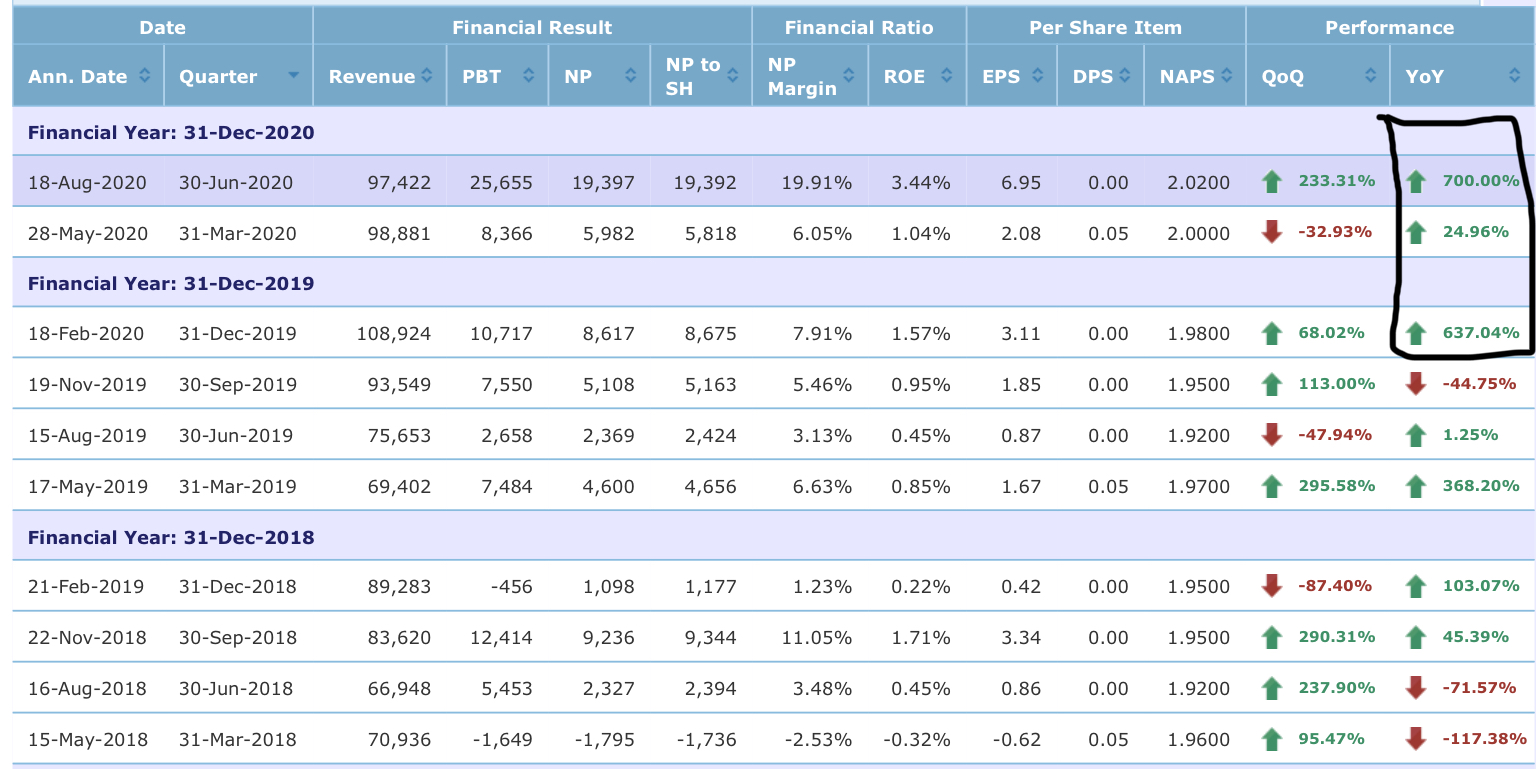

3 consecutive quarters of earnings growth. Public Invest expect to see a strong catch-up in the subsequent quarters given the current CPO price momentum and continuous growth in FFB production.

