jun 2021. slowly tapering off into 2022.

This is under a conservative scenario of vaccination is working and WHO declaring pandemic is over.

While we wish it is true. The latest development of possible ADE respond from Reinfection and Rushed Vaccine Hazard had topped many headlines. On top of that Distribution and Vaccination will probably take years to complete. Not to say acceptance of a 40-50% efficacy vaccine especially in the US and Euro is not exceptionally high.

Since NO ONES SAFE UNTIL EVERYONES SAFE. Control of Pandemic will be slowed when theres distribution difficulty as well. If there is continue resurgence in 2021 winter time again. The below graph might not be accurate and ASP price will be sustained and continue into 2023.

Why we think ASP will be sustained on the high side even into 2022/23 are discussed in our previous blog:

https://klse.i3investor.com/blogs/freetospeak/2020-08-18-story-h1512394632-VACCINE_OR_WITHOUT_GLOVE_STOCK_RALLY.jsp

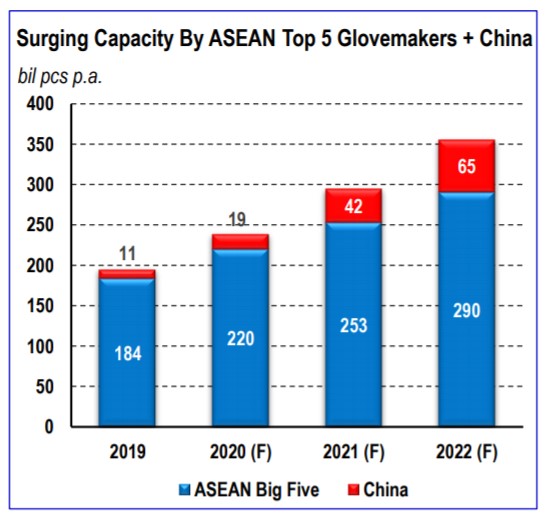

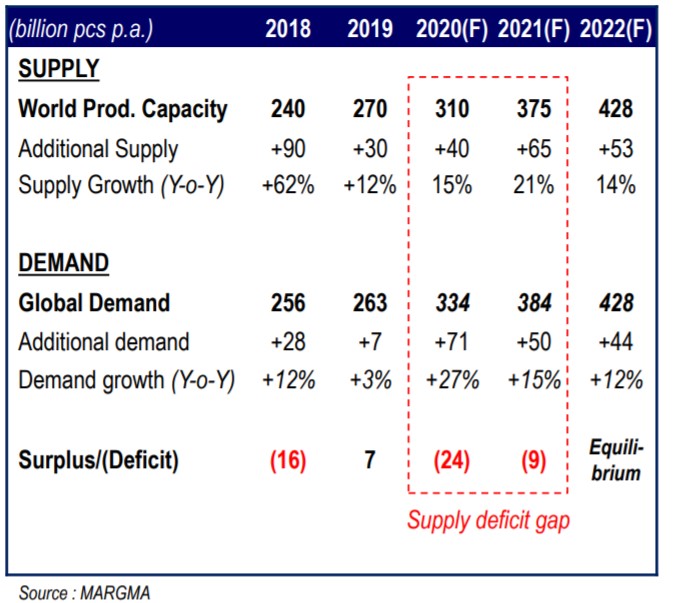

SUPPLY SIDE FORCAST

From the above table we can see that excess capacity is gradual and it will only reach equilibrium in 2022.

Take note that Capacity expansion above shown is on normal expansion speed. No one can be sure whether there will be any set back.

During current exploding demand. Both materials and suppliers had JUST beginning to embark on 100% increase in their capacity. This will slow down the capacity rollout worldwide because it takes even longer time to build a new material plant like NBR plant.

Just an example:

The latest NBR plant by PETRONAS and LG will only complete in mid 2023 earliest if it works out smoothly. Topglove have plan to build NBR plant, but is still in planning stage only. So capacity rollout is not as simple as building a new glove plant. All supplies side must keep up in line as well. As all material and supplies are expanding at normal growth rate precovid. Expecting them to expand up by 100% in short notice is unthinkable citing the NBR plant as example.

According to industrial source, NBR shortage is getting acute now and major supplies are all booked by regular players. But even with early booking , they are not enough even for the big 4. They might need to resort to producing 2.5g -3g light gloves to reduce consumption. Alternative is to turn to rubber gloves to make up volume. That is the same for China and Thailand glove company, NBR and other supplies shortage are slowing down capacity expansion.

In other words, ASP is not coming down and instead be increasing due to serious material shortage and slower capacity expansion. Not many are aware of this, so we are here to enlighten everyone.

In regarding to new comers . We can say they will be at the lowest priority to be allocated the limited supplies due to huge early booking by all the big boys. They probably has to pay for spot rate for Materials and supplies just like the new glove buyers from gloves company. Even with spot order, they will still suffer insufficient nbr to produce enough nitrile gloves cost effectively.

Newcomer will not be able to produce 2.5g-3g gloves. Big 4 took many years to reach there. When small /new player failed to deliver, quality issue, financial issue, FDA failure will come. It will make big4/small4 even stronger.

