SCOMNET - MEDTECH Company - Bright Future Ahead

!!!

(INVESTMENT GRADE - MY PERSONAL TP 1.00 Short to

Mid Term), RM 1.20 Upon Breakout

I would like to highlight about this mid cap company; which I believe has an interesting future ahead -SUPERCOMNET

TECHNOLOGIES BERHAD or SCOMNET (Stock Code 0001, listed on ACE MARKET,

INDUSTRIAL PRODUCS & SERVICES, market cap RM 565.84 million as at

writing)

1. Possible Humongous Growth Ahead - Being a Medical & Technology Company

In April 2018, SCOMNET had diversified into MEDICAL EQUIPMENT

supply after fully taking over SUPERCOMAL MEDICAL PRODUCTS SDN BHD.

Since then their revenue and net profit had been expanding aggressively.

SCOMNET recently has caught attention of many eyes. At end of April 2019, it was informed to the public that SCOMNET is one of 2 Malaysian suppliers for Edwards Lifesciences Ltd.

A little bit info on Edwards

Lifesciences Ltd. It is lited on NYSE Stock exchange at USD 228 (as of

latest closing) with a market cap of USD 47.6 billion (yes BILLION, not

MILLION !!!)

As recently mentioned, Edwards is one of largest client of SCOMNET. Recently,

Edwards has obtained approval from US FDA for its heart valve systems.

This would mean more and more work orders for SCOMNET in the near time

!!!

Also, locally, SCOMNET would be benefiting from the many allocations of Budget 2020 for healthcare industry, as highlighted below :

Therefore, I see a very exciting future ahead for SCOMNET !!!

2. FA - HISTORICAL HIGH Profit Recorded in August 2019 - Dividend of 1.5c in 2019 highest since 2009 (& more to come !!!)

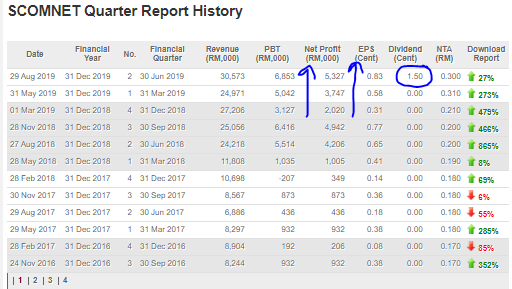

Refer below summary of latest SCOMNET QR. A few observations below:

i. SCOMNET has recorded 2 increasing Net Profits in a row. From RM 2m, to RM 3.7m to RM 5.3m. This signals a sign of growth amidst an uncertain market

ii. This year dividend declared of 1.5c is highest dividend given since FY2009

iii. With the potential increase in revenue from the above (FDA

approval of heart valve systems of its largest client coupled with

Malaysia BUDGET 2020 Healthcare allocations), I believe that there is

much growth waiting ahead for SCOMNET !!!

3. TA Point of View - Trading at Mid Channel - Small Downside but Higher Upside Towards Resistance

Let's look at daily chart of SCOMNET below from December 2018 to October 2019. Below observations:

1. Hit a high of RM 0.985 in June 2019

2. Recently backtested support of 72c in August 2019, then gathered momentum to start resume trending upwards

3. Upper channel resistance seen at around RM 1.00 to 1.10

4. Support seen at 75-80 cents

CONCLUSION

Considering all the above, my personal TP for SCOMNET is maintained at RM1.00 (Short

to Mid Term), and RM 1.20 upon breakout. Funds & Investors should

consider SCOMNET to add to their long term portfolio.

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is

never intended to be a BUY CALL whatsoever. I am sharing my observations

ONLY based on fundamental; past history; current trading pattern;

charts etc. Please make your own informed decision before buying this

share or whatever share for that matter.

HAPPY DEEPAVALI TO ALL HINDU FOLLOWERS & HAPPY HOLIDAY TO THE REST

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/232210.jsp