1

Panasonic Manufacturing Malaysia Berhad (Panasonic Malaysia) manufactures and sells a total of 11 electrical appliances predominantly in Malaysia and Southeast Asia, and the Middle East. The Panasonic brand is well-known in Malaysia. I am sure most of us have either used or seen a Panasonic product before such as fans, rice cookers, and home showers.

In 2020, the company’s revenue dropped to a five-year low and its ailing revenue was only exacerbated by the outbreak of COVID-19. So how is the company faring given the pandemic?

Here are seven things I learned from the 2020 Panasonic Malaysia AGM.

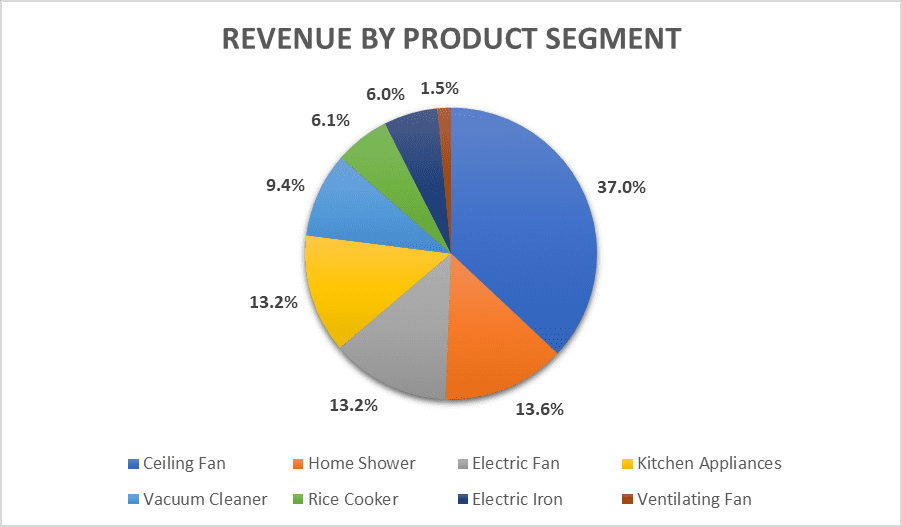

1. Revenue dropped 6.7% year-on-year to RM1.1 billion in 2020. Home appliances and fan products accounted for 48.3% and 51.7% of the company’s revenue in FY19/20 respectively. These segments posted a 9.3% and 4.2% year-on-year drop in revenue respectively. Ceiling fans were the largest revenue product contributor in 2020.

Here’s a breakdown of Panasonic’s revenue by its product segments:

Source: 2020 Panasonic Malaysia AGM presentation slides

Net profit was up by 10.6% year-on-year to RM117.0 million because of lower cost of materials and operating expenses.

2. Panasonic Malaysia will continue to maintain a 100% dividend payout. For FY19/20, the company’s dividend payout ratio was 103% and its dividend per share was 198 sen. Based on Panasonic Malaysia’s share price of RM28.50 (as at 7 October 2020), its dividend yield is currently 6.95%.

3. Panasonic Malaysia is constructing a new building at one of its factories. Executive director Kwan Wai Yue added that this expansion will increase the production capacity of its fan segment by 35%. The company spent RM12.7 million in 2020 and will incur an additional RM39 million in CAPEX in the next two years. The new building will also accommodate more in-house injection plastic moulding activities to reduce its reliance on outsourced supply. The company will incur RM7 million on this initiative.

4. The company allocated RM28.8 million to further automate its manufacturing processes. Kwan explained that approximately 300 workers will be replaced in phases by increasingly automated processes. Panasonic Malaysia is expected to save RM9.6 million from this investment between 2018 and 2023. As the Malaysian government restricts the entry of foreign workers into the country, the company aims to recruit more local workers to replace foreign workers.

5. Minority Shareholders Watch Group (MSWG) pointed out that Panasonic Malaysia’s inventory grew substantially to RM73.2 million in 2020 from RM49.6 million in 2019 despite lower sales. Kwan explained that when COVID-19 started in China, the company ordered additional raw materials with long lead times from Europe to secure production and failed to fulfil certain orders. When the Movement Control Order (MCO) was announced in Malaysia, raw materials delivered were neither fully utilised nor manufactured. As a result, they were stored as inventory. Finished goods also piled up in March before they were subsequently approved by Ministry of Transport for shipments in April.

Executive director Siew Pui Ling reassured shareholders that inventory would decline to a satisfactory level in the first half of 2021. On a separate note, its inventory makeup includes resin (74%), aluminium (15%), steel (6%), and copper (5%).

6. As the company’s products were not regarded as essential goods, Panasonic Malaysia’s manufacturing activities came to a complete halt between mid-March and early May 2020. Its manufacturing activities were further affected by the lower attendance of production workers during the MCO period because of travel restrictions and individual childcare arrangements as schools were closed. Several critical suppliers were located in areas under the enhanced MCO and only resumed business in mid-May. The company also experienced order cancellations during the MCO.

7. Consequently, the company incurred net losses in Q1 2021. It still aims to achieve a 3% annual growth in 2021 and seeks growth from fans and home showers in the ASEAN market. Given that people stay at home more and are more concerned about hygiene, Siew expects the demand for selected products such as air conditioners and air purifiers to rise.

