Company background

Dominant Enterprise Berhad which commenced operation in 1992, is involved in the manufacturing of environmentally friendly engineered wood mouldings, laminated wood panel products as well as the distribution and export of a wide range of wood products to over 20 countries around the world. Dominant distributes wood panel and building material products to furniture manufacturers, interior designers, and construction-related players in Malaysia, Singapore, Australia, Thailand and Vietnam. The manufacturing segment manufacture laminated wood panel products, wrapped medium density fibreboard mouldings and furniture components for furniture manufacturers and interior design industries.

Investment thesis

Competitive strength and good track record.

A leading wood-based exporter in Asia. The Group currently has subsidiary presence in Malaysia, Singapore, Australia, Thailand and Vietnam. The Group aims to strengthen its footprint in all these countries through increased production capability, introduction of new products to the markets and developing new industries in each of these countries. With the Group’s excellent track record in exceptional product quality and timely delivery, we are optimistic that we will be able to capture a larger piece of the pie.

The Company has also earned a good reputation as a reliable and quality supplier when it supplied wood panels and other building materials to some prestigious and major building projects in Singapore, such as the Republic Plaza, Changi Airport Airfreight Terminal 5 and extensions of the DBS Bank building. Today, one of the subsidiaries of Dominan ranks as one of the major wood panel importers in Singapore.

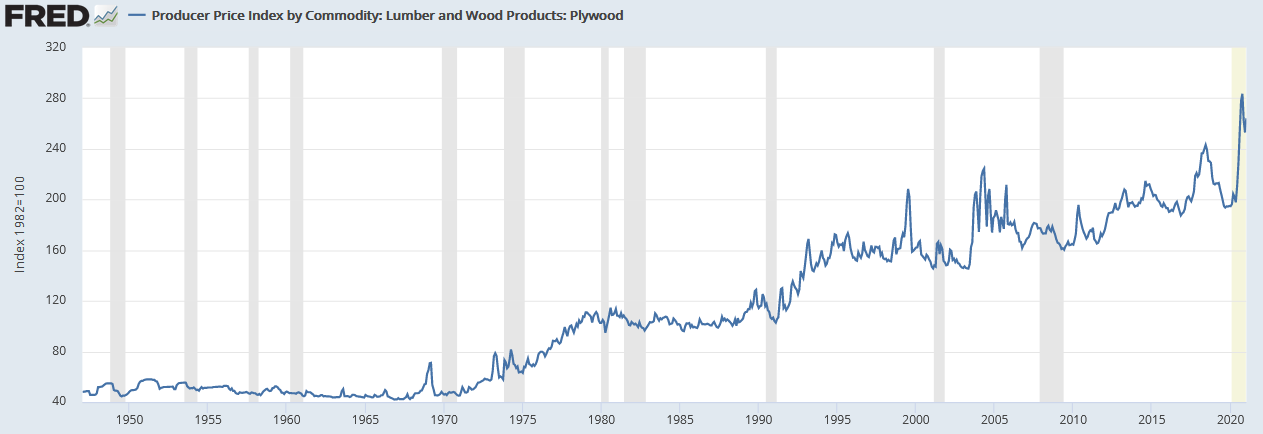

Improving margin on up-cycle

Historically, Dominan has hit record profit in 2018 when average selling price (ASP) of the plywood hit the previous peak of 240 USD. However, the latest ASP has reached the all-time high of 280 USD. This can be seen from the spike in margin to 4.9% in the latest earning quarter as compared to ~2% pre-covid. The management of Dominan has attributed this improvement to better margin as well as effective costs management.

Work-from-home boom is a bust for big office furniture makers

Major corporations such as Google, Microsoft and Facebook have adopted work-from-home (WFH) policies to help contain the spread of the virus. Some have even gone to the extent of providing employees with one-off cash allowances to purchase home office furniture. Also, the cash handouts as part of the stimulus from the US government are reported to have spurred consumer spending on items such as home furnishing. This bodes well for furniture companies operating out of Muar, Johor, deemed the “heartland” of the local industry. Public Invest Research expects the growth in demand for Malaysian furniture to resume once the global economy recovers and returns to normal in 2021, with potential earnings growth of 37% and 20% in FY21 and FY22 respectively. Although some of the furniture maker has reported margin compression as a result of weaker USD and rising material costs, Dominan as supplier of the raw material for the furniture industry is the beneficiary from this trend.

