Hi there guys,

Majority companies are having their quarter reports released in February. However, some had chosen to release it on March cycle instead. I would like to highlight one upcoming QR which is for GREENYIELD BERHAD (GREENYB).

GREENYB (BSKL Code 0136, MAIN Market, Consumer Products & Services)

TP 1 - 17c (short term), TP 2 - 25c mid to long term

Below are my opinions on this stock based on the three usual criterias which I usually cover on:

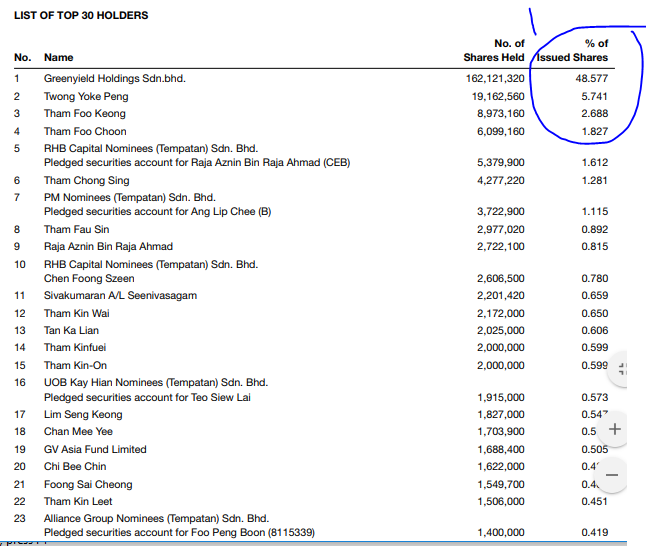

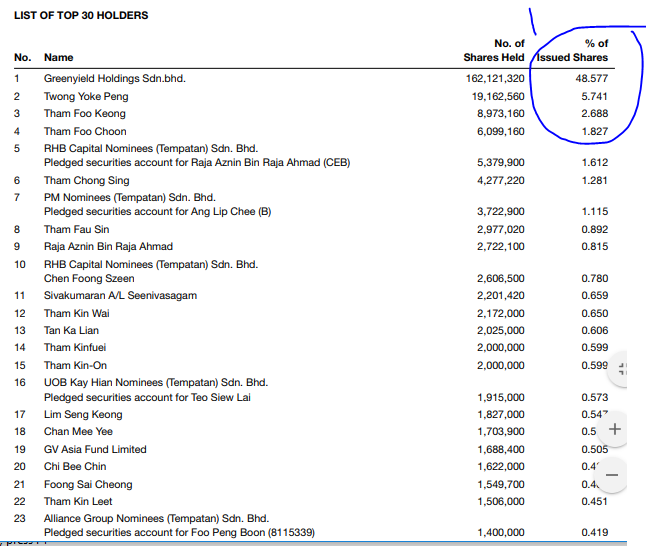

1. Share Float

GREENYB has total share float of 333.74 million shares. Refer below to the list of top shareholders taken from its annual report. As you can see, the top 4 shareholders collectively hold about 58.4%, leaving the total effective float to about 41.6% which is around 138 million shares, as the long term shareholders will usually hold on to their holdings for long term.

