Edge Weekly

Undervalued, underfollowed ACE stocks to keep an eye on

SOME of today’s fastest-growing companies started out very small, with their shares listed on the ACE Market. As their businesses grew in size, the wealth of their shareholders grew along with them.

Take Inari Amertron Bhd, for example. After doubling its net profit in FY2013 and FY2014, the electronics manufacturing services provider “graduated” from the ACE Market to the Main Market in 2014. Investors who saw the company’s growth potential during the early stages would have made massive gains as the stock jumped a staggering 15-fold from 24 sen to RM3.64 from 2013 to 2015.

The segment is highly fragmented and inadequately covered by analysts, resulting in inefficient markets. This opens up opportunities for experienced investors to generate alpha, or excess returns on a risk-adjusted basis, through active stock selection.

Based on historical fundamental data compiled by The Edge, 10 stocks show growth potential or offer attractive yields (see table). During the process of narrowing down our list, companies that posted any losses in the past three years were eliminated to reduce the downside risk.

Save for YTL e-Solutions Bhd, which is more of a yield play, all companies on our list have demonstrated positive revenue and earnings growth, at least in the past three years. Each also possesses a strong balance sheet, with eight out of the 10 in a net cash position and the rest with net gearing ratios of less than 10%.

The list is ranked by earnings risk, namely the consistency of earnings growth in the past 10 years. For instance, the top stock — OpenSys (M) Bhd — has achieved double-digit compound annual growth rates in earnings since 2005 without posting any annual losses. They tend to pay steady dividends with little need for a cash call.

Earnings growth aside, corporate exercises could be another share price catalyst. The growing net profit enables companies to capitalise their earnings reserve and carry out a bonus issue to improve trading liquidity and public visibility.

As many of them have met or are about to meet the profit requirement, perhaps a more significant catalyst would be the transfer to the Main Market, which would raise investor confidence and render the companies more accessible to more institutional investors.

(1) OpenSys (M) Bhd

OpenSys, which provides cash and non-cash payment solutions such as bill payment kiosks and cheque processing services, is a beneficiary of the ongoing efficient self-service trend in the banking sector. In 2001, the company pioneered the design and development of non-cash efficient service machines (ESMs) that are installed at bank branches.

In recent years, it has partnered Japan’s Oki Electric to supply cash recycling machines (CRMs) that are more cost efficient — they provide both cash dispensing and cash deposit functions. Moving forward, OpenSys sees huge market expansion opportunities in the local ATM market as the penetration rate of CRMs currently stands at a mere 4%.

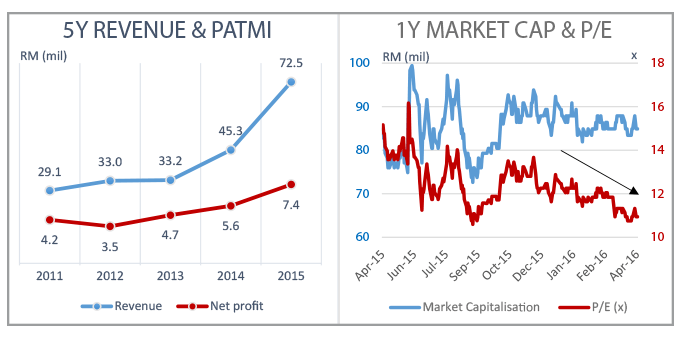

After securing orders worth RM20 million for CRMs in 2014, the company saw its revenue for FY2015 soar 61% year on year to RM72.5 million and net profit expand 32% to RM7.4 million, even though its margins were hit by higher import costs arising from the weaker ringgit last year.

Thanks to its earnings growth, the stock currently trades at a trailing price-earnings ratio (PER) of 10 times, down from 15 times a year ago. It has consistently paid dividend of one sen in the past five years, giving a yield of 3.3%.

https://www.theedgemarkets.com/article/undervalued-underfollowed-ace-stocks-keep-ey

https://klse.i3investor.com/blogs/Multibagger/197597.jsp