Expansion plan

The construction of the Group’s Dengkil factory and Ipoh warehouse was expected to be completed by Dec 2020. This plant will increase their production capability, allowing Dominan to cater more effectively to market demand.

In 2019, the Group has also entered into an agreement to purchase 3 parcels of land in Muar totalling 18.4 acres, for RM12.8 million. The land parcels are expected to be delivered in December 2021.

Steadily growing plywood market

Amid the COVID-19 crisis and the looming economic recession, the plywood market worldwide will grow by a CAGR of 7.9% from 2019 to 2027 based on the report by Businesswire (range of projection: 2.3% by Market Watch to 25.5% by Simplywall.St)

Financials

FY21-FY22 could be see a potential recovery in earnings for Dominan from the impact of Covid-19, however bottom line would be slightly dragged by potential higher cost. Moving forward, I am bullish on FY21’s growth on the back of improving margin and dirt-cheap valuation.

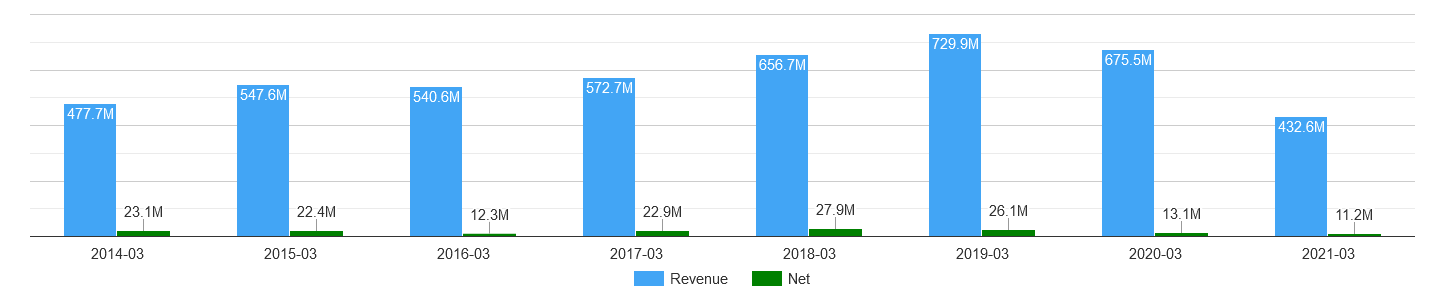

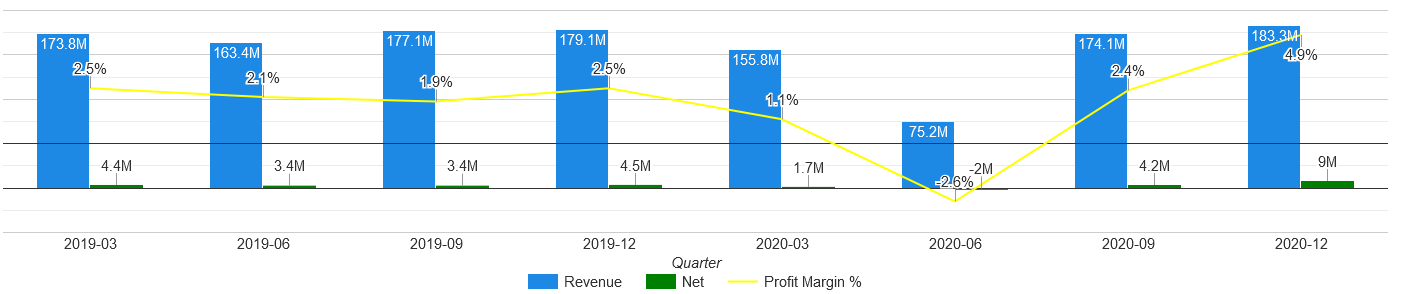

Good earnings record

Dominan has always been profitable with steadily growing revenue and net profit with 5-year CAGR of 8.8% and 2.5% respectively from 2014 to 2019. This could be the result of the group’s competitive strength backed by an experienced management team as not many players in the same industry were able to display similar result during the stated period due to margin compression. For the 12-month period ended 31 December 2020, the drop in earnings was due mainly to the imposition of Movement Control Order (“MCO”) by the Malaysian Government, to tackle the COVID-19 pandemic. The latest earning quarter has delivered the highest net profit since 1Q19 which has reflected the rising margin due to higher ASP.

