PE ratio is a figure used to assess the value of a company, and also used to compare the value of one company to another peer company to show which company has a lower valuation, hence a lower risk and higher return shall be achieved. PE ratio is obtained by dividing the share price with its Earning per Share (EPS). When comparing PE ratio between companies, a higher PE ratio means the company is overvalued, hence higher risk is to invest in this company.

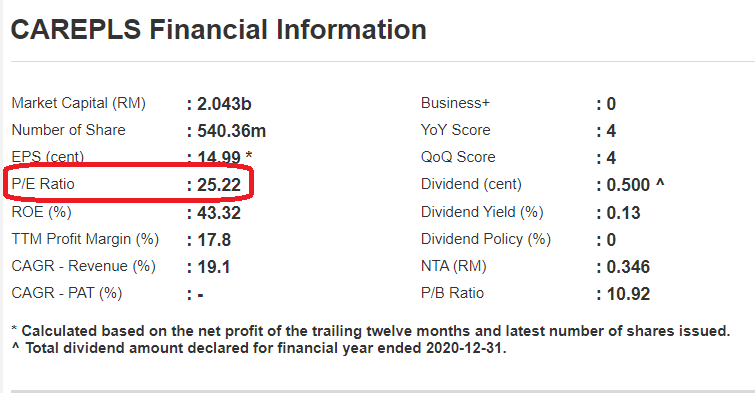

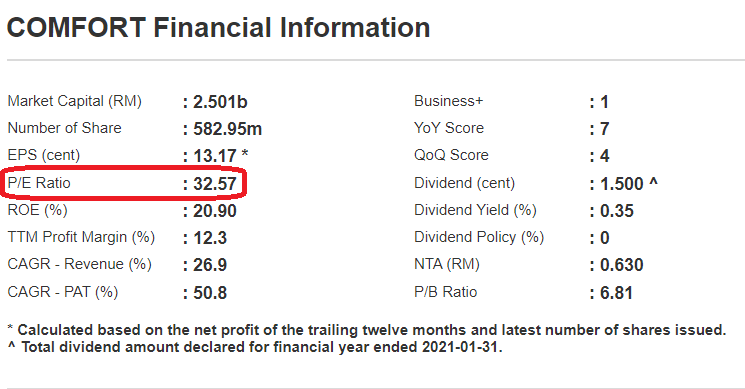

As we can see the PE ratio for both CAREPLS and COMFORT, where it is 25 and 32, respectively. This means that in gloves manufacturing business, COMFORT is slightly overvalue as compared to CAREPLS, which means investors may face a higher risk when investing in COMFORT.

There are two ways to change a company’s PE ratio, which is the price fluctuation that occurs every day, and the EPS change that occurs every quarter (3 months). Once the company earn more in the coming quarter, the PE ratio will be reduced, hence becoming more reasonable.

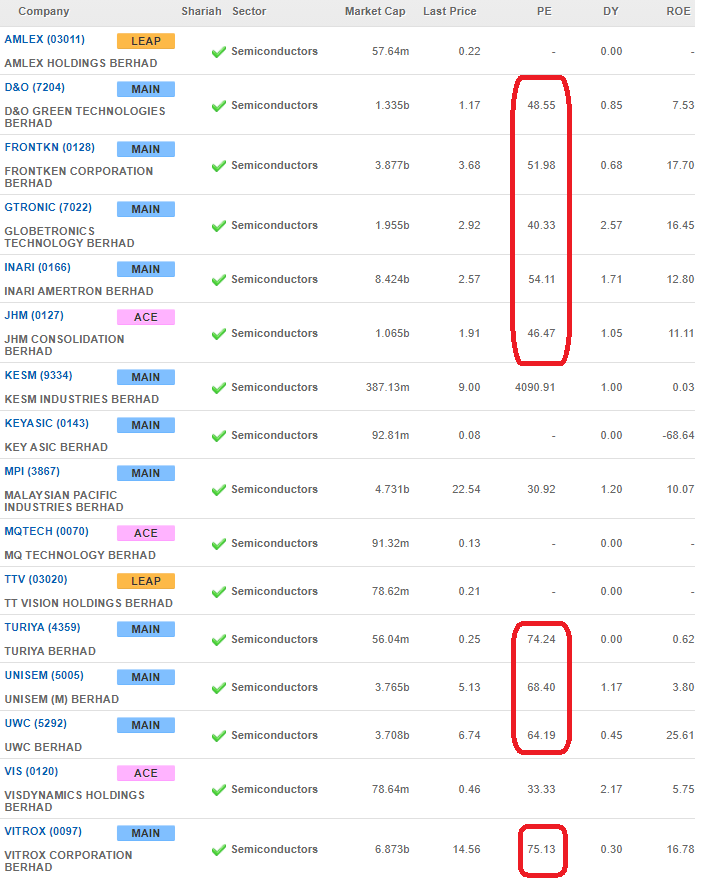

Besides, when a company possesses a higher PE ratio means that most investors are having a more optimistic view towards their future, that they will earn more in the future. For example, technology companies listed under Bursa are having 40-60 of PE ratio, meaning most investors are looking forward their future business, rather than only focusing on their current value.

本益比可以用来算出一间公司的价值,亦可以拿来与同行公司做比较。当其他同行有更低的本益比时,那间公司会有更低的风险和有机会获得更好的回酬。当我们要算出本益比时,我们要拿现在的股价,并拿它除于每股净利。当一间公司有很高的本益比时,代表着那间公司已经被高估了,所以投资此公司会有较高的风险。

我们可以看到CAREPLS有25的本益比,而COMFORT有32的本益比,这也可以证明在手套板块上COMFORT会稍微比CAREPLS高估了一些,所以也会有较高的投资风险。

本益比可以在两种情况下被改变,一个是每天的股价浮动,而另一个是每个季度(三个月)才报告一次的每股净利。当公司所赚到的盈利更多时,它的本益比将会相对地被拉低,亦因此让股价更加的合理。

除此之外,当一间公司有较高的本益比时,也代表着投资者对它的未来有更好的憧憬,也会在未来有更好的盈利。举例,马来西亚的科技股都有大概40-60的本益比,代表大多数的投资者对科技公司的未来更感兴趣,所以也不会对现在的高估感到担心。

For more information, visit: https://www.facebook.com/InvestingKnowEverything/

https://klse.i3investor.com/blogs/InvestingKnowEverything/2020-10-28-story-h1535506626.jsp