E&O(3417) Possible Limit Up

Welcome back to “The Huat Project” We would like to present E&O(3417) Possible Limit Up.

E&O(3417) was presented with the Mandatory Take Over by Datuk Tee of Kerjaya Prospect at RM0.60, and the offer has been closed, however most of the shareholders of E&O(3417) did not accept the offer of RM0.60 because E&O(3417) should worth at least RM1.20. As the offer ends Datuk Tee only managed to acquire 58% of the total shares.

![]()

New Chieftain (Datuk Tee Eng Ho) will turnaround E&O(3417). Datuk Tee who has vast experience in the construction and property industry recently appointed as executive chairman where he will be in charge of the day-to-day business. He brought along 2 of his directors from KERJAYA to E&O(3417). https://www.theedgemarkets.com/article/eastern-oriental-says-tee-eng-ho-redesignated-executive-chairman

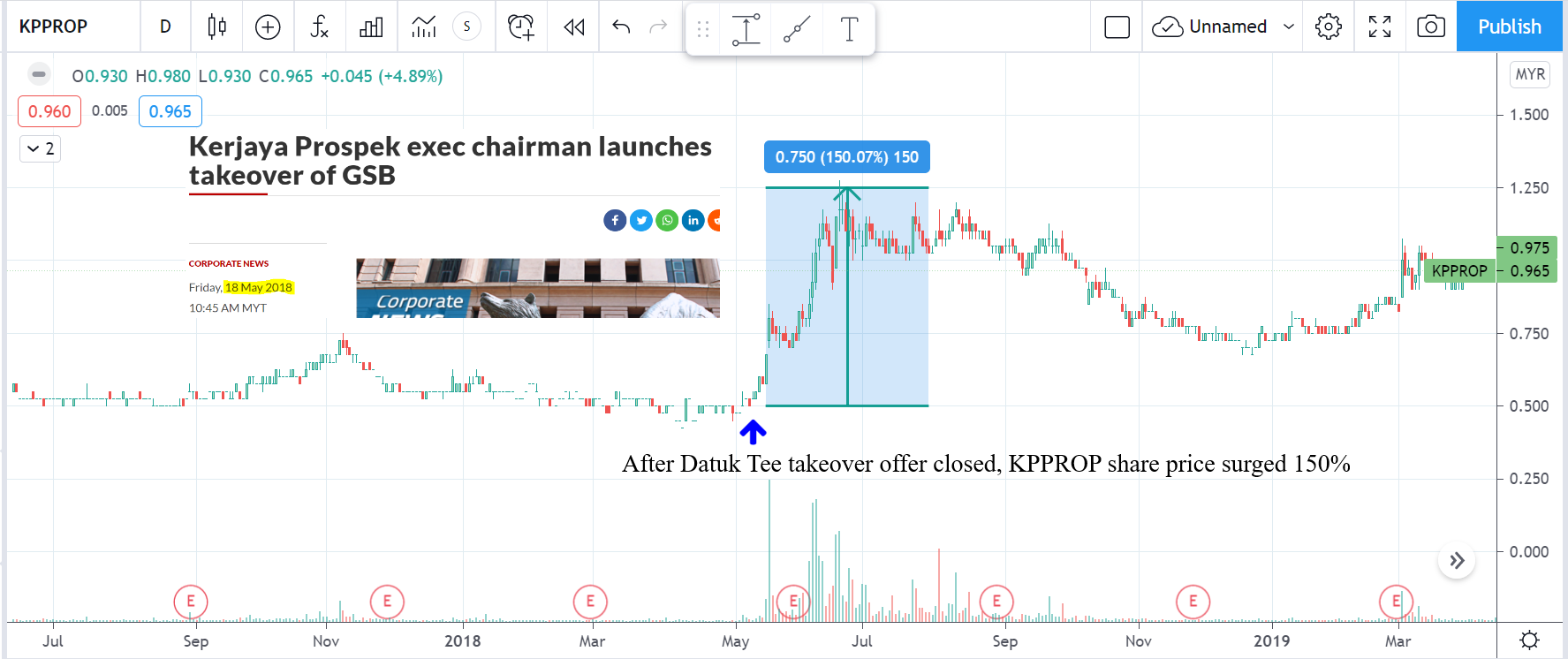

Datuk Tee has good business acumen with outstanding track record. Currently he owns 2 listed co’s: KERJAYA and KPPROP. KERJAYA consistently (i) make profits of >RM100m (with growth) since takeover in 2016 and (ii) register above average construction margins compared to peers. Meanwhile, KPPROP show QoQ growth in quarterly profit (from RM1m to RM22m) since 5 quarters ago. Surely as the new Executive Director, Datuk Tee will be able to steer E&O(3417) to greater heights.

History Analysis

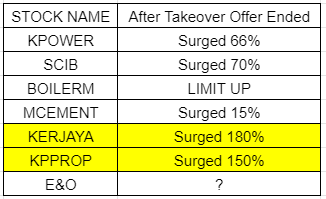

“History Repeats itself”, Lets have a look to all the counters which have undergone Take Overs.

