KOTRA (0002) KOTRA INDUSTRIES BHD The Most Undervalued Healthcare Stock in Malaysia. Famous value investor Fong Siling in Top 30 shareholder list for the first time!

Kotra Industries Bhd (0002) has been flying under the radar of most investors even though it offers the highest return on equity and highest growth in net profit over 3 years in the healthcare sector.

Do you know who is the owner of this famous brand Appeton? GlaxoSmithKline? Pfizer? Novartis? No.

Few of us realise that the iconic pharmaceutical line is homegrown. It’s owned by Kotra, which was founded in 1982 and is now headquartered in Malacca. Since its launch in 1989, Appeton has rapidly grown into an internationally recognised brand, available in over 30 countries worldwide.

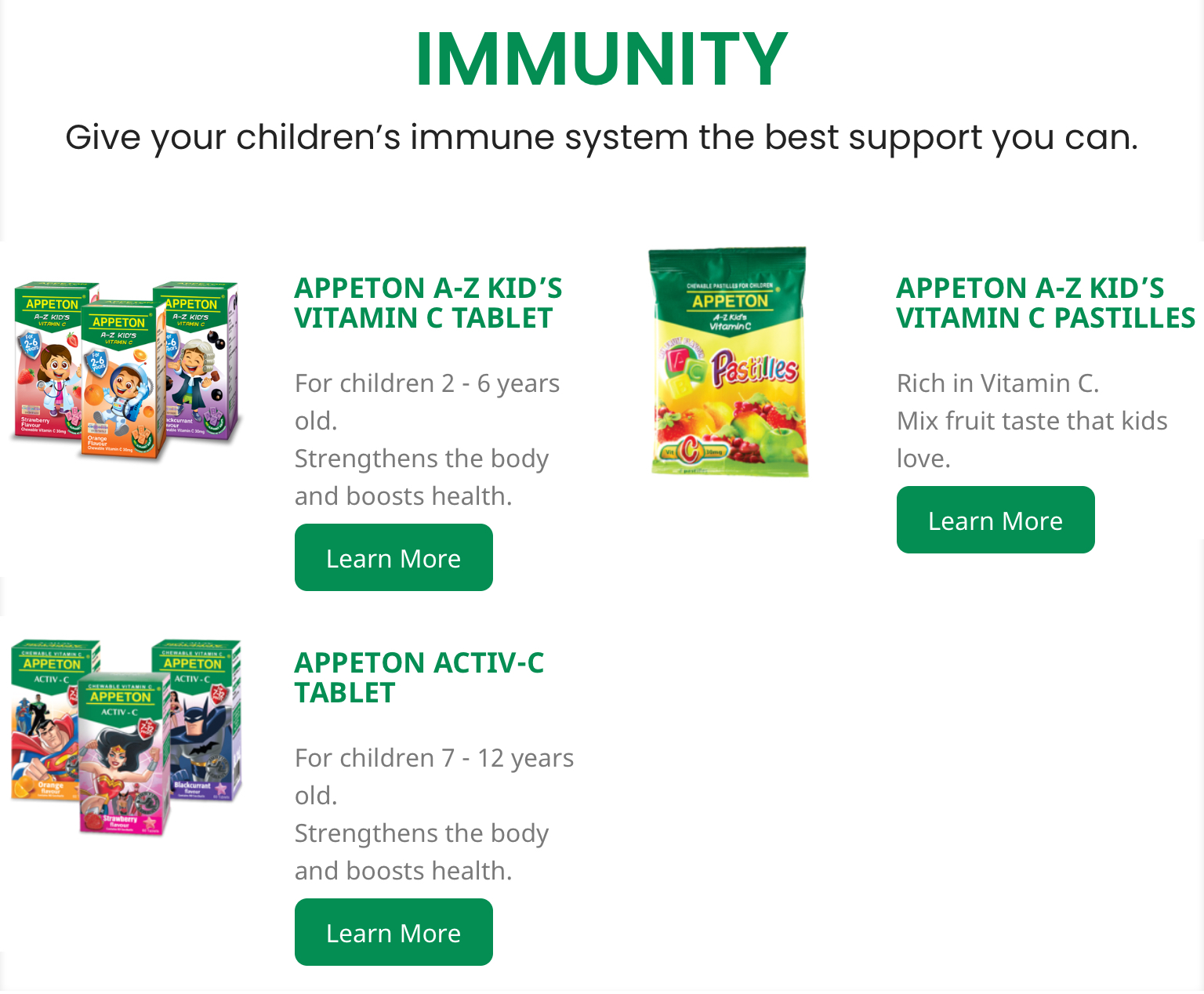

Kotra’s main brand is its Appeton range of products, which include child health supplements such as multivitamins and Vitamin C, as well as Appeton Weight Gain for both children and adults, and the Appeton Wellness range for seniors.

