(CHOIVO CAPITAL) MYNEWS (5275) MYNEWS HOLDINGS BHD – Dr CU in da house. 66% Upside

For a the original copy with high resolution pictures, better formatting and additional details.

Go here.

(CHOIVO CAPITAL) MYNEWS (5275) – Dr CU in da house. 66% Upside

========================================================================

“The best thing that happens to us is when a great company gets into temporary trouble. We want to buy them when they’re on the operating table.”

Warren Buffett

MyNEWS Berhad - A Background

MyNEWS was started back in 25 December 1996 as a single news stand called “MAGBIT” by Mr Dang Tai Luk, together with his wife, Ling Chao and his family on the ground floor of 1 Utama. In 1997 he opened a second outlet in Jejantas Sungai Buloh, and just one year later, he expanded and opened his first magazine and convenience store called “myNEWS.com” the precursor to the company today.

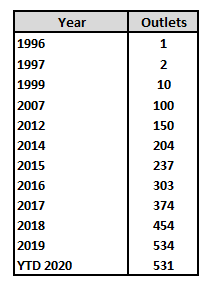

By 1999, he had 10 outlets. 2007, 100 Outlets and so on.

And on 29 March 2016, MYNEWS’s IPO’ed with the purpose of raising money to open more outlets, and more importantly, to bring their stores up to the level of overseas convenient stores, by opening a Food Processing Centre (“FPC”).

MyNEWS needed to own their own Food Processing Centre, as there are very few businesses in Malaysia that can supply to all their current stores, much less the future ones. Especially since they also require their own types of products etc (And one thing MyNEWS have learnt this year, is that it’s extremely to start up a food processing center without prior experience.)

To open their Food Processing Centre, in 2017, they teamed up with two Japanese Companies,

1) Gourmet Kineya Co. Limited (Ready to Eat Meals)

2) Ryoyu Baking Co. Ltd. (Bakery)

to produce the meals in their FPC, and by the 2018, the FPC was finally operational.

They had the idea of doing what QL Resources is doing today via Family Mart, before QL even opened one store.

However, MYNEWS was a touch more ambitious than QL and 7/11, and instead of going at it via the franchise route where the franchisor already has in place certain SOP’s regarding

1) What kind of food products are more popular?

2) What is the typical sales volume and sales mix given certain demographics?

3) Storage/Manufacturing of Food?

4) Logistics etc etc

This was in exchange for the ability to do what the Franchisor of Family Mart, 7/11, CU, Circle K, Lawson can. Which was the ability to franchise out the name and business model and earn what basically amounts to free money.

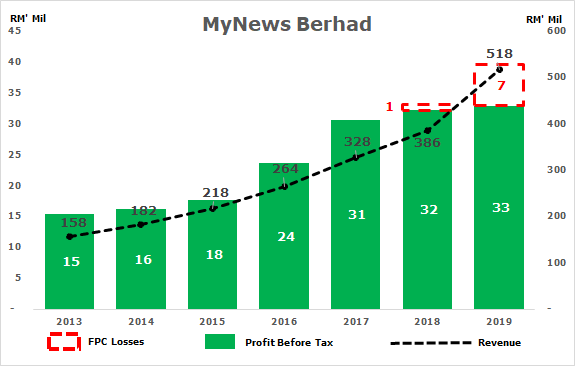

This gave rise to a certain gestation period, where they had to optimize all these things via trial and error, resulting in start-up losses from the FPC’s that was larger and longer than expected, and this masked strongly increasing revenue and profit.

If not for taking their shot at making their own complete franchise brand by offering Ready-To Eat, and experiencing what Jeff Bezos would call an experimental failure.

myNEWS would have recorded their best year in 2019.

However, their troubles with the FPC, also came alongside the meteoric rise of QL Resources’ “Family Mart” (who went with the franchisee model under Family Mart), which is hugely popular among the Malaysian public.

This magnified their FPC struggles, reduced the level of patience investors are willing to give MyNEWS to go at it their own way, and slowly turned investing sentiment against them.

And then in 2020, the COVID 19 pandemic hit. And for the first time since the start of the company, did their number of stores fall. This has caused the share price to fall back close to their IPO price of RM0.55 after a 1:1 split (It IPO’ed at RM1.1), despite 2019 earnings (excluding FPC start-up costs) being 67% higher than of 2016.

A wonderful company have gotten into temporary trouble and is currently on the operating table.

I think they will be getting off that operating table very soon (but as usual, the price does not reflect that).

The Convenience Market & Convenience Store Industry

Now, the Convenience Market consist of the below three main categories.

myNEWS is in the “Retail Convenience Stores” category. They have also recently expanded into Grocery Convenience Stores (think KK Mart), with the “Super Saver” brand, and have two outlets opened in Alor Setar and Melaka

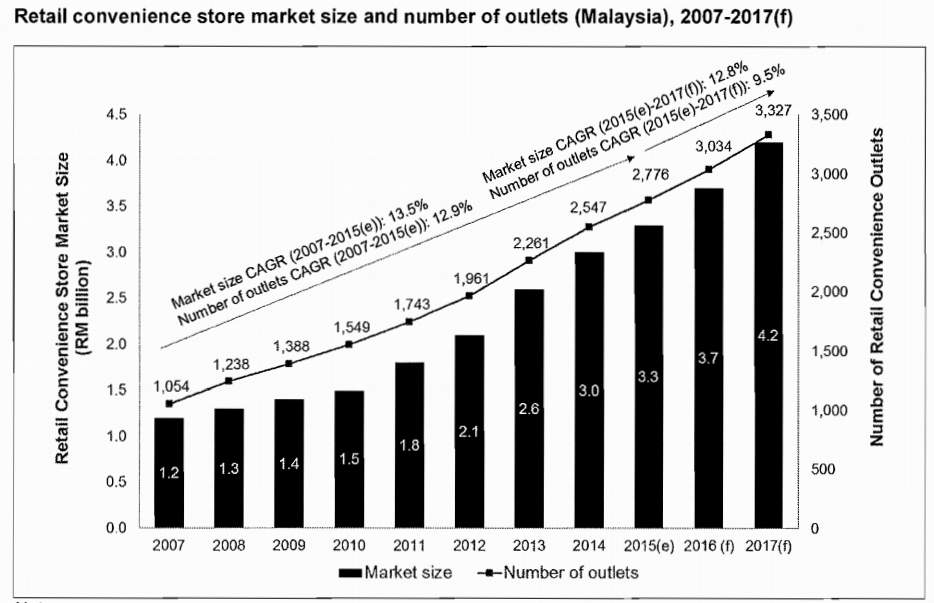

One a very fundamental level, the Convenience Store industry Globally and especially in Malaysia is a fast-growing industry with good margins.

And the reason for it is simple and, its in the name. “Convenience”.

As population density increases, this increases traffic jams, difficulty in finding parking spaces, increases parking costs and increases the length of time needed to access your vehicle (Condominiums versus Landed Property). It is so much more convenient and saves much more time, to just walk to the nearest convenience store.

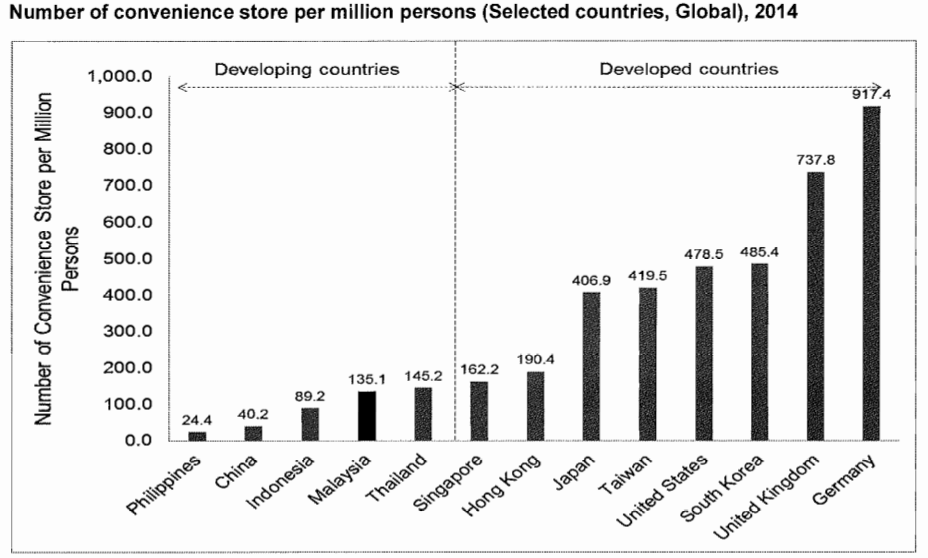

As we can see this in the chart above, the more developed a country, the higher the population density, and land size with high population density, the higher the number of convenience stores.

