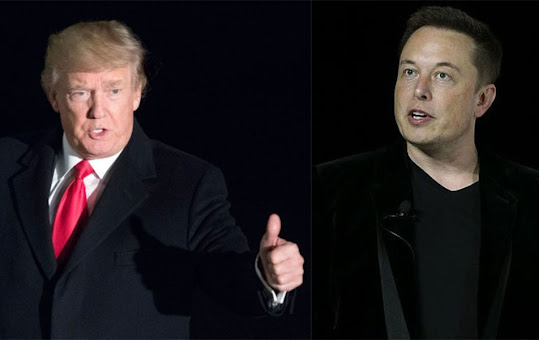

About 2 weeks ago, Elon Musk's Tesla revealed they have taken a huge position in Bitcoin and he believe in this cryptocurrency so much so he think it is worth more than cash (I am assuming he is only talking about currencies which are subjected to negative rates). Then, this week he said he feels Bitcoin is a bit on the high side. Few weeks ago, he promoted Dogecoin. Then he said it is best to sell. In 2020, the most watched or followed twitter account was Donald Trump. After Trump was banned, Elon Musk pretty much became the new king of twitter. One was a mad president. Another is a mad richest man in the world. Both are extremely powerful people with great influence.

I

grew up with the belief the the Presidential office of the United

States is one of prestige, decorum and greatness. I too believed to

become the richest man in the world, it would require someone of great

brilliance and humility like Bill Gates, Warren Buffet and the likes. I

never knew being eccentric, crazy and out of the norm would be what it

takes to scale such heights. At times, I am not sure what is becoming of

the world anymore.

In

relation to the stock market, everyday, I am learning something new,

toying with new ideas and trying to bridge the gap between expectations

and reality. I have always understood being a fundamentalist is very

lonely. Most path taken is not that common. With the flood of new retail

investors, social media and surge in "Gurus", the market may not behave

as in tune with the usual rationality that I am used to. In 2020,

investors were always searching for resilient stocks which are shielded

from the pandemic and is able to deliver earnings. In 2021, investors

are looking beyond recovery. Those who are screaming buys on tech stocks

mostly do not know what they are shouting about except to justify with

the common hip words "5G, AI, IOT, Solar, Green, Renewable,

Digitalisation etc".

So

how do we navigate the market as it is? I asked myself this question

almost every day. To sit out a rallying market is to miss out on

opportunities. At the same time, to be highly vest in an overextended

irrational rally, is to take a huge risk. The good thing is, we are

retail investors. We should use this to our advantage. Our capital is

small, we are nimble and we have the luxury of time. The luxury of time

is not what hedge funds, professionals or banks have. They need to churn

out returns every single day, month and year to justify taking clients

money. We do not face such pressure. We are not forced to pull the

trigger or swing the bat. This is what I hope you all will remember. One

of the best lessons I have learnt from investing over the years is risk

management is as important as picking the right stock.

It

is never easy investing in the stock market. Over the CNY, I have heard

how many people became stock market experts in the course of 2020.

Often during such conversations, I am usually a very good listener. A

big part about investing is to be a good observer, listener in order to

gauge the market sentiment, feel on the ground in order to have better

market insights. If you are always the one talking, I do not think you

would benefit much in terms of learning from others. My takeaway from

these CNY conversations which revolved around glove stocks, GameStop,

BitCoin, Tech stocks, EPF withdrawl, "what's next year theme" would be - Retail investors did well in 2020, is hungry for more action in 2021 and can't wait to have another stellar run.

There

were honestly no sense of fear or worry but more skewed towards

optimism. In my view this is a good thing. Being all solemn and

worrisome wouldn't help with the current predicament. Optimism

translates to confidence and confidence is important from the aspect of

investor confidence, business confidence and consumer confidence. However,

whilst I do think it is important to remain invested in the stock

market, I will adopt a rather cautious stance in 2021. I believe that

the market is due for a correction, before it can continue any further

uptrend or historic rally. When too much optimism is in the market, it

becomes exuberance. Over-exuberance at any point in time, is never good.

You can have a look at this viewpoint from Michael Burry, famous from

the movie "Big Short".

In

a nutshell, this is what I would do in such times. Take your time in

looking to enter stocks. If you want to take a position, be prepared to

hold it for some time. If you are not, stay sidelines. For position in

good fundamental stocks which may yet to be performing or temporarily

underperforming, do not be too worried as overextension in the market

goes in both directions (upwards and downwards). This

is why I am advocating as what I always have been, build a balance

portfolio and build up the cash coffers. By doing so, in the event there

is a correction, investors can navigate better be it to average down or

take fresh positions in their favourite companies. By being heavily

invested as they were in 2020, would be a dangerous move considering

many sectors or stocks are "overvalued".

_______________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought: