RSI = Relative Strength Index, a momentum indicator derived from the recent price change, and indicate whether the stock is located at overbought or oversold situation.

RSI indicator will have their value between 0 to 100, where higher than 70 means overbought or temporarily overvalued, whereas lower than 30 means oversold or temporarily undervalued.

Back in March, there is a lot of stocks who dropped below 30 from RSI indicator, but there are not much people who dared to buy stocks during that time.

Although when RSI dropped below 30 means the stock is currently being oversold, hence it is a suitable time to buy. However, the writer recommend only buy the stocks that have relatively stronger fundamental. This is because a weaker fundamental company will have a higher chance to drop furthermore even if their share price is currently being oversold.

So, how should we find stocks that are being oversold? Need to search one by one?

NO NEED!

In short, RSI indicator can serve as an entry point, but we must first assess the company before buying. We should not invest in a company just because they are being oversold. Remember, once you earn something just by luck, you will eventually need to pay the price.

RSI = 相对强度指数,它是一个从最新的股价变化而演变出来的势头指标,而它也会指出现在这个股是否处于超买或者超卖的状况。

RSI指标的数值会处于0到100之间,如果数值大过70就表示这个股超买或者暂时性被高估了,反之如果数值低过30就代表这个股超卖或者暂时性被低估了。

回顾三月的时候,几乎全部的股都跌破RSI的30数值,但那时候却只有一部份的人愿意在那个时候买股。

尽管RSI跌破30代表着这个股现在已经超卖了,所以会是买入的时机。但是,笔者想提醒大家的是尽量只买有强大基本面的股。这是因为如果比较没有基本面的股尽管处于超卖的情况还是有机会再跌到更低的价位。

那我们应该怎样找出超卖的股呢?难道要一个一个的找吗?

不需要!

