Company background

Formosa Prosonic Industries Berhad (FPI) is one of the leading manufacturers of sound system in Malaysia with proven engineering expertise in designing, manufacturing and marketing of sound system products to worldwide multinational companies. Established in 1989, with over 30 years of experience in the audio equipment industry, the company has evolved from the manufacturing of conventional speaker systems to smart audio systems and musical instrument components including the design and development of wireless and blue tooth speakers with cutting edge functionality and seamless connectivity. FPI provides and assembles a variety of audio component and speakers for renowned Japanese and American brands like Sony, Panasonic, Sharp, Bose and etc.

Investment thesis

Synergistic partnership with global leader

Wistron Corporation is one of the biggest global suppliers for information and communication products based in Taiwan. It was the manufacturing arm of Acer Inc. before being spun off in 2000. Wistron, focuses on Information Communications Technology (ICT) products, Liquid-crystal-display TVs, handheld devices and equipment for medical applications in Taiwan, holds a controlling stake of 28% in FPI.

As a result of trade war in 2018, Wistron has approved a capital injection of USD45m into Wistron Technology (Malaysia) Sdn. Bhd. with a maximum capex of USD77m to accelerate business expansion. While iPhone production assembly will not be transferred here, Wistron has dedicated the Malaysian operation to focus on Internet of Things (IoT) devises. Wistron had set its total production capacity outside China to be 50% by end-2021.

Additionally, FPI has a 20-acre vacant land beside Wistron’s 22-acre built factory in Port Klang. This may bode well in easing business transfer should Wistron’s existing customers look for ways to diversify away from China due to deeper decoupling of US-China when conflict escalates further. Aside from trade war, the latest scandal of Super Micro super spy-chip further place China’s reliability in doubt. According to Bloomberg, Chinese spies have infiltrated the supply chain for servers used by nearly 30 US companies, including government contractors, Apple, and Amazon. Electronics produced in China may be viewed as unsafe, this gives multinational companies more of a reason to reroute their production away from China. FPI which has the ability to provide audio components for electronic gadgets like laptop, speaker, and central processing unit (CPU) is a potential beneficiary should opportunity arise.

Bullish speaker market outlook

The growing trend of internet of things (IoT) is encouraging consumers to buy connected household entertainment systems such as smart (voice activation with artificial intelligence (AI), portable and wireless speakers. Speakers are riding along with the growing penetration of technologies including in-house entertainment systems and are expected to propel home and commercial audio equipment markets growths.

According to Technavio, global speaker market will post a 4-year CAGR growth of 17% from 2018-2022 to reach 27 billion USD, the key factor driving the growth of the market is the rise in popularity of wireless streaming of audio device. The behavioural shift in how people listen to music inside and outside their homes will boost demand for portable speakers and sound bar.

This trend can be observed in the latest report by Strategy Analytics which highlighted that global smart speaker sales hit a new record last year despite the pandemic. FY20 sales crossed 150 million units, while 4Q20 shipment grew 4.3% to 58.2 million units. The research firm, Canalys expect the global speaker market will return to greater growth, with numbers hitting 163 million units in 2021, marking a 21% growth overall.

Based on the data published by Statista Research Department on Jan 22, 2021, the global smart speaker market was valued at 15.6 billion USD in 2020 and could reach 19.6 billion USD in 2021 (25.6% YoY growth). By 2025, projections suggest that this annual figure could more than doubled to 35.5 billion USD.

Travel curtailment has boosted consumer electronics spending

Covid-19 has caused an unprecedented crisis for the tourism industry. With the travel curtailments imposed, individuals may divert their disposable income from tourism spending to consumer electronics. Moreover, with working from home becoming new norm, demand for consumer electronics is surging on the back of the inclination to make home environment more comfortable and well equipped by buying/upgrading electronic appliances for lifestyle (speakers, sound bar, etc) and work (PC, laptop, tablet).

Demand upcycles leading to robust expansion

The new plant in FY19 has enabled the group to ramp up production capacity by 20%. FPI has already secured a contract with one of their existing customers for manufacturing a new series of smart portable audio, which was projected to take up 50% of new plant’s capacity. The remaining will be use to broaden its scope of service including ODM orders to strengthen its position in the market as a contract manufacturer.

Financials

FY21 is projected to be another record-breaking year for top line, however bottom line would be slightly dragged by higher cost. Moving forward, I am bullish on FY21’s growth on the back of bullish speaker market outlook and the synergistic partnership with global leader.

