A RELOOK ON

THE DRY BULK INDUSTRY

(AND PONDER ON MAYBULK)

DISCLAIMER

Information below is compiled from publicly available resources, as an attempt to understand the evolving dry bulk shipping industry. While MAYBULK is mentioned due to its position as the only KLSE dry bulk player, detailed financial analysis and stock valuation is beyond scope. There is no BUY/SELL recommendation on any stock or security. Investors are responsible for their investment decision and outcomes.

MAYBULK TRANSPORTS DRY BULK INTERNATIONALLY

MAYBULK transports dry bulk cargos internationally, covering the world’s shipping lanes. Major dry bulk cargos include iron ore, coal, grains. Minor dry bulk cargos include sugar, coke, fertilisers, etc. The dry bulk cargos are transported via vessels (dry bulk ships). As the name suggests, dry bulk cargoes need to be kept dry, as moistures would damage the goods.

MAYBULK has 12 vessels – 3 large, 4 medium, 5 small.

- Alam Kekal (Kamsarmax/Panamax category, i.e., large vessel)

- Alam Kukuh (Kamsarmax/Panamax category, i.e., large vessel)

- Alam Kuasa (Kamsarmax/Panamax category, i.e., large vessel)

- Alam Sayang (Supramax category, i.e., medium vessel)

- Alam Madu (Supramax category, i.e., medium vessel)

- Alam Molek (Supramax category, i.e., medium vessel)

- Alam Mulia (Supramax category, i.e., medium vessel)

- Alam Seri (Handysize category, i.e., small vessel)

- Alam Suria (Handysize category, i.e., small vessel)

- Alam Setia (Handysize category, i.e., small vessel)

- Alam Sinar (Handysize category, i.e., small vessel)

- Alam Sejahtera (Handysize category, i.e., small vessel)

Reference on vessel size categories:

MAYBULK’s revenue highly depends on dry bulk demand and freight rates. They have been on the rise since May 2020. Could MAYBULK benefit, return to profitability and enjoy sustained profitability?

DRY BULK SHIPPING DEMAND & RATES: WEAK 1H20, STRONG 2H20, STRONGER 1Q21

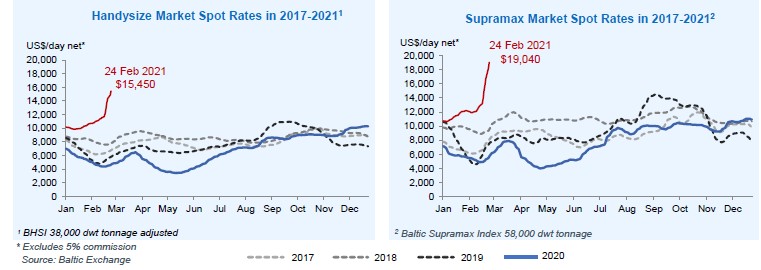

2020 was a year of two very different halves for dry bulk shipping. The Covid outbreak impacted the dry bulk market in the first half, driving certain dry bulk indices (Handysize & Supramax indices) down to their lowest second-quarter average in 50 years.

However, dry bulk demand and freight earnings started to improve significantly from May 2020 and have continued to strengthen into 2021.