Of course, they are exceptions such as Hong Kong and Singapore. This is because in those countries, they fully integrate shopping malls, hypermarkets, train stations and condominiums all in one package. In which case, there isn’t much need for convenience stores.

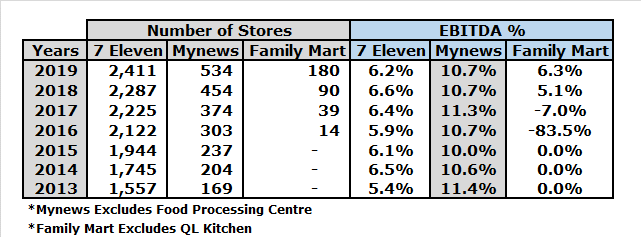

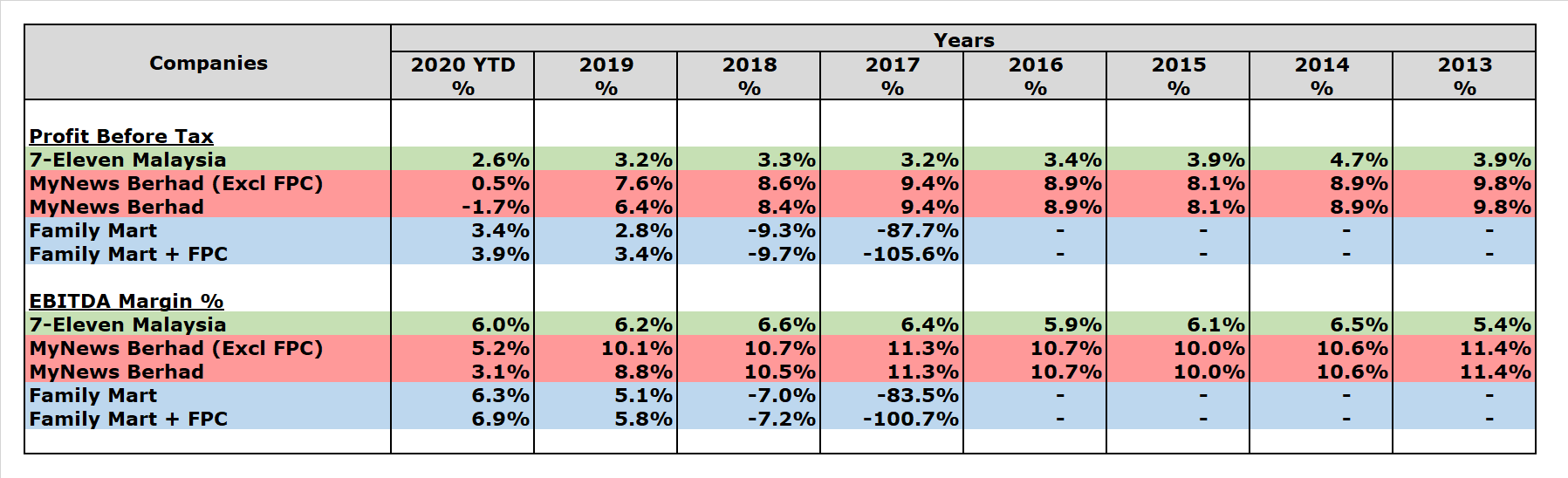

And as we can see here in this table comprising of the 3 largest retail convenience stores in terms of store number and EBITDA % (Earnings Before Interest, Tax, Depreciation & Amortization).

As we can see here, despite all 3 parties opening new outlets at a very fast pace, EBITDA margins remain constant for all 3.

This is an industry with very strong structural tailwinds and long-term growth and profit potential and can therefore sustain a few large players.

And why is this important? Because you cannot spin gold out of straw.

“When a management with a reputation for brilliance tackles a business with a reputation for poor fundamental economics, it is the reputation of the business that remains intact.” Warren Buffet

Barbarians at the Gate – The Rise of Family Mart

On 11 November 2016, QL Resources opened the very first Family Mart outlet in Wisma Lim Foo Yong, and with this company primarily run by their very competent son, Mr Chia Lik Khai, an ex-Shanghai Mckinsey who also spent a number of years at Agilent and Avago Technologies, it took off like a rocket.

They expanded very quickly, and soon, new outlets started popping up like Mushrooms (pun intended) in Klang Valley, and sights below where outlets were constantly full of people queuing became very common.

For a very long time, the convenience retail store industry in Malaysia was very static. As this was such a good industry with great margins.

Companies like 7-Eleven were more than happy to just continue selling their little tidbits and Slurpee’s and just create more stores, instead of hitting the levels of services and products offered by convenience stores in Thailand, Korea, Japan or Taiwan.

As for myNEWS, they evolved as their capabilities and capital grew. Starting from a single news stand, to opening a magazine shop, then convenience stores, while being far more efficient than 7-Eleven and then raising via an IPO the approximately RM100 million needed to open a food processing center and the required logistic system, to evolve to the next level of offering Ready-To-Eat meals (QL Resources also spent around RM100 million on their food processing centre).

However, their choice to start without their franchisor (as well as QL’s deep experience in Ready to Eat Meals and Processed Food) meant that QL beat them to the punch when it comes to offering the “Konbini” experience.

Comparing the numbers of Family Mart, 7-Eleven & myNEWS.

So, what does this mean in terms of the numbers?

Before we continue, there is a few things to note.

The year-end of Family Mart, 7-Eleven & myNEWS is as follows, 31 March, 31 December & 31 October. Therefore, for the year 2020, Family Mart’s financials does not include the impact of COVID-19 and the detailed financial statements are available.

As for myNEWS and 7-Eleven, as their year end results of not been obtained, this is just a Year-To-Date figure, and unlike Family Mart, their 2020 contains the full impact of the COVID-19 pandemic.

Additionally, as Family Mart has only been operational for 3-4 years, their numbers is not fully stabilized. However, I think it is more than enough to give a good estimate in terms of their long-term margins etc.

As for myNEWS, their Food Processing Centre (“FPC”) first started in November 2019.

In order to make it comparable to 7-Eleven, as well as to illustrate their incredible performance, if not for the temporary troubles with the FPC, we have illustrated the numbers when FPC is include and when it is excluded.

Lastly, in November 2019, 7-Eleven purchased Caring Pharmacy and consolidated their numbers in the financial statements. As there is no detailed breakdown, we are unable to separate them out.

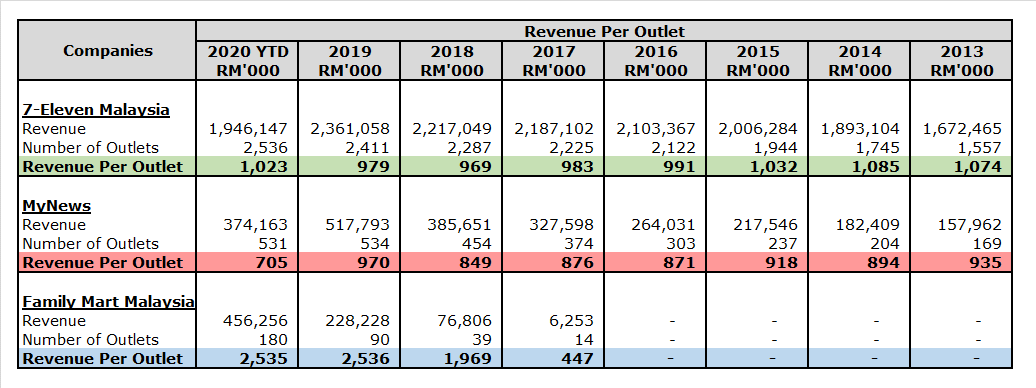

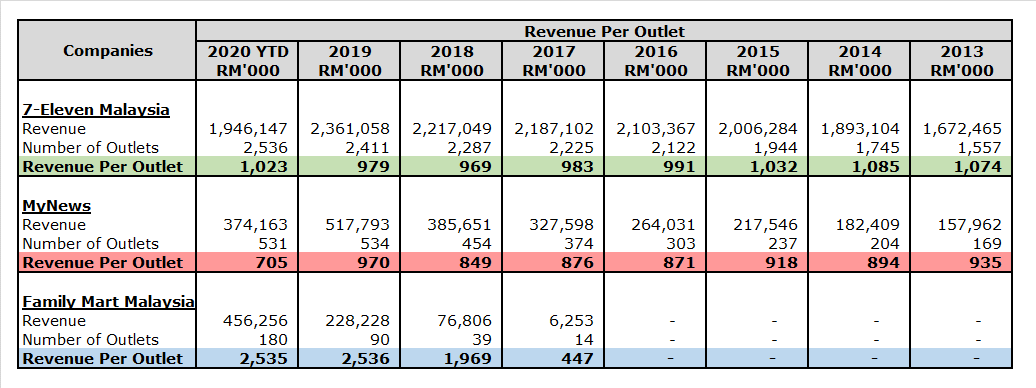

Revenue Per Outlet

One of the key metrics used when looking at a store, is the amount of Revenue generated by Each Store.