Annual

Quarter

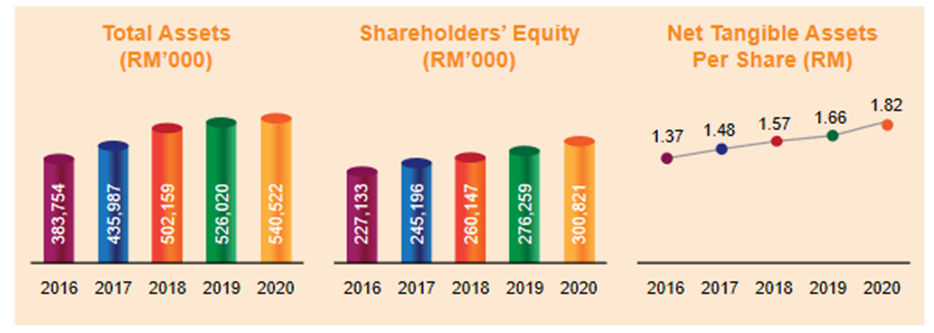

Reasonable balance sheet and rising net tangible asset (NTA)

Although the debt may be considered as relatively high to some investors, the Group’s bank borrowings have decreased to RM 153 million as at 31 Dec 2020 from RM 197 million as at 30 June 2018 (22% reduction) while cash and short-term fund has increased in the same period from RM 51 million to RM 82 million (increased by 61%).

Additionally, expansion plan of the group has boosted the NTA to RM 1.86 based on the latest quarter report. The current share price of 81 sen represents a steep 56% discount when compared to Hevea and Mieco in the same industry. In the event liquidation, the high NTA may be able to provide some protection to shareholders.

