POHKONG

(5080)

SEIZING UNPRECEDENTED ‘GOLD’EN OPPORTUNITY.

MR. MARKET DOES NOT KNOW THIS YET.

#jntstudynotes

DISCLAIMER

We share study notes for sharing purpose only. Facts are compiled from publicly available resources. Study notes may involve our views and guesses, which could be inaccurate. Our valuation involves assumptions which could be inaccurate. Share prices are ultimately determined by Mr Market. There is no BUY/SELL recommendation. Share investment involves uncertainties and risks. Investors own all their investment decisions and decision outcomes.

‘We're still in extraordinary circumstances, and in our lifetimes, we've never seen anything like COVID-19. I think we're still coming to terms with that. We think there's going to be no reduction in the safe-haven buying of gold as an investment in the industrialized world.’

- World Gold Council, December 11, 2020

POHKONG MAY PRODUCE RECORD HIGH EARNINGS IN THE NEXT QUARTER(S).

POHKONG designs, manufactures and sells gold, platinum, silver and jewellery. POHKONG has operated for more than 4 decades in Malaysia and survived multiple economic cycles.

POHKONG’s business model relies on gold. Gold is a precious metal that has been which has been used since ancient times. Gold does not corrode and has become a symbol of immortality and power.

POHKONG generates most of its earnings by selling gold and jewellery to retail customers across Malaysia. POHKONG’s earnings would increase if their sales volume of gold and jewellery increases. In fact, this is the case, due to 3 reasons:

Reason 1: Steadily rising gold price in 2020 fuels gold optimism among retail customers.

This

is the chart of gold price + S&P500 index movements. In previous

years, gold price has moved in opposite direction of the stock market.

When stock market rises, gold drops, and vice versa. When people are

confident in the economic, they buy stocks, anticipating stock price

increase. When people lose confidence in economy, they buy stocks as a

defensive move to preserve their wealth.

This

is the chart of gold price + S&P500 index movements. In previous

years, gold price has moved in opposite direction of the stock market.

When stock market rises, gold drops, and vice versa. When people are

confident in the economic, they buy stocks, anticipating stock price

increase. When people lose confidence in economy, they buy stocks as a

defensive move to preserve their wealth.

Starting from 2020, gold price moves in tandem with the stock market. Both roughly move up and down together. One possible reason is that under this low-interest, high-liquidity environment, money is aplenty and needs to go somewhere. Hence, money flows into both stocks and gold, driving the bullish prices of both asset classes. Underpinned by low interest-rate + high liquidity environment, this phenomenon stands a good chance to continue in 2021.

Gold prices gathered bullish momentum and reach an all-time high in August 2020. Despite gold price retracement from September until December, the midterm MA50 uptrend is still intact. On Nov 30, gold price made a rebound from its MA50, like what happened in May 2019 and March 2020, as highlighted below. Probabilistically speaking, gold price is more likely to continue rallying starting from December 2020.

The breaking of all-time high gold price stirs up retailers’ interests to start looking to buy gold and gold products. They believe they can sell them higher in future.

In late November and early December, when gold price retraces from its all-time high, retailer customers buy gold and jewellery aggressively.

Take a look:

November 30, 2020 - Customers flooded the jewellery shops to buy gold and gold products during the gold price retracement – to the extent they violated social distancing rules and got fined.

Source: TheStar

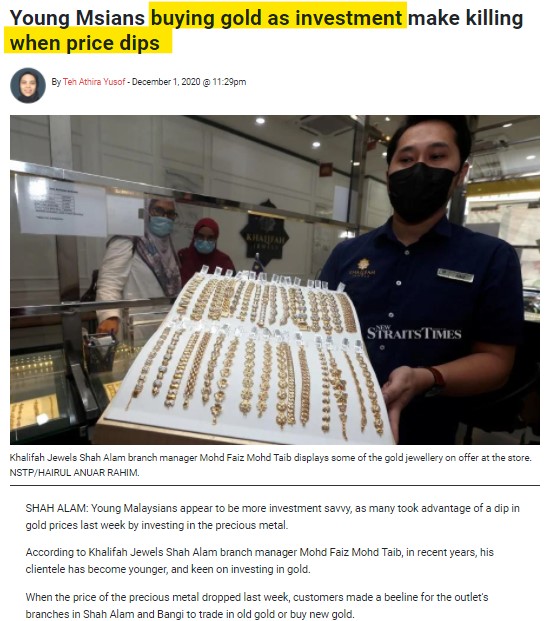

On December 1, 2020, New Straits Times mentioned that more and more financial savvy young Malaysians are buying gold investment as investment when price dips (value investing practitioners). They are making a killing.

Source: New Straits Times, December 1, 2020

On December 5, 2020, CNA covered Makmur Gold company. It is jewellery company based in Kuantan that has enjoyed strong sales in 2020 despite Southeast Asia’s weakened economy. Makmur Gold recorded strong sales of about RM80 million ringgit (US$19.5 million) over the past eight months as buyers sought to park their cash somewhere safe. The business sells goods directly to customers from its four outlets as well as online, offering items ranging from bracelets and rings to small gold bars.

Source: CNA, December 5, 2020

Field Surveys: Here are the photos taken at different jewellery shops at the Malaysia’s shopping malls on 12 and 13 December 2020. As you can see, many gold and jewellery shops, including POHKONG, experience higher-than-usual traffic.

Reason 2: Global high-liquidity + high uncertainty + low interest rate environments are likely to keep gold price bullish in 2021.

Bank Negara Malaysia’s decision to cut the Overnight Policy Rate (OPR) resulted in interest rates falling, driving people and institution to invest in other products – and gold was often the preferred choice.