Explosive earnings growth

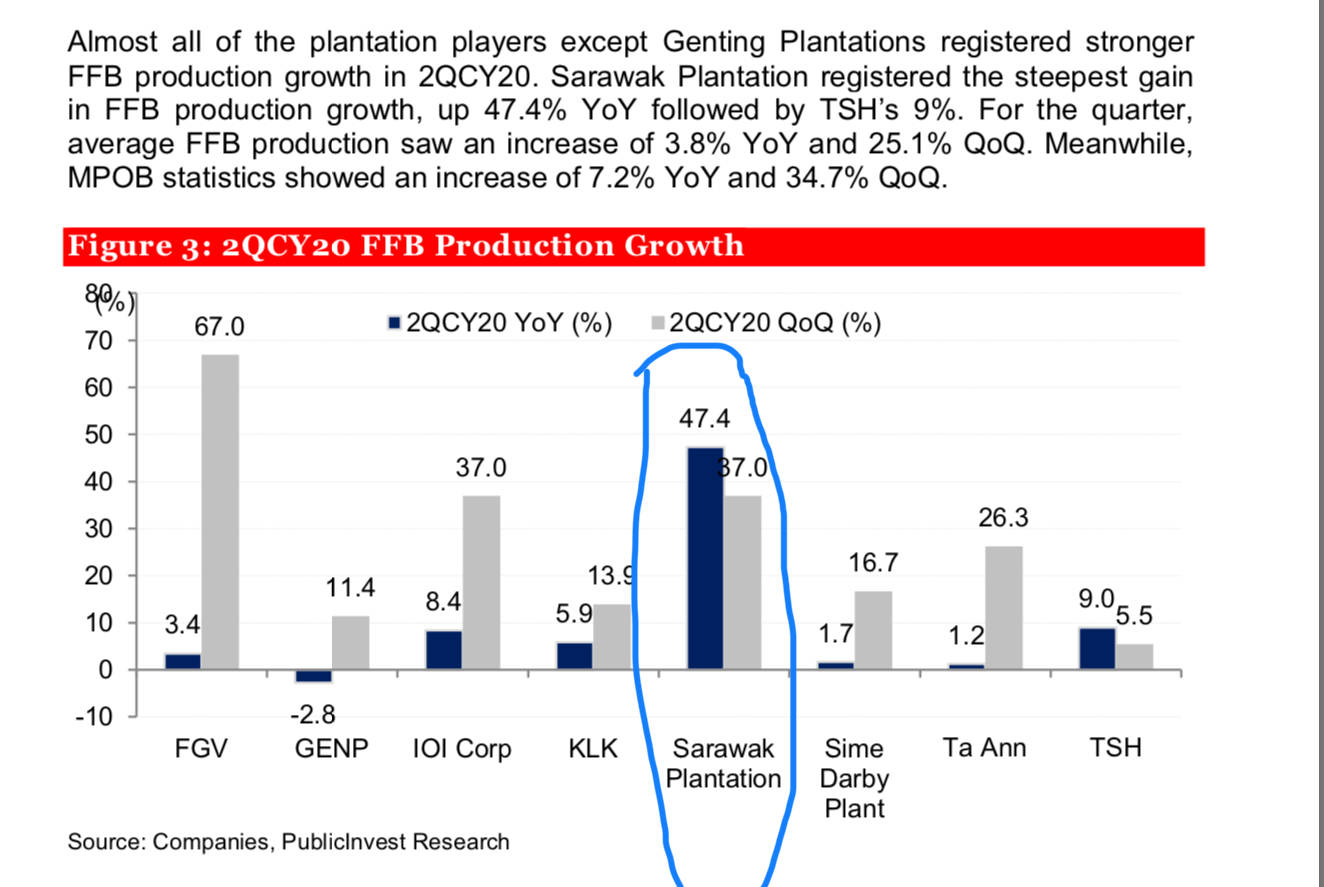

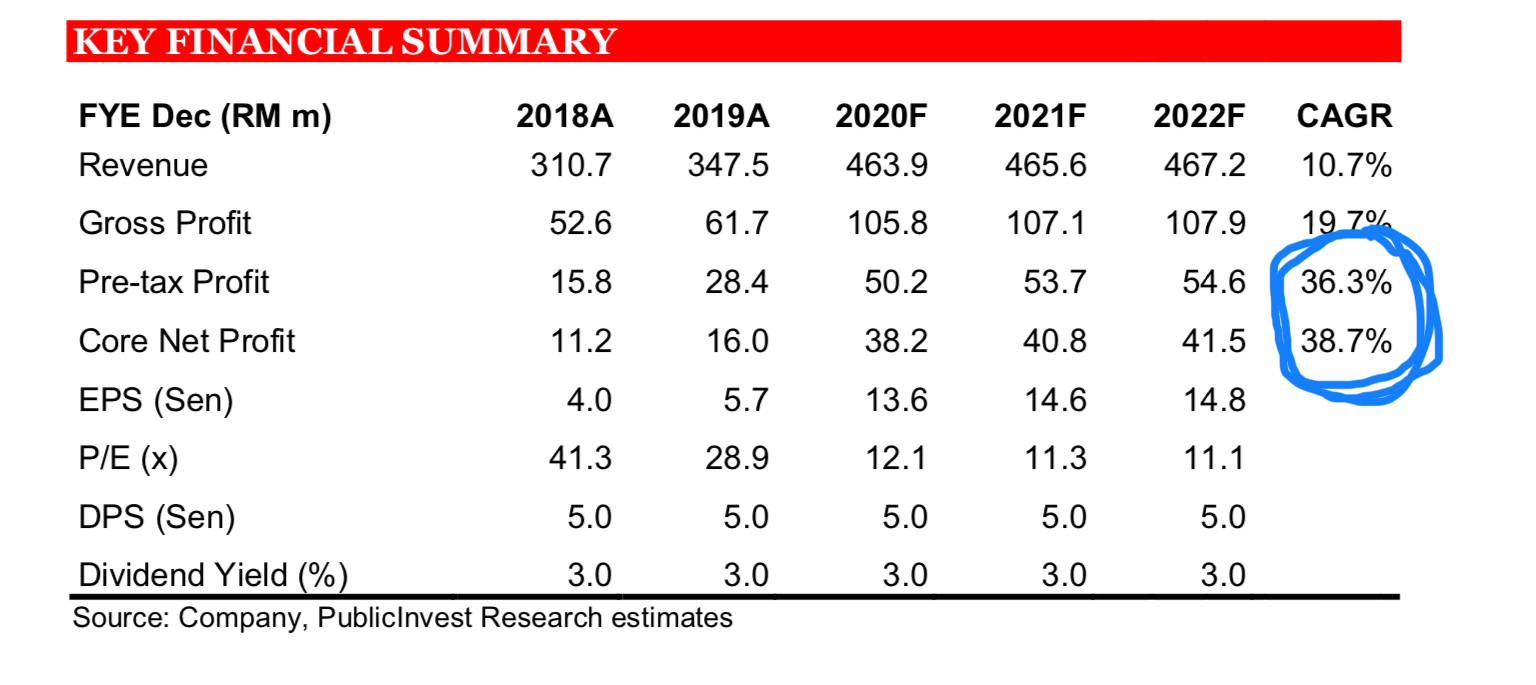

Sarawak Plantation saw its 1HFY20 core earnings jump 4-fold to RM15.2m, bolstered by stronger CPO prices and staggering growth in FFB production. The results accounted for 40% and 47% of our and the street expectation, respectively. The results were deemed fairly in line considering that FFB production expected to larger in 2H compared to 1H. We expect to see a strong catch-up in the subsequent quarters given the current CPO price momentum and continuous growth in FFB production. No dividend was declared for the quarter. Maintain Outperform call with an unchanged TP of RM2.62 based on 18x FY21 EPS.

Outlook guidance. Meanwhile, management has set an aggressive FFB production growth target of 30% YoY to 364k mt this year (vs our full-year target of 346k mt) on the back of yield improvement from the enhancement area transferred to harvestable area. For Jan-July, it jumped 31% YoY to 188,208mt and we expect to see a stronger growth in the subsequent months. Management expects lower production cost in the coming months on the back of higher production yield. It expects full-year cost of production to average at RM1,650/mt. Manuring activities have slowed down in 2Q but it picked up since 3Q. Given the recent strong CPO price performance, management has locked in forward sales of 4,000mt for Aug delivery at RM2,760/mt. It also has an outstanding forward sales of 1,000mt/mth at RM2,360/mt.

Background

A pure-play Sarawak-based plantation company. Sarawak Plantation Group, founded in 1997, is mainly involved in the pure upstream oil palm plantation business. It owns a total land bank of 46,248ha located along Miri-Bintulu Highway and Sibu-Mukah Road, Sarawak, of which 78% has been developed