GENETEC was incorporated as private company in year 1997 under the name of Genetax Technology Sdn Bhd.

In year 2004, it converted to a public limited company and changed its name to Genetec Technology Berhad. In the following year, it listed on MESDAQ Market of Bursa Malaysia.

GENETEC core business is to provide assembly automation and engineering services to various industries. It is able to provide engineering service to customize design the industrial automation system to suit individual needs, build to print, customizable conveyor and transportation system and vision system

Currently, its core revenue industry segment is hard disk drive (“HDD”), which contributed 84% of total revenue, followed by automotive industry 9% and pharmaceutical, semiconductor 7%.

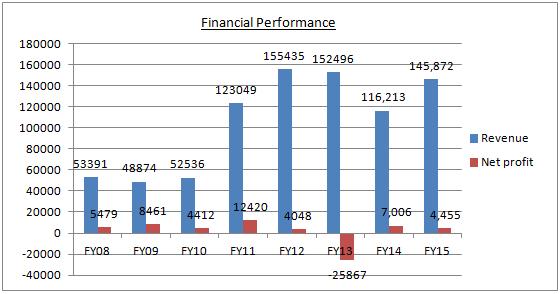

Have a look with its past financial performance.

GENETEC doesn't have a stable or outstanding track record.The net loss in FY13 was mainly attributable to one-off goodwill written-off in USA business which is a discontinued operation unit. So, in year 2014, the financial result had excluded USA business, which lead to a drop in revenue.

FYI, Genetec Global Technologies, Inc., a wholly-owned subsidiary of Genetec, was incorporated in USA in year 2010. System's South, Inc. and IP Systems, Inc. were the subsidiary of Genetec Global Technologies, Inc.

However, their business in USA was not doing well; revenue had increased significantly but net profit did not seem to have any improvement. Hence, they discontinued the operation in USA in year 2013.

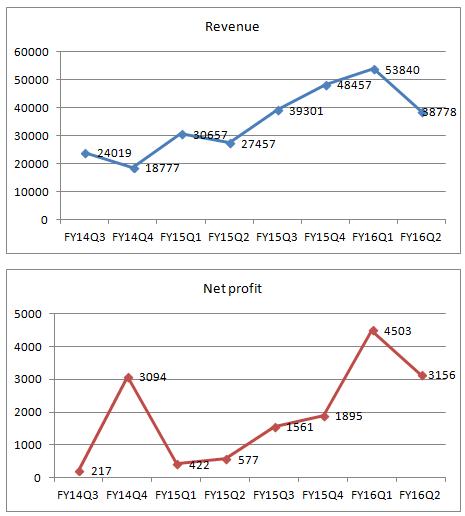

Let’s look at its past 8 quarters revenue and profit.

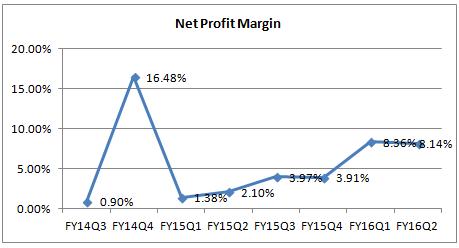

FY14Q4 net profit margin 16.48% is an outlier. Without taking into account of profit from discontinued operation, actually GENETEC made losses on that quarter. So, let’s just ignore this.

Overall, GENETEC net profit margin had been improve from 1% to current 8% in the past 8 quarters. It was mainly contributed by recognition of foreign exchange gain!

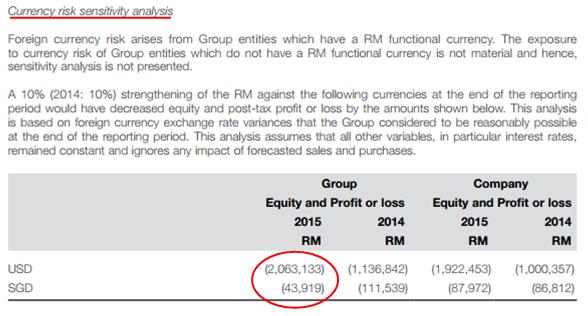

The below is the currency risk sensitivity analysis which extracted from GENETEC annual report 2015.

From the statement above, 10% strengthening of MYR against USD will decrease GENETEC profit by MYR2m! In other words, GENETEC is a beneficiary from weakening of MYR.

To recall back, on the first quarter of 2016, the conversion for USDMYR was around 3.7 while on FY16Q2, it had appreciated to around 4.1. Compared to year 2014, USD had strengthened by more than 15% against MYR.