As we can see here, QL/Family Mart by virtue of selling higher ticket value items, knocks it out of the park when compared against 7-Eleven and myNEWS.

Higher revenue, assuming all other things are equal, result in better economy of scale, and higher profitability (hopefully).

Is this the case?

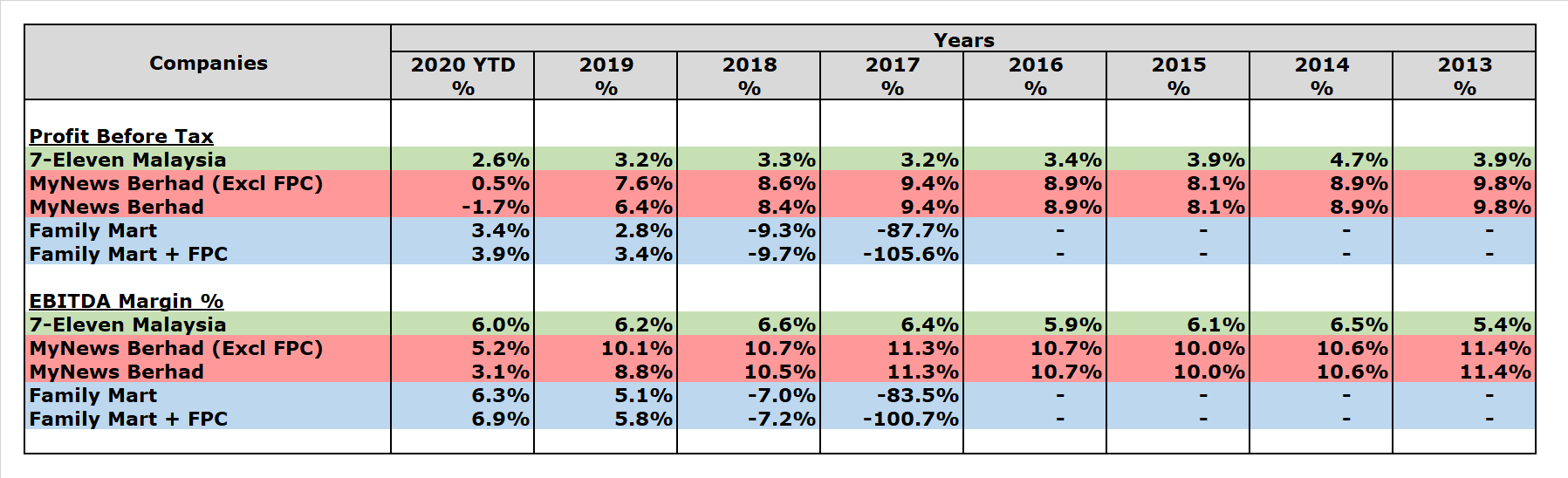

EBITDA (Earnings Before Interest, Tax, Depreciation & Amortization) & Profit Before Tax as a Percentage of Revenue

As we can see from above, this is not really the case.

On average before including the temporary losses of the Food Processing Centre, myNEWS records close to triple the EBITDA margin of 7-Eleven and Family Mart, and in terms of Profit Before Tax Margin, myNEWS is close to double that of 7-Eleven and Family Mart.

And to give on idea on why this is the case, we need to look at the more detailed numbers.

