Hi guys,

As my usual hobby I love to find undervalue LAGGARD Stocks. Once a Stock flew away into high high prices I always tell people not to chase

The Investment Approach of Buying low & hope to sell high is my forte. Not chase high with the hope of selling higher.

Now these are the reasons why ThPlant is still a palm oil laggard

1) THPLANT HAS MET THE GOLDEN RULE OF 2 QUARTERS POSITIVE EARNINGS

See

SUMMARY OF KEY FINANCIAL INFORMATION

|

|

INDIVIDUAL PERIOD

|

CUMULATIVE PERIOD

|

||||

|

CURRENT YEAR QUARTER

|

PRECEDING YEAR

CORRESPONDING QUARTER |

CURRENT YEAR TO DATE

|

PRECEDING YEAR

CORRESPONDING PERIOD |

||

|

30 Jun 2020

|

30 Jun 2019

|

30 Jun 2020

|

30 Jun 2019

|

||

|

$$'000

|

$$'000

|

$$'000

|

$$'000

|

||

| 1 | Revenue |

127,570

|

106,113

|

243,121

|

221,396

|

| 2 | Profit/(loss) before tax |

25,431

|

-29,088

|

10,943

|

-32,121

|

| 3 | Profit/(loss) for the period |

13,349

|

-22,745

|

401

|

-31,647

|

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent |

8,157

|

-19,150

|

-3,374

|

-27,241

|

| 5 | Basic earnings/(loss) per share (Subunit) |

0.92

|

-2.17

|

-0.38

|

-3.08

|

| 6 | Proposed/Declared dividend per share (Subunit) |

0.00

|

0.00

|

0.00

|

0.00

|

|

AS AT END OF CURRENT QUARTER

|

AS AT PRECEDING FINANCIAL YEAR END

|

||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) |

0.6300

|

0.6400

|

||

Definition of Subunit:

In a currency system, there is usually a main unit (base) and subunit that is a fraction amount of the main unit.

Example for the subunit as follows:

| Country | Base Unit | Subunit |

| Malaysia | Ringgit | Sen |

| United States | Dollar | Cent |

| United Kingdom | Pound | Pence |

2ND QUATER RESULT SHOWED A GOOD TURNAROUND

From a loss of 2.17 sen to a profit of 0.92 Sen

SUMMARY OF KEY FINANCIAL INFORMATION

|

|

INDIVIDUAL PERIOD

|

CUMULATIVE PERIOD

|

||||

|

CURRENT YEAR QUARTER

|

PRECEDING YEAR

CORRESPONDING QUARTER |

CURRENT YEAR TO DATE

|

PRECEDING YEAR

CORRESPONDING PERIOD |

||

|

30 Sep 2020

|

30 Sep 2019

|

30 Sep 2020

|

30 Sep 2019

|

||

|

$$'000

|

$$'000

|

$$'000

|

$$'000

|

||

| 1 | Revenue |

167,430

|

136,007

|

410,551

|

357,403

|

| 2 | Profit/(loss) before tax |

37,776

|

-48,791

|

48,719

|

-80,912

|

| 3 | Profit/(loss) for the period |

23,864

|

-40,013

|

24,265

|

-71,660

|

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent |

15,772

|

-31,609

|

12,398

|

-58,850

|

| 5 | Basic earnings/(loss) per share (Subunit) |

1.78

|

-3.58

|

1.40

|

-6.66

|

| 6 | Proposed/Declared dividend per share (Subunit) |

0.00

|

0.00

|

0.00

|

0.00

|

|

AS AT END OF CURRENT QUARTER

|

AS AT PRECEDING FINANCIAL YEAR END

|

||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) |

0.6600

|

0.6400

|

||

Definition of Subunit:

In a currency system, there is usually a main unit (base) and subunit that is a fraction amount of the main unit.

Example for the subunit as follows:

| Country | Base Unit | Subunit |

| Malaysia | Ringgit | Sen |

| United States | Dollar | Cent |

| United Kingdom | Pound | Pence |

AND 3RD QUARTER EVEN BETTER THAN 2ND QUARTER

REVENUE UP FROM RM127 MILLIONS TO RM167 MILLIONS

PROFIT INCREASED FROM 0.92 SEN TO 1.78 SEN (OR UP 93%)

NAV ALSO UP FROM 63 SEN TO 66 SEN

SO FAR SO GOOD

WHAT ABOUT NEXT QUARTER & THE NEXT?