Since we are not able to track its operation profit margin, I believe weakening of MYR is the main reason why GENETEC net profit margin suddenly surged from 4% to 8% in FY16.

Financial Strength

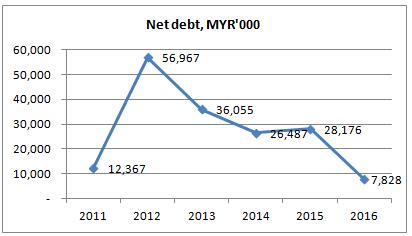

*FY16 data was referring to GENETEC latest Q2 unaudited account

Net debt = Total borrowing – Cash and cash equivalent

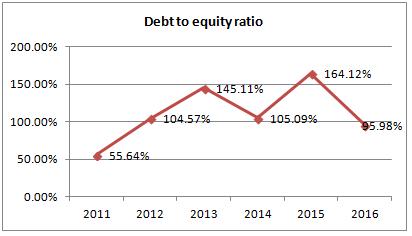

GENETEC net debt had been decreasing from year to year. I believe sooner or later, GENETEC cash on hand will be more than its borrowing, based on its current consistent quarter earnings. However, its debt to equity ratio is not good, which is around 100%! GENETEC definitely need to improve its financial strength.

Book Order

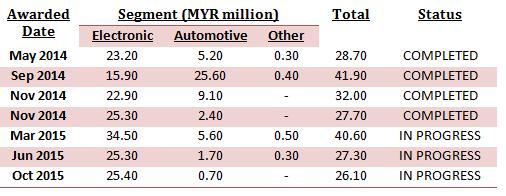

In year 2014 and 2015, GENETEC had been awarded 7 orders, based on its announcement in Bursa. Its orders obtained in year 2014 worth MYR130.3m while orders in year 2015 worth only MYR94m. Theoretically, GENETEC 2015 revenue supposed to be lower than year 2014 but it came the opposite way.

GENETEC book orders were to complete within 3 to 9 months. Assume the orders are to be complete by maximum 9 months, GENETEC still have 3 orders in hand.

Let’s have a brief calculation on its next coming quarter earnings. MYR94m divided by 3 quarters, equivalent to approximately MYR32m per quarter. With a profit margin of 8%, GENETEC is expected to deliver MYR2.5m profit in next quarter. This is just a brief estimation to know roughly how much GENETEC can deliver.

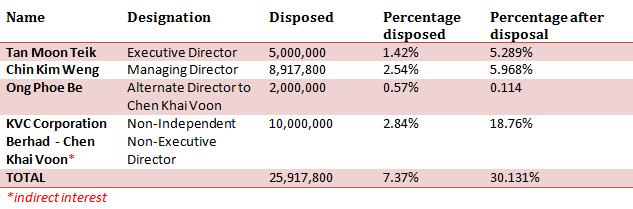

Directors Shareholdings

GENETEC issued and paid up share capital is 351,738,000.

However, do take note that, since October 2015, GENETEC directors had been disposed their shares quite aggressively.

For me, there are only two reasons for the disposal.

1. In Nov 2015, GENETEC shares price had surged from MYR0.20 to current MYR0.30. Maybe, it is the best time for time to take some profit. FYI, over the past 2-3 years, the highest GENETEC reached was only MYR0.24; it was just a very short time before it dropped again.

2. The directors understand the company business well. They realize that the company will not be able to sustain its profit in coming quarter. So, they choose to sell part of it, before the share price drops.

Is there any third possibilities?

Conclusion

According to TechNavio Report Global HDD Market 2011-2015, it predicted an 8.1% annual growth rate for the global HDD through 2015.

According to Fitch Ratings’ Report on 2015 Outlook for Global Automotive Manufacturers, the global demand for new vehicles should increase modestly in 2015, despite challenging conditions in some markets.

Having said so, GENETEC books order will still be our main concern, as the report statements above are purely a research paper.

With its current price of MYR0.30, GENETEC is currently traded at PE of 9.49 and ROE of 17.55%. If it is able to sustain its first two quarter profit in the next two quarter, GENETEC is still considering cheap.

With USDMYR expected to trade above 4.00 in the next half to one year, GENETEC probably still able to deliver satisfied result, given its book order is able to sustain.

However, when the catalyst of beneficiary of weakening of MYR no longer exists, is GENETEC still able to deliver good result? It is another story.

Just for sharing

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

I will send you one or two samples of my report, for your reference.

Have a wonderful December! Hopefully all of you are doing well in investment this year :)

Cheers!

https://klse.i3investor.com/blogs/rhinvest/2015-12-02-story-h53407350-_RICHE_HO_Genetec_Technology_Berhad.jsp