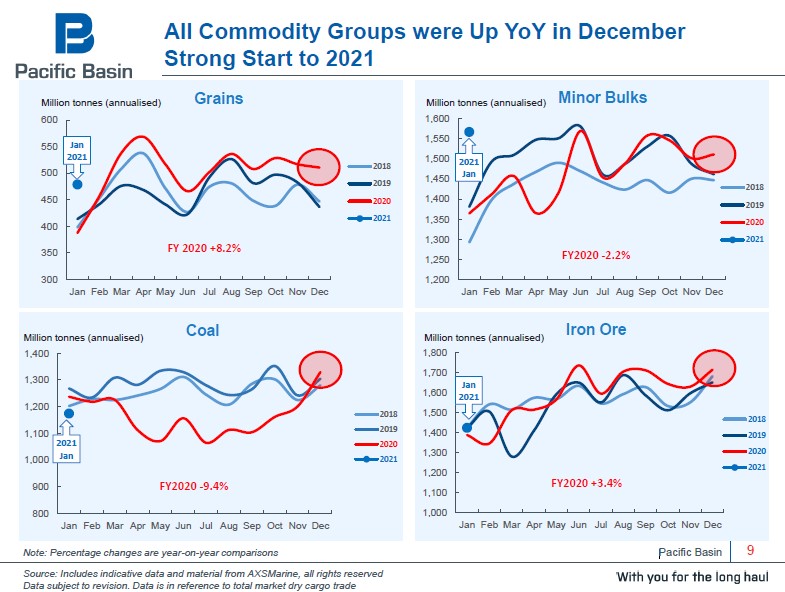

A rise in COVID-19 cases in European, US and some Asian economies has further enhanced social distancing measures, but there has been a strong and atypical start for all major dry bulk commodities in 2021 - iron ore, coal, grain, outperforming shipments volumes for the past five years.

Dry bulk shipment volumes in 1Q2021 broke 5-year new high. Handysize and Supramax market freight rates (MAYBULK’s 9 out of 12 vessels) have almost quadrupled since May to 10-year highs.

RISING DRY BULK DEMAND AND RATES BOLSTERED BY FOURFOLD MACROECONOMIC FACTORS

-

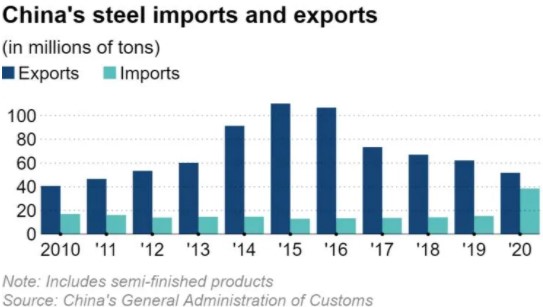

China’s all-time high steel imports. China's imports

of steel increased by 150% to 38.56 million tons in 2020, according to

the country's customs agency, as its producers struggled to keep up with

surging demand fuelled by government efforts to pull the economy out of

a coronavirus-induced downturn. The China Iron and Steel Association

expects the current heavy demand to peak around 2023.

-

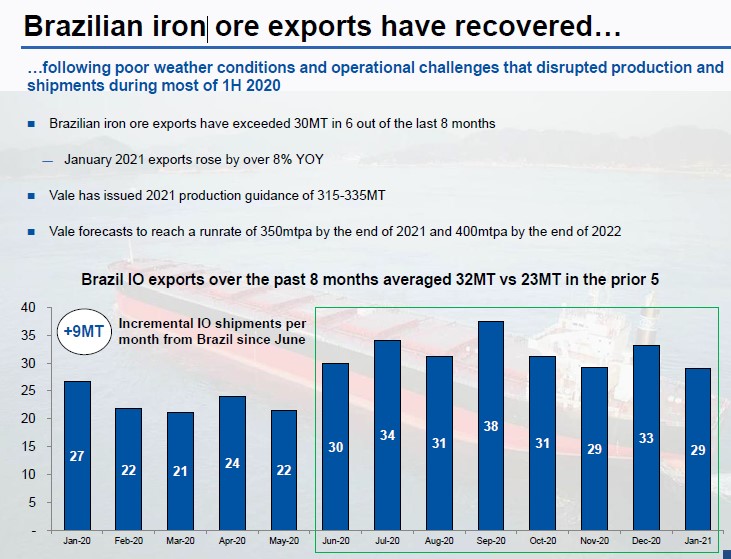

Recovery and growth of Australian and Brazilian iron ore exports.

For Australia, iron ore export shipments are expected to rise from 900

million tonnes in 2020-21 to 1.1 billion tonnes by 2025-26.