Its main pharmaceutical brands include Axcel, which specialises in providing paediatric care, anti-infective medicine and dermatological care through prescriptive medication in the form of tablets, capsules, creams, ointments, syrups and suspensions, as well as Vaxcel which specialises in providing sterile injectables.

These products are found on the shelves of most major pharmacies in the country.

The Best Healthcare Company Awards

Kotra is the winner of The Edge Malaysia Centurion Club corporate awards in all categories — Highest Return on Equity Over Three Years, Highest Growth in Profit After Tax Over Three Years and Highest Returns to Shareholders Over Three Years — in the healthcare sector.

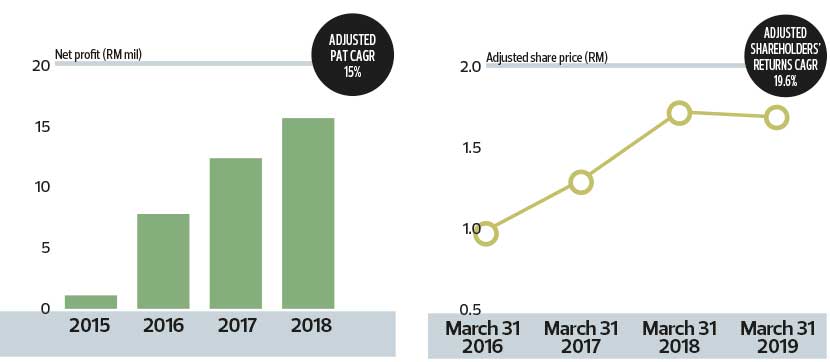

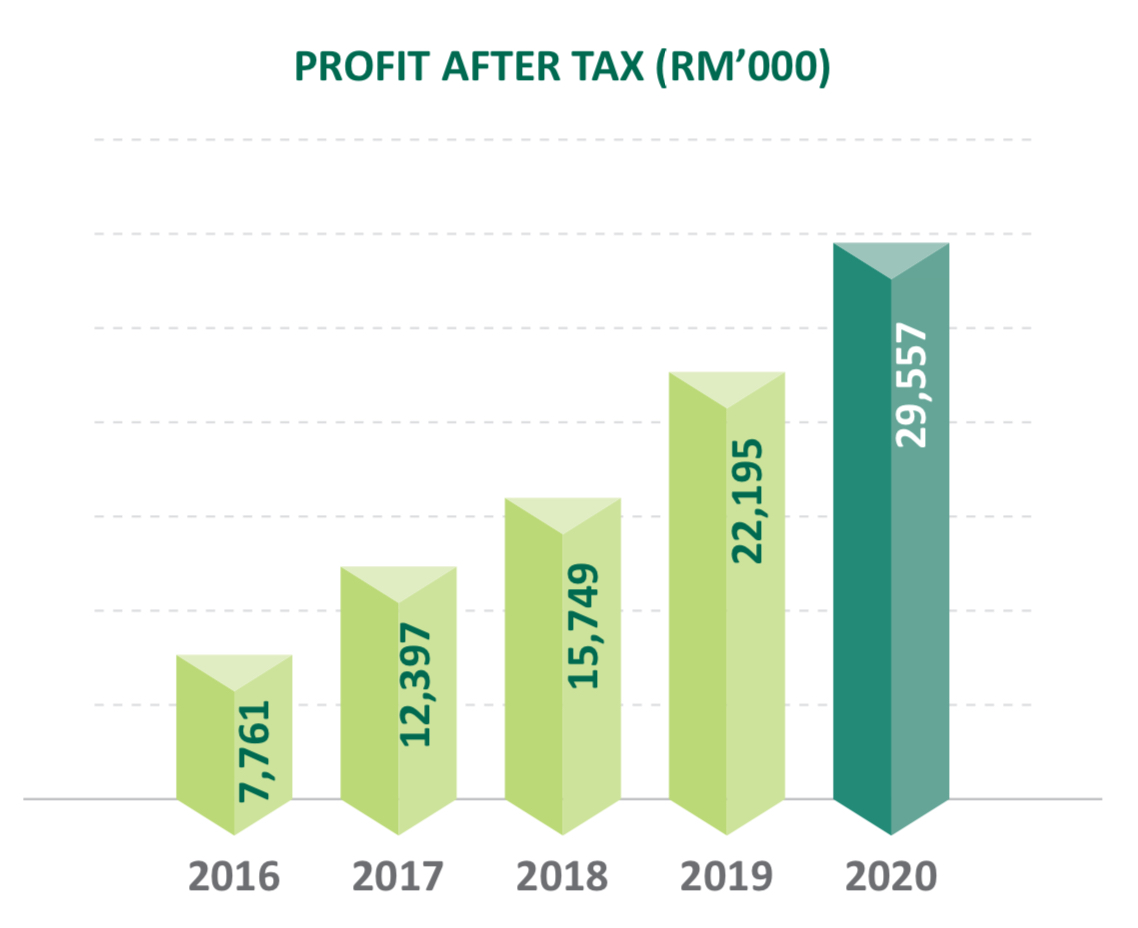

The pharmaceutical company’s earnings growth trajectory has been pretty steady over the past few years. Its profit after tax compound annual growth rate over the three-year period stood at 15% while CAGR for shareholders’ returns was 19.6% — both the highest in the sector.

In FY2019, Kotra posted an unaudited net profit of RM22.2 million, a 41% increase from RM15.75 million in FY2018, which it attributes to the rationalisation of its selling and administration expenses, higher foreign exchange gain and lower finance cost incurred during the year.

According to the group, research and development (R&D) plays a crucial role in ensuring the group’s long-term success in the highly competitive pharmaceutical industry in Malaysia. It is also its intention to increase its shareholders’ value through product innovation.

“Our dedicated in-house R&D team is constantly working on developing and formulating new as well as existing pharmaceutical products to support the growing demand and to fulfil hitherto unmet medical needs,” says managing director Jimmy Piong Teck Onn.

Appeton new Vitamin C Pastilles

http://www.appeton.com/7-immunity.html

Exports the name of the game for Kotra

AS Covid-19 continues to spread globally and create ripples across industries, many companies looking to expand their business overseas may have put that plan on the back burner. But that is not the case for Kotra Industries Bhd. The pharmaceuticals and consumer products company is carrying on with its expansion beyond Malaysia, says managing director Jimmy Piong Teck Onn.

“Southeast Asia is still our biggest export market and we also see a lot of potential in Africa, where we have a presence in seven countries.” Exports constituted 44% of Kotra’s sales for the first half of its financial year 2020, ended Dec 31, 2019 (1HFY2020).