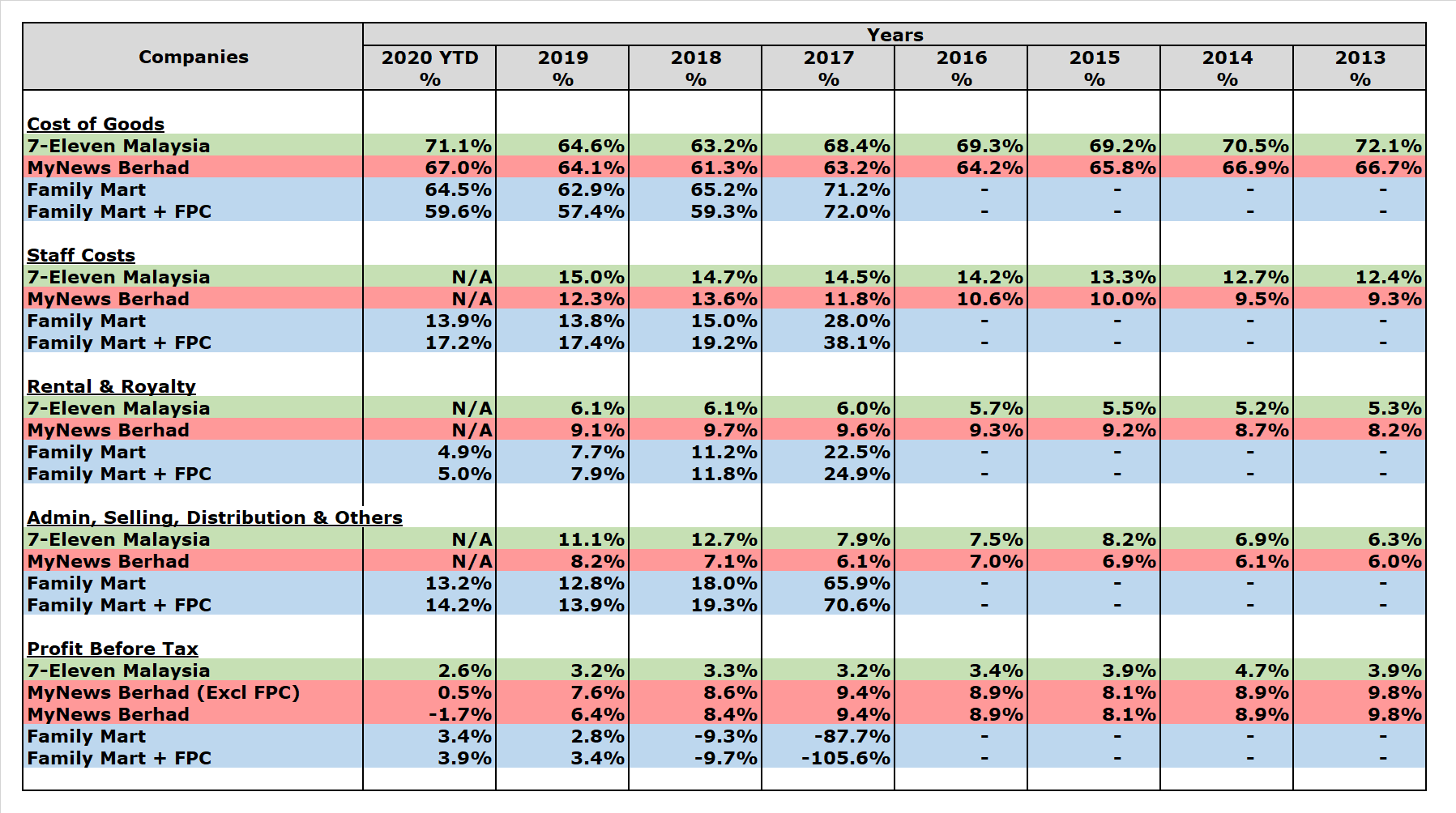

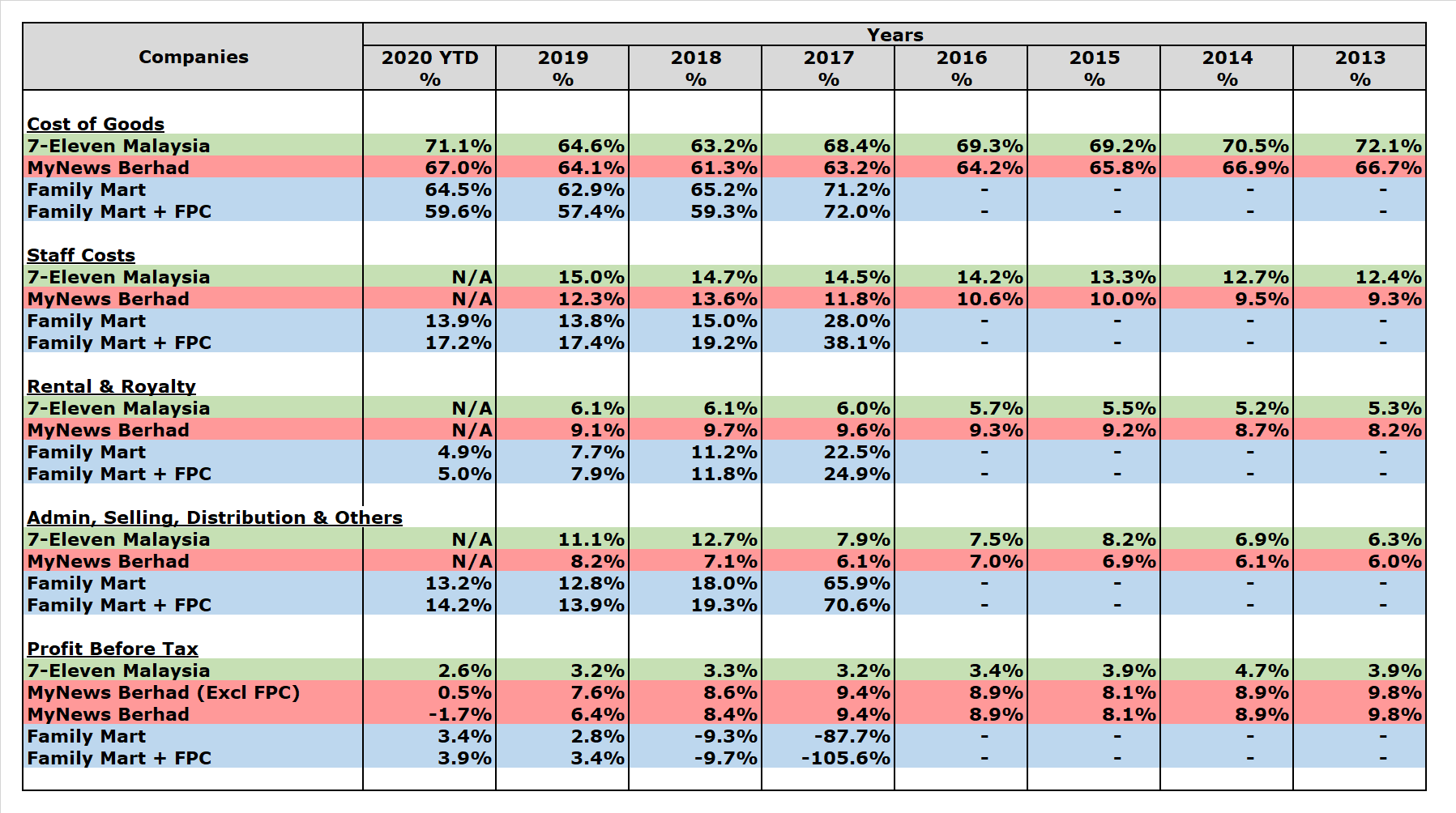

Detailed Cost Breakdown as a percentage of Revenue

Cost of Goods

In terms of Cost of Goods, the prices obtained by myNEWS have typically been significantly lower than that obtained by 7-Eleven. And much of this is likely due to the significantly longer credit terms obtained by 7-Eleven versus myNEWS, which likely results in higher prices.

As for Family Mart, leveraging on the bankability of QL when it comes to sourcing goods, as well as being able to purchase directly from QL any raw materials, they can obtain significantly lower prices than both. Much of myNEWS Cost of Goods increase in 2020 is due to higher wastage from the COVID 19 pandemic.

Staff Costs

Staff Costs is another aspect where myNEWS really shine. myNEWS (the ones without Maru Café) typically have smaller sized stores in Shopping Malls, and because of this, myNEWS can man the store with significantly fewer staff, and this reduces staff costs significantly.

As for whether more foreign workers in the mix having contributes to this. According to Mr Dang, foreign workers actually cost the same of local employees as you need to bear the cost of housing them, flying them over, settling their visa’s etc.

Rental Costs

However, because myNEWS store composition usually consist of smaller shops in shopping malls (around 80%), this results in higher than usual Rental Costs. As for why 7-Eleven’s is so low, its due to their much wider reach, resulting in a very large portion of the stores, being in rural areas, or city outskirts, when compared against myNEWS and Family Mart.

Administration, Selling, Distribution & Others Costs

As for Administration, Selling, Distribution & Others costs, this is where myNEWS really shines. myNEWS had by far the lowest when compared to the other two. By running smaller store which focuses mainly on dried goods etc, they needed to pay significantly less when it comes to utilities, logistics, food wastages etc.

As for Family Mart, due to their model where they started directly with the “Konbini” model and served Ready-To-Eat Meals from the beginning, they had significantly higher costs, in some cases almost doubling that of myNEWS’s.

All these gains in (Costs of Goods, Staff Costs & Administration, Selling & Other Costs) which more than offset their higher rental costs, are the reason for myNEWS’s higher profitability versus the other two before the onset of the temporary troubles with the FPC’s.

Having said that, how does this translate to the numbers of the Company as a whole?

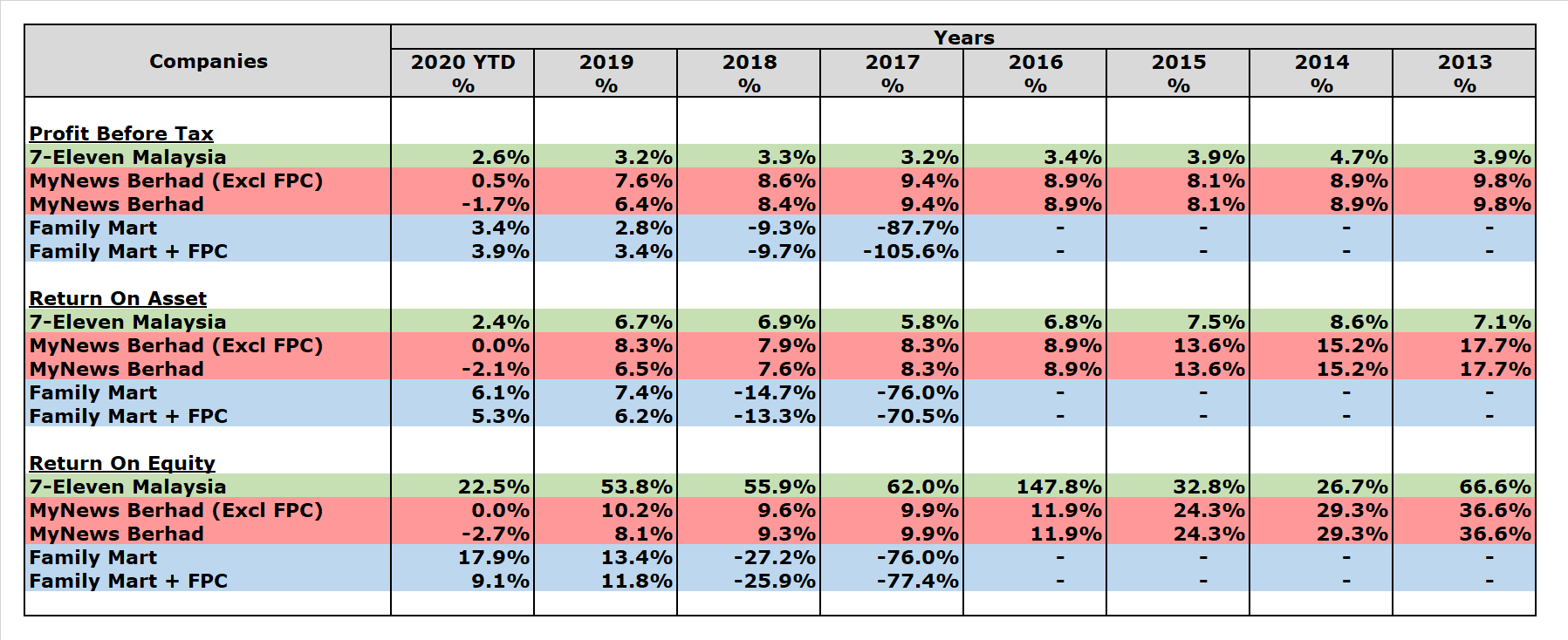

Profit Before Tax (%), Return on Asset (%) & Return on Equity (%)

Despite having far better Profit Before Tax and Return on Asset Margins, their return on Equity have been significantly lower than that of 7-Eleven and Family Mart, a company that have only started for 3 – 4 years.