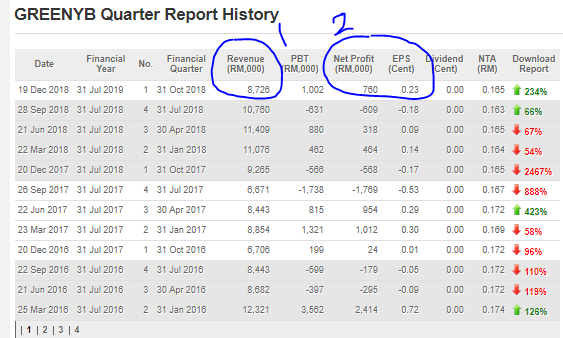

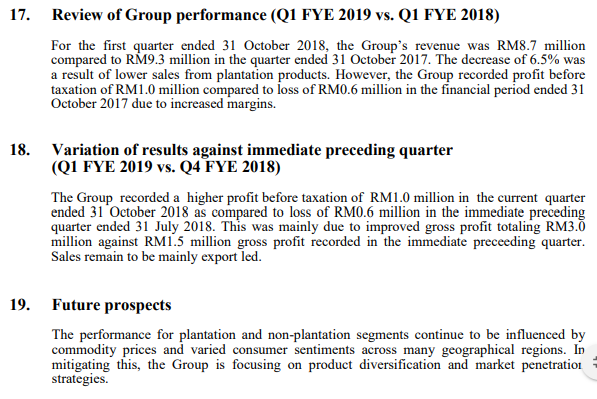

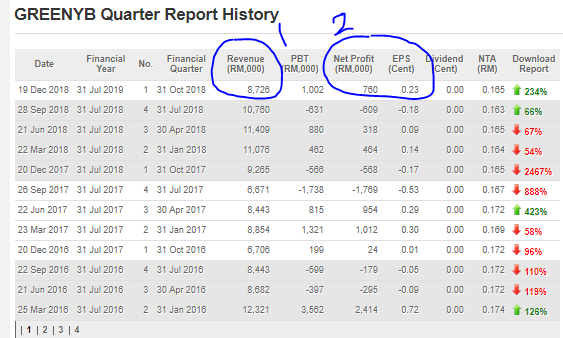

2. Financial Analysis

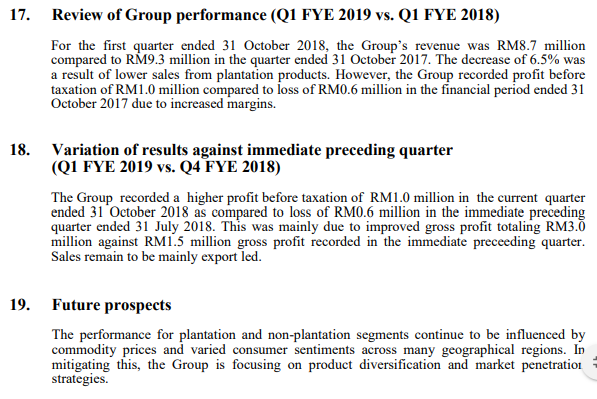

Below images on latest quarter report and future prospect of company is refferred. From the QR summary, we see from circle 1 that the company revenue has declined slightly but it has achieved net profit of RM 750,000 with EPS of 0.23c. Company is also now trading below NTA value of 16.5c.

For the upcoming QR in March 2019 (which can be out anytime soon between today and latest next week), I foresee the report to be better if compared to QR March 2018 which they had achieved EPS of 0.14c. The company also commented that they are focusing on product diversification and market penetration strategies to improve their net profits.

3. Technical Analysis

Refer below daily chart for GREENYB. You can see in Circle 1 that it had recently achieved ICHIMOKU cloud breakout at around 13c. Then after some consolidation, recently there had been some price movements which had pushed it into the resistance area of 14-15c. This bullish momentum is supported by MACD crossing (circle 3) and building volume (circle 4).

Should the result be strong as expected, then breakout of above 15c is seen to bring the stock towards the 17c first target in near term.

CONCLUSION

From the above views, I opine that GREENYB is bullish biased, based on the following:

1. Low share float which allows it to trend strongly with less resistance

2. Financial Analysis - anticipated good upcoming quarter report in March 2019 to boost investor confidence

3. Technical Analysis - breakout of ICHIMOKU cloud, MACD crossing and building volume

See you next time.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/198822.jsp

Majority companies are having their quarter reports released in February. However, some had chosen to release it on March cycle instead. I would like to highlight one upcoming QR which is for GREENYIELD BERHAD (GREENYB).

GREENYB (BSKL Code 0136, MAIN Market, Consumer Products & Services)

TP 1 - 17c (short term), TP 2 - 25c mid to long term

Below are my opinions on this stock based on the three usual criterias which I usually cover on:

1. Share Float

GREENYB has total share float of 333.74 million shares. Refer below to the list of top shareholders taken from its annual report. As you can see, the top 4 shareholders collectively hold about 58.4%, leaving the total effective float to about 41.6% which is around 138 million shares, as the long term shareholders will usually hold on to their holdings for long term.

2. Financial Analysis

Below images on latest quarter report and future prospect of company is refferred. From the QR summary, we see from circle 1 that the company revenue has declined slightly but it has achieved net profit of RM 750,000 with EPS of 0.23c. Company is also now trading below NTA value of 16.5c.

For the upcoming QR in March 2019 (which can be out anytime soon between today and latest next week), I foresee the report to be better if compared to QR March 2018 which they had achieved EPS of 0.14c. The company also commented that they are focusing on product diversification and market penetration strategies to improve their net profits.

3. Technical Analysis

Refer below daily chart for GREENYB. You can see in Circle 1 that it had recently achieved ICHIMOKU cloud breakout at around 13c. Then after some consolidation, recently there had been some price movements which had pushed it into the resistance area of 14-15c. This bullish momentum is supported by MACD crossing (circle 3) and building volume (circle 4).

Should the result be strong as expected, then breakout of above 15c is seen to bring the stock towards the 17c first target in near term.

CONCLUSION

From the above views, I opine that GREENYB is bullish biased, based on the following:

1. Low share float which allows it to trend strongly with less resistance

2. Financial Analysis - anticipated good upcoming quarter report in March 2019 to boost investor confidence

3. Technical Analysis - breakout of ICHIMOKU cloud, MACD crossing and building volume

See you next time.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/198822.jsp