Welcome back to another series of our simplified info about the stock market. Congratulations to those who read our previous article on Steel Sector and if you made any profits, enjoy them and hope you have learned something through that process despite a bad market condition.

As of today we will be talking on another sector that looks interesting and still has a good risk to reward ratio like how we covered Steel 2 weeks back. We are talking about the PLANTATION Sector.

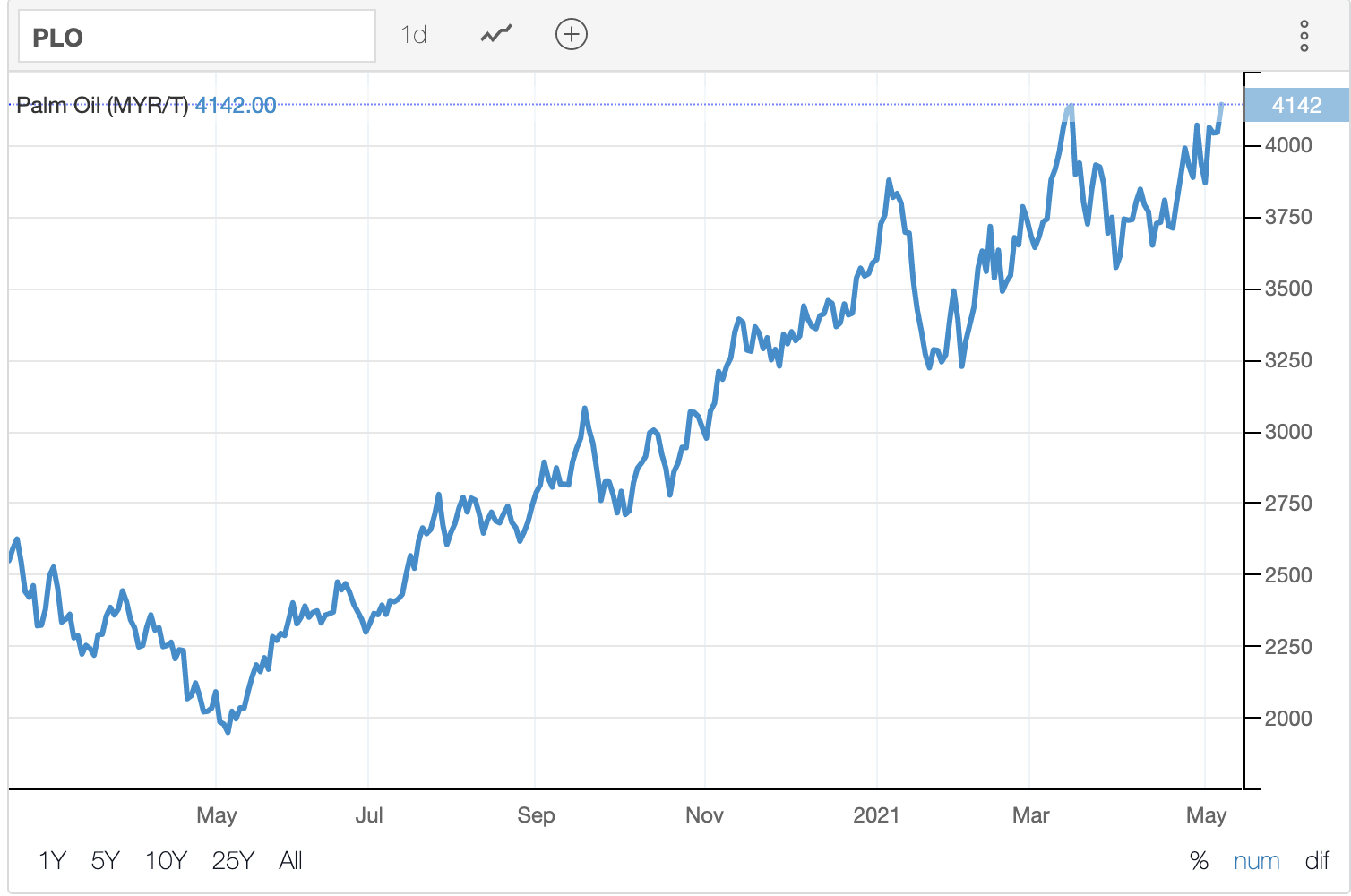

First of all, whenever we research about a specific sector, always look at the overarching element that controls the performance of the companies within that sector. In this case we will be looking at CPO prices.