The final outcome of those small newcomer will probably be "built to be acquired" modal when they are unable to produce profitably n reliably. Their only fate is to sell it away at the BIG BOYS preference price . This had happened in the past and it will happen again.

Note: Not all gloves company are the same especially the newcomers.

POST COVID DEMAND AND SCENARIO.

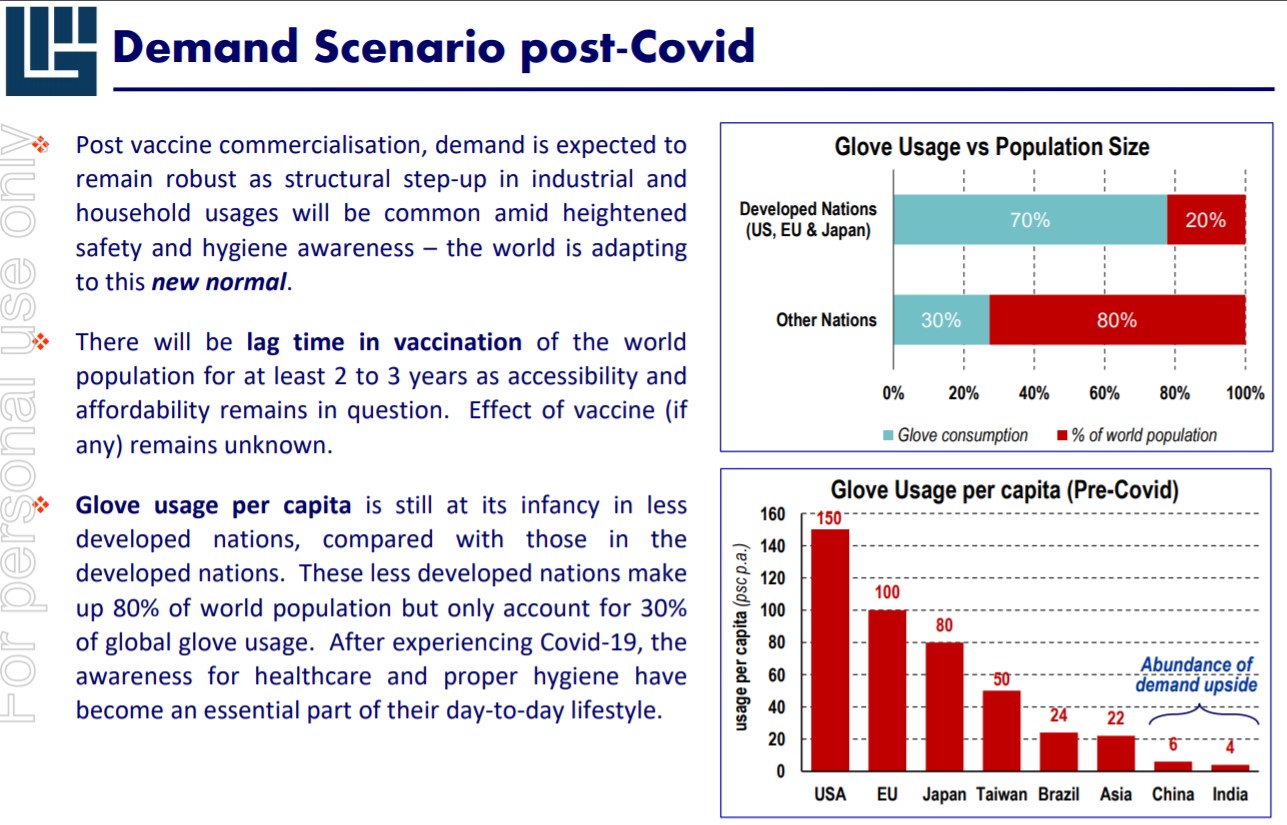

From the above chart . Glove usage per capital in Brazil, Asia , China, India are very low in the range of 4 - 24 VS 80 -150 in developed countries like US and EU.

We dont think they will remain so low post COVID. There are ABUNDANCE of UPSIDE DEMAND from many other countries worldwide after this pandemic experience. As many expert expressed that COVID is here to stay permanently. We have to live with it.

And prevention measures will not go away and same as to stockpiling for PPE.

The Consortium of Independent Analyst wish to express here is that there is more future to Supermax for the coming quarters due to its OBM advantage which allows them for dynamic pricing and super margin being capitalised .

We

believe other Glove stock with exceptional performance in operation and

profits will be OP as well during and post this unusual time.

Side Note:

1. Although we believe there is a super

bull run in the future. It doesnt mean it will go up in straight line.

Up and down are expected during the long up trend.

2. This is the first time the world is

going into Winter season with Covid 19 at 23 million base. Last time we

had 0 case at this juncture. So the worst had yet to come.

3. Who is the foreign fund that bought 4+% of Supermax at 22.14 on friday 28th Aug?

4. If you like our post please share it out. Hit the LIKE button !!!

Disclaimer…This is not an advice to buy or sell. It is just for education and sharing purpose.

CiA do not take accountability for any trading occurring from our information disseminated.

https://klse.i3investor.com/blogs/freetospeak/2020-09-04-story-h1513289415-topGLOVE_SUPERmax_BULL_COMING.jsp