WHAT IF PRODUCTION OF FRESH FRUIT BUNCHES DECREASE FROM NOV 2020 TO FEBRUARY 2021?

TO FIND THE TRUTH LET US GO BACK TO SEE THE LAST QTR REPORT

HA! FOR THE PROFIT OF 1.78 SEN THEY BENCHMARK CPO PRICES AT RM2,477 PER TONNE

THAT WAS UNTIL SEPTEMBER 31TH 2020

AND FROM OCTOBER, NOVEMBER AND DECEMBER 5TH AS WE TYPE FCPO HAS REACHED THE LOFTY HEIGHT OF RM3,690 A TONNE

| 13 | FCPO | Dec 2020 | 3,530.00 | 2,450.00 | - | 3,690.00 |

+186.00

|

3,695.00 | 3,530.00 | 180 | 2,241 | 3,645.00 |

| 14 | FCPO | Jan 2021 | 3,440.00 | 3,450.00 | - | 3,553.00 |

+142.00

|

3,560.00 | 3,426.00 | 3,357 | 25,187 | 3,552.00 |

UP BY HOW MANY PER CENT?

RM3,690 - RM2,447 = RM1,243

DIVIDES RM1,243 BY RM2,447 = 50.79%

WILL FFB OR CPO DROP BY 50%?

NO! ONLY 10% TO 15%

SO THE OVERALL PICTURE PAINTS A VERY BRIGHT FUTURE

WHY?

LET US LOOK AT THE COMMENTS FROM LAST QTR RESULTS

True Visionary Statement!

India suffered the La Nina Cyclones & Floods. Maharastha state where Onion, Corn & Soybean are produced have been inundated by Floods - wiping out its crops. Red onions from India has jumped from Rm3 a kg to Rm18 a kg or up 600%

Fearing for its 1.35 BILLION CITIZENS INDIAN GOVT HAS REDUCED CPO IMPORT BY 10%

China 1.39 BILLION PEOPLE Upcoming CHINESE NEW YEAR ON FEBRUARY 12 2021 WILL NEED LOTS OF PALM OIL AS ITS SOYBEAN & CORN WERE WIPED OUT BY 3 SUPER TYPHOONS, HAISHEN & MAYSAK THIS YEAR= ALL DUE TO LA NINA EFFECT

