One of the writer previous articles talked about “buying a fair company at a great price, or buying a great company at a fair price”. This is the exact point that differentiate value investing and growth investing.

Value investing is to buy a fair company at a great price. Their valuation is often at a relatively low point, which comes with the PE ratio between 5 to 10. These companies still have a strong fundamental but their growth will be limited, as trend may not be on their side. However, since their valuation is very low, there are not much risk when investing in these companies, and the return may be exceptional as they have a lot of growing potential. Value investors will often buy the stock when they are undervalued and sell their shares when they are overvalued.

Growth investing on the other hand is to buy a great company at a fair price. Their valuation is often higher, which will lie between 30 to 80. Some companies from this category may have a strong fundamental, but their borrowings will also be high as they tend to borrow money from banks in order to expand their business. That being said, there are also growth stocks that are net cash companies and still constantly growing. The risk when investing in growth stocks is higher as uncertainties are higher. If the growth is sustainable then you got yourself a fantastic investment, but if let say their expansion failed to kick in, the company may suffer losses, and investors will also suffer the capital losses. Growth investors will often buy the stock when their potential is just revealing, and will sell the stock when their growth reached a bottleneck.

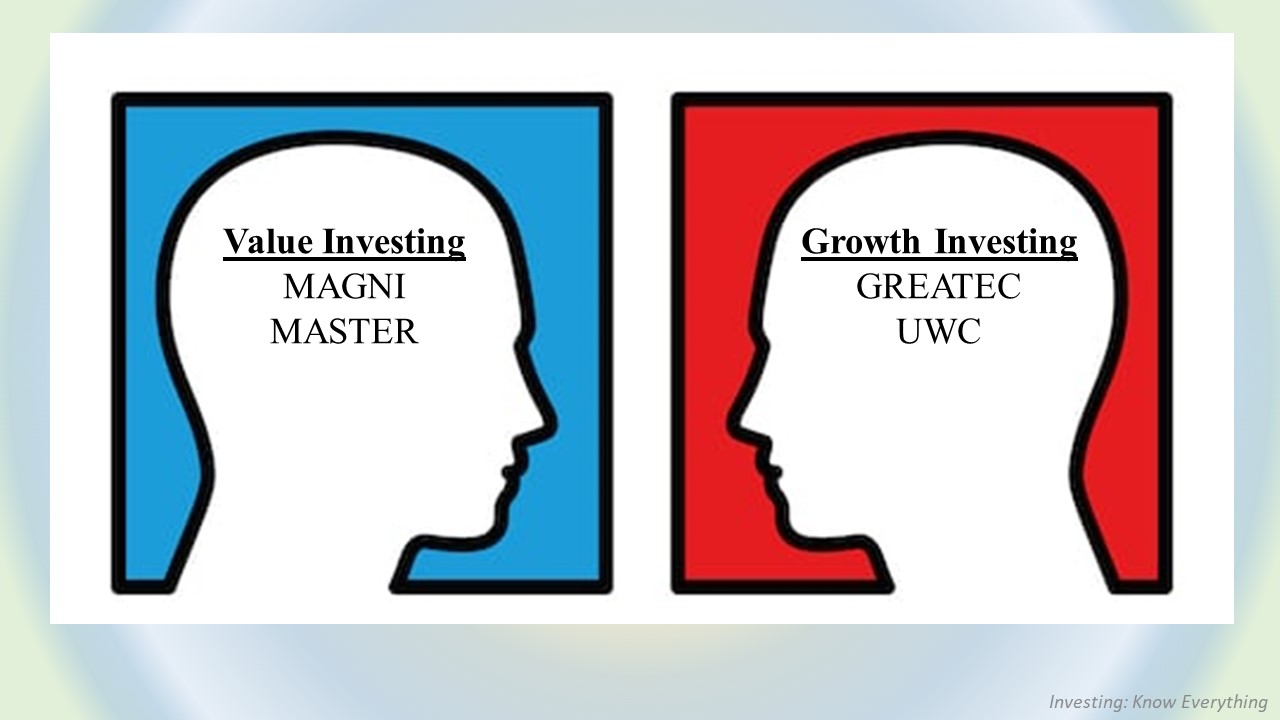

The writer will not say which is better, but it all depends on the risk you are willing to take. Obviously, value investing will have a lower risk but may have a lower return than growth investing. Some examples can be provided for both cases, both MAGNI and MASTER are considered as value investing as their PE ratio is lesser than 10, and have a strong fundamental. For growth investing, GREATEC and UWC can be considered as it, since their PE ratio is higher than 70 but it is also obvious that their profit is improving, and their forward PE ratio will eventually be lowered down.

In short, both types of investing are considered as long-term investing, but each of them consists of their own risk and reward. Besides, a stock with high PE ratio is not necessary a growth stock and stock with low PE ratio is also not necessary an undervalued stock. It is all up to their fundamental, only stocks with strong fundamental can be used for long-term investment, or you will loss all your invested money over time.

笔者之前有写过一篇文章是关于“在普通的价钱买一家很好的公司,和在很好的价钱买一家普通的公司”。而这正正就是价值投资和成长型投资的不同点的写照。

价值投资就是在很好的价钱买入一家普通的公司。它们的估值通常都会比较低,本益比会介于5到10之间。这些公司也有很强的基本面,但成长可能因为趋势而受限制。但是,正因为他们有很低的估值,投资在它们的风险很低,而且回酬也将会非常可观,毕竟股价上升的空间比较大。价值投资者会在股价被低估时买进,而在股价被高估的时候卖出。

成长型投资就是以普通的价钱买入一家很好的公司。它们的估值都会比较高,通常介于30到80之间。有些公司会有很强的基本面,但是却负债累累,因为他们会向银行借钱来扩张。尽管如此,还是有净现金的成长型公司存在的。可是,投资成长型公司的风险在于它们的不确定性很高。如果他们的成长和扩张很成功的话,那么这项投资就值了;反之,如果他们扩张失败而公司蒙受亏损的话,投资者也会蒙受股价下滑所带来的亏损。成长型投资者通常会在公司刚露出它们的潜力时买入,而会在公司成长遇到一个瓶颈时卖出。

笔者并没有说哪个会比较好,因为这全部都要归功于个人的愿意承担的风险。当然,价值投资会有很低的风险,但是回酬绝对会低于成长型投资。我们来给大家一些例子,MAGNI和MASTER就属于价值投资的首选,因为它们的估值都低于10,并且有着很好的基本面。GREATEC和UWC便属于成长型投资的首选之一,尽管有着超过70的本益比,但盈利也同时在增长着,因此未来的本益比也会被降低。

总结,这两种投资都属于长期投资,但各自都有各自的风险以及回酬。此外,要注意的是不是高估值股都属于成长型公司,也不是低估值的股都属于有价值的公司。这全都要先看基本面,而也只有很强基本面的公司才能够用作长期投资;否则,你所投资的钱将会慢慢的化作乌有。

For more EXCLUSIVE content, visit: https://www.facebook.com/InvestingKnowEverything/

请关注笔者的脸书专页以获得独家资讯。

https://klse.i3investor.com/blogs/InvestingKnowEverything/2020-12-27-story-h1538397309.jsp