The defensive nature of the pharmaceutical and consumer sectors is probably why Kotra can still look for opportunities abroad amid a slowdown in global growth, but Piong says it boils down to more than that.

First, the group is benefiting from the investments totalling RM180 million made in its manufacturing plant in Cheng, Melaka, over the past 10 years or so. The plant is at about 40% utilisation now.

“We can now [grow] our sales without much capital expenditure and I believe we will continue to benefit from this investment over the next few years. Also, because we have invested in automation, the beauty is that we can increase our revenue without adding to our headcount,” says Piong.

Company not resting on its laurels

Piong says there is still more work to be done. “We cannot rely solely on the domestic market as Malaysia has a population of just over 30 million. Therefore, you cannot do big jobs here compared with places like Myanmar, where the population is more than 50 million. That is why we have chosen to focus on exports in the past 10 years.

“Focusing on export markets is, of course, a more difficult task as it takes time to obtain approvals and for our brand to be recognised. We also have to compete with countries such as India, where a small pharmaceutical player is already considered a major player here. We will continue to invest in research and development and training. We believe that if we do the small things right, the bigger picture will fall into place.”

Revenue target of RM250 million

On Kotra’s future plans, Piong says the group will only embark on its next expansion phase after hitting its revenue target of RM250 million. “We don’t want to stretch our finances. Besides, it is high time we capitalised on the capacity we have built. I don’t want to speculate on how many years it would take us to reach RM250 million ... realistically, it will take a few years.”

Simple valuation on Kotra vs peers

| Market cap RM mil | Net profit | Trailing PER | Net margins | |

| DPHARMA |

2,888 |

55.3 |

52.2 |

9.6% |

|

PHARMA |

1,497 |

-149 |

N.A. |

-5.3% |

|

AHEALTH |

1,710 |

52.8 |

32.4 |

7.7% |

|

KOTRA |

490 |

29.6 |

16.6 |

17.2% |

DPHARMA and AHEALTH are trading at trailing PER of more than 32x. Using the lowest PER range of 32.4x for the peers, Kotra is worth RM959mil. With 147mil share outstanding, that translates to RM6.50 per share! Current market price is just RM3.31.

Kotra should trade at higher valuation because it is a global player and can grow their earnings at higher rates. Another plus point is Kotra has superior double digit profit margins when compared to its peers’ single digit margins.