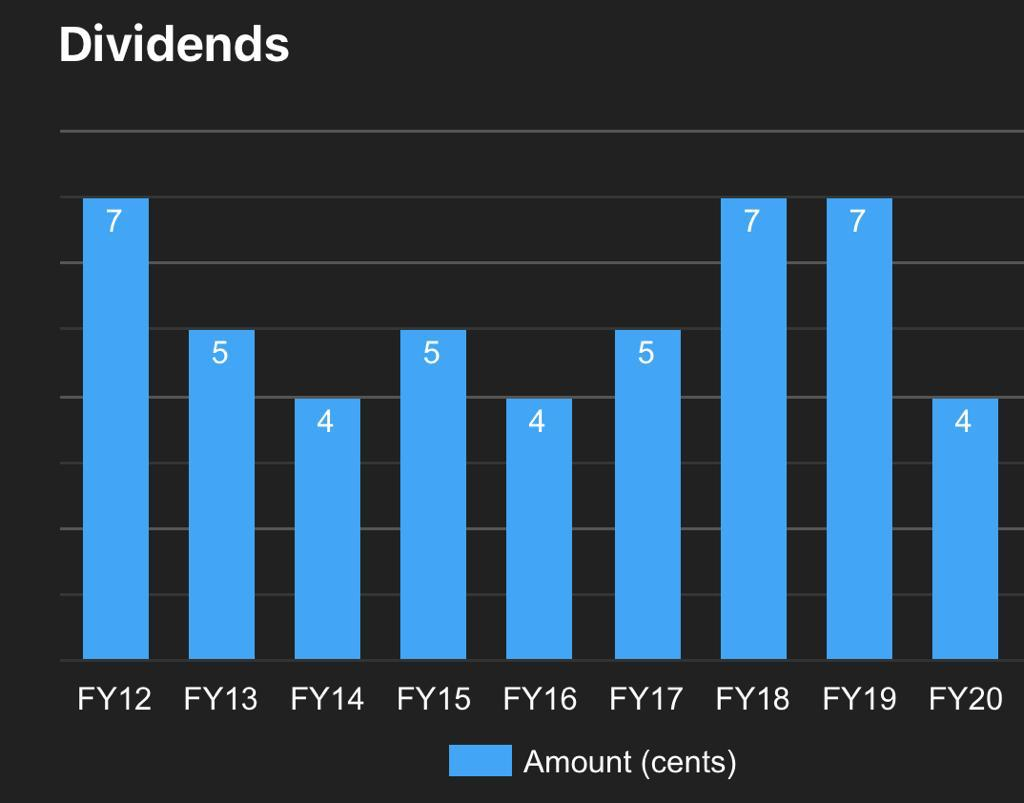

Strong track record of dividend pay-out

In total, Dominan has declared dividends of 4.0 DPS in respect of FY2020, equivalent to a dividend pay-out of approximately RM6.6 million, representing 50.5% of FY20 net profit. This would translate to 4.9% dividend yield at the closing price of 81 sen. Dominan has been paying out generous dividends annually since 2004.

Moving forward, estimation based on the historical dividend of 4-7 DPS and 50% pay-out ratio would translate into a dividend yield which may range from 4.9-8.6% for FY21-FY22. This generous dividend pay-out can match if not beat the dividend yield from the employee provident fund (EPF), which is particularly commendable given the current low yield and low interest environment.

Valuation

Conservatively, using growth rate expectation by Public Invest at 22% pegged to 9.5x PE for FY22 estimated EPS of 14.8 sen, would give Dominan a fair value of RM 1.41.

Aggressively, there could be potential re-rating (+1 SD to 13x PE) if the earnings of Dominan continues to improve above estimation with additional capacity from the new Dengkil plant.

Historical PE ratio of Dominan

Key take away

Dominan valuation can be considered as dirt-cheap (when compared to the other player in the same industry based on its consistent earnings pre-Covid with 4.9% dividend yield of 4 sen DPS for FY21. At current price of 81 sen, the favourable risk-to-reward ratio with good dividend yield provide a low-risk diversification to weather the current highly volatile market.

Risks

Covid-19

Business operations of all Malaysian companies in non-essential sectors were suspended from 18 March 2020 to early May 2020. Operations were also affected by weak market sentiments and pandemic-related restrictions imposed by the respective local governments during this period.

Additionally, the company announced that the two infections were detected on Feb 11, 2021 during a screening exercise for all of its employees in Muar. These two workers have since been quarantined and separated from all other workers. It will be suspending operations at its Muar operations from Feb 12 to Feb 25, subject to further directives from the relevant authorities. “The temporary suspension will have minimal impact on the group’s operations and financial performance for the financial year ending 31 March 2021,” it noted.

Loss recovery from insurance claim as a result of fire outbreak

There was a fire outbreak at the Group’s factory and warehouse in Muar located at PTD 2805, Jalan Raja, Kawasan Perindustrian Bukit Pasir, 84300 Muar, Johor, Malaysia on Jan 23, 2021. The actual losses incurred from the fire incident are still being ascertained.

Margin compression due to rising cost of raw materials

Raw material costs may continue to influence the Group's profit performance. Though the price of some of the raw material is not at peak, it seems to be on uptrend probably due to Covid-19 supply disruption.

Fortunately for the Group, it has always been their strategy to develop diverse source of supply from various countries to avoid the situation of over-reliance on any supplier. This strategy has helped the Group to cushion the supply shock from the pandemic. The Group will continuously source for alternative supplies.

However, The Group has started on the construction of two warehouses in Johor Bahru. Construction is expected to be completed in the middle of 2021. Once completed, these warehouses will be rented out to generate stable, recurring rental income for the Group to potentially cushion the impact of low margin.

Regional and domestic competition

The plywood industry is highly competitive, with operating margins across the industry in the low single digit.

Change in government policy, labour supply and overhead costs.

Government policy can make a huge difference to company’s profitability. For instance, the hike in minimum wage would negatively affect the company as it is heavily dependent on foreign labour.