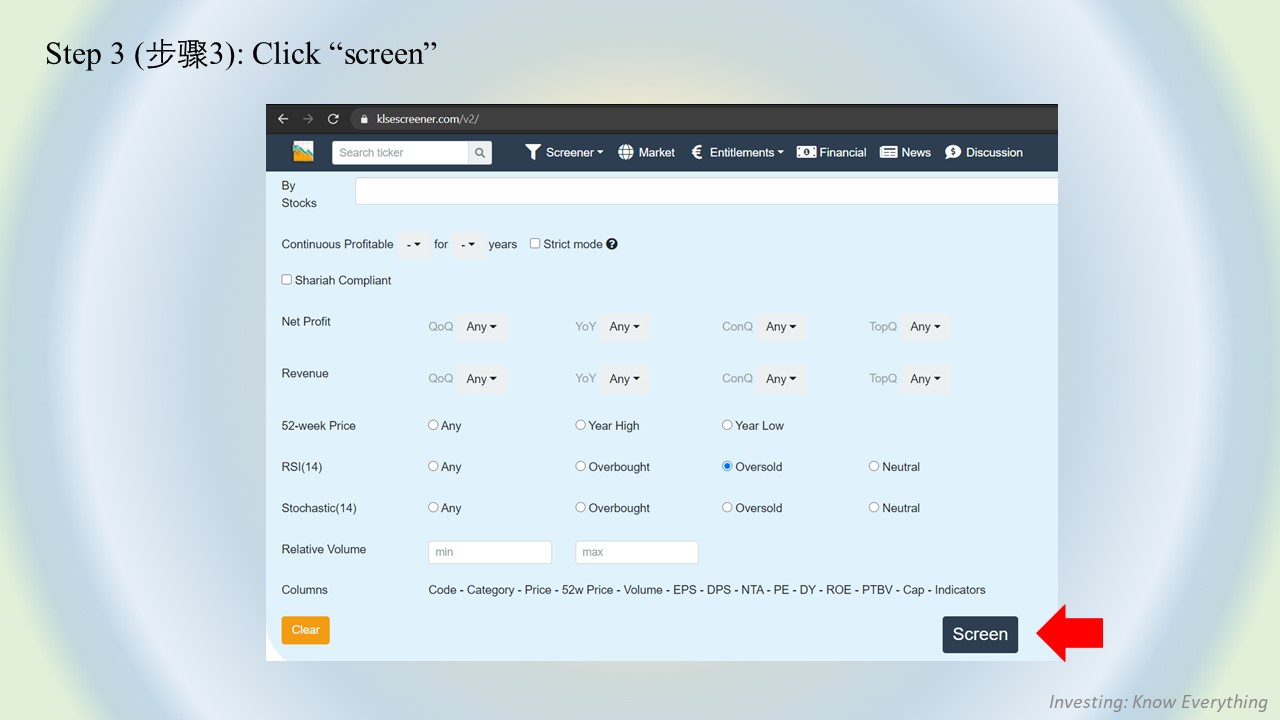

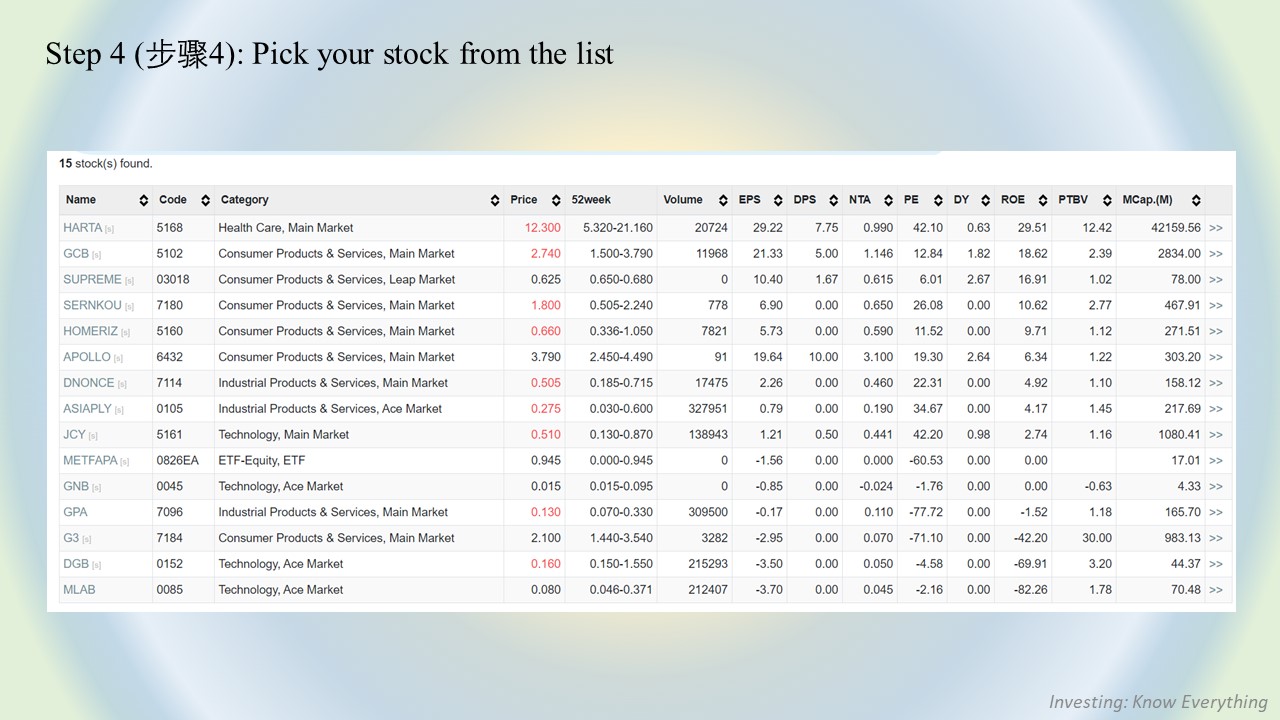

(方法请参考以上的图画)

总结,RSI指标可以成为买入的指引,但是我们也必须再买入前先评估公司。我们不应该因为一家公司处于超卖的情况而投资这家公司。要记得一句话,靠运气赚到的,始终还是会靠实力输回去。

For more EXCLUSIVE content, visit: https://www.facebook.com/InvestingKnowEverything/

请关注笔者的脸书专页以获得独家资讯。

https://klse.i3investor.com/blogs/InvestingKnowEverything/2020-12-23-story-h1538314818.jsp