Top-down or bottom-up approach (自下而上或者自下而上的选股法)

YOLO123

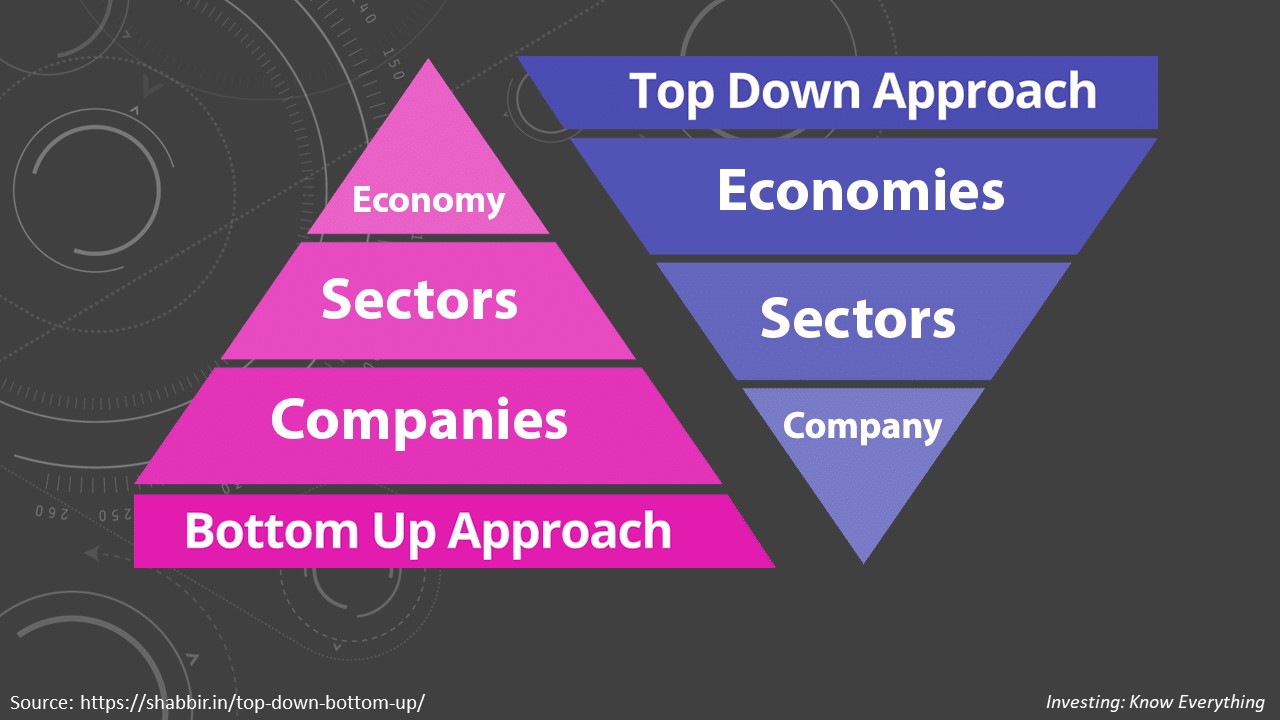

When investors come to selecting good companies, there are various choices. Some people may look at PE ratio and choose the company with lowest PE ratio, some may choose the company based on the RSI indicator, where they choose companies that are oversold and hope for a rebound before selling them. However, fundamentally, there are two approaches to select a company, which are top-down approach and bottom-up approach.

First, let us talk about top-down approach. The first step shall be choosing the economy or country to invest, in order to choose the economy or country that will have the better growth compared to others. After that, you need to choose the sector to invest in, may it be medical, technology, food and beverages or retailers. This is to see which sector can grow the fastest or which sector will be the near future trend. Then, only you proceed to choose the company, on which company is the best out of the bunch. For example, you expect that glove sector will do well in 2020, and after confirming the sector, then you will proceed to choose the company, which may end up let say be, TOPGLOV. That’s what we call top-down approach.

On the other hand, bottom-up approach is to first select a group of companies that have a very strong fundamental, may it be cash flow, profit margin or growth potential. When doing this step, we will not consider what sectors are these companies in yet, where all we need is a strong company. After filtering all these companies, then we will only look at their sector on which sector works the best in terms of growth prospect. Let say 900+ companies in Malaysia, and you are able to find 50 companies that are fundamentally strong and stable, then maybe 8 out of 50 are within a good sector. Hence, your selection will be within these 8 companies.

So, you will ask which is the best to use? However, there is not an exact answer to it, you can use either approach to select your company or stock to invest. It can also change based on the situation. For example, when glove is booming back in May 2020, we then can use top-down approach, to choose which glove company to invest. On the other hand, if a bear market approach, we can use bottom-up approach to choose a few best out of the best stocks so that we can gain much more when the market rebound.

In short, there is no fix approach to which investors should use, it shall be up to the investors’ selection and mind-set, followed by the current and future trend. However, knowing these two options allow you to be flexible in the future when comes to stock selection.

当投资者们在选择好公司的时候,他们会用不同的方法。一些人可能会看本益比,而他们会投资最低本益比的公司;一些人则会看RSI指标,看哪个公司目前出现超卖的情况,那么他们就可以等他反弹过后再卖出。但是,基本上来说,我们在选股的时候有两种方法,那就是自上而下或者自下而上的选股法。

首先,我们来说说自上而下的选股法。我们的第一步就是选择经济或者国家来投资,因为我们要找出有最大成长空间的地点。接下来,我们就要选择应该投资在什么行业上,而哪个行业有着最大的成长空间,又有哪个在未来会有一片作为。最后,我们才会从这个行业中选择最好的股来投资。我们举例,手套股将会在2020有个非常好的一年,那决定了行业过后,我们就看看哪个手套股是最好的,有假设你觉得TOPGLOV是最好的,那么你就应该投资在这家公司上,这就是自上而下的选股法。

另一方面,自下而上的选股法就是我们先选择一群有着很好基本面的股,例如有很好现金流,净利润率亦或者成长空间。在实行这一步的时候,我们不必顾虑这个公司是什么行业,只要是好公司就会被纳入。那么选了公司后,我们就看看什么行业会比较吃香,哪个可以走得更远。举例,马股中有900+家公司,而你能够找出50家非常好也非常稳的公司,而可能只有8家是处于比较好的行业的,那么你的投资选择便在这8家之中了。

那么你可能回问,究竟哪个方法才是最好的呢?但是,这并没有正确的答案,你完全可以任选一种来用。当然,这也可能随着情况而改变。举例,当手套股在2020年5月来势汹汹的时候,我们就可以用自上而下的选股法来选择最好的手套股来投资。相对的,如果是熊市来的时候,我们就可以用自下而上的选股法来挑出精英中的精英,这样在股市回弹时,他们便会回到顶峰摸样。

总结,投资者并不需要指定一个方法来使用,这完全是根据投资者本身的决定和心态的,当然也要看当时的趋势等。但是,有了这两种选股方法的知识便会让你的选股法在未来更加生动并且不死板。

For more EXCLUSIVE content, visit: https://www.facebook.com/InvestingKnowEverything/

请关注笔者的脸书专页以获得独家资讯。

https://klse.i3investor.com/blogs/InvestingKnowEverything/2021-01-13-story-h1539262207.jsp