Since the beginning of last week, many have wondered who the mysterious short seller of gloves, who has spent a whooping RM1.8 billion shorting Top Glove, Hartalega, Kossan, and Supermax within the past 7 working days of this year, is. We might have just indirectly gotten the answer to that question. This short seller is currently sitting on a pile of paper losses as the market prices of the 4 glove giants have gone up (in some cases significantly up) as compared to the average price at which they have been shorted, mostly last week.

First, if you are unfamiliar with the situation, please quickly go through my earlier posts where I cover it more extensively:

Gloves: The Bad Guy Loses (From Time to Time)

Gloves: Zero Short Positions Closed for the Entire Last Week

Earlier today, two truly curious items were published.

First, AmInvest released an analyst report, full of logical inconsistencies, pegging their target price for Top Glove at RM6.50, for Hartalega at RM12.22, and for Kossan at RM4.56. You can read the report here. You can read my thoughts on AmInvest's report and the inconsistencies presented in it here.

More importantly, the chief "glove bear" - JP Morgan, have released a research note on Monday, according to reports from The Edge (see here). In this note they reconfirm their target prices for Top Glove at RM3.50, Hartalega at RM8.50, and Kossan at RM3.80. These target prices were first released in a reported dated December 11, 2020, according to an article on The Edge (see here). Unfortunately, we do not have the full report, but only the quoted excerpts, so it is hard to comment on how those target prices have been derived. It would be truly appreciated if anyone who may have access to the actual report could share it.

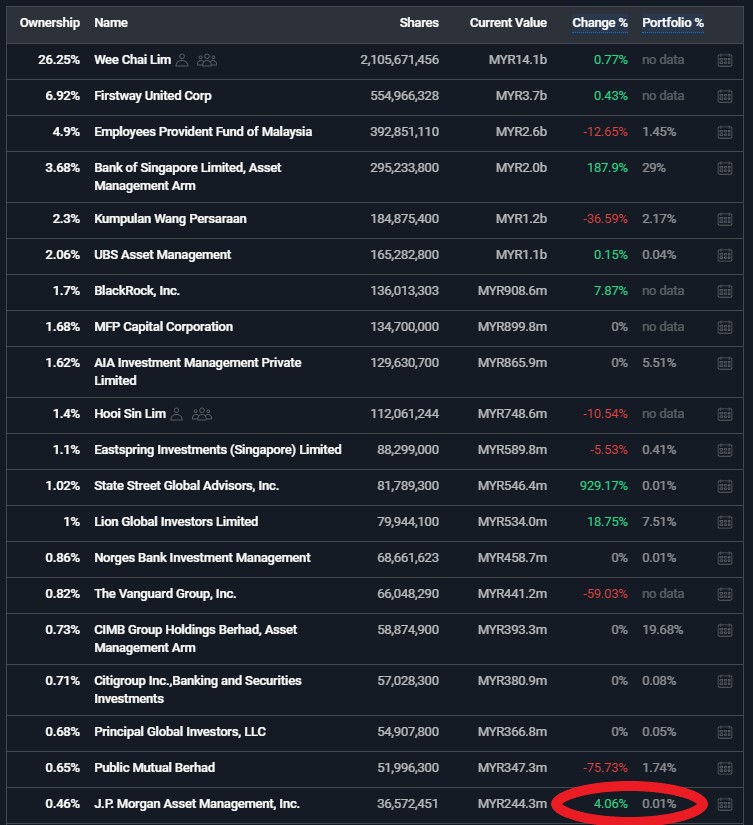

What we can comment on though, is that JP Morgan's asset management department may not have received this report. As of the last reported date (December 31, 2020), JP Morgan's holding of Top Glove stock has actually increased by 4.06% (see here). Note that as of November 30, 2020, their JPMorgan Malaysia Fund portfolio consisted of 9.4% Top Glove stock and 8.1% Hartalega stock (see here). These are their first and third stocks with highest weightage in their portfolio. The prospectus (same source) states that "Investments in, or exposure to, any single entity (other than Government and other public securities) cannot exceed 10% of the Fund’s total net asset value." In other words, JP Morgan owns close to the maximum of Top Glove stock it can own. This might be the first bear investor in the world this could be said for.

So the question that remains unanswered is - are JP Morgan's analysts wrong in their valuations, or are JP Morgan's fund managers wrong to have bought enormous amounts of glove stock and hugely overpriced market valuations?

Important disclaimer: Any views expressed are for informational and discussion purposes only. None of this information is intended as, and must not be understood as, a source of advice. It is imperative that you always do your own research and that you make any decisions based on your personal situation and your own personal understanding.

https://klse.i3investor.com/blogs/bursainvestments/2021-01-13-story-h1539320832-Who_Is_the_Mysterious_Gloves_Short_Seller.jsp