For Brazil, January 2021 iron export shipments has risen by over 8% YoY and are expected to rise from 370 million tonnes in 2020 to 400 million tonnes in 2022.

-

Undersupply of new vessels (due to regulation uncertainties and a 2-year vessel production period). As

of April 2021, the dry bulk vessel demand continues to outstrip supply.

Dry bulk vessel operators who want to increase their fleet are now

buying second-hand vessels, driving their values up. Supramax and

Handysize’s resale value has shot up by 28% in the past 6 months. Out

of MAYBULK’s 12 vessels, 4 are Supramax, 5 are Handysize. Moving into

April 2021, buying strength of second-hand vessel continues. Certain vessel operators continue to offer to buy vessels from ship owners at high prices.

Purchasing second-hand dry bulk vessels is the only available option as vessel manufacturers are reluctant to manufacture new vessels due to vessel regulation uncertainties (new environmental-protective specifications to be introduced).

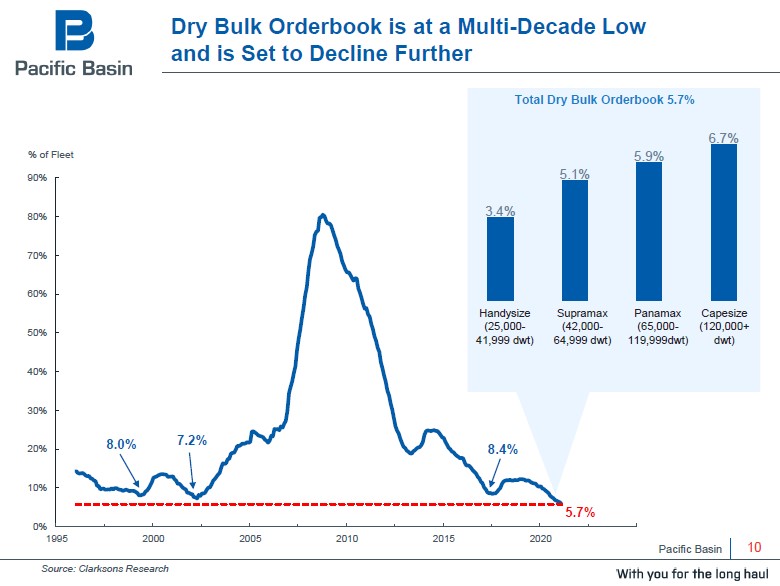

As a result, dry bulk vessel’s orderbook is at a multi-decade low:

- The overall dry bulk orderbook at 5.7% of the existing fleet is now the smallest it has been in decades,

- The combined Handysize and Supramax orderbook is even lower at 4.6%. Out of MAYBULK’s 12 vessels, 4 are Supramax, 5 are Handysize.

Even if the latest

environment-protective dry bulk vessel specifications are introduced,

supply would not catch up immediately, as vessel manufacture takes time

(and costs significantly more).

According to John Wobensmith, the CEO of Genco Shipping (US), it takes two years to build a vessel. In other words, as long as shipments continue to remain at elevated levels, undersupply of vessels is likely to stay for 2 years or more.

- Unprecedented levels of global stimulus. This excites economic activities and drives up the shipment volume across all commodity groups (grains, minor bulks, coal, apart from iron ore), which have registered a strong start in 2021.

1Q21: INTERNATIONAL DRY BULK & SHIPPING PLAYERS EXPRESSED OPTIMISM TOWARDS 2021 & 2022

> Star Bulk Carriers Corporation (SBLK), 17 February 2021

In an environment where on the macro side we expect a world economic rebound a weak dollar, strong oil prices and low interest rates. And on the micro side, low order book now and in the future increased Brazilian iron ore exports and West African bauxite, strong long-haul grain trade, congestion and a positive supply effect due to environmental regulations, we continue to remain very positive about the short and medium-term prospects of dry shipping.

