Digitisation Era Leader - Telekom Malaysia, TM (4863)

Industry Expert Analysis:

TM (4963) Offers best and cheapest exposure to Malaysia’s digital transformation (Tong Kooi Ong from theEdge on their 04Feb issue). Tong also explained that TM (4863) is closely relatable to Microsoft as both companies have real value digital proposition. Tong also articulated that they are confident of the growth prospects and remain bullish on the Tech outlook.

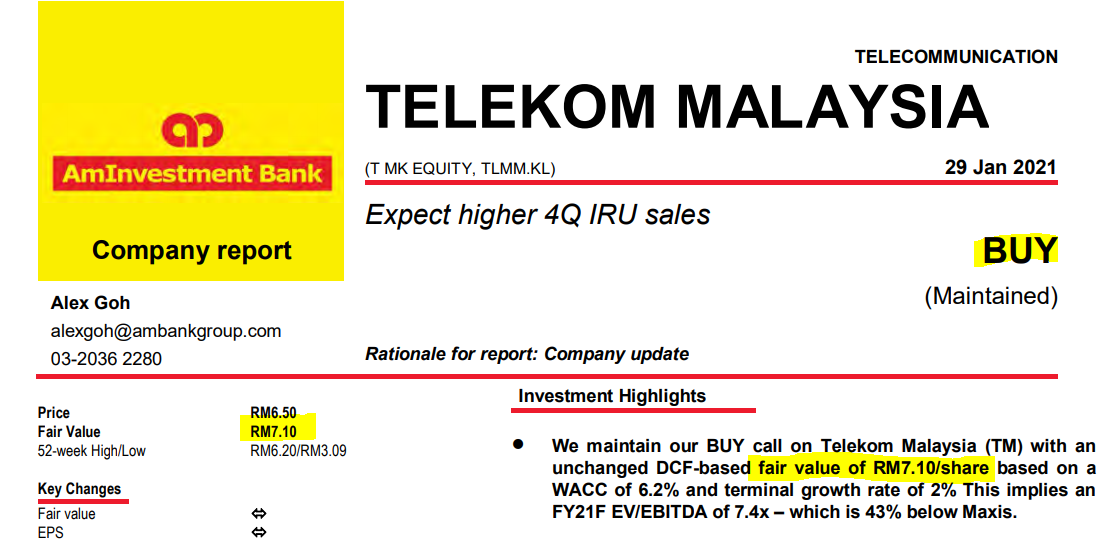

Aminvestment Bank analyst Alex Goh maintained buy on TM(4963) with fair value of RM7.10. Among the salient highlight are the growth of TM (4863) Wholesale arm which contributed 20% group revenue, driven by higher International Voice and domestic data.

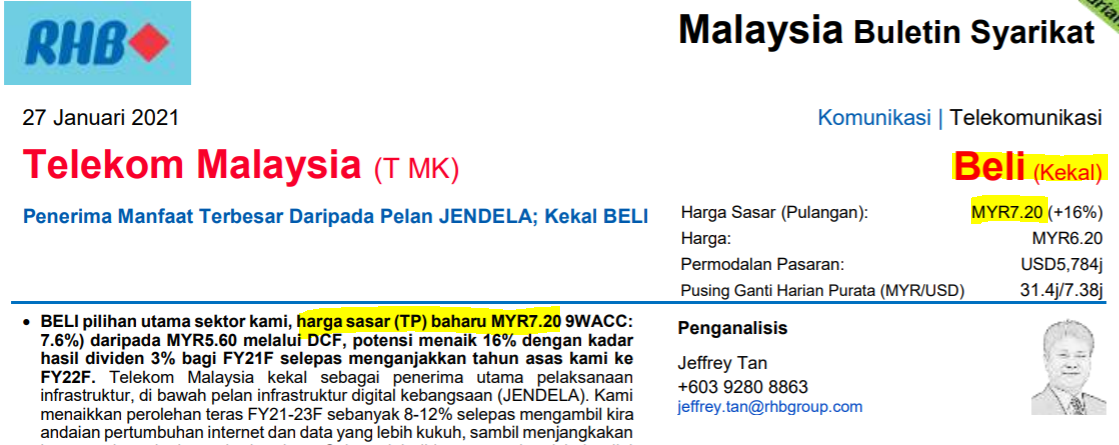

RHB research analyst Jeffrey Tan highlighted that TM(4863) would greatly benefit from JENDELA. TM(4863) also possibly to end 2021 with higher revenue for unifi and internet. The Analyst maintained buy with Target Price of RM7.20.

News Analysis:

Last year, TM(4863) Inks Agreement with Huawei; Set to Become the Only Malaysian-Owned End-to-End Cloud AI Infrastructure Service Provider. With this, TM(4863) will have a bright future.

Also,

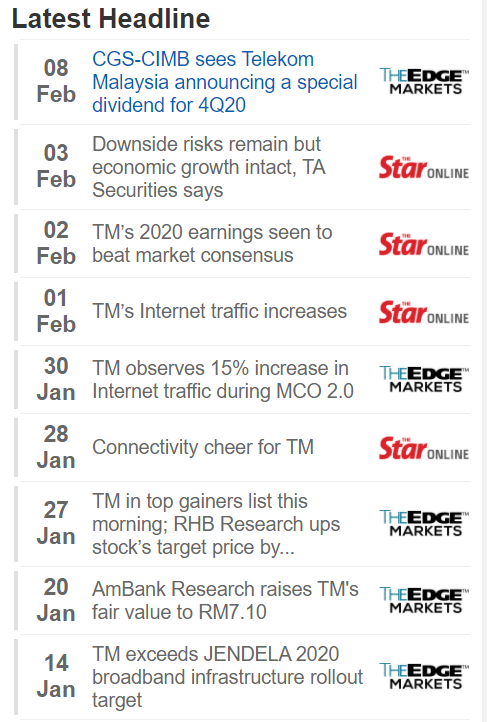

CIMB-CGS sees TM(4863) to announce special dividend for 4Q2020.