In Q1 2021, trade and other receivables rose more than half from RM74.9 million to RM121.4 million because orders were mostly placed in June after the company had fully resumed its operations.

https://fifthperson.com/2020-panasonic-malaysia-agm/

Panasonic Manufacturing Malaysia Berhad (Panasonic Malaysia) manufactures and sells a total of 11 electrical appliances predominantly in Malaysia and Southeast Asia, and the Middle East. The Panasonic brand is well-known in Malaysia. I am sure most of us have either used or seen a Panasonic product before such as fans, rice cookers, and home showers.

In 2020, the company’s revenue dropped to a five-year low and its ailing revenue was only exacerbated by the outbreak of COVID-19. So how is the company faring given the pandemic?

Here are seven things I learned from the 2020 Panasonic Malaysia AGM.

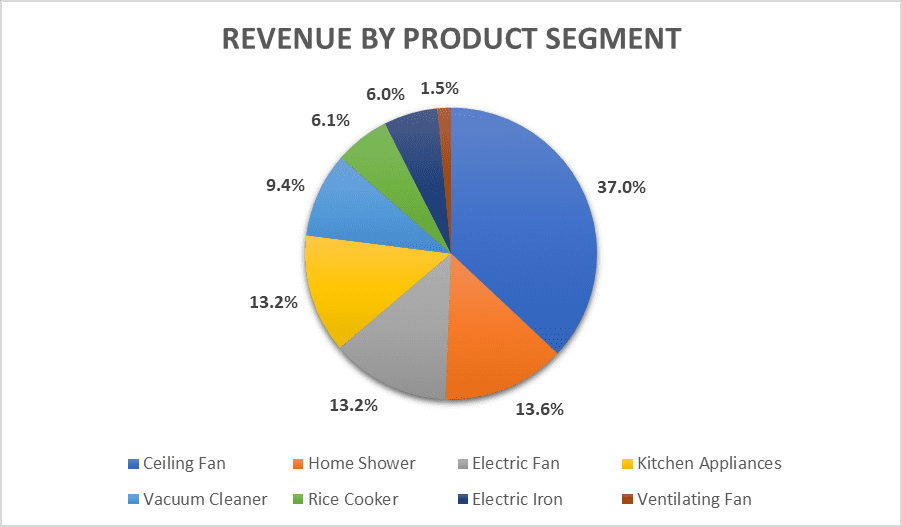

1. Revenue dropped 6.7% year-on-year to RM1.1 billion in 2020. Home appliances and fan products accounted for 48.3% and 51.7% of the company’s revenue in FY19/20 respectively. These segments posted a 9.3% and 4.2% year-on-year drop in revenue respectively. Ceiling fans were the largest revenue product contributor in 2020.

Here’s a breakdown of Panasonic’s revenue by its product segments:

Source: 2020 Panasonic Malaysia AGM presentation slides

Net profit was up by 10.6% year-on-year to RM117.0 million because of lower cost of materials and operating expenses.

2. Panasonic Malaysia will continue to maintain a 100% dividend payout. For FY19/20, the company’s dividend payout ratio was 103% and its dividend per share was 198 sen. Based on Panasonic Malaysia’s share price of RM28.50 (as at 7 October 2020), its dividend yield is currently 6.95%.

3. Panasonic Malaysia is constructing a new building at one of its factories. Executive director Kwan Wai Yue added that this expansion will increase the production capacity of its fan segment by 35%. The company spent RM12.7 million in 2020 and will incur an additional RM39 million in CAPEX in the next two years. The new building will also accommodate more in-house injection plastic moulding activities to reduce its reliance on outsourced supply. The company will incur RM7 million on this initiative.

4. The company allocated RM28.8 million to further automate its manufacturing processes. Kwan explained that approximately 300 workers will be replaced in phases by increasingly automated processes. Panasonic Malaysia is expected to save RM9.6 million from this investment between 2018 and 2023. As the Malaysian government restricts the entry of foreign workers into the country, the company aims to recruit more local workers to replace foreign workers.

5. Minority Shareholders Watch Group (MSWG) pointed out that Panasonic Malaysia’s inventory grew substantially to RM73.2 million in 2020 from RM49.6 million in 2019 despite lower sales. Kwan explained that when COVID-19 started in China, the company ordered additional raw materials with long lead times from Europe to secure production and failed to fulfil certain orders. When the Movement Control Order (MCO) was announced in Malaysia, raw materials delivered were neither fully utilised nor manufactured. As a result, they were stored as inventory. Finished goods also piled up in March before they were subsequently approved by Ministry of Transport for shipments in April.

Executive director Siew Pui Ling reassured shareholders that inventory would decline to a satisfactory level in the first half of 2021. On a separate note, its inventory makeup includes resin (74%), aluminium (15%), steel (6%), and copper (5%).

6. As the company’s products were not regarded as essential goods, Panasonic Malaysia’s manufacturing activities came to a complete halt between mid-March and early May 2020. Its manufacturing activities were further affected by the lower attendance of production workers during the MCO period because of travel restrictions and individual childcare arrangements as schools were closed. Several critical suppliers were located in areas under the enhanced MCO and only resumed business in mid-May. The company also experienced order cancellations during the MCO.

7. Consequently, the company incurred net losses in Q1 2021. It still aims to achieve a 3% annual growth in 2021 and seeks growth from fans and home showers in the ASEAN market. Given that people stay at home more and are more concerned about hygiene, Siew expects the demand for selected products such as air conditioners and air purifiers to rise.

In Q1 2021, trade and other receivables rose more than half from RM74.9 million to RM121.4 million because orders were mostly placed in June after the company had fully resumed its operations.

https://fifthperson.com/2020-panasonic-malaysia-agm/