Strong earnings record and balance sheet

FPI has strong balance sheet where it is in a net cash position of RM270.34 million or RM 1.09 per share (41.1% of total market cap) as FY20. This is a result of FPI’s steady growth in operation cash flow from RM 35.74 mil in 2017 to RM 71.30 mil in 2019.

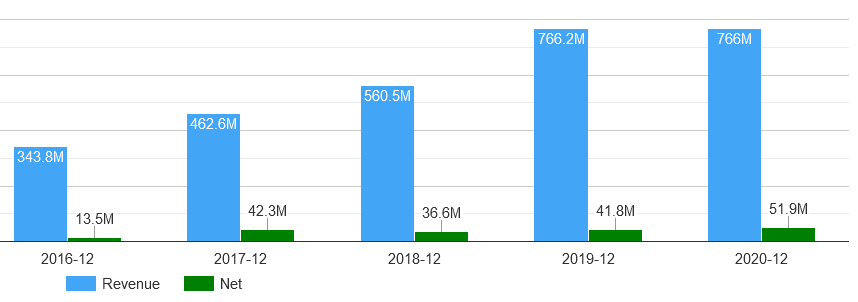

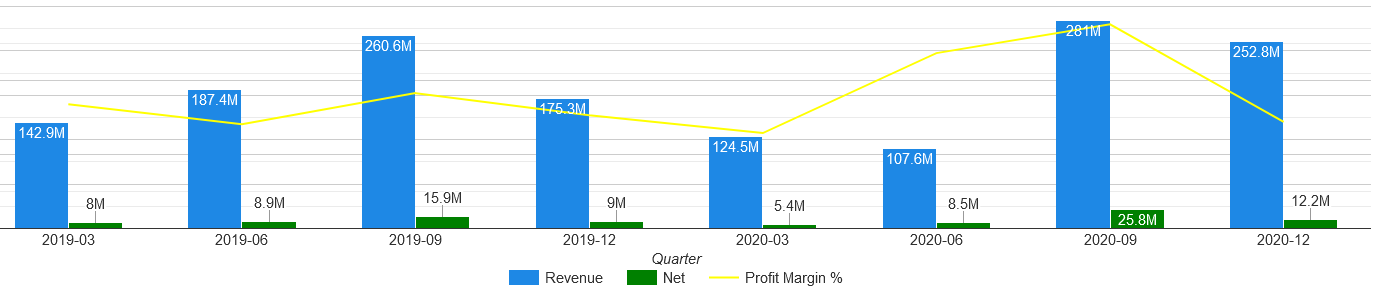

FPI’s revenue and net profit grew by 4-year CAGR of 22.2% and 40.0%, respectively from 2016 to 2020. Historically, FPI results chalked in strongest for the 3Q. The pullback in their 4Q20 earning was largely due to seasonal variation. For the 12-month period ended 31 December 2020, the Group recorded marginally lower sales at RM766.0 million compared to RM766.2 million in the previous year’s corresponding period in compliance with the Movement Control Order (“MCO”) imposed by the Government of Malaysia in an effort to contain the outbreak of COVID-19 pandemic.