Why is this the case?

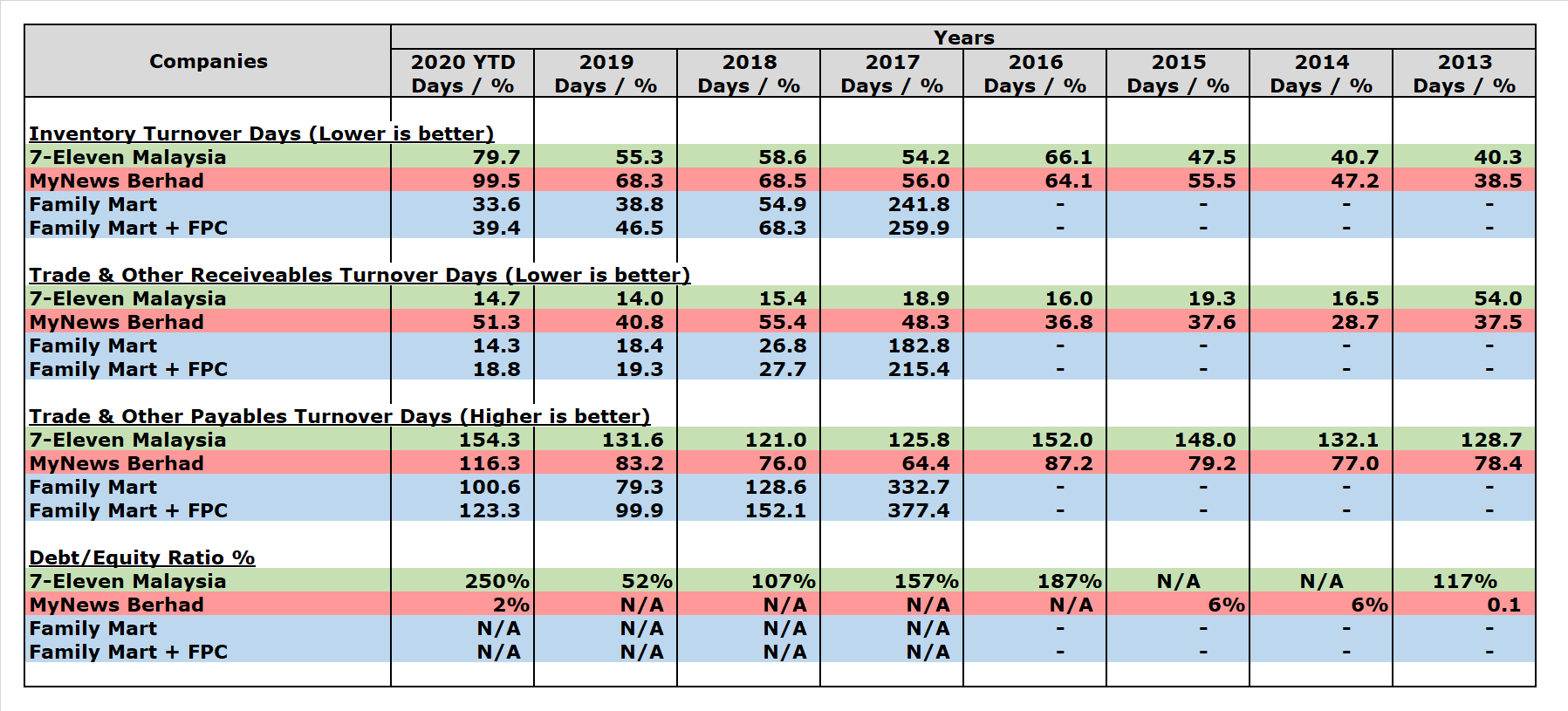

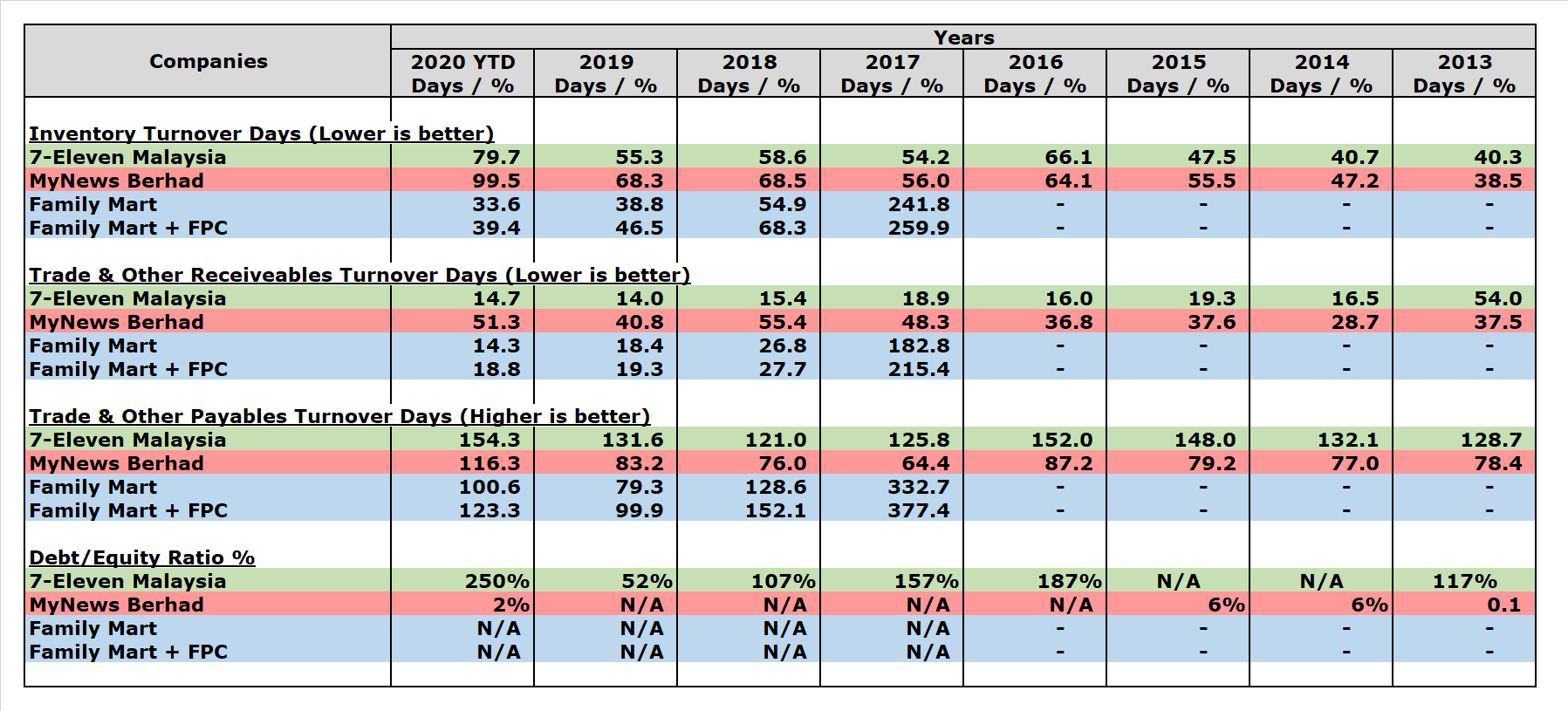

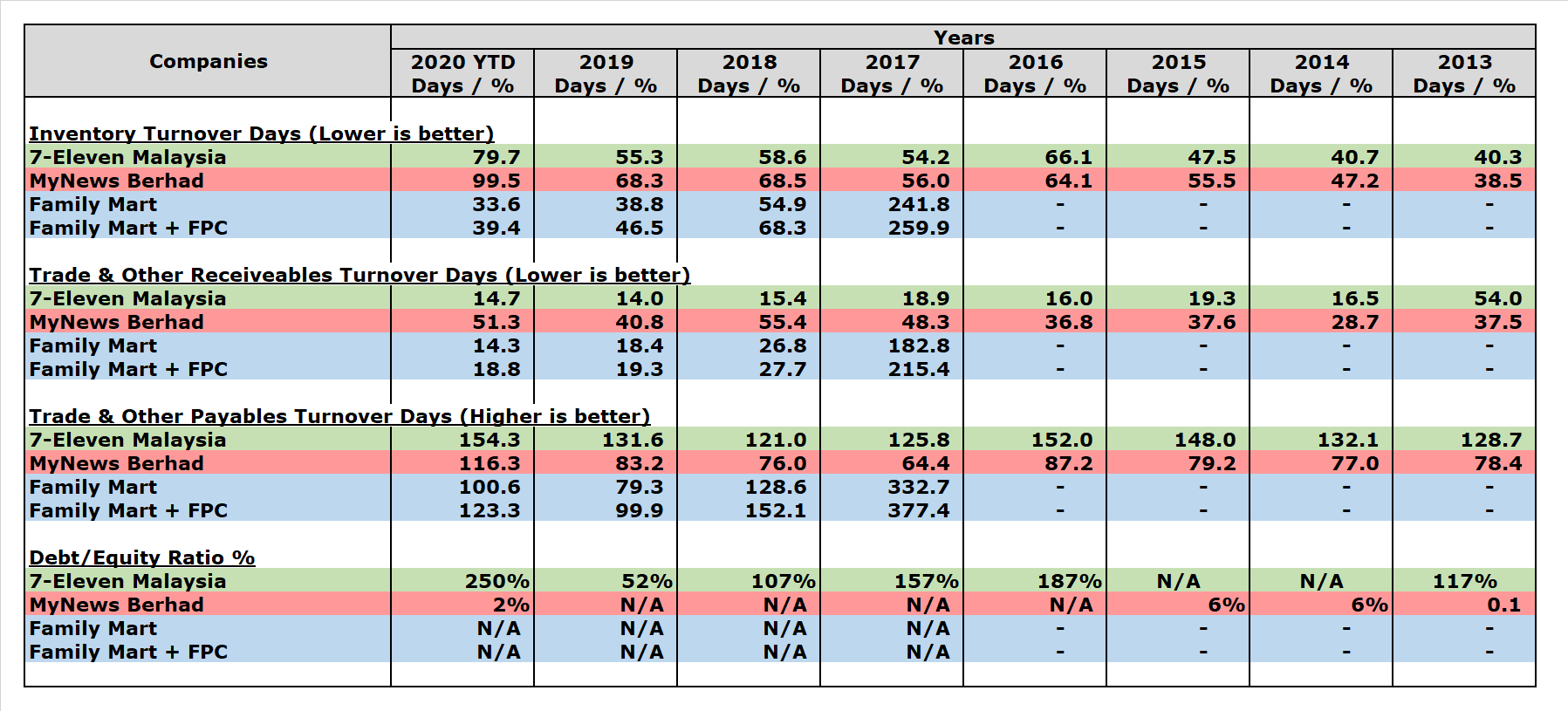

Inventory Turnover Days, Trade & Other Receivable Turnover Days, Trade & Other Payable Turnover Days and Debt/Equity Ratio

Well, one thing about 7-Eleven is that they employ significant leverage in their business, which both Family Mart and myNEWS do not.

But the main reason for this, is the ability of Family Mart and 7-Eleven to obtain run negative Working Capital Business Models, which basically mean that their suppliers are the ones providing the cash/working capital needed to run the business.

And they do so by keeping Inventory and Receivables Days Turnover Days as short as possible (which mean they keep less inventory as a percentage of their Revenue, and give very little credit to their Debtors), while keeping Payables Days Turnover long (which means they require a lot of credit from their suppliers).

Why are Family Mart & 7-Eleven able to do so, when compared against MyNEWS? It is largely due to two reasons.

- QL Resources Berhad/Family Mart and 7-Eleven, are far bigger companies when compared against MyNEWS, this means that more people want to do business with them, and therefore they have to ability to extract longer credit terms. In addition, currently Family Mart is also funded by significant number of advances by its holding company QL Resources.