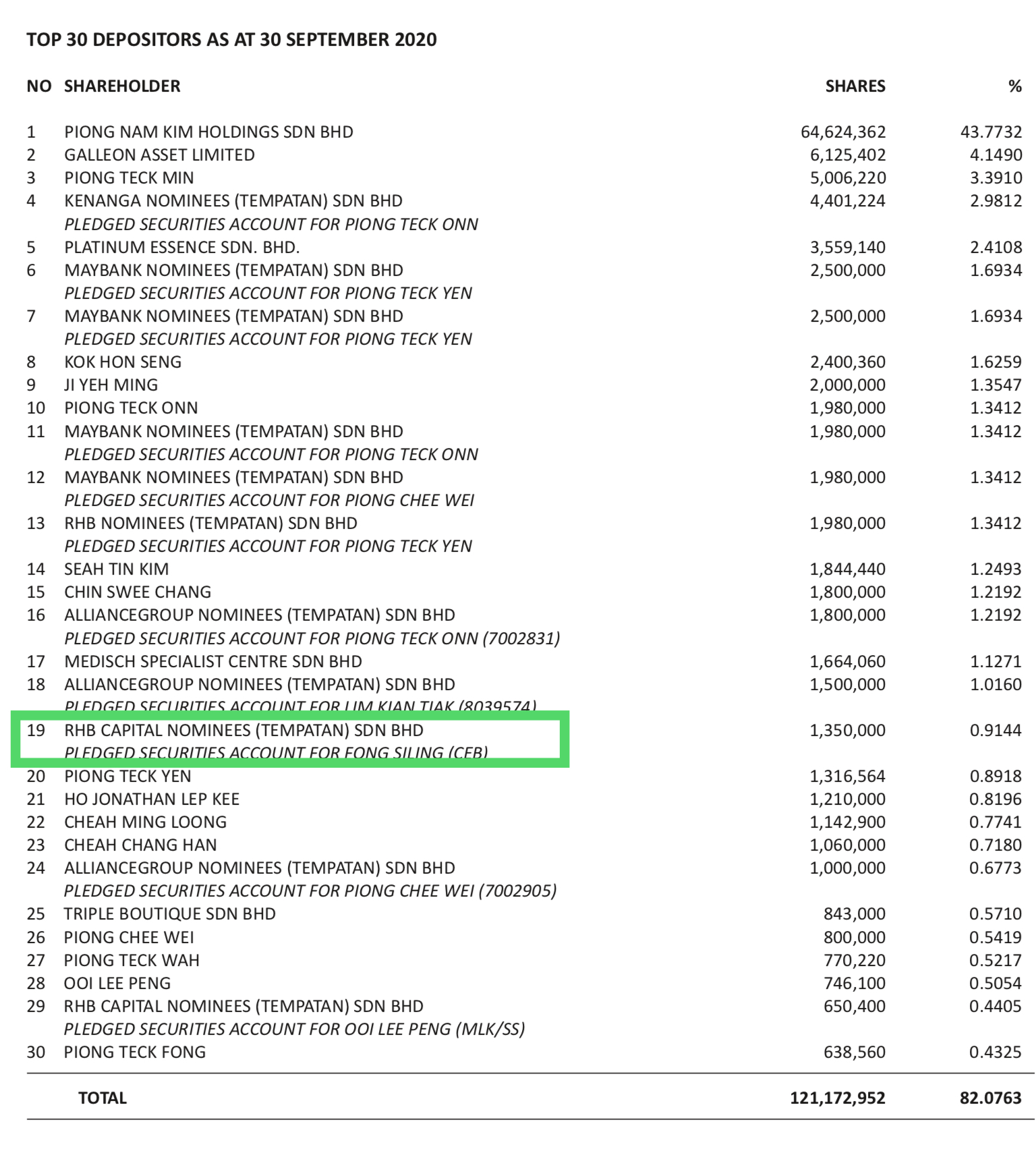

Fong Siling in Top 30 shareholder list for first time

Famous value investor Fong Siling appears in Kotra’s Top 30 shareholders list for the first time in Kotra 2020 annual report as at 30 September 2020.

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=203890&name=EA_DS_ATTACHMENTS

Disclaimer

All information provided here should be treated for informational purposes only. It is solely reflecting author's personal views and the author should not be held liable for any actions taken in reliance on information contained herein.

https://klse.i3investor.com/blogs/Momentum/2020-11-19-story-h1536518618-The_Most_Undervalued_Healthcare_Stock_in_Malaysia_Famous_value_investor.jsp