Annual earnings

Quarter earnings

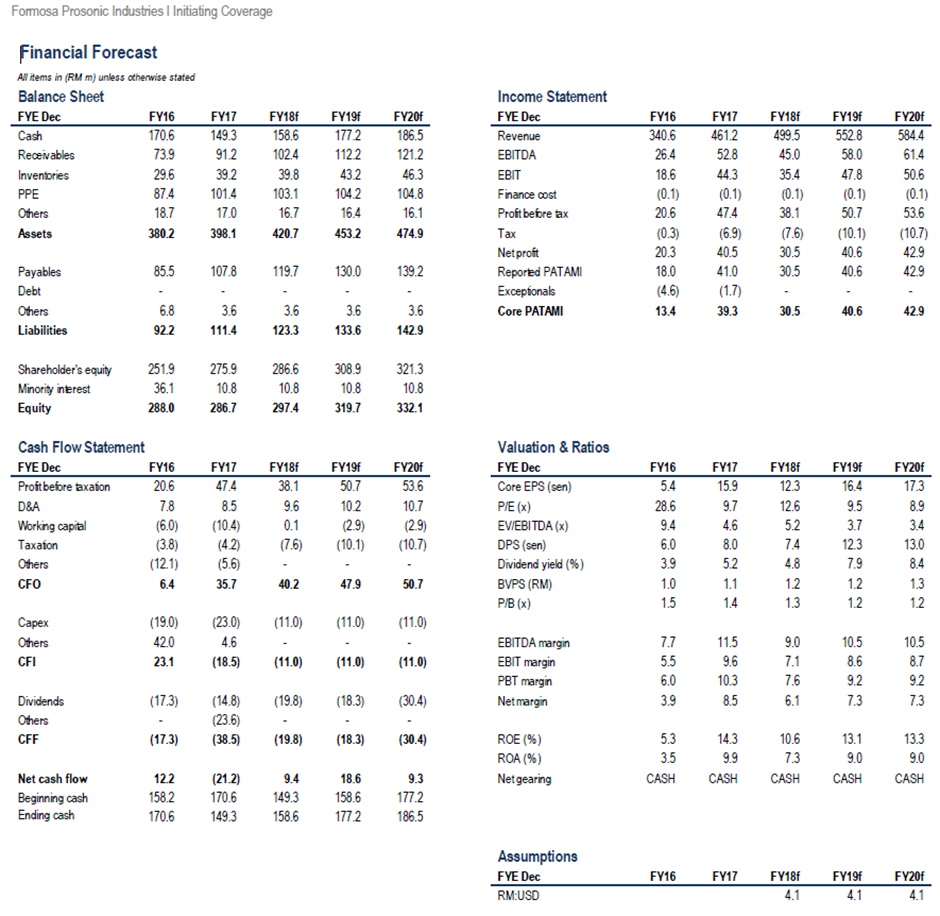

The company’s impressive cash position, revenue, net profit, and EPS have also beaten the prior estimates released on November 7, 2018 by HLIB research by 44.8%, 31.1%, 21% and 21.4% respectively for FY20.

Strong track record of dividend pay-out

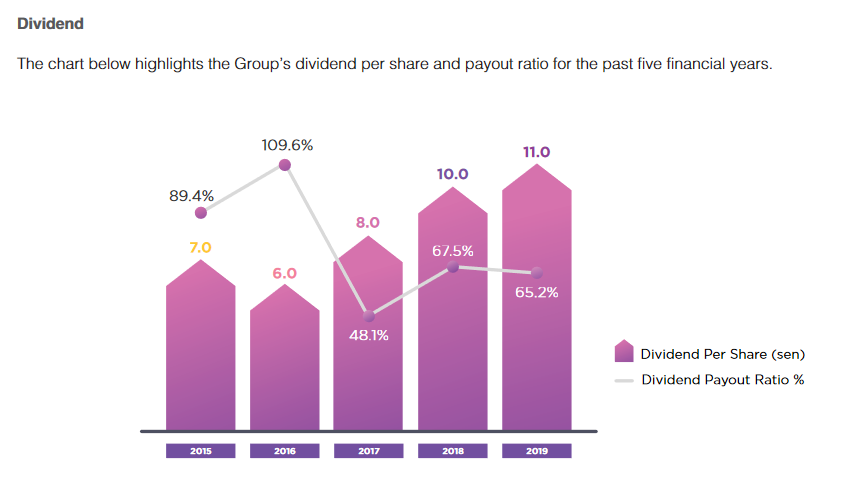

FPI does not have a dividend policy. However, the company has been paying out generous dividends annually since 2001. FPI has declared 14.0 DPS in respect of the latest financial year ended 31 December 2020 (31 December 2019: 11.0 DPS; 27% increment in dividend).

Moving forward, DPS is projected to increase in tandem with their earning to 16.0-17.0 DPS for FY21 based on a pay-out of 65%, translating to a dividend yield of 6.0-6.4% (based on latest closing price of RM 2.66). This generous dividend pay-out can match if not beat the dividend yield from the employee provident fund (EPF), which is particularly commendable based on current low yield and low interest environment.

Valuation

Conservatively, using the growth expectation by research firm Canalys of 21.0% pegged to 13x PE (in line with the average PE of the global EMS industry based on HLIB research) for FY21 estimated EPS of 25.4 sen, would give FPI a fair value of RM 3.30.

Aggressively, based on current high liquidity environment as seen from strong rally above most investment bankers target prices for the other electronic manufacturing services (EMS) peers, +1 SD at 16.5-17.4x PE (coincidentally was the highest PE during the 2017 bull run of FPI) would result in FPI target price of RM4.20 to RM 4.42 (~60% upside potential for FY21) based on current ATAIMS +1 SD 14x PE to 19.2x PE as the larger EMS player.