- Both 7-Eleven and Family Mart have significant amount of franchisee’s who bear the costs of stocks & inventory and are required to pay this upfront with no credit terms (while they keep the credit terms given by the suppliers). This take a certain amount of inventory out of their books and provides them with additional cashflow.

- A large of amount of the revenue (and therefore inventory) of myNEWS consist of tobacco products around 34%. Tobacco companies don’t usually provide long credit terms.

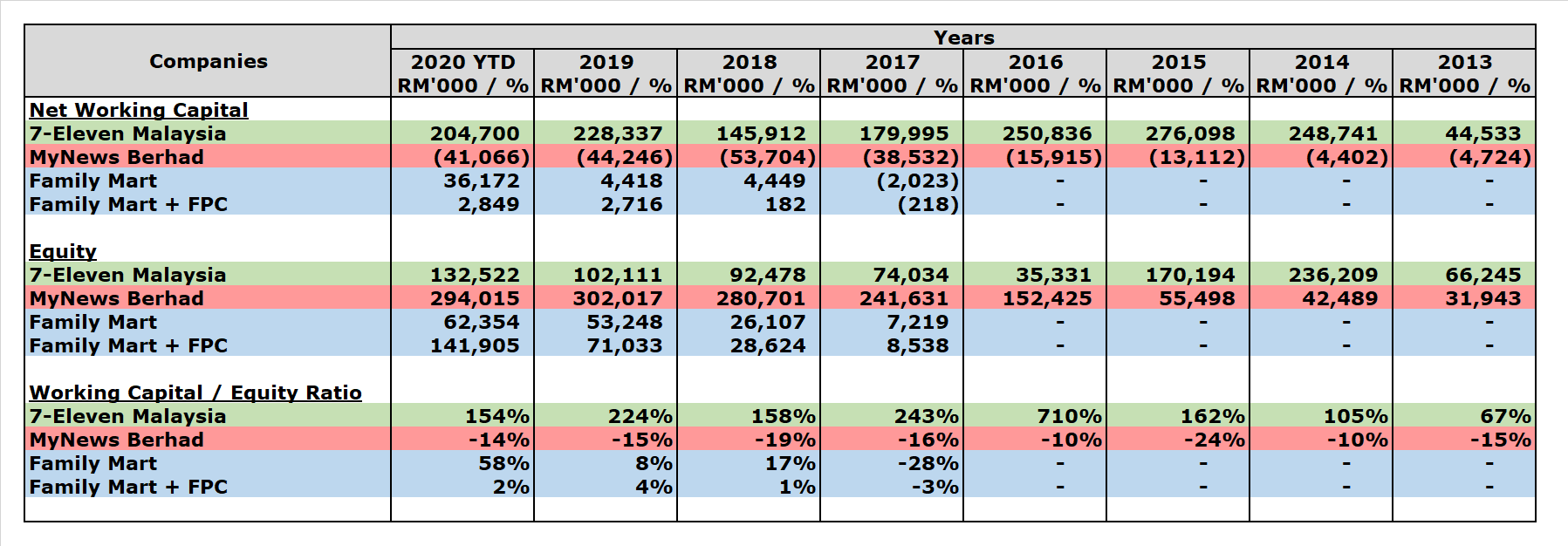

Net Working Capital and Working Capital/Equity Ratio

Translated into numbers, those Inventory, Receivables and Payable Turnover Days mean that,

For companies like 7-Eleven & Family Mart, in addition to the capital they have put into the business “Equity”, on a net basis, the suppliers of these companies, provided them with an additional 154% and 58% of capital to fund or expand their existing businesses.

While for myNEWS, in addition to their Equity, they also need to fork out, on average 15% of additional capital to fund their supplier’s businesses.

The thing about running negative working capital business models, is that it is especially advantageous when the company is expanding very quickly.

For a company without an expansion plan running a negative working capital business model, this business model only provides additional returns on the initial phase, before going on as normal.

