This article is written because it is the author's opinion that Discounted Cash Flow (DCF) is the most appropriate method of valuation for a company with a predetermined stream of future cash flows.

Important ! Readers are advised to gain thorough understanding of DCF valuation method before reading this article.

A significant new revenue stream

After successful completion of 336 hours of trial run on 17 November 2020, JHDP has commenced commercial operation of its first power plant unit on 24 November 2020, it marks the beginning of a new significant future cash flow stream for Jaks.

What is the expected free cash flow from JHDP ?

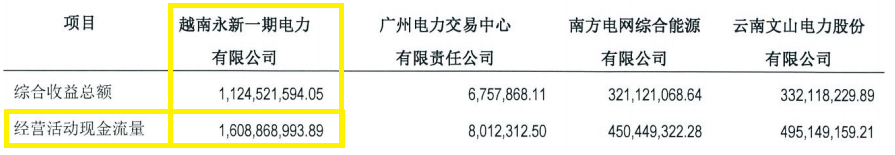

I have extracted the following information from my earlier article “Jaks Resources - The Most Reliable Earnings Guidance for JHDP”

https://klse.i3investor.com/blogs/Jaks%20resources/2020-05-01-story-h1506848575-Jaks_Resources_The_Most_Reliable_Earnings_Guidance_for_JHDP.jsp

Annual free cash flow = RMB1,609m = RM981m.

Hence, potential free cash flow from JHDP attributable to Jaks.

@30% = RM981m x 30% = RM294m

@40% = RM981m x 40% = RM392m

(Caution : free cash flow is different from earnings)

The question is how to value this stream of FCF ?

I will evaluate the FCF using Discounted Cash Flow methodology. That is to get the sum of all present values of the cash flows that will be received in each of next 25 years.

What is the intrinsic value of a company ?

Owner earnings is a valuation method detailed by Warren Buffett in Berkshire Hathaway's annual report in 1986. He stated that the value of a company is simply the total of the net cash flows (owner earnings) expected to occur over the life of the business, minus any reinvestment of earnings.

To put it simply, it is the present value of all net future cash flows. The valuation method relies on the accuracy of future cash flow projection. As JHDP has a BOT contracts with Vietnam government, it has a stable and predictable future income stream for 25 years making it a well-suited candidate for discounted cash flow (DCF) valuation method.

“The purpose of DCF analysis is to estimate the money an investor would receive from an investment, adjusted for the time value of money The time value of money assumes that a dollar today is worth more than a dollar tomorrow because it can be invested. As such, a DCF analysis is appropriate in any situation where a person is paying money in the present with expectations of receiving more money in the future. DCF analysis finds the present value of expected future cash flows using a discount rate.” - Investopedia

So how much is 25 years of such FCF worth in today’s value ?

The stream of cash flow is discounted at Jaks' weighted average borrowing cost of 6.12% to arrive at the present values (PV) of between RM3.8 billions to RM5 billions. This is equivalent to RM2.15 to RM2.85 per share.

Figures are in millions

|

Year |

FCF@30% |

PV |

FCF@40% |

PV |

|

1 |

300 |

283 |

400 |

377 |

|

2 |

300 |

266 |

400 |

355 |

|

3 |

300 |

251 |

400 |

335 |

|

4 |

300 |

237 |

400 |

315 |

|

5 |

300 |

223 |

400 |

297 |

|

6 |

300 |

210 |

400 |

280 |

|

7 |

300 |

198 |

400 |

264 |

|

8 |

300 |

187 |

400 |

249 |

|

9 |

300 |

176 |

400 |

234 |

|

10 |

300 |

166 |

400 |

221 |

|

11 |

300 |

156 |

400 |

208 |

|

12 |

300 |

147 |

400 |

196 |

|

13 |

300 |

139 |

400 |

185 |

|

14 |

300 |

131 |

400 |

174 |

|

15 |

300 |

123 |

400 |

164 |

|

16 |

300 |

116 |

400 |

155 |

|

17 |

300 |

109 |

400 |

146 |

|

18 |

300 |

103 |

400 |

137 |

|

19 |

300 |

97 |

400 |

129 |

|

20 |

300 |

91 |

400 |

122 |

|

21 |

300 |

86 |

400 |

115 |

|

22 |

300 |

81 |

400 |

108 |

|

23 |

300 |

77 |

400 |

102 |

|

24 |

300 |

72 |

400 |

96 |

|

25 |

300 |

68 |

400 |

91 |

|

Total |

7,500 |

3,792 |

10,000 |

5,056 |

(A total of RM7.5 billions to be received over 25 years is worth RM3.792 billions today, and a total of RM10 billions to be received over 25 years is worth RM5.056 billions today)

What does this Present Value (PV) mean ?

It means if the company borrows RM3.8 billions at 6.12% fixed interest rate now, it is able to fully repay the loan plus interest costs using the future cash flow from JHDP.

Does it mean Jaks is worth RM2.15 to RM2.85 per share in today’s value ?

The answer is YES and NO.

YES, if the company shall cease to explore all future investment activities and return all future cash received from JHDP to its shareholders.

NO, if the company continue to invest all or part of the funds it received from JHDP in new business ventures which will generate additional revenues. Just like YTLPOWER.

It is likely that Jaks will continue to invest part of the FCF from JHDP in new opportunities. Therefore, how much is Jaks really worth ?

Assuming a reasonable return on investment of 15%, RM3.8 billions to RM5 billions will generate RM570m to RM750m recurring annual income. This translates to EPS of between RM0.32 to RM0.43. 10x PE will value Jaks at RM3.20 to RM4.30.

Nonetheless, this is based on the assumption that the company is able to borrow using the FCF as collateral. Note that It is a common practice in Malaysia where long-term Government contracts are used to secure capital financing.

Conclusion

A stream of FCF of between RM300m to RM400m to Jaks for the next 25 years is worth between RM2.15 to RM2.85 per share in present value. The 25 years of FCF is more than just cash, they are sources of capital to more business opportunities !

Caution

It is NOT the intention of this article to INFLATE the TARGET PRICE of Jaks. It merely highlights the most appropriate method of valuation for a company with predetermined stream of long-term future cash flows.

Price earnings (PE) valuation is most popular amongst market investors as it is easily understood but less appropriate in this case.

Readers must understand that market price of a stock rarely correspond to its valuation. Hence, It is prudent to provide 30% margin of safety.

There are several assumptions made in this DCF calculation which may not be accurate.

Therefore, readers’ discretion is strongly advised.

DK

Disclaimer : This article is purely for information and opinion sharing purposes. You should not make your decision based on the writing. You are strongly advised to seek independent verification and advice.

https://klse.i3investor.com/blogs/Jaks%20resources/2020-11-29-story-h1537301739-Jaks_Resources_What_Is_The_Long_Term_Intrinsic_Value.jsp