into oil palm estates. In terms of age profile, about 34% is below 6 years old, 46% is under the prime mature category and only 20% is at old age category (over 20 years old). Average age profile stands at 12 years old. The Group derives the bulk of its income from crude palm oil (CPO) and palm kernel sales, which accounted for almost 99% of FY18 sales.

Ta Ann entry cost RM2/ share. In Jan 2018, Ta Ann, another Sarawak-based public listed plantation company emerged as the largest shareholder of the company after acquiring a 30.3% stake through a related party transaction with Cermat Ceria S/B for a total cash consideration of RM169m or RM2/share. The Group is currently under the helm of Dato Wong Kuo Hea, who is also the Group Managing Director/ Chief Executive Director of Ta Ann. We believe there will be drastic improvement across the group given Dato Wong’s vast experience in the plantation industry, assisted by his prudent management team from Ta Ann.

Riding on Ta Ann’s expertise. Since becoming the controlling shareholder of Sarawak Plantation, Ta Ann management’s main priority is to increase productivity as a whole. It places focus on automation and mechanization of its mills and estates’ operation respectively. It also smoothen the processes to further streamline its operations. It also shares its expertise and knowledge in water control system and planting terrain as its strength lies in the peat soil planting area. It brought in new machineries to improve productivity for mineral land plantation. The results are proven given that the Group registered a 4.7% FFB production growth last year and 20% for the first 9 months of this year.

Source: PublicInvest Research

https://klse.i3investor.com/blogs/Multibagger/2020-09-13-story-h1513466240-WHY_THIS_STOCK_VERY_LIKELY_TO_DOUBLE_IN_3_MONTHS.jsp