TM(4863) 2020 earnings seen to beat market consensus; meaning to say good results, and possibly a upgrade of target price soon ?

TM(4863) Internet traffic increases 15% during MCO 2.0. TM(4863) is bulletproof!

TM(4863) exceeds JENDELA 2020 broadband infrastructure rollout target !! JENDELA also known as National Digital Infrastructure Plan. Well, TM(4863) will lead the Malaysia Digitisation scene !

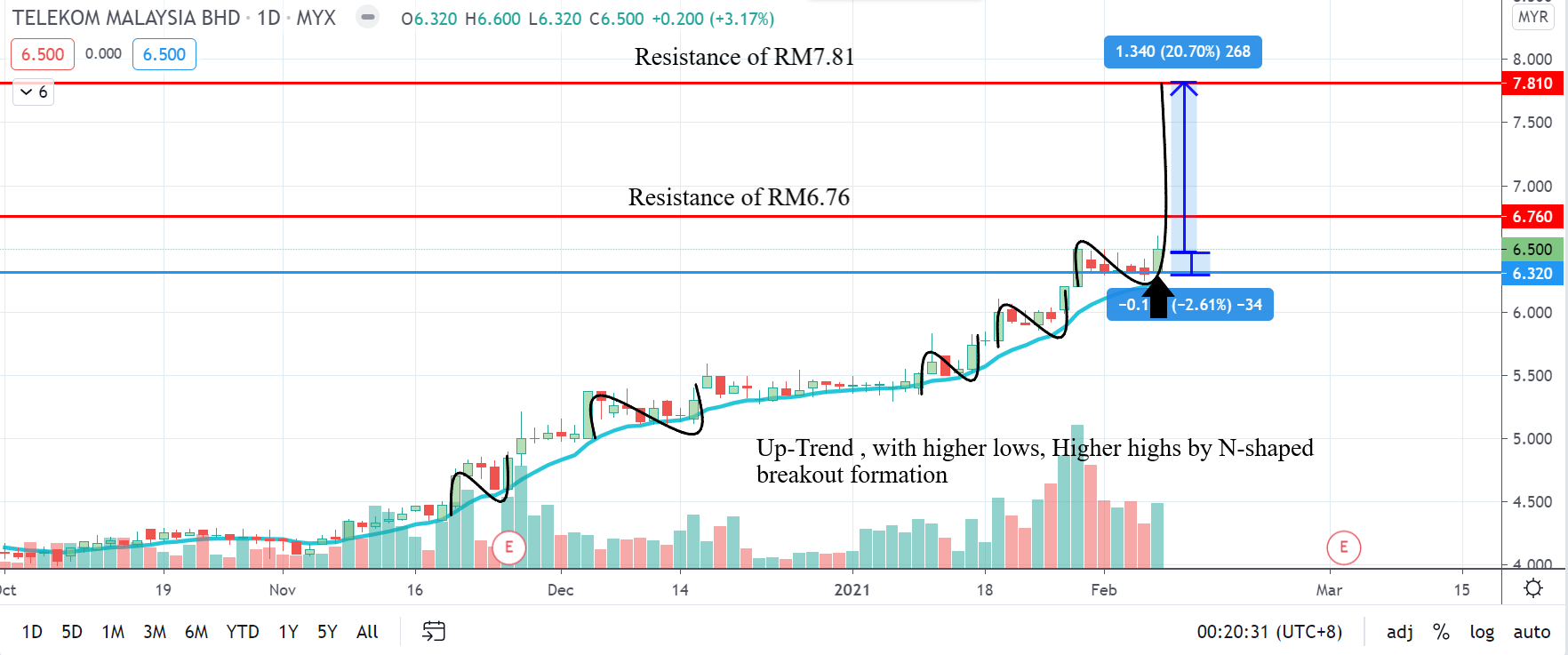

Technical analysis:

TM(4863) has been on a uptrend by N-shapes breakouts forming higher lows and higher highs. The near term resistance is RM6.76, and should this resistance be broken, the next Resistance to tets will be RM7.81. With support of RM6.32, the upside to downside reward to risk ratio is about 10 times.

Conclusion:

We strongly believe that TM(4863) has solid like rock fundamentals, and is well backed by all the great minds of industry experts. Besides that the News flow for TM(4863) is also very positive. We strongly suggest to give TM(4863) some consideration and detailed study before it is too late and becomes the gem of the town.

What will you do?

DISCLAIMER: This post serves as an educational analysis and is never meant to be a buy/sell call or recommendation. Investors must always do their own due diligence before making any investment decisions. The author of this post is not liable in any way for any decisions made by any individual.

https://klse.i3investor.com/blogs/THP/2021-02-09-story-h1541016936-Digitisation_Era_Leader_Telekom_Malaysia_TM_4863.jsp