But for a fast-growing business, like myNEWS and Family Mart, running a negative working capital business model give rise to situations like below.

As you can see above, this means that your suppliers can now fund your expansion plans.

The more stores you open, the larger the amount of funding provided by your suppliers, which reduces the amount of cash you need to open new stores.

And unlike 7-Eleven and Family Mart who have already fully optimized this, there is still significant room for myNEWS to optimize their working capital structure to obtain superior Return on Equity and supercharge their growth, while maintaining their superior Net Profit Margin and Return on Asset.

A full breakdown of the numbers will be attached as appendixes at the back.

The Turnaround – The Evolution of Retail Convenience Stores

With the advent of Family Mart, the current convenience store model used in many locations (particularly in Klang Valley) by myNEWS are no longer viable.

Because the moment Family Mart opens a store near you, the number of customers your get to come into your shop to buy the snacks and little knick knacks plummet.

To understand why, we need to think in terms of how retail convenience stores evolved.

For a long time, these stores started as newsstands and cigarette shops. Why?

Because at that point, the fact that you sold newspapers and magazines (for people to also peruse) is enough reason for people to come in, entertain themselves by taking a quick flip through the papers etc (I know I did this a lot back when I was younger, when my parents are paying for the groceries at Tesco) and then pick up their paper/magazine, along with any other stuff.

With the advent of the internet, smart phones etc. This suddenly created a vacuum in terms of a reason for people to enter these stores.

Now, for the overseas stores, because their stores have already evolved long enough and offer many different products from food and dessert (extremely good ones in fact) and pharmaceuticals, to even every-day grocery items like eggs, some vegetables and even meat and fish (along with them already being in high density areas and fulfilling the convenience factor), they could just continue moving along.

But for convenience stores like myNEWS who are still in the early phase of the evolution, they need to take the second step, and give customers a reason to come to their stores again.

Sugar (and then food). One of the three most addictive things in the world, with the other two being carbohydrates and a steady salary.

And, this was why myNEWS IPO’ed to raise the RM100m to fund their FPC’s.

However, Family Mart (QL) beat them to the punch and released that incredible ice cream (we don’t even need to mention 7-Eleven here. Who on earth still drinks slurpees?), along with their range of food products.

And now the moment a customer walks by a Family Mart, the memory of the taste of that ice cream instantly triggers, and they can’t help but walk in, and buy one (along with whatever catches their eye then). I know I am one of these people.

In addition, unlike myNEWS or 7-Eleven, Family Mart started with “Food & Desert” as their Main Selling Proposition, and therefore unlike the other two, does not have legacy items/relationships regarding of them

And so, how does myNEWS plan to turn things around?

Catalyst 1 : The opening of the first CU Store in 2021 Q1

This is where their new partner CU comes in, and myNEWS intends to open the first CU stores by Q1 2020, with a target for 30-50 CU stores opened in 2021, and a 500 stores target in five years. All of it will be funded via internal finances.

In my opinion, there are two main reasons for myNEWS being unable to fulfil their ambition of opening their own branded franchise, and the problems faced by the FPC.

-

Inconsistent and Subpar Branding

For one, the experience across myNEWS Stores are inconsistent, unlike Family Mart, where I know if I walk in now, I can 100% get my Sofuto ice cream.

As there is no clear and obvious segregation between the outlets with the ice cream, and those without the ice cream.

In addition, the name, “myNEWS”.

It is a legacy of their earlier days and the early days of retail convenience stores, where Newspapers and the Magazines are the reason why people walk in the store.

There is a quote from the movie “The Founder” (a movie about the Ray Kroc & the early days of McDonalds). This was directly after Ray Kroc essentially forced/buys out the McDonalds Brothers from the company.

One of the brothers, Richard McDonalds asked him, why did you want our company, why not open your own with the system you learned from us, and Ray Kroc replied,

“Its not just the system Dick, it’s the name, that glorious name Mcdonalds, it could be anything you want it to be, its limitless, its wide open, it sounds uh, it sounds like , sounds like America. As compared to “Kroc”. Why Kroc? What a load of Kroc. All over the Kroc. Would you eat at a place name Krocs. Krocs has that one Slavic sound. Krocs. But Mcdonalds, oh boy, it’s a beauty.”

I think the name “MyNEWS” is no longer suitable today when people no longer think about News, Newspapers, or Magazine when walking into a convenience store.

-

Inability to provide the right product mix and the “Taste” needed.

As QL was the franchisee of Family Mart, they obtained the right product mix and the required recipe’s and beat myNEWS to the punch in releasing the ice cream and Japanese food.

This meant that, even if myNEWS copied the product mix used by Family Mart, they may always be seen as Johnny-come-lately and an inferior copycat.

And with the above in mind, myNEWS needs a restart button when it comes to their RTE focused stores, and this is what CU provides.

CU is owned by BGF Retail who used to be the biggest Family Mart operator in Korea.

In 2014, they took what they knew from Family Mart, and started their own brand CU. From there, BGF converted all their stores in Korea to CU stores.

Today, CU are the biggest convenience store operator in Korea with 15,000 outlets. Their products in Korea are so good, that today, Family Mart is non-existent in Korea. This despite the non-compete agreement signed in 2014 having expired in 2016, and Family Mart is able to re-enter the market via another player.

With CU as their partner, MyNEWS now can offer another completely different type of food, “Korean”, that is equally popular as Japanese food in Malaysia, and have access to CU’s product mix and recipes.

By having CU come in, it solves most of their problems in one go.

- The opening of the CU stores means that myNEWS now have a new identity and would be able to be able to provide a consistent experience across the board for their customers.

- The CU stores, like Family Mart, will be built with Ready-To-Eat food as its core, and this means the Food Processing Centre, can now be run at a much higher capacity (75%) and enable it to breakeven (before COVID 19, it was operating at 50% capacity). In addition, materials used for both RTE segments are interchangable.

In addition, as of today, myNEWS still has a RM100m credit line, that lies mostly unused, which can be utilized to open the new stores.

Catalyst 2: COVID 19 and the Formula 1 Safety Car Mental Model.

In Formula 1, whenever an accident happens, a Safety Car will come out and all the cars must follow behind them.

When this happens, this is very bad for the leaders of the race, as because the safety car limits everyone to a slower speed (by virtue of it being a much slower car than a Formula 1 car), this meant that all the hard won gains by the leader is lost, and the competition becomes much closer.

When the COVID-19 pandemic hit, both myNEWS & Family Mart had to slow down their expansion. In addition, lower footfalls, meant that both myNEWS & Family Mart had both reduced their RTE offerings volume.

If you were to go into a Family Mart store today, it’s Ready to Eat shelves are actually quite empty and comparable to that of myNEWS previously.

However, unlike Family Mart/QL whose main route of improvement consist of opening new stores (which has been put on hold).

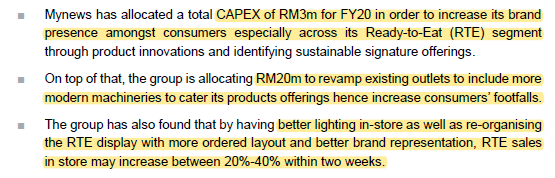

During this COVID 19 period, MyNEWS had been able to take advantage of the lower footfalls and revamp their current MyNEWS outlets to include more machineries that is needed to convert an outlet to be RTE focused.

At the start of the 2020, during an analyst meeting, the management have indicated the following.

And the benefits of this is very clear, the store on the left with the new layout, is clearly much better than the one on the right.

Have myNEWS taken advantage of this COVID 19 pandemic and revamped the existing outlets?

