LETS JOIN KIM'S STOCKWATCH GROUP?

Date : 22 March 2021

- Investors should be cautious and vigilant when it comes to pursuing growth stocks such as technology counters.

- The rotational play is still ongoing in the market. Is it Recovery stocks in a limelight or others

- Buy when there is consolidation or collection. That would be the best strategy, provided you still believe in the stock.

- Technology counters are previously overvalued given that some of them are trading at 100 times P/E ratio. But now, it's looking soften and good from my view. As long as Bond yields can maintain below 1.70% levels. The worst is coming, if it touch 2.00% and above.

- It all depends on the specific company. Some companies have seen a many fold earnings growth among the tech companies.

- Regarding Malaysia Digital Economy Blueprint and upcoming 5G roll-out was announced, there was some buying interest in telecommunications stocks. Announcements have always been easy to make, while implementation has always been the toughest part.

- In terms of recovery play sectors, the energy, plantation, financial services, technology, transportation and logistics, as well as utilities sectors are set to continue their recovery in 2021.

- The construction sector and property sector in the research houses view are not expected to post a recovery at this juncture. In terms of strategies that retail investors should look at in 2021.

- The rotational play is still very much ongoing at a high velocity but also noted that recovery play strategies had emerged and that many retail investors are still in short-term mode at the moment.

- So that for those that are trading at 100 times P/E, there is always a reason for it. Regarding about P/E, my comments is below.

- A stocks P/E ratio doesn't indicate whether a stock is good or bad. It only indicates the stocks price in relation to its earnings. A stock with a lower P/E ratio is typically regarded as being cheaper than a stock with a higher P/E ratio.

- Stocks with a low P/E ratio may be underpriced in the short term. But if investors spy a bargain and buy these stocks, the purchase activity can drive up the price of the stock. When it does, the investors who bought low make their profit. This is why stocks with a low P/E ratio are often called "value stocks."

- A higher P/E suggests high expectations for future growth, perhaps because the company is small or is an a rapidly expanding market. For others, a low P/E is preferred, since it suggests expectations are not too high and the company is more likely to outperform earnings forecasts.

- For me, there is no bad or good about high and low P/E ratio. Depending on your view of the market, expensive is not necessarily bad. i.e Tesla, its at high earnings. Why? because people are happy to pay more for earnings if they think the stock price is going to continue climbing.