Malaysian palm oil futures rose to as high as RM4,200 per tonne, the highest level since March 2008 on the back of tight global edible oil supplies and despite falling demand from India amid a deepening coronavirus crisis. Harvesting has been affected by labor shortage as oil palm estates dependent on foreign workers struggle with a shortage of manpower under a prolonged freeze on hiring by the government due to Covid-19. Meantime, April’s production is likely to rise by 8.9% from a month earlier in Malaysia and by 10.8% in Indonesia due to favorable weather and increased fertilizer use; while shipments are set to increase by 8.7% and by 14.6% respectively.

Source : https://tradingeconomics.com/commodity/palm-oil

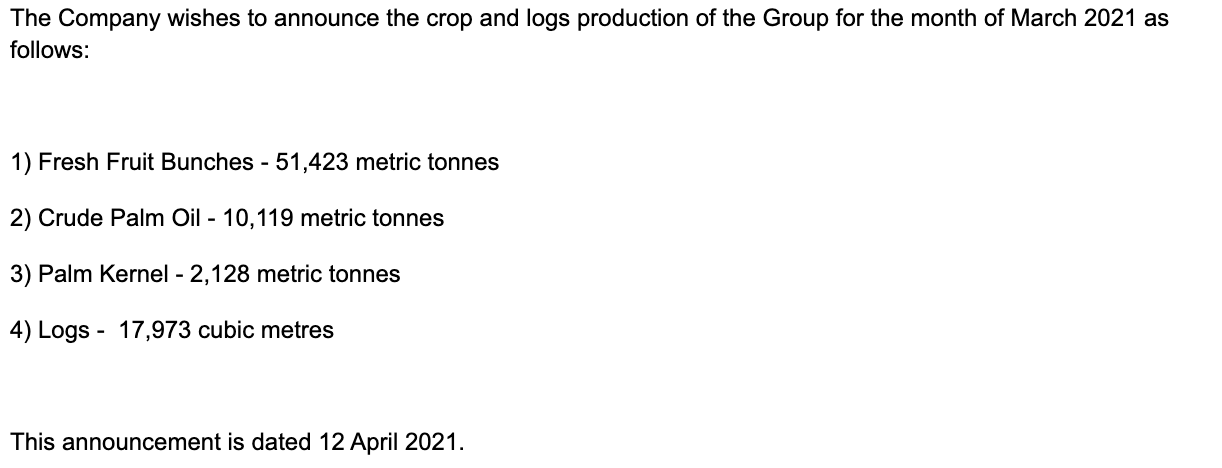

As we can see, the CPO price is at all time high since March 2008 and the production quantity is expected to increase due to the factors mentioned above. We will also validate this with a data given by a Public Listed Company in Malaysia for February and March 2021 in terms of production.

The two most important things among others that drives the price of a stock is definitely profit margin and prospects. Previously plantation stocks were facing some difficulty despite the CPO price going up is due to the uncertain prospects cased by COVID-19 and shipments obstacles. Based on the forecast mentioned in the earlier note, the second factor seems to be overcomed from the increased in shipments.

Since CPO prices are still going up and shipments are expected to increase in tandem with the high production, there is probably only one direction for the plantation stocks.

Based on these simplified analysis, we believe there will be some form of interest coming into this sector. Some of the plantation stocks in Bursa Malaysia that has been gaining attention recently includes KLK, SWKPLNT, INNO, JTIASA, KMLOONG, SIMEPLT, SOP, RSAWIT, TDM and many more.

Kindly check with a licensed investment advisor to know which of these stocks could benefit your portfolio, if any. Remember; the most important rule to make profits from the stock market is to do extensive research and coming up with relevant hypothesis before it comes out in the news.

So we hope this has increased your awareness on how the plantation sector works for you to make use of it in the future.

We have more for you! Follow us in our Telegram Channel @StockAdvisor FBMKLCI for more updates in Bursa Malaysia on a daily basis!

Disclaimer : All notes expressed

here are solely individual point of views and we are not responsible for

any buy or sell decisions made by others. Kindly use this as a

reference reading material to add value to your current research and

pleas verify any information stated here with a licensed individual in

the capital markets industry before making any decisions.

https://klse.i3investor.com/blogs/StockAdvisor/2021-05-06-story-h1564318517-WHAT_S_AFTER_THE_STEEL_RALLY_DON_T_WAIT_FOR_NEWS.jsp