Down with western colonialism and imperialism!

32 minutes ago

Type something and hit enter

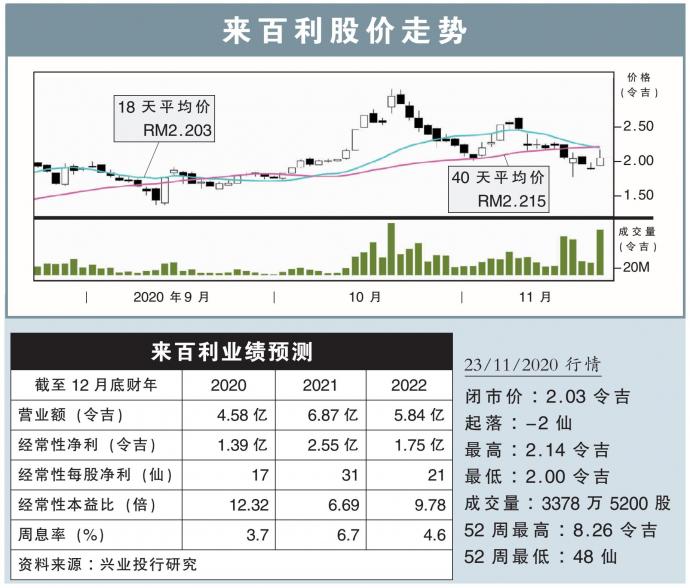

分析:兴业投行研究

目标价:3.00令吉

最新进展:

来百利(RUBEREX,7803 ,主板工业股)在2020财年第三季,净利飙升11.7倍,至3951万5000令吉。

当季营业额按年大起75.2%,录得1亿902万8000令吉。

首3季来看,该公司净赚7173万8000令吉,按年激增8.6倍;营业额报2亿6355万9000令吉,年涨56.6%。

该公司以1139万133令吉,收购霹雳的两片租赁地契土地,主要扩大制造和销售丁晴一次性手套的业务。

行家建议:

首9月核心净利7170万令吉,占我们全年预测的52%,算是符合预期,因为末季业绩料强劲,主要是平均售价走高和新厂房会开始贡献盈利。

该公司年产能为15亿只的厂房已经竣工,5条生产线中的首两条已经投运,因此该厂房料在11月开始贡献盈利;12月时估计会全面运作。

由于产量和平均售价提升,我们预计末季盈利会按季走高。

丁腈手套业务方面,年产能将从目前的10亿,大增1.5倍至25亿只。 新厂房会在2021财年全面贡献盈利,激励该公司的前景向好。

另外,我们也看好来百利收购霹雳土地的举措,但暂时维持盈利预估,静待扩充计划的细节。

我们维持“买入”评级,及按照折扣现金流(DCF)估值法,维持3令吉目标价,意味着股价还有46%上涨空间,下财年周息率为7%。

https://www.enanyang.my/行家论股/【行家论股视频】来百利-股价上涨空间46