What are ADRs ?

ADRs or American Depository Receipts is a negotiable certificate issued by a U.S. depositary bank representing a specified number of shares—often one share—of a foreign company's stock. The ADR trades on U.S. stock markets as any domestic shares would. (source)

Genting Berhad (3182) has an ADR. The ticker is GEBHY and trades on the OTC (over-the-counter) market. GEBHY's ratio is 1 ADR : 5 Ordinary (source). In other words, 1 ADR is equivalent to 5 ordinary shares of Genting Berhad (3182). Note that the ADRs are in USD $

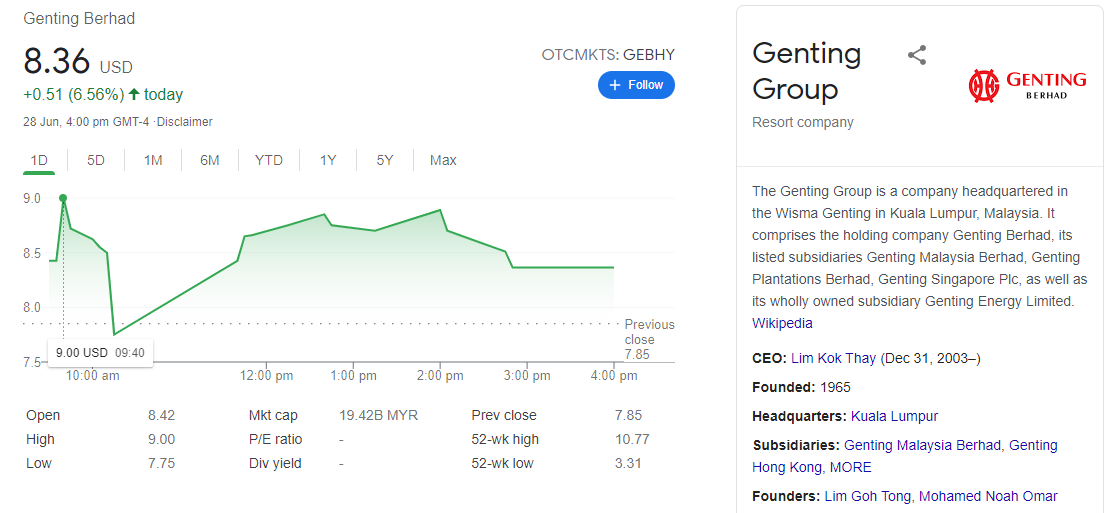

As at the close Monday 28 June 2021, GEBHY shot up 6.56% ! : -

Implied Value

ADR Price: US $ 8.36

Exchange Rate: USD 1 : RM 4.15

Ratio: 1 ADR : 5 Ordinary

= (8.36 * 4.15) / 5

= RM 6.94 per Genting (3182) share

Performance

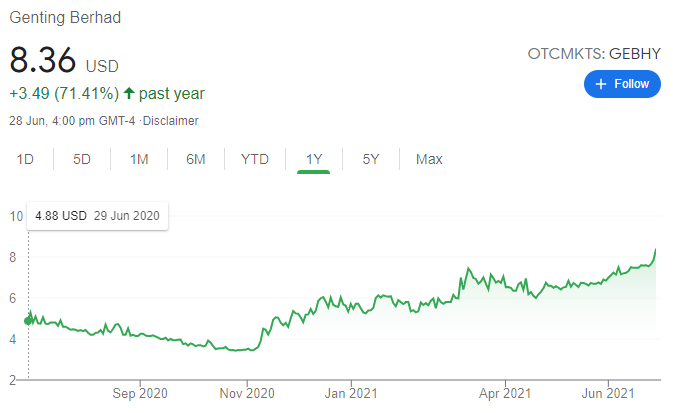

Interestingly, GEBHY has been on an uptrend [likely in anticipation and as a result of the opening of Genting's USD $ 4.3 billion Resorts World Las Vegas (RWLV)] while GENTING (3182) has been stagnant: -

GEBHY 1-year chart (+71.4%)

GENTING (3182) 1-year chart

This disparity in GEBHY and GENTING (3182) offers potentially an arbitrage opportunity. The concept is simple - what happens in one market happens in all markets.

Perhaps the difference is a result of the Americans' direct access to the New York City and Las Vegas scene as well as the tremendous recovery in the gaming sector.

TLDR; We like GENTING (3182) stock

Disclaimer: The information and opinions expressed here are for educational purposes only and the contents of this report should not be construed as financial advice and does not constitute a buy or sell call. Consult your investment advisor before making any investment decision.

https://klse.i3investor.com/blogs/emsvsi/2021-06-29-story-h1567089054-BREAKING_THIS_MALAYSIAN_STOCKS_ADR_IN_THE_USA_IS_FLYING_ARBITRAGE.jsp