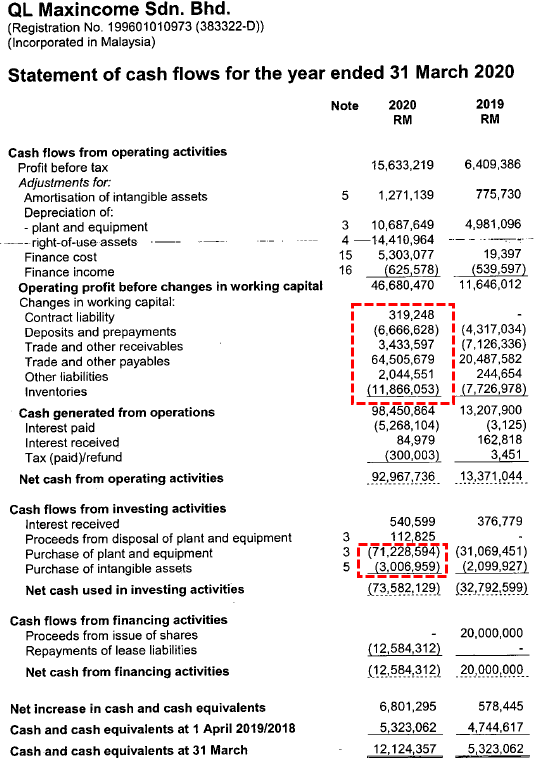

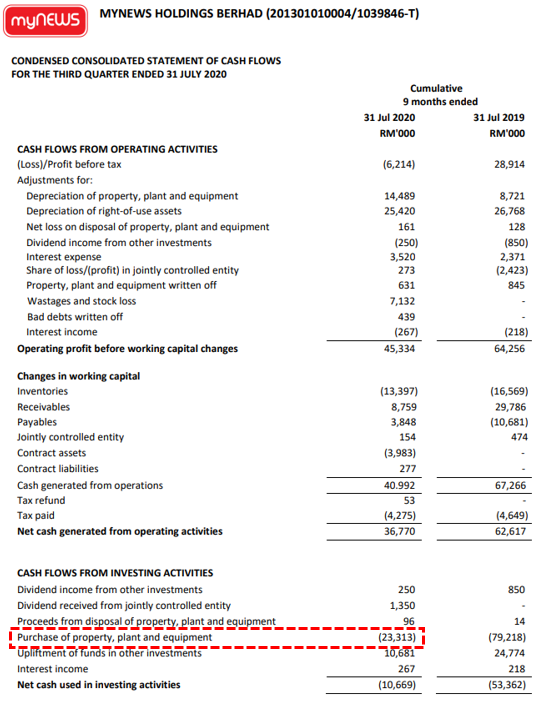

For the 9 months YTD 2020, MyNEWS have spent Rm23.3mil in purchase of property, plant & equipment.

As the number of outlet in 2020 on a net basis have actually reduced slightly, this means that the management have followed through on the revamp of existing stores, and most of the RM23.3m spent have been done on the store revamps to enable them to catch up to Family Mart’s offerings.

Catalyst 3: COVID 19 and the Safety Car leaving

However, unlike Formula 1, the retail convenience market is not purely a race. It is a business, where the pie is expanding for everyone.

As long as COVID 19 and the government’s policy (safety car) regarding it is around, everybody can only drive slowly and make less money or losses.

However today, despite COVID 19 Cases still being above 1,000 per day, we see the jams starting around the roads, queues outside of restaurants, and business reopening. Sunway Pyramid today is packed like usual.

As for our government, they have also done the following.

- Allowed Travel Between States and Districts Starting 7 Dec;

- No more limit on number of pax per table for dine in Starting 7 Dec; and

- No more 3 pax limit for travelling in cars Starting 7 Dec.

Its clear that many people, including our government think we may have somewhat overreacted in relation to this COVID-19 pandemic, and/or, that our hospitals and other medical businesses have had more than enough time to build up capacity, and/or, the consequence of not doing business or going about your own day is worse than the COVID-19 virus.

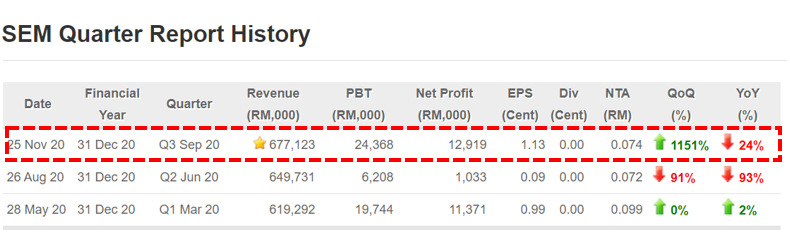

And as we can see here from 7-Eleven’s financial results for Q3, which run from (July 2020 – September 2020),

7-Eleven’s profits have largely recovered.

myNEWS’s Q3, which run from (August – October 2020), and should therefore contain a larger recovery as its further from that (March to July), and I think myNEWS has a good chance to breakeven this quarter as well.

Risks 1: Execution.

With all investments, especially turnaround ones like this, the main risks have always been in terms of the execution.

On a personal level, having studied MyNEWS since its inception as a business 20 plus years ago, and how the management runs it.

So far, I’ve always mostly agreed with the actions taken by management.

Of course, one could always say that they should have just worked with CU from the get-go, instead of trying to do things from scratch. However, it’s always easier to criticize and suggest the correct choice, with the benefit for hindsight.

One thing I like about this family run business, is the lack of Ego and especially Wah Lai Toi drama that typically comes with family businesses.

On September 2019, they have hired Madam Low Chooi Hoon who has deep experience in marketing and operating FMCG goods across South East Asia. And on October 2020, after proving herself, the co-founder and brother, Mr Dang Tai Wen himself, steps aside to allow her to take the reins as Chief Executive Office – Retail, a role he had help since the start of the company without drama, proving that they can work together and focus on the bigger picture.

And at the end of the day, this management is still one that turned 1 News-stand into 531 Convenience stores.

I think they will execute it fine.

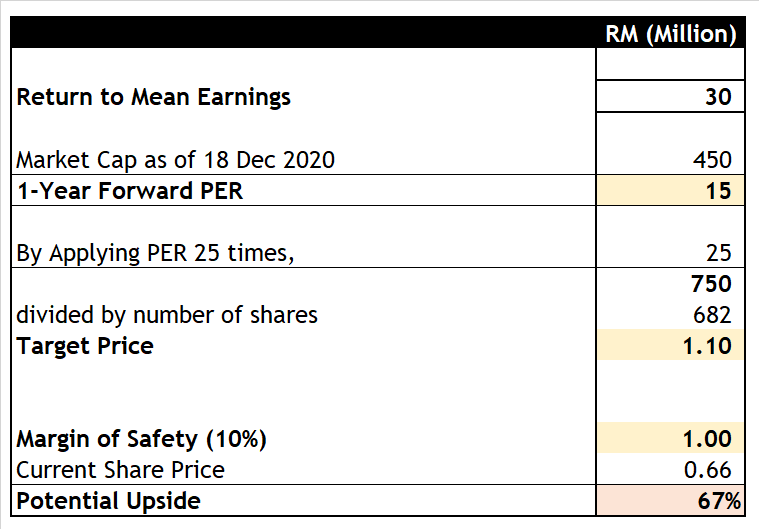

Valuation.

The thing about great businesses, is that they are rare, and its something that must be proven over time.

And if they do end up being great and turnaround from their temporary troubles, whatever your target price initially then, you would likely be severely undervaluing it. And if it turned out to not be great and the turnaround fails, whatever price you previously bought it for, is likely to be overvalued (like Parkson).

And so, for MyNEWS, my focus when it comes to this investment, is not so much on the share price, but keeping track on this business in terms of,

How the revamp is going?

How are the CU stores going?

How is the Food Processing Centre Utilization Rate and Wastages?

How does the drinks, food and snacks taste like?

Having said that I have a high conviction that within the next 3-6 months, MyNEWS would be able to revert their Pre-COVID 19 mean, and so we will use that as a basis for determining an initial valuation.

A higher PER is used to account for the fact it is a very fast-growing business, with great industry economics and good management.

Do note, before their problems with the Food Processing Centre, MyNEWS used to trade at around 35 times earnings, at RM1.3. In addition, with most convenience stores players around the world trading at 40PE-50PE (QL is around 60PE).

I think the current PER applied is quite conservative.

And, One Last Thing

Is it priced in?

Other than the brief pop back in April-May 2020, which affected all stocks, it has only gone down since then and is way below its Dec 2020 closing price of RM1.13.

It has since increased somewhat as people notice the gradual reopening of businesses around Malaysia.

However, I don’t think the market has priced in,

- Breakeven for Q3 2020 for MyNEWS

- Start of the first CU stores in Q1 2021 and

- Turnaround of the Food Processing Centres, and

- The long-term prospects of the venture as a franchisee of CU in Malaysia.

=====================================

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Telegram: https://t.me/Choivo_Capital

For a the original copy with high resolution pictures, better formatting and additional details.

For a the original copy with high resolution pictures, better formatting and additional details.

Go here.

(CHOIVO CAPITAL) WCE (3565) – When the roads align. 562% Upside.

========================================================================

1