Source: POHKONG FY20 Annual Report

On December 11, 2020, Adam Perlaky, the manager of investment research at the World Gold Council mentioned the following:

Source: S&P Global Market Intelligence, December 11, 2020

Reason 3: POHKONG’s online branding and marketing strategies work amidst the New Normal.

In 2020, POHKONG has observed their customers buying a combination of gold jewellery and gold investment products. POHKONG also sees an upsurge in their online retail business. Therefore…

POHKONG’s online sales has grown by more than 23% during the year under review (FY20). Source is FY20 annual report released in November 23, 2020, which has not included the Double 12 sales as well as year-end, new-year plus Christmas sales catalysts.

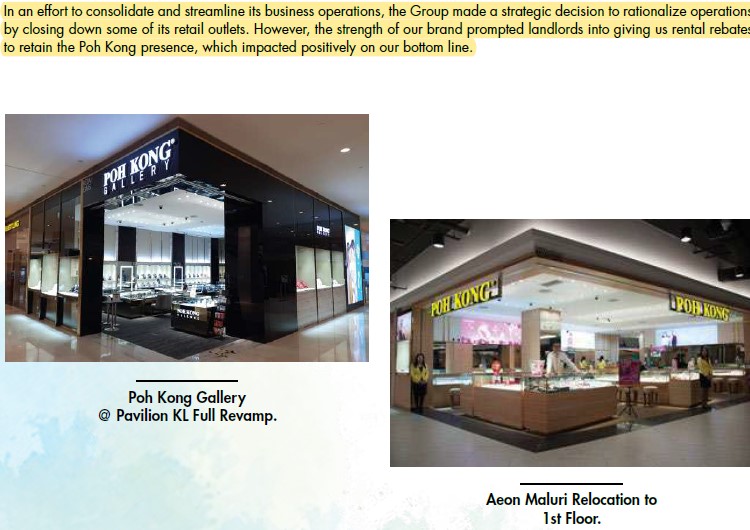

Reason 4: Earnings margins improvement from strategic consolidation.

Besides enjoying increased revenue and earnings, POHKONG also saves costs. POHKONG is consolidating its non-performing stores and focusing on outlets in high growth potential areas.

POHKONG: AT A GLANCE

- POHKONG’s sales volume and revenue likely to increase. Under the global high-liquidity and low-interest environment, global markets expect gold price to increase in the middle term. More and more retailers notice this and start to buy more gold and gold products during gold price retracements. This boosts POHKONG’s sales volume and revenue.

- POHKONG’s earnings margin increases. POHKONG is streamlining is business by focusing on performing stores and capturing online customers. This improves earnings margins.

- Coupling #1 and #2, POHKONG stands a chance to produce record-high quarterly earnings.

- POHKONG’s business risks include plummeting gold prices, weakening consumer spending power and streamlining inefficiencies, as well as inability to cover its debt due to financial mismanagement (however, this has not happened in the past).

-

High debt, but easily manageable. Despite

a high debt-to-cash ratio of 17.7 times (which is common in the gold

and jewellery business), POHKONG has a healthy current ratio of 4.2x.

POHKONG’s current net asset of RM472 million is already 2.8x times of

its total debt. POHKONG should be able to cover all its debt relatively

easily.

- POHKONG’s inventory is 2 times larger than its entire market capitalisation.

- Market capitalisation : RM332 million (At 81 sen/share)

- Inventory : RM579 million (equal to RM1.41/share)

This means that Investors who buy POHKONG shares at 81 sen, is getting a nett 61sen's worth of gold + jewellery products, for free.

FAIR VALUE ESTIMATION

- 20Q1: In the latest quarter ended October 31, 2020, POHKONG achieved its highest quarterly earnings of RM14.6 million over 8 quarters, mainly driven by bullish gold prices. This does not include the Double-11, Double-12, as well as year-end, new-year plus Christmas sales catalysts, which could mean the best quarterly earnings is yet to come.

- 21Q2: Based on strong buying interests from the retailers; the next quarterly earnings may greatly exceed RM14.6 million. RM18 million is possible.

- 21Q3: Assuming gold prices does trend up as expected, POHKONG may generate another RM14.6 million, similar to 21Q1.

- 21Q4: Assuming gold prices does trend up as expected, POHKONG may generate another RM14.6 million, similar to 21Q1.

Therefore, 4 quarter earnings: RM (14.6 + 18.0 + 14.6 + 14.6) million = RM 61.8 annual earnings, equivalent to an EPS of 15 sen.

If Mr Market values POHKONG at…

- A conservative PER of 10 times, share price : RM1.50.

- A conservative PBR (Price-to-Book ratio) of 1 time, share price : RM1.43.

- A conservative marked-to-inventory basis, share price : RM1.41.

RM (1.50 + 1.43 + 1.41) / 3 = RM 1.45.

Based on 1 PER, 1 NTA and 1 marked-to-investory benchmarks, POHKONG’s mean fair value’ will be RM1.45.

Moving forward, how will POHKONG’s share price move? Let’s let Mr. Market decide.

DISCLAIMER

We share study notes for sharing purpose only. Facts are compiled from publicly available resources. Study notes may involve our views and guesses, which could be inaccurate. Our valuation involves assumptions which could be inaccurate. Share prices are ultimately determined by Mr Market. There is no BUY/SELL recommendation. Share investment involves uncertainties and risks. Investors own all their investment decisions and decision outcomes.

https://klse.i3investor.com/blogs/jomnterry/2020-12-15-story-h1538218534-POHKONG_SEIZING_UNPRECEDENTED_GOLD_EN_OPPORTUNITY_MARKET_DOES_NOT_KNOW_.jsp