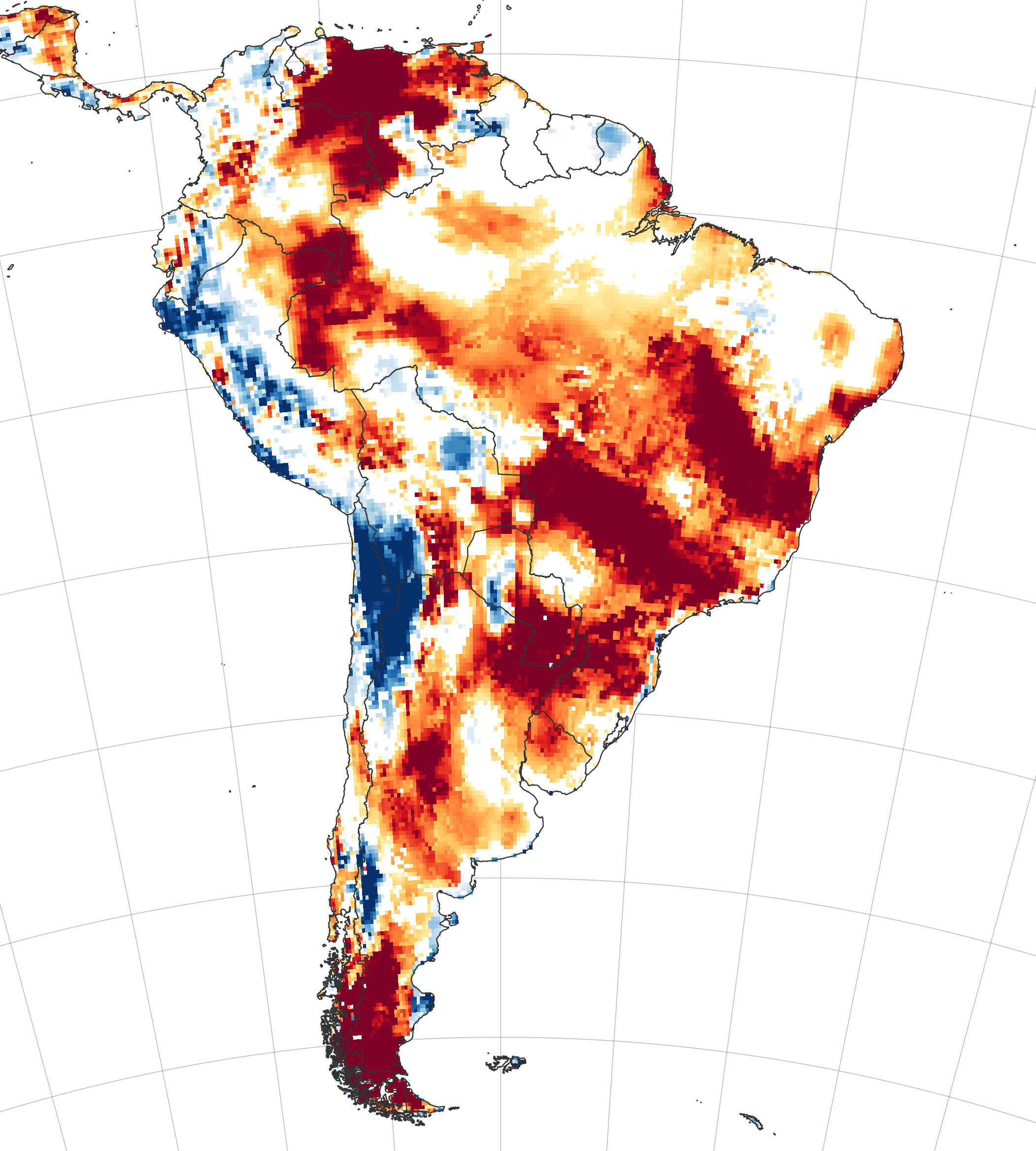

RIGHT NOW IN SOUTH AMERICA BRAZIL, ARGENTINA, BOLIVIA, URUGUAY & PARAGUAY SOYBEAN PLANTING SEASON ALMOST OVER AND YET DRY WEATHER OVER 95 DEGREE FARENHEIGHT ARE DAILY OCCURANCE

AND SO CAN WE EXPECT PALM OIL TO GO MUCH MUCH HIGHER OR IF NOT AT LEAST SUSTAIN ITS PRICES ABOVE RM3,000 A TONNE?

SINCE COST OF PRODUCTION AROUND RM1,700 ALL PALM OIL COMPANIES SHOULD DO WELL

NOW LET US TAKE A LOOK AT WHO ARE THE TOP 30 HOLDERS OF THPLANT

1) TABUNG HAJI (Now cleaned up like FGV)

2) Public Mutual Fund

3) Pertubuhan Peladang Negeri Terengganu at Top 5.

Ha! Trengganu Govt also in Top 30. No wonder TDM bought 70% stake in one of Th Plant subsidiary. TDM like Tmakmur people value add by rearing Animals for Sale in Palm oil plantations

But look at 4 & 5

4) Dynaquest has 750,000 shares of Th Plant.Yes Dynaquest by Grand Champion Master Sifu Investor Dr Neoh Soon Kean

5) Neoh Choo Ee & Company Sdn Bhd. Wahaha. This is the private personal investment of Sifu Dr. Neoh

He owns a whopping 3.7 Million shares of Thplant and he is in number 9

Total 30 Topholders own 86.5% of TH PLANT Shares according to Annual Report. So free float only 13.5%

Best Regards

Calvin Tan Research

Republic of Singapore

All information provided here should be treated for informational purposes only. It is solely reflecting author's personal views and the author should not be held liable for any actions taken in reliance on information contained herein

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/2020-12-05-story-h1537419199-TH_PANTATION_5112_A_PLANTATION_STOCK_LAGGARD_WORTH_ANOTHER_LOOK_Calvin_.jsp