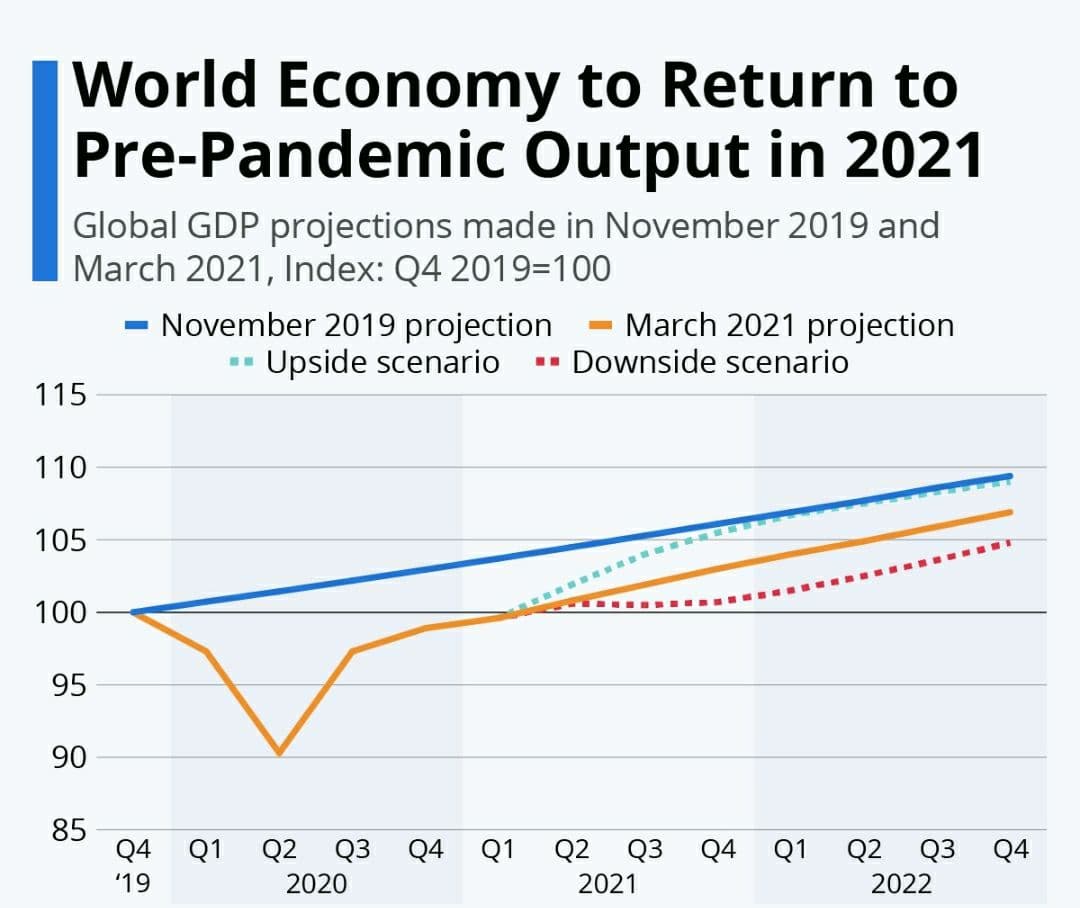

- Investors should look beyond this year and consider 2022 earnings to get a more accurate view of the market’s valuation. The market can look through this recession and say, 'I’m going to put a multiple on the more normalized earnings we’ll see in the next few years'. If earnings do get back to last year’s levels, then a valuation of between 18 and 20 times may be more reasonable. But that's still not cheap, but its at least closer to historical norms.

- The one problem is that it may be difficult to determine what kind of earnings the market, or a company will have post-pandemic. Some businesses will rebound, some may post higher earnings and others will have trouble getting back to where they were. Investors can look at how a company fared during the last recession, or how well they were doing before COVID-19, to decide what sort of earnings they may have in a year or two or more, but not knowing what is to come will make it difficult for investors to figure out whether the market, or the company they are interested in, is cheap or expensive right now.

- By saying that, cyclical stocks look better from a valuation perspective than defensive stocks, which are typically more value oriented. In a recession, investors scoop up defensives, like grocery stores and other consumer staples, pushing their valuations higher. Cyclical companies, where fortunes can rise and fall based on the economic environment, tend to get hit hard, but then rebound during the recovery like I have foreseen now due to worldwide vaccines roll-out by phases. We have seen some cyclicals come back, but not much as people are still concerned about the outlook for the economy.

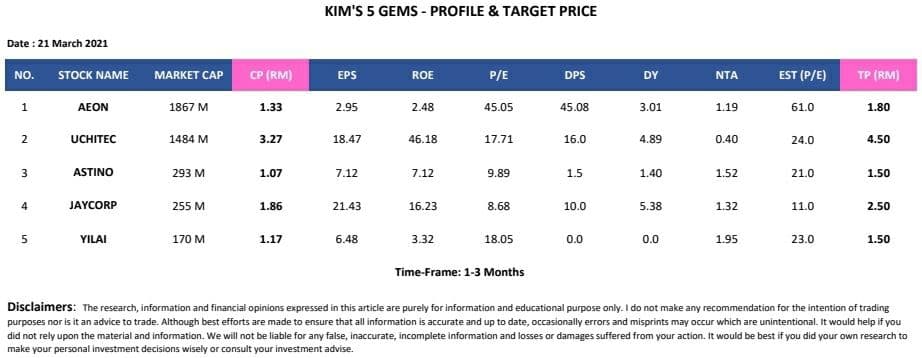

- We will see that rotation, and it happening now. Like everything in this pandemic, nothing makes a lot of sense, so if you think something is odd, like high market valuations, then dig a little deeper to find out more about what is going on. You never want to base an investment decision only on P/E, but that is especially true today. I still on valuation through P/E, so that is why I took 10's stocks for my porfolio's 2021.

Disclaimers: The research, information and financial opinions expressed in this article are purely for information and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date, occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the material and information. We will not be liable for any false, inaccurate, incomplete information and losses or damages suffered from your action. It would be best if you did your own research to make your personal investment decisions wisely or consult your investment advise.

https://klse.i3investor.com/blogs/spartan/2021-03-22-story-h1542900622-MY_KEYNOTE_AND_5_GEMS_READY_TO_GO_HIGHER_LEVEL.jsp