1.KPOWER- after the mandatory offer ended its share price surged 66%

2. SCIB- after the mandatory offer ended its share price surged about 70%

3. BOILERM- after the mandatory offer ended its share price Limit Up (30%)

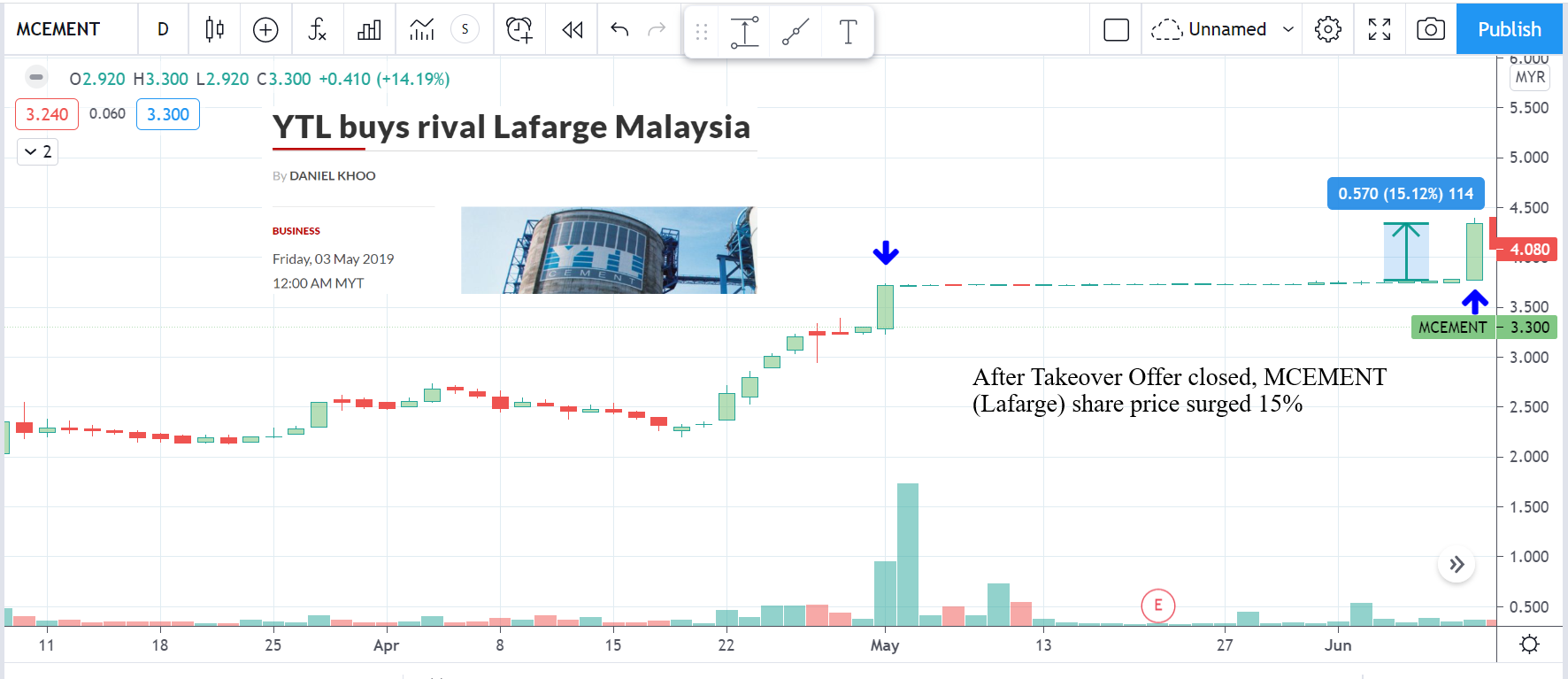

4. MCEMENT (Lafarge) - after mandatory offer ended its share price surged 15%

5. Kerjaya Prospect and KPPROP after taken over by Datuk Tee share price surged from RM0.690 to RM1.90 (180%) and RM0.505 to RM1.20 (150%)

Technical Analysis

E&O(3417) Takeover Offer ended on 18/5/2021. With RM0.550 as support, the Reward to Risk ratio is 12 times which is very good.

E&O(3417) Takeover Offer ended on 18/5/2021. With RM0.550 as support, the Reward to Risk ratio is 12 times which is very good.

Conclusion

We strongly believe that E&O(3417) has the potential to limit up with 1. Datuk Tee piloting the company’s direction from now onwards. 2. E&O(3417) current undervalued price of RM0.575 vs its NTA of RM1.20. Also, BDO Capital Consultant Sdn Bhd values E&O(3417) fair value at RM2.12, against current price of RM0.600. We believe that the downside for E&O(3417) is limited as all the sellers would have sold their shares during this takeover offer period. With this being said, there is only UPside for E&O(3417). The Limit Up Price for E&O(3417) is RM0.875.

What will you do?

DISCLAIMER: This post serves as an educational analysis and is never meant to be a buy/sell call or recommendation. Investors must always do their own due diligence before making any investment decisions. The author of this post is not liable in any way for any decisions made by any individual.

https://klse.i3investor.com/blogs/THP/2021-05-19-story-h1565124766-E_O_3417_Possible_Limit_Up.jsp