Historical PE ratio of FPI

For investors who prefer to hold for dividend and longer-term capital growth, a longer-term projection based on Statista Research Department 5-year CAGR of 17.8% to 35.5 billion by 2025, 13x PE for estimated EPS of 47.6 sen would give FPI a fair value of RM 6.19.

Key take away

FPI valuation is relatively less demanding (when compared to the other EMS players based on its strong cash position (41.1% of total market cap). Taking into consideration a safety margin of 5% beta discount to the aggressive target price of RM4.20 to give final target price of RM 4.00 would still offer about 50% upside potential with 4.0% dividend yield of 16.0 sen DPS for FY21. At current price of 2.66, it is below that of the conservative fair value of RM 3.30 with potential 6.0% dividend yield for FY21.

Risk

Covid-19

The company has shut down its operations from March 18, 2020 in compliance with the Movement Control Order imposed by the government.

Shortages and rising cost of raw materials

Company may face constraints in particular component supplies, including display panels, optical disc drives and chipsets as a result of the Covid-19 disruption to productions. This may also lead to margin compression due to the higher cost of raw materials as a result of supply disruption.

Customer concentration

Historically, the group’s top two customers accounted for about 64.8% of total sales. Losing any of these big customers would have a harmful negative effect on both top and bottom line in a rapid pace.

Regional and domestic competition

The electronic manufacturing space is highly competitive, with operating margins across the industry in the low-to-mid-single digits. Price war can affect big brands to shift their orders to competitors.

Change in government policy

Government policy can make a huge difference to company’s profitability. For instance, the hike in minimum wage would negatively affect the company as it is heavily dependent on foreign labour.

Currency exchange

As an exporter, stronger USD bodes well for FPI as all of their sales are denominated in USD while 60% of their total cost are denominated in RM. The 40% cost in USD term is due to the procurement of direct materials such as resin, wood and metal parts which are imported from abroad. Any weakness in USD could potentially reduce the earnings of FPI.

Consumer behavioural shift

International tourist arrivals were projected to plunge by 60-80% in 2020, and tourism spending is not likely to return to pre-crisis levels until 2024. Could early recovery of the tourism industry as a result of rapid vaccines roll-out may temporarily reduce the currently elevated consumer electronic spending?

However, despite the challenges, The Board of Directors of FPI expects the Group to achieve profitable results for FY21 on the back of prevailing sales orders.

What the price is saying?

Briefly, FPI is undergoing a steep correction (-27% to low of RM 2.50) after the recent upward price movement from RM 2.45 to RM 3.43. The current price weakness may warrant some caution for traders but may be of value to investors at decent support levels. Details regarding FPI current price movement would required discussion in a separate write-up.

Disclaimer

The information contained in this article is based on data obtained from internet. However, the data and/or sources have not been independently verified and as such, no representation, express or implied, are made as to the accuracy, adequacy, completeness or reliability of the information.

Investors are advised to make their own independent evaluation of the information contained in this article and seek independent financial, legal or other advice regarding the appropriateness of investing in any equities discussed in this article. Under no circumstances should this article be considered as an offer to sell or a solicitation of any offer to buy any securities referred to herein.

Disclosure

I am long FPI. This article is written as an expression of personal opinions. I have no business relationship with any company mentioned in this article.

References

- https://klse.i3investor.com/servlets/staticfile/402205.jsp

- https://www.bursamarketplace.com/mkt/tools/research/ch=research&pg=research&ac=570176&bb=582206

- https://www.theedgemarkets.com/article/taiwans-wistron-purchase-western-digital-plant-pj-confirming-edge-report

- https://techcrunch.com/2020/10/22/the-smart-speaker-market-is-expected-grow-21-next-year/

- https://www.businesswire.com/news/beverlyhillschamber/20210303005852/en

- https://www.statista.com/statistics/1022823/worldwide-smart-speaker-market-revenue/

- https://www.theedgemarkets.com/article/teh-hong-piow-says-malaysias-low-interest-rates-persist-foreseeable-future

- https://www.thestar.com.my/business/business-news/2020/10/30/aminvest-research-keeps-hold-call-on-ata-ims-higher-fv-of-rm222

https://klse.i3investor.com/blogs/FPIattractivevaluation/2021-03-06-story-h1542059868-Recent_steep_correction_of_FPI_may_offer_attractive_entry_ahead_of_bull.jsp