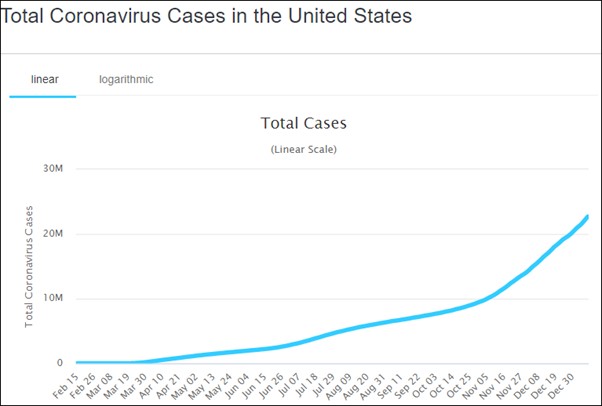

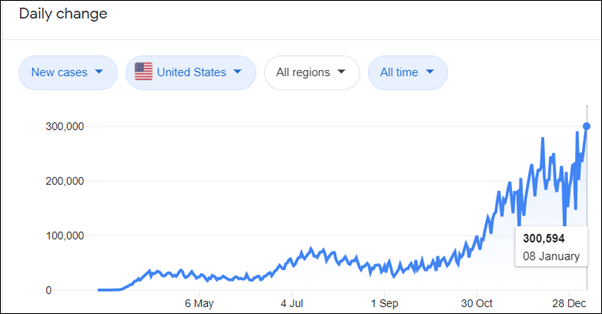

Currently US has the most Covid 19 cases in the world. It has a total of 22.7 million cases and 381,480 deaths. These 2 figures are still surging as shown on the 2 charts below.

JP Morgan downgraded all glove stocks so that they can buy at cheaper prices. As a result, Supermax dropped from Rm 11.89 on 6 Aug 2020 to close at Rm 7.30. It dropped Rm 4.59 or 39% as shown on the price chart below. It is so ridiculous to drop so much when the demand for gloves is still surging and the number of Covid 19 cases is also surging in most countries in the world especially in USA and in Europe.

Due to Covid 19 pandemic, the demand for medical gloves far exceeds supply and all the glove makers can easily increase their selling prices to make more and more profit.

Supermax recently reported its 1st quarter, ending September, earning per share (EPS) of 30.58 sen. Its EPS for the previous quarter, ending June was 15.29 sen. The reason for the company to be able to increase its profit by 100% is due to surge in demand for medical glove for the coronavirus prevention. Its 2nd quarter ending Dec will be another new record profit which will be announced next week.

Supermax is making more earning per share (EPS) in every quarter since the pandemic began in March, than any of its peers, namely Top Glove, Kossan, Hartalega, Comfort Glove, Care Plus and Rubberex, etc.

The reason why Supermax can make more EPS in every quarter than any of its peers is because it has its own brand and sale outlets in many cities in US and in many other countries around the world. Smaller glove makers cannot sell their glove at higher price than Supermax because they have to sell their gloves through agents or middle men.

To be very safe and sure of making money, I assume the company does not increase its selling price for the whole financial year.

Its annual EPS will be 4 X 30.58 sen = Rm 1.22

To be very safe and easily achievable I based on PE 10, my target price will be Rm 12.20.

The last traded price was Rm 7.30 per share

https://klse.i3investor.com/blogs/koonyewyinblog/2021-01-10-story-h1539262400-Supermax_update_target_price_Koon_Yew_Yin.jsp