> Danaos Corporation (DAC), 16 February 2021

Now everyone is focused on whether the current market strength is sustainable and for how long. Fortunately, incremental vessel supply will remain low for the time being. Although there have been new orders placed, the current order book is at historically low levels. Since there is a two-year lead time for new orders to hit the water, supply growth should be moderate for the next couple of years. This quarter, we saw an improvement in adjusted EBITDA and adjusted net income compared to the same quarter in the prior year. Our earnings improvement should be even more pronounced in the coming quarters as new contracted charters at significantly higher rates start to contribute to our top line.

> Pacific Basin (PCFBF), 25 February 2021

Although some Covid-related uncertainty remains, the demand outlook is positive with vaccines and economic stimulus expected to lead the demand recovery. The dry bulk orderbook is now the smallest it has been in decades and fleet growth is expected to slow further because of the effect of environmental regulations on new ship ordering and on vessel operating speeds. All this presents real potential for a continued beneficial demand/supply balance in the next few years, from which we are very well positioned to benefit.

> Genco Shipping & Trading (GNK), 25 February 2021

We believe 2021 will be an improved year for the dry bulk market relative to 2020 due to record low orderbook as a percentage of the fleet to limit net fleet growth, unprecedented levels of global stimulus, global GDP forecast to rise by 5% in 2021, China’s economy to continue to lead while ROW continues economic improvement, recovery and growth of Brazilian iron ore exports and India’s coal imports and steel production to continue their rebound.

CROSS-CHECKING #1: BREAKWAVE ADIVISORS, THE CREATOR OF BDRY, 23 JANUARY 2021

Breakwave Advisors, the creator of the Breakwave Dry Bulk Shipping ETF (NYSE: BDRY), echoed that sentiment. “The dry bulk market is about to surprise a lot of people, something that is not priced in the futures and is not in the mind of most investors,” it argued in a report on Tuesday. “A lethargic decade for the industry is behind us."

CROSS-CHECKING #2: SHARE PRICE MOVEMENT OF DRYBULK STOCKS FROM END OF DECEMBER 2020 TO 11 APRIL 2021

- Danaos Corporation (DAC) : + 176.53%

- Star Bulks Carriers Corporation (SBLK) : + 74.94%

- Pacific Basin : + 54.61%

- Genco Shipping & Trading (GNK) : + 51.60%

- On the other hand, MAYBULK : + 6.78%

BDI UPTRENDING WELL AS OF EARLY APRIL 2021

The Baltic Dry Index (BDI) is reported around the world as a proxy for dry bulk shipping stocks. It has been on an uptrend since the rebound in May 2020, 2 months after the worst COVID pandemic fear.

Bolstered by favourable macro factors and supply-demand situation, would BDI make a strong upswing, like it did between 2003 and 2008? If it does, dry bulk shipping companies would enjoy much-elevated freight rates, making strong comebacks from the previous multi-year of brutal industry consolidations, where most dry bulk players across the world have been incurring losses.

CONNECTING THE DOTS, MAYBULK

In Q1, international dry bulk players have expressed confidence on the dry bulk demand for near term and middle-term (1-2 years). As the only KLSE dry bulk carrier, would MAYBULK capture the imminent earnings upside, recover its previous losses and make a turnaround, for at least the near and middle term? Time will tell.

DISCLAIMER

Information above is compiled from publicly available resources, as an attempt to understand the evolving dry bulk shipping industry. While MAYBULK is mentioned due to its position as the only KLSE dry bulk player, detailed financial analysis and stock valuation is beyond scope. There is no BUY/SELL recommendation on any stock or security. Investors are responsible for their investment decision and outcomes.

https://klse.i3investor.com/blogs/jomnterry/2021-04-13-story-h1563213399-MAYBULK_5077_A_RELOOK_ON_THE_DRY_BULK_INDUSTRY_PONDER_ON_MAYBULK.jsp