Optimising overhead expenses is crucial, especially during times of uncertainty. The Group will continue to take a proactive approach to optimise our overhead expenses. We will, however, do this from a long-term perspective to effectively break the reactive cycle and permanently improve our business’s cost competitiveness.

The shortage of labour has always been a challenge for the manufacturing industry in Malaysia. In order to overcome this problem, the group has also invested in new machineries for their manufacturing plants. These new machineries allow for significantly greater level of automation, reducing the number of workers required. At the same time, the new technology that comes with these machineries allows for the consistent production of higher quality products and have lower downtime, leading to greater efficiency.

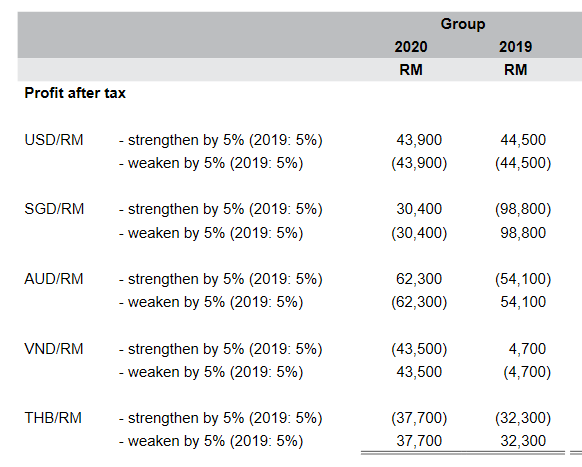

Currency exchange

Subsidiaries operating in Australia, Singapore, Vietnam and Thailand have assets and liabilities together with expected cash flows from anticipated transactions denominated in foreign currencies that give rise to foreign exchange exposures.

While the exact impact may be difficult to ascertain, historical spike of USD/MYR in 2015-2016 did not severely impact the profitability of Dominan. This could be due to the group's financial risk management policy seeks to ensure that adequate financial resources are available for the development of the Group's businesses whilst managing its interest rate risk, credit risk, liquidity risk and foreign currency risk.

However, despite the challenges, the group will continue to leverage on its competitive strength to meet these challenges.

What the price is saying?

Briefly, Dominan share price is trying to recover from the Covid crash in March 2020 (from RM 1.20 to low of RM 0.65). Recent price movement suggests this low-profile cyclical has caught some attention from traders.

Disclaimer

The information contained in this article is based on data obtained from internet. However, the data and/or sources have not been independently verified and as such, no representation, express or implied, are made as to the accuracy, adequacy, completeness or reliability of the information.

Investors are advised to make their own independent evaluation of the information contained in this article and seek independent financial, legal or other advice regarding the appropriateness of investing in any equities discussed in this article. Under no circumstances should this article be considered as an offer to sell or a solicitation of any offer to buy any securities referred to herein.

Disclosure

I am long Dominan. This article is written as an expression of personal opinions. I have no business relationship with any company mentioned in this article.

References

- https://www.klsescreener.com/v2/stocks/view/7169

- https://fred.stlouisfed.org/series/WPU083

- https://www.theedgemarkets.com/article/local-furniture-players-get-boost-wfh-policy-us

- https://www.reuters.com/article/health-coronavirus-office-furniture/analysis-work-from-home-boom-is-a-bust-for-big-office-furniture-makers-idUSL1N2FF2CG?edition-redirect=in

- https://www.businesswire.com/news/home/20200702005214/en/Global-Plywood-Industry-2019-to-2027---Market-Trajectory-Analytics---ResearchAndMarkets.com

- https://www.marketwatch.com/press-release/plywood-market-growth-2021-global-industry-demand-share-top-players-industry-size-future-growth-by-2026-2021-03-01

- https://www.theedgemarkets.com/article/dominant-enterprise-temporarily-shut-muar-ops-two-workers-tested-covid19-positive

- https://www.thestar.com.my/business/business-news/2021/01/25/fire-breaks-out-at-dominant-enterprise-factory

https://klse.i3investor.com/blogs/LowProfileCyclical/2021-03-08-story-h1542063653-This_low_profile_cyclical_company_may_provide_